Introduction: Your Guide to a Timeless Asset

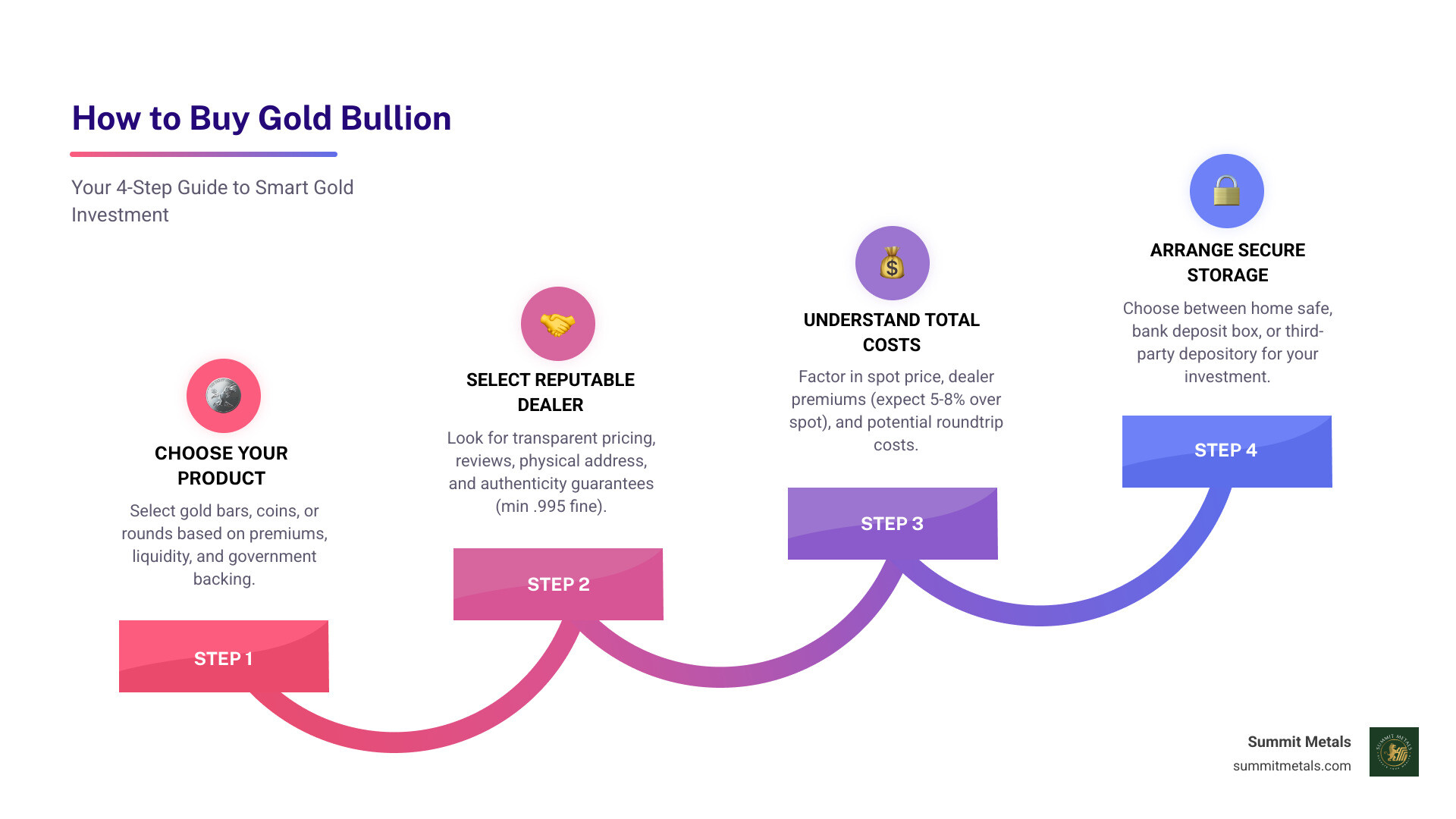

Learning how to buy gold bullion is simpler than you might think. This guide will walk you through five key steps:

- Choose Your Product: Bars, coins, or rounds.

- Select a Reputable Dealer: Prioritize transparent pricing and verified reviews.

- Understand the Cost: Expect to pay a premium over the spot price.

- Arrange Secure Storage: Options include a home safe, bank box, or depository.

- Verify Authenticity: Buy from trusted dealers who guarantee purity.

For millennia, gold has been a reliable store of value. Unlike stocks or bonds, physical gold holds intrinsic worth that isn't dependent on a third party. Amid economic uncertainty and inflation, investors are increasingly turning to this tangible asset-the same one central banks continue to accumulate.

However, the market has risks. The CFTC has charged companies with over $500 million in fraud, often involving hidden fees and inflated premiums. This guide will help you avoid those pitfalls.

I'm Eric Roach, a former investment banker. I spent a decade advising Fortune 500 companies on risk management. Now, I help everyday investors use the same disciplined approach to buy gold bullion as a hedge for their portfolios.

Whether you want to preserve wealth, hedge against inflation, or diversify, this handbook provides a clear path forward.

Why Smart Investors Choose Gold Bullion

When traditional investments falter and cash loses value, smart investors often turn to gold bullion. Understanding how to buy gold bullion begins with knowing why it's a cornerstone of wealth preservation.

Here's why gold belongs in a modern portfolio:

Portfolio Diversification: Gold often moves independently of stocks and bonds, which can help stabilize your portfolio during market volatility.

Store of Value: For 5,000 years, gold has maintained its purchasing power. An ounce of gold that bought a fine suit in ancient Rome can still buy one today, a claim no paper currency can make. Learn more in Why Gold and Silver: Understanding Their Value as Safe Haven Assets.

Inflation Hedge: As the cost of living rises, gold prices tend to rise as well, protecting your wealth from the erosive effects of inflation.

Tangible Asset: In a digital world, gold is a physical asset you can hold. There are no passwords or servers-just the metal itself, which provides a unique sense of security.

No Counter-Party Risk: When you own physical gold, its value doesn't depend on a bank or company's solvency. The asset is yours, free from institutional promises. Explore this in The Midas Touch: Exploring the Benefits of Gold Investment.

Liquidity: Investment-grade gold is recognized and traded globally, making it easy to convert to cash when needed-far more so than assets like real estate.

It's important to know what gold isn't. It doesn't pay dividends or generate passive income. Its purpose isn't to make you rich, but to help keep you from becoming poor. Gold is financial insurance-a hedge against uncertainty that makes it indispensable for many investors.

The Complete Guide on How to Buy Gold Bullion

Now that you know the why, let's cover the how. Buying gold bullion is a straightforward process when broken down into these steps.

Step 1: Choose Your Preferred Form of Gold

Your first decision is whether to buy gold bars, coins, or rounds. Each has unique benefits.

Gold Bars: The no-nonsense choice, valued almost purely for their gold content. They offer the lowest premiums, especially in larger sizes. Look for bars from respected refiners like PAMP Suisse or Valcambi, which should be at least 99.5% pure (.995 fine) and come with an assay card verifying weight and purity.

Gold Coins: Minted by sovereign governments (e.g., American Eagle, Canadian Maple Leaf), they carry a legal tender face value. This government backing makes them universally recognized, highly liquid, and provides an extra layer of fraud protection. Premiums are slightly higher due to minting costs.

Gold Rounds: Privately minted and shaped like coins but with no face value. They often have lower premiums than sovereign coins, offering a cost-effective way to own gold in a familiar shape.

Here's a quick comparison:

| Feature | Gold Bars | Gold Coins | Gold Rounds |

|---|---|---|---|

| Premiums | Lowest | Higher | Lower than coins |

| Liquidity | Good | Excellent | Good |

| Government Backing | No | Yes | No |

| Fraud Protection | Relies on assay/dealer | Strong (government mint) | Relies on dealer |

| Purity | .999+ fine | Varies (.9167 to .9999) | .999+ fine |

Key takeaway: For their blend of liquidity and security, gold coins are often preferred. Their government backing provides trust and makes them easy to sell. For more details, see How to Compare Gold Bars vs. Gold Coins: 5 Factors to Consider.

Also, be sure you are buying bullion (valued for metal content) and not numismatic coins (valued for rarity). Unscrupulous dealers may push "semi-numismatic" coins at inflated prices-a major red flag. Always check that your bullion is marked with its purity. Learn more at Understanding Karats and Purity in Gold.

Step 2: Select a Reputable Dealer

Where you buy gold is as important as what you buy. A reputable dealer guarantees authenticity and fair pricing. Here's what to look for:

- Transparent Pricing: Prices should be clearly displayed in real-time relative to the spot price. At Summit Metals, what you see is what you get.

- Strong Reputation: Look for thousands of positive customer reviews on platforms like Shopper Approved. A long history of satisfied customers is a great sign.

- Verifiable Information: A trustworthy dealer has a physical address and a clear history, not just a P.O. Box.

- Clear Policies: Shipping, insurance, returns, and buy-back policies should be easy to find and understand.

Red Flags to Avoid:

- High-Pressure Sales: The CFTC and FINRA warn against unsolicited calls and aggressive tactics. A good dealer will never rush you.

- "Semi-Numismatic" Hype: This term is often used to justify excessive prices on non-collectible coins.

Online dealers like Summit Metals often offer lower prices due to high volume and lower overhead. For more tips, read Your Golden Compass: Navigating to a Reputable Gold Dealer and How to Avoid Common Precious Metals Scams. The CFTC also offers great advice in its 10 Things to Ask Before Buying Physical Gold, Silver, or Other Metals bulletin.

Step 3: A Smart Approach to Buying Gold Bullion

Once you've chosen your product and dealer, it's time to buy. Payment options often include bank wire, e-check, credit card, or even cryptocurrency. Wires may offer a discount due to lower processing fees.

After your payment clears, your order will be processed. Always ensure your shipment is fully insured and tracked from the dealer to your door.

For a disciplined investment strategy, consider Dollar-Cost Averaging (DCA). This means investing a fixed amount of money at regular intervals, regardless of the price. When prices are low, you buy more gold; when they're high, you buy less. This approach averages out your cost over time and reduces the risk of buying at a market peak.

We've made this easy with Summit Metals Autoinvest. You can set up automatic monthly gold purchases, similar to a 401k contribution. It's a simple, stress-free way to build your holdings. Learn about this powerful strategy in The Power of Dollar-Cost Averaging in Gold and Silver Investments and Never Miss a Beat: How to Buy Gold and Silver Automatically.

Understanding the Costs and Risks of Owning Gold

To invest wisely, you must understand the full cost of owning gold, not just the purchase price. This includes pricing, storage, and taxes.

How to Buy Gold Bullion at the Right Price

The price you pay for gold has two main components:

- Spot Price: The live market price for one troy ounce of gold. This is the baseline.

- Premium: The amount you pay above the spot price. This covers minting, distribution, and the dealer's profit. Premiums are higher for smaller items (like 1-gram bars) and can rise with market demand.

Typically, expect to pay 5-8% over spot when buying gold coins or small bars. When you sell, you'll likely receive 5-8% less than spot. This difference is the dealer spread. Together, these create a roundtrip cost of 10% or more. This is why gold is a long-term investment, not for short-term trading.

Choosing a dealer with competitive pricing is crucial to minimizing these costs. At Summit Metals, our efficiency and bulk purchasing allow us to offer some of the best rates. Learn more at Spot Price vs. Premium: How Precious Metals Pricing Works and Why Gold and Silver Prices Fluctuate.

Safely Storing Your Investment

Physical gold must be stored securely. You have three main options:

- Home Storage: Offers direct access but carries risks of theft or loss. Standard homeowner's insurance rarely covers the full value of precious metals, so a high-quality, anchored safe is a must.

- Bank Safe Deposit Box: More secure than home and relatively affordable. However, contents are not federally insured, and access is limited to banking hours.

- Third-Party Depository: The most secure option for significant holdings. These facilities offer specialized security, full insurance, and regular audits. This is the required method for IRA-held metals.

Your choice depends on your holdings and risk tolerance. For more, read Top Tips for Precious Metals Storage: Secure Your Investments and Storing Your Shine: A Guide to IRS-Approved Precious Metals Depositories.

Taxes, Reporting, and Authenticity

Understand the legal side of gold ownership:

- Reporting: U.S. dealers are required by law to report cash-like transactions over $10,000 to the IRS using Form 8300. This is a standard anti-money laundering procedure for many industries, not specific to gold.

- Taxes: When you sell gold for a profit, it is subject to capital gains tax. The IRS classifies precious metals as "collectibles," which can be taxed at a higher rate (up to 28%) than stocks. Consult a tax professional for advice.

- Authenticity: The best way to avoid counterfeits is to buy only from reputable dealers like Summit Metals, who guarantee every product they sell. Authentic bullion is stamped with its weight and purity (e.g., ".9999 Fine Gold"), and many bars come in tamper-evident packaging with an assay card for verification. Learn to spot fakes with our guide, How to Tell If Gold Is Real.

Physical Gold vs. Other Gold Investments

Physical bullion is just one way to invest in gold. Understanding the alternatives helps clarify why so many investors prefer to own the actual metal.

Gold ETFs (Exchange-Traded Funds), gold mining stocks, and gold futures offer exposure to the gold price without the need for physical storage. They trade like stocks and offer high liquidity. However, they all introduce counter-party risk-your investment's value depends on a third party, like a fund manager or a mining company's performance.

- Gold ETFs: You own shares in a fund that supposedly holds gold. You are trusting the fund's managers and their audits.

- Gold Mining Stocks: You are betting on a company's ability to mine gold profitably. Your investment is subject to business risks like labor strikes, political instability, and poor management, even if gold prices are high.

- Gold Futures: These are complex contracts for speculation or hedging, unsuitable for most individual investors due to high leverage and risk.

Here is how they compare to physical bullion:

| Feature | Physical Gold Bullion | Gold ETFs | Gold Mining Stocks |

|---|---|---|---|

| Tangibility | Yes, you own the actual metal | No, you own shares in a fund that holds gold | No, you own shares in a company that mines gold |

| Counter-Party Risk | Minimal (primarily storage provider if applicable) | Yes, relies on the fund's integrity and holdings | Yes, relies on the company's performance and solvency |

| Liquidity | Good, but selling large amounts can take time | Excellent, trades like a stock | Excellent, trades like a stock |

| Storage Needs | Yes, requires secure storage and insurance | No, held electronically | No, held electronically |

| Income Potential | No dividends or interest (pure appreciation) | No dividends (tracks gold price) | Yes, potential for dividends and stock appreciation |

| Direct Control | High | Low (fund manager controls holdings) | Low (company management controls operations) |

| Cost Structure | Premiums over spot, storage, insurance | Expense ratios, trading commissions | Trading commissions, company-specific risks |

At Summit Metals, we focus on physical metals because they offer security that paper investments cannot. In a financial crisis, physical gold's value doesn't rely on anyone else's promise. It is real, permanent, and directly in your control. This is why, despite the convenience of alternatives, experienced investors continue to choose the timeless simplicity of owning the metal itself.

Frequently Asked Questions about Buying Gold Bullion

Here are concise answers to common questions from new gold investors.

What is the smallest amount of gold I can buy?

You don't need a large sum to start. Fractional gold makes investing accessible to any budget. You can begin with:

- 1-Gram Gold Bars: These are tiny, affordable, and a popular entry point, often costing under $100.

- Fractional Gold Coins: Sovereign mints produce their flagship coins (like the American Gold Eagle) in smaller 1/10 oz, 1/4 oz, and 1/2 oz sizes.

Starting small is a great way to learn how to buy gold bullion without a major financial commitment. For more on these options, see our guide on Fractional Gold Bars: An Affordable Entry Point for Gold Investors.

Is it better to buy gold online or from a local store?

Both have pros and cons, so the best choice depends on your priorities.

Online Dealers (like Summit Metals): Typically offer lower premiums, a much wider selection, and the convenience of shopping from home. All shipments are discreetly packaged and fully insured. The trade-off is a short wait for delivery.

Local Stores: Offer the ability to see the product and take immediate possession. However, they usually have higher premiums to cover overhead and a more limited inventory.

Regardless of your choice, always perform due diligence on the dealer's reputation and pricing. Learn more about finding trusted dealers in Precious Metals at Your Fingertips: Best Online Sources.

Can I buy gold for my IRA?

Yes, holding physical gold in a Self-Directed IRA (SDIRA) is a popular way to diversify retirement savings with a tangible asset while retaining tax advantages.

However, the IRS has strict rules:

- Purity Requirement: The gold must be of a minimum fineness, typically .995 or higher. Approved products include American Gold Eagles, Canadian Gold Maple Leafs, and qualifying bars.

- Custodian and Depository: You cannot take personal possession of IRA-held gold. It must be managed by an IRA custodian and stored in an IRS-approved depository.

The custodian handles the paperwork, and the depository provides secure, insured storage. While this involves more setup than a direct purchase, it allows your gold investment to grow tax-deferred or tax-free. For a complete walkthrough, see our IRA Gold Investment: A Comprehensive Guide to Securing Your Future.

Conclusion: Begin Your Gold Investment Journey

You now have a clear roadmap for how to buy gold bullion. You've learned how to choose the right products, vet dealers, understand costs, arrange storage, and steer the legal details. You are equipped with the knowledge to invest with confidence.

Investing in physical gold is not about getting rich quick; it's about long-term wealth preservation. It's about owning a real asset that holds its value through economic storms, independent of banks and markets.

Taking the first step can be daunting, but you don't have to do it alone. At Summit Metals, our mission is to make gold investing transparent and secure. We offer real-time, competitive pricing with no hidden fees, ensuring you get maximum value. Our wide inventory supports everyone from first-time buyers to seasoned investors.

Ready to make it even simpler? With Summit Metals Autoinvest, you can automate your investments with monthly purchases. This dollar-cost averaging strategy lets you build your holdings steadily over time, just like a 401k, removing the stress of timing the market.

You have the knowledge. Now is the time to act. Whether you start with a single gram or a full ounce, the most important step is the first one.

Start building your precious metals portfolio with Summit Metals today. Your journey to financial resilience is waiting.