Why Knowing Where to Sell Gold and Silver Coins Can Mean Thousands More in Your Pocket

Where to sell gold and silver coins is a key decision that can change your payout by hundreds or even thousands of dollars. Your main options include:

Top Places to Sell Gold and Silver Coins:

- Online Bullion Dealers (like Summit Metals) – Highest payouts, transparent pricing, secure shipping.

- Local Coin Shops – Immediate payment but often lower offers.

- Pawn Shops & Mall Kiosks – Fast cash but typically the lowest prices.

The precious metals market is active, with major dealers purchasing billions from sellers annually. There’s real demand for your coins, but your choice of buyer determines whether you get a fair price.

Some buyers use vague quotes and pressure tactics. Reputable online dealers provide transparent, real-time pricing tied to the live spot price and a secure process from quote to payment.

This guide shows you how to value your items, compare buyers, and steer the sale safely so you keep more of your money.

First, Know What You're Selling and What It's Worth

Before you decide where to sell gold and silver coins, you must understand what you own. An informed seller gets better offers. Think of it like selling a car: you wouldn't accept an offer without knowing its make, model, and condition. Knowing your items gives you the confidence to spot a fair deal and reject a bad one.

Types of Gold and Silver Products You Can Sell

- Bullion coins: Government-minted coins like American Gold and Silver Eagles or Canadian Maple Leafs. Valued for metal content, they are highly liquid and easy to sell.

- Gold and silver bars: Produced by private refiners like PAMP Suisse or government mints like Perth Mint. They trade very close to their melt value with lower premiums than coins.

- Numismatic coins: Collectibles valued for rarity, history, and condition, not just metal content. A rare Morgan dollar, for example, can be worth far more than its melt value and may require a specialized dealer.

- Jewelry and Scrap Gold: Jewelry's value depends on purity (karats), weight, and craftsmanship. Most non-designer or broken pieces are sold as scrap gold for their melt value.

For information on other metals, see our guide on selling different metals like copper bullion.

Key Factors That Determine Your Selling Price

- Spot Price: The live market price for one troy ounce of pure gold or silver. This is your baseline.

- Melt Value: The value of your item based on its precious metal content at the current spot price.

- Premiums and Dealer Margins: When you sell, you'll receive a price below spot. This difference, or margin, covers the dealer's costs and profit. Expect to get 1-5% below spot for common bullion from a competitive dealer.

- Purity and Weight: Purity is measured in karats or fineness (.999). Weight is measured in troy ounces (31.103 grams), not standard ounces.

- Condition and Numismatic Value: Condition is critical for numismatic coins, where a high grade from PCGS or NGC can dramatically increase value. For bullion, minor scratches usually don't affect the price.

Learn more about market timing in our article on when is the best time to sell your silver and gold.

How to Value Your Items Before You Sell

First, check live spot prices on a site like Kitco or Summit Metals. Next, identify purity marks on your items (e.g., ".999" or "14K"). If you're unsure, a dealer can use non-destructive XRF analysis. For potentially rare items, consider an independent appraisal.

Finally, understand the difference between bullion and numismatic value. Check completed sales on eBay or auction sites like Heritage Auctions for numismatic items. For bullion, the price will be tied to melt value.

Here's a quick comparison of coins vs. bars:

| Feature | Gold Coins | Gold Bars |

|---|---|---|

| Face Value | Yes (protected by government) | No |

| Government Guarantee | Yes | Sometimes |

| Premium | Higher | Lower |

| Liquidity | Easier to sell in small amounts | Best for bulk sales |

| Fraud Protection | High (face value, legal tender) | Lower |

| Stackability | Less efficient | Highly efficient |

Benefits of Gold Coins: Face value offers added protection against fraud and government guarantee, making them a trusted choice for many investors.

The Main Players: Where to Sell Gold and Silver Coins

Now that you know what you have, let's discuss where to sell gold and silver coins. This choice has the biggest impact on your payout. The same coin might fetch $2,300 from one buyer and only $2,100 from another.

Selling to Summit Metals (Your Trusted Online Dealer)

Online bullion dealers like Summit Metals are built to deliver strong payouts with clear, real-time pricing. Operating from Wyoming with low overhead, we offer higher payouts than most traditional shops. Price transparency is core to our model; you can see real-time buyback prices for many items on our website 24/7, so you know your net before you commit.

Our online process is convenient and secure. Get a quote, lock in your price, and arrange insured shipping from anywhere. We accept a wide range of products, from bullion to numismatic coins. Security is paramount, with insured shipping and video-recorded verification upon arrival.

The trade-off is that you must ship your items and payment takes 1-3 business days after verification. For most sellers, the higher payout is worth the short wait.

Learn more about why online often beats local in our guide: Explore online vs. local selling.

Local Coin Shops (A Good In-Person Option)

For those who prefer a face-to-face transaction, local coin shops are a solid option. The biggest advantage is immediate payment—walk in with your coins and leave with a check or cash. You can also ask questions and build a relationship with a dealer.

However, local shops have higher overhead costs (rent, security), which means they typically offer lower buyback prices. They may also have cash flow limitations for large sales and often lack the price transparency of online dealers, requiring you to negotiate.

Why Summit Metals is a Better Choice Than Pawn Shops & "We Buy Gold" Kiosks

Pawn shops and mall kiosks offer fast cash, but at a steep cost. They have the lowest payout model in the industry, preying on sellers who are uninformed or in a hurry. Expect high-pressure tactics and employees who lack the expertise to value your items correctly. The reality is nothing like TV shows such as Pawn Stars; their business model relies on paying you as little as possible.

Summit Metals offers a transparent, secure, and expert-driven process that ensures you get the best value for your precious metals—unlike pawn shops and kiosks, which often pay the least and lack industry expertise.

Here's how your options stack up:

| Selling Venue | Payouts | Transparency | Convenience | Security | Expertise |

|---|---|---|---|---|---|

| Summit Metals | Highest | High | High | High | High |

| Local Coin Shops | Medium | Medium | High | Medium | Medium |

| Pawn Shops/Kiosks | Lowest | Low | High | Low | Low |

Choose wisely. For most sellers, the combination of high payouts, transparency, and security makes online dealers like Summit Metals the clear winner.

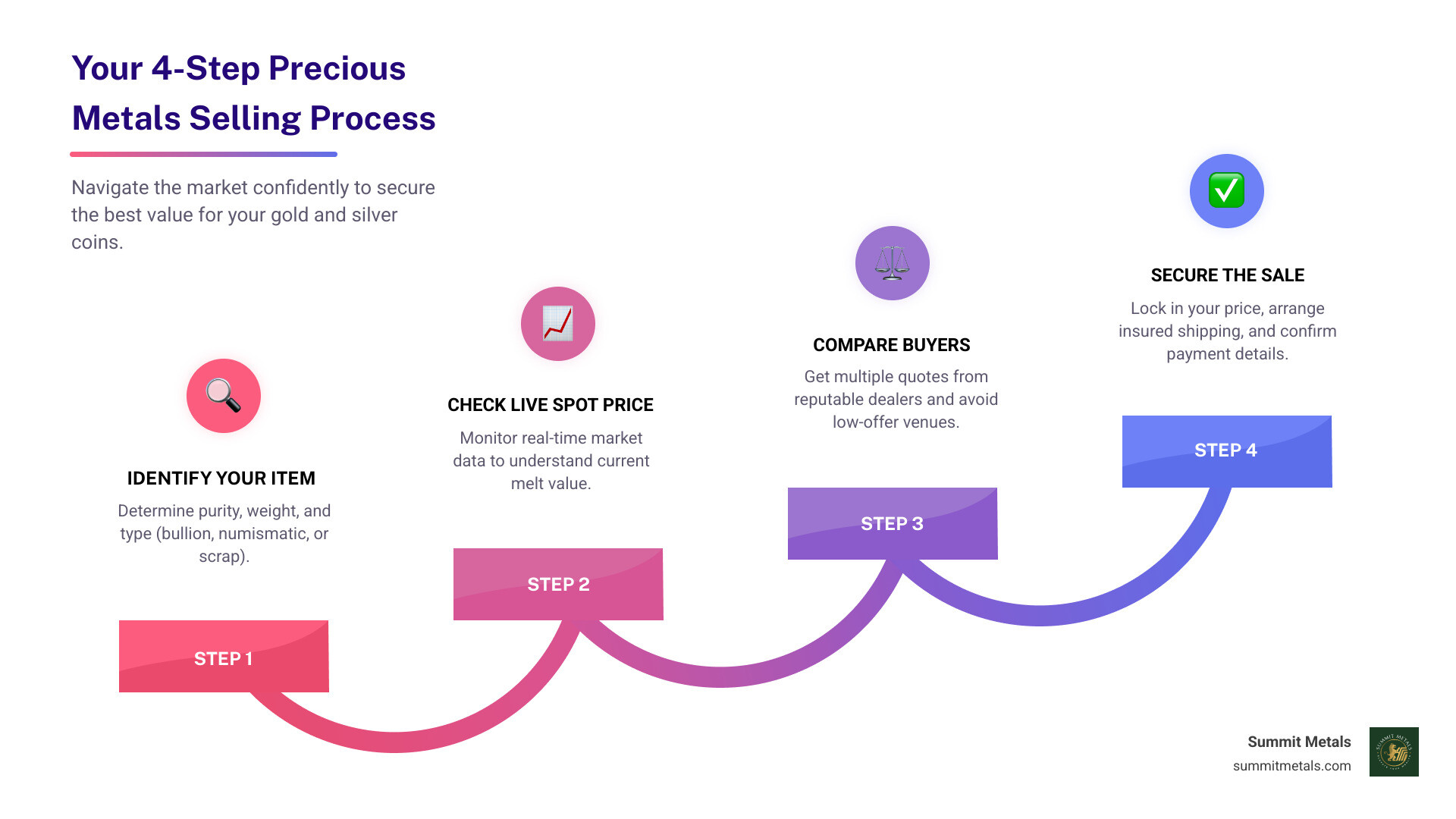

The Selling Process: A Step-by-Step Guide

Whether selling online or in person, a clear process protects you and your assets. It's your safety net for securing the best deal and avoiding common pitfalls.

How to Sell Gold and Silver Coins Online: A Step-by-Step Guide

Selling online with Summit Metals is simple and secure, whether you're in Wyoming, Salt Lake City, Utah, or anywhere else.

- Request a Quote: Visit our "Sell to Us" page or call us. Describe your items (type, weight, purity), and we'll provide a real-time quote based on current spot prices.

- Lock-In Your Price: Once you accept the offer, we lock in your price. This protects you from market dips while your items are in transit.

- Package Securely: Follow our detailed instructions for packaging your items safely.

- Ship with Insurance: We provide a prepaid, fully insured shipping label. Drop the package at the designated carrier, and you're covered.

- Verification: Upon arrival at our Wyoming facility, your package is opened under video surveillance. Our experts authenticate and verify each item.

- Get Paid: After verification, payment is processed within 1-3 business days via bank wire or check. It's a small trade-off for the industry's highest payouts.

For more on finding reputable buyers, see our guide: A guide to finding trustworthy buyers.

The In-Person Selling Experience: What to Expect

If you choose a local coin shop, follow these steps:

- Get Multiple Quotes: Never accept the first offer. Visit several reputable shops to compare prices.

- Present Your Items: Bring items clean but unpolished (polishing can reduce the value of numismatic coins). Have any original packaging or certificates ready.

- Bring Valid ID: Dealers are legally required to record seller information, so have a government-issued photo ID.

- Understand the Offer: Ask the dealer to explain how they calculated their price. A reputable dealer will be transparent.

- Confirm Payment: You'll typically receive cash or a check immediately. Always get a receipt.

Best Practices for Safely Shipping Your Precious Metals

Shipping valuables is safe with the right precautions:

- Double-Box: Place items in a small inner box, then place that inside a larger outer box with padding.

- Be Discreet: Never write "gold," "silver," or other valuable-related terms on the package.

- Insure for Full Value: This is non-negotiable. When you sell to Summit Metals, we provide an insured label.

- Track Your Shipment: Use the tracking number to monitor your package's progress.

- Document Everything: Take photos or a video of your items and the sealed package as proof of condition.

Avoiding Pitfalls and Maximizing Your Return

Selling smart means knowing what to look for and what to avoid. Protecting yourself is key to getting the most value from your gold and silver coins.

Red Flags to Watch Out For When Choosing a Buyer

Trust your instincts. If a deal feels off, it probably is. Watch for these warning signs:

- Vague Quotes: A reputable dealer provides clear, specific numbers. If they won't give you a firm price, be wary.

- No Live Pricing: Buyers should be transparent about the current spot price they are using. If they hide it, you can't verify the fairness of their offer.

- High-Pressure Tactics: Phrases like "this offer is only good now" are designed to rush you. A good dealer encourages you to feel confident, not pressured.

- Unsolicited Offers: Be cautious of cold calls or door-to-door buyers. Legitimate dealers don't operate this way.

- Bad Online Reviews: Check Google, BBB, and Trustpilot. A pattern of complaints about lowball offers or shady practices is a clear red flag.

- Refusal to Explain Pricing: You have a right to know how an offer was calculated. If a buyer is evasive, walk away.

How to Ensure You Get the Best Price for Your Gold Coins

Being proactive is the best way to get a great price.

- Know the Spot Price: Check live gold and silver prices before contacting any buyer. This is your most powerful negotiating tool.

- Get Multiple Quotes: Contact at least three different buyers, including online dealers like us and local shops. This helps you understand the fair market range.

- Sell Popular Items: Recognizable items like American Silver Eagles or Canadian Maple Leafs are in high demand, so dealers often offer better buyback prices for them.

- Understand Dealer Margins: Dealers pay below spot to cover costs and make a profit. For common bullion, expect to receive 1-5% below spot from a competitive dealer. Anything significantly less warrants shopping around.

- Choose High-Volume Buyers: Large online dealers like Summit Metals process high volumes, allowing them to operate on thinner margins and offer you better rates.

For more tips, read our guide on how to avoid common selling mistakes.

Frequently Asked Questions About Selling Precious Metals

Here are concise answers to common questions from sellers.

How much below the spot price will I be paid?

It depends, but you can generally expect to be paid 1-5% below the current spot price for common bullion from a competitive dealer like Summit Metals. The exact percentage depends on the dealer's margins, their current inventory needs, and the popularity of the item you're selling. Highly liquid items like American Gold Eagles typically fetch better prices than generic bars.

Do I have to report my gold and silver sales to the IRS?

We recommend consulting a tax professional for personalized advice. In general, certain large-quantity sales must be reported by the dealer to the IRS on Form 1099-B. However, even if a sale is not formally reported, any profit you make is generally considered a capital gain and is taxable. You are responsible for reporting these gains on your tax return. The rules are complex, so professional advice is crucial.

What's the difference between selling a bullion coin and a rare coin?

This distinction is vital for getting the right price.

Bullion coins (e.g., American Silver Eagles, Canadian Gold Maples) are valued primarily for their metal content based on the current spot price. Their value is tied directly to the commodities market.

Rare coins (numismatic coins) are valued for factors like rarity, historical significance, condition (grade), and collector demand. A rare coin can be worth many times its melt value. Selling these often requires specialized numismatic dealers or auction houses, not general bullion buyers.

If you're unsure what type of coin you have, we can help point you in the right direction.

Conclusion: Sell Smart, and Keep Building Your Wealth

Understanding where to sell gold and silver coins is about protecting your investment and ensuring you receive its full value. Selling is a natural part of the investment journey, and with the knowledge from this guide, you are in control.

Your Next Steps

The path forward is clear: know what you have, check the spot price, and compare buyers. Focus on reputable online dealers like Summit Metals, where transparent pricing and competitive payouts are standard.

At Summit Metals, we believe in transparency. Our real-time pricing is tied directly to the live spot price, with no hidden fees or surprises. We are committed to giving you the best value for your precious metals.

After selling, consider your next wealth-building move. Many investors use a dollar-cost averaging approach to rebuild their holdings. Our Autoinvest program makes this easy, allowing you to set up automatic monthly purchases of gold and silver, similar to a 401k contribution. It's a disciplined, emotion-free way to grow your stack over time.

You are now equipped to make informed decisions. The precious metals market rewards those who do their homework.

Ready to get a fair, transparent offer? Sell your gold and silver to us today!