Why American Silver Eagle IRA Eligibility Matters for Your Retirement

An American Silver Eagle IRA is a self-directed retirement account that holds physical American Silver Eagle coins—the official silver bullion coin of the United States. It allows you to invest in tangible precious metals with tax-advantaged growth. Here's what determines eligibility:

Quick Answer: Is Your American Silver Eagle IRA-Eligible?

- YES - Standard bullion American Silver Eagles (.999 fine silver, one troy ounce)

- YES - Burnished (uncirculated) versions from the U.S. Mint

- NO - Most proof versions (classified as collectibles)

- NO - Graded or slabbed coins (MS-70, MS-69, etc.)

- NO - Commemorative editions or special issues

- REQUIRED - Coins must be held by an IRS-approved custodian, not at home

The American Silver Eagle has been the world's most popular silver bullion coin since 1986. Investors turn to silver for retirement as an inflation hedge, for portfolio diversification, its relative affordability compared to gold, and its strong industrial demand.

But here's the catch: not all American Silver Eagles qualify for your IRA. The IRS has strict rules about purity and whether a coin is considered a "collectible." A mistake could lead to taxes and penalties, as seen in the landmark McNulty v. Commissioner case where an investor stored IRA coins at home.

The good news? The standard bullion version of the American Silver Eagle checks every IRS box. It's .999 fine silver, minted by the U.S. Treasury, and designed purely for investment—not collection. This makes it one of the safest, most liquid choices for a precious metals IRA.

I'm Eric Roach. After a decade on Wall Street advising Fortune 500 clients on using hard assets to hedge against uncertainty, I now help everyday investors apply those same institutional-grade tactics to safeguard their wealth with physical precious metals.

American Silver Eagle IRA terms to know:

- How to buy gold bullion

- Investment grade gold bars

- Where to buy gold bars

Understanding the American Silver Eagle

Before diving into an American Silver Eagle IRA, it's crucial to understand what makes this coin special. Since 1986, it has been the official silver bullion coin of the United States, celebrated for its beauty, purity, and government backing.

The Anatomy of an American Icon

The American Silver Eagle's design is a powerful blend of history and patriotism.

Obverse Design: Walking Liberty The front features Adolph A. Weinman's iconic "Walking Liberty" design, originally from the U.S. Half Dollar (1916-1947). Lady Liberty strides confidently towards a rising sun, symbolizing hope and freedom.

Reverse Design: The American Eagle The reverse has seen two designs:

- Type 1 (1986-2021): John Mercanti's heraldic eagle, a classic symbol featuring a shield, olive branch, and arrows.

- Type 2 (2021-Present): Emily Damstra's naturalistic eagle in flight, introduced for the coin's 35th anniversary with improved anti-counterfeiting features.

These designs, coupled with the coin's legal tender status, make it a true American icon.

For a deeper dive into this magnificent coin, explore our guide: American Silver Eagle 101.

Physical Specifications and Value

The tangible nature of physical silver is a key draw for investors. The American Silver Eagle boasts impressive and consistent specifications:

- Purity: One troy ounce of .999 (99.9%) pure silver.

- Weight: 31.103 grams (one troy ounce).

- Diameter: 40.6 mm (1.598 inches).

- Face Value: $1 (USD). This is symbolic; the coin's true worth is based on its intrinsic silver content. However, its legal tender status is a government guarantee of authenticity, a key anti-fraud measure.

The price you pay is influenced by:

- Spot Price: The real-time market price of one troy ounce of silver, which fluctuates based on global supply and demand.

- Premiums: The amount charged by dealers above the spot price to cover manufacturing, distribution, and overhead. Premiums vary by dealer and market demand.

For a thorough breakdown of how to decode the value of your American Silver Eagle, check out our guide: Eagle Eye on Value: Decoding the American Silver Eagle .999 Fine Silver.

The Core of Eligibility: IRS Rules for Precious Metals IRAs

What makes an American Silver Eagle eligible for your IRA? The IRS has specific, non-negotiable rules to ensure retirement accounts hold investment assets, not speculative collectibles.

What Makes a Coin "IRA-Approved"?

The Internal Revenue Code (IRC) Section 408(m) makes specific exceptions to its general prohibition on "collectibles." For an American Silver Eagle IRA, the key rules are:

Minimum Purity: Silver must be .999 fine (99.9% pure). The American Silver Eagle proudly meets this standard. For comparison, gold must be .995 fine, and platinum/palladium must be .9995 fine.

Fineness Standards: The coin's .999 fineness must be stamped on the product, a guarantee provided by the U.S. government.

Non-Collectible Rule: This is where investors can trip up. The IRS prohibits items whose value is subjective or tied to numismatic appeal rather than intrinsic metal content. This generally excludes graded/slabbed coins, antique coins, and most proof or commemorative editions.

Approved Mint: Coins must be minted by the U.S. Treasury or another accredited national or private mint that meets strict standards (e.g., ISO 9001 certified).

The standard bullion American Silver Eagle is the poster child for IRA-eligible silver, meeting every requirement.

For a comprehensive understanding of these rules, consult our guide: Precious Metals SIRA Regulations 101.

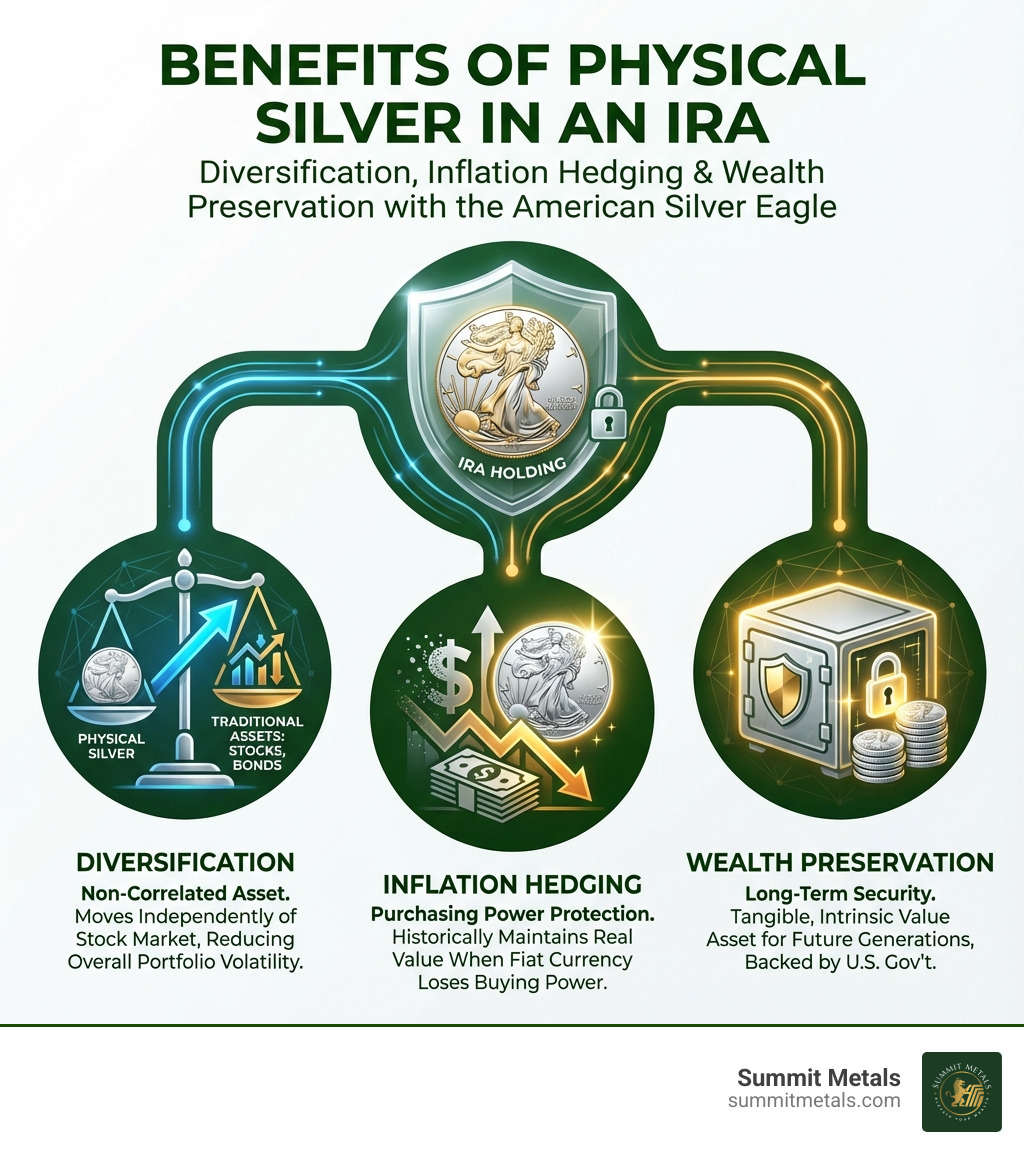

Why Choose an American Silver Eagle IRA for Your Retirement?

Investing in physical silver through an American Silver Eagle IRA offers compelling advantages for long-term planning. The primary benefit is tax-advantaged growth; in a traditional IRA, gains are tax-deferred, while in a Roth IRA, qualified withdrawals are tax-free. This can significantly boost your overall returns.

Furthermore, adding a tangible asset like American Silver Eagles provides powerful portfolio diversification, as silver often moves independently of stocks and bonds. This acts as a hedge, offering protection from market volatility and currency devaluation. As highly recognized and government-backed bullion, American Silver Eagles are also extremely liquid, ensuring you can easily convert your investment to cash when needed. This combination of tax benefits, stability, and trust makes it a cornerstone of a resilient retirement strategy.

For more on fortifying your financial future, see: Retirement Riches: How Gold IRAs Can Fortify Your Financial Future.

Bullion, Proof, or Burnished: Which Eagles Can Go in Your IRA?

This is a common area of confusion. The American Silver Eagle is produced in different finishes, and not all are IRA-eligible.

Understanding Coin Finishes and Their IRA Status

The U.S. Mint produces three primary types:

- Bullion: The standard investment-grade coin, produced in large quantities.

- Proof: A collector's coin with a mirror-like finish, produced in limited numbers.

- Burnished (Uncirculated): A collector's coin with a matte, satiny finish, also produced in limited numbers.

Here's a comparison to clarify their IRA eligibility:

| Feature | Bullion American Silver Eagle | Proof American Silver Eagle | Burnished American Silver Eagle |

|---|---|---|---|

| IRA Eligibility | YES | NO (Generally) | YES |

| Primary Purpose | Investment (Silver content) | Collectible (Aesthetics) | Collectible/Investment (Special Finish) |

| Finish | Brilliant Uncirculated | Mirror-like fields, frosted devices | Matte, satiny finish (W mint mark) |

| Mintage | Very High (Millions) | Limited (Thousands/Hundreds of Thousands) | Limited (Tens/Hundreds of Thousands) |

| Typical Premium | Lower (closer to spot price) | Higher (due to collector appeal) | Moderate to High (due to special finish) |

As the table shows, standard bullion and burnished versions are typically IRA-eligible. The key difference lies in their primary intent and how the IRS views them.

The Trap of "Collectible" Coins

The IRS explicitly prohibits "collectibles" in IRAs to prevent tax-advantaged accounts from holding assets with subjective value. For Silver Eagles, this means:

- Proof (PF) Coins: These are made for their aesthetic appeal and are generally classified as collectibles by the IRS.

- Graded/Slabbed Coins: While grading (e.g., MS-70, MS-69) authenticates a coin's condition, it often pushes it into the "collectible" category in the eyes of the IRS. These coins command numismatic premiums inconsistent with the investment-grade nature required for IRAs.

- "First Strike" & "Early Release": These are marketing terms that emphasize a coin's collectible nature, making it unsuitable for an IRA.

For IRA purposes, the IRS prefers assets with objective, quantifiable value based on their metal content. As we discuss in The Value of Perfection: Graded Silver Eagles Explained, while graded coins are fascinating, they generally don't belong in your American Silver Eagle IRA. Stick to the bullion or burnished versions to ensure compliance.

The Step-by-Step Process for an American Silver Eagle IRA

Setting up an American Silver Eagle IRA is a straightforward process when broken down into these three steps.

Step 1: Choose a Self-Directed IRA Custodian

This is the most critical step. The IRS mandates that all IRA-held precious metals be managed by an approved third-party custodian, not stored at home. The McNulty v. Commissioner case affirmed that personal possession results in immediate taxation and penalties.

A custodian administers your Self-Directed IRA (SDIRA), handles all paperwork, facilitates transactions, and arranges for secure storage, ensuring full IRS compliance. Look for custodians with a proven track record in precious metals, transparent fees, and good service. We at Summit Metals can help connect you with trusted partners to set up your SDIRA account.

For a comprehensive guide on selecting the right service provider, see our Ultimate Checklist for Gold IRA Services Comparison.

Step 2: Fund Your Account

Once your SDIRA is established, you can fund it using one of several methods:

- Rollover: Move funds from an existing IRA (Traditional, Roth, SEP, SIMPLE) or a 401(k) from a previous employer into your new SDIRA. This is a common way to diversify existing retirement savings without tax penalties.

- Direct Transfer: Move funds directly from one IRA trustee to another.

- New Contributions: Make annual contributions subject to IRS limits.

Your custodian will assist with the necessary paperwork to ensure a compliant transfer or rollover.

For a detailed guide on moving funds, read: Unlocking Your Retirement's Potential: A Guide to Gold IRA Transfers.

Step 3: Purchase and Store Your Silver Eagles

With a funded SDIRA, you're ready to buy. The U.S. Mint distributes bullion coins through authorized dealers like Summit Metals, not directly to the public.

The Process:

- You instruct your custodian to purchase IRA-eligible American Silver Eagles from an authorized dealer.

- The custodian transfers funds from your SDIRA to the dealer.

- The dealer ships the coins directly to a secure, IRS-approved depository for storage. You cannot take personal possession.

This custodian-depository system safeguards your investment and ensures your American Silver Eagle IRA remains IRS-compliant. For more information on storage, see: The Ultimate Guide to Gold and Other Precious Metals Storage.

Smart Strategies and Pitfalls to Avoid

Navigating a precious metals IRA requires smart strategies and awareness of potential pitfalls.

Automate Your Investment: The Power of "Autoinvest"

One of the most effective strategies for long-term wealth building is dollar-cost averaging. This involves investing a fixed amount of money at regular intervals, regardless of price. When prices are low, you buy more silver; when high, you buy less. This averages out your purchase price and reduces the impact of market volatility.

Think of it like your 401(k) contributions. With Summit Metals' Autoinvest program, you can set up recurring monthly purchases of IRA-eligible American Silver Eagles. This disciplined approach helps you build a substantial position in silver over time, removing the emotional stress of trying to time the market and maximizing your retirement security.

For more on this strategy, read: Maximizing Retirement Security Using a Precious Metals IRA to Invest in Gold and Silver with SummitMetals.com.

Common Pitfalls of an American Silver Eagle IRA

While an American Silver Eagle IRA offers significant benefits, avoid these critical mistakes:

- Home Storage Trap: Taking physical possession of IRA-held metals is considered a taxable distribution, leading to immediate taxes and penalties. As confirmed in the McNulty v. Commissioner case, all metals must be held by an IRS-approved custodian in a depository.

- High-Premium Collectible Coins: Avoid dealers pushing "rare" or "collectible" coins for your IRA. These have high premiums and are typically not IRA-eligible. Stick to standard bullion or burnished versions.

- Unscrupulous Dealers: Not all dealers are equal. Some charge excessive premiums or push non-eligible products. Work with reputable dealers like Summit Metals who offer transparent pricing and understand IRA rules.

- Ignoring Fees: Be aware of all custodian, storage, and transaction fees, as they impact your returns. Ensure you understand the full fee structure before committing.

- Misunderstanding Withdrawals: Withdrawals, especially before age 59½, can trigger taxes and penalties. Consult a tax professional to understand the rules for your specific IRA type.

To safeguard your investment, it’s essential to be well-informed. Our Ultimate Rulebook for Precious Metals IRA Investors provides further guidance.

Frequently Asked Questions about the American Silver Eagle IRA

Here are answers to some of the most common inquiries about an American Silver Eagle IRA.

Can I take physical possession of the Silver Eagles in my IRA?

No, you cannot. IRS regulations are clear: precious metals in an IRA must be held by an approved third-party custodian in a secure depository. Taking physical possession is considered a taxable distribution, subjecting the metals' entire value to income tax and a 10% early withdrawal penalty if you are under 59½. The McNulty v. Commissioner Tax Court ruling firmly established this rule. Your metals are safely vaulted and insured at the depository, providing security without the severe tax consequences of home storage.

For more details on secure storage, see our Depository Deep Dive: Understanding Precious Metals Storage Options and Fees.

Are Proof American Silver Eagles IRA-eligible?

Generally, no. Proof American Silver Eagles are typically considered "collectibles" by the IRS and are therefore not eligible for an IRA. Their value is driven by numismatic appeal, rarity, and aesthetic qualities, often carrying a high premium over the silver spot price. For an American Silver Eagle IRA, the focus must be on the bullion version, which is valued for its intrinsic metal content. The standard bullion coin is the safest and most common choice to ensure compliance.

Learn more about this distinction in The Proof Is In The Purchase: Finding Your Perfect Silver Eagle.

How do I sell my Silver Eagles from my IRA?

When you're ready to sell, the process is managed by your custodian:

- Instruct Your Custodian: You direct your custodian to sell a specific amount of your silver.

- Facilitate the Sale: The custodian works with a dealer like Summit Metals to sell the metals. The proceeds are then deposited back into your IRA's cash account.

- Take a Distribution: From your cash account, you can take a distribution. This is a taxable event for traditional IRAs. Alternatively, you can have the physical metals shipped to you (an "in-kind" distribution), which is also a taxable event. Once you reach RMD age (currently 73), you must begin taking annual distributions.

Always consult a tax professional to understand the specific tax implications of liquidating your IRA metals.

Conclusion: Secure Your Future with America's Silver Coin

An American Silver Eagle IRA is a powerful tool to diversify your retirement portfolio, hedge against inflation, and secure your wealth with a tangible asset backed by the U.S. government. Understanding the key IRS rules—using bullion coins and an approved custodian—is the key to successfully integrating this iconic silver coin into your financial strategy.

At Summit Metals, we pride ourselves on transparent pricing and competitive rates for authenticated precious metals. Based in Wyoming, we help investors in Salt Lake City, Utah, and across the nation build robust retirement portfolios. We simplify the process by connecting you with reputable custodians and providing the IRA-eligible American Silver Eagles you need.

Take control of your retirement savings. Explore an American Silver Eagle IRA and let us help you grow your silver stack with confidence.

For a comprehensive guide to securing your future with precious metals, visit: IRA Gold Investment: A Comprehensive Guide to Securing Your Future.