Why 2026 is a Historic Year for Silver Coin Collectors

2026 1oz silver coin releases are capturing attention across the precious metals market. This year marks multiple significant anniversaries and features the highly anticipated Year of the Horse theme from the Chinese zodiac.

Quick Comparison: Top 2026 1oz Silver Coins

| Coin | Mint | Purity | Key Feature | Mintage Limit |

|---|---|---|---|---|

| American Silver Eagle | US Mint | .999 | 40th Anniversary | TBA |

| British Britannia | Royal Mint | .999 | Advanced Security | TBA |

| Australian Lunar Horse | Perth Mint | .9999 | Year of the Horse | 300,000 |

| Canadian Maple Leaf | Royal Canadian Mint | .9999 | Horse Privy Mark | 25,000 |

The 2026 silver coin lineup stands out for three major reasons. First, the American Silver Eagle celebrates its 40th anniversary while coinciding with America's 250th birthday (Semiquincentennial). Second, multiple world-class mints are releasing Year of the Horse designs that appeal to both Western collectors and Asian markets. Third, security features have reached new heights, with coins incorporating micro-laser engraving, latent images, and surface animation that make counterfeiting nearly impossible.

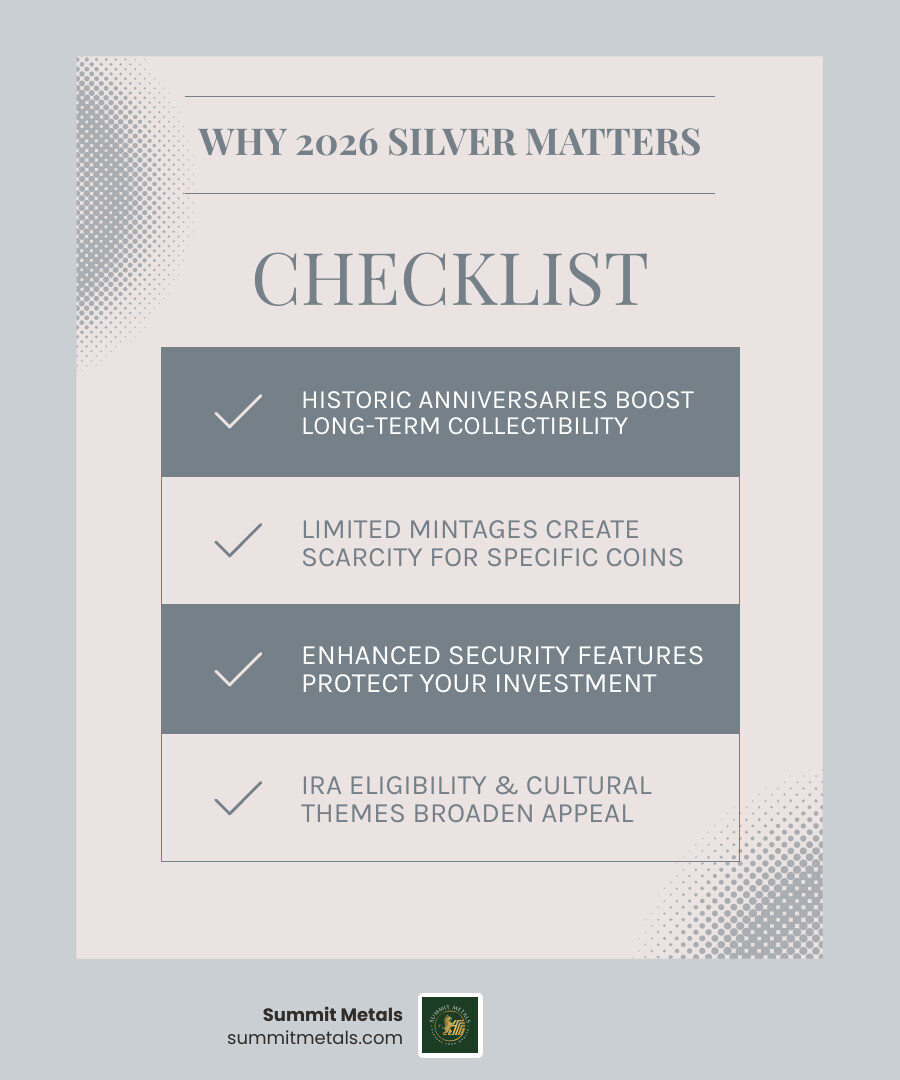

Why 2026 matters for investors:

- Historic anniversaries increase long-term collectibility

- Limited mintages create scarcity (Canadian Maple Leaf capped at just 25,000)

- Improved security protects your investment

- IRA eligibility for retirement planning

- Cultural significance of Year of the Horse broadens appeal

Whether you're adding to an existing stack or starting fresh, understanding the differences between these releases helps you make informed decisions. Some coins prioritize security, others focus on artistic design, and certain releases offer better liquidity.

I'm Eric Roach. After a decade on Wall Street, I now help everyday investors apply institutional strategies for using precious metals. Physical silver is a resilient hedge against volatility, and 2026's special releases offer unique opportunities for both immediate value and long-term appreciation.

Comparing the Top 2026 1oz Silver Coin Releases

Choosing the right 2026 1oz silver coin means understanding what makes each release special. Let's walk through the highlights so you can decide which one deserves a spot in your collection or investment portfolio.

2026 American Silver Eagle: A Landmark 40th Anniversary

The 2026 American Silver Eagle is a double celebration that collectors will remember for decades. This year marks the 40th anniversary of the series and America's 250th birthday (the Semiquincentennial). This combination creates what numismatists call a "key-date" coin, giving its long-term value potential a serious boost.

The design features Adolph A. Weinman's iconic Walking Liberty on the obverse and Emily Damstra's modern eagle reverse, introduced in 2021. Each coin contains 1 troy ounce of .999 fine silver with a $1 legal tender face value backed by the U.S. government. For 2026, the US Mint will use fully laser-engraved master dies, resulting in sharper details and improved security.

As an IRA-eligible coin, the 2026 American Silver Eagle is perfect for diversifying retirement savings. Whether you're building a stack through our Autoinvest program or making a single purchase, this anniversary edition offers both immediate recognition and long-term appreciation potential.

Want to become a Silver Eagle expert? Check out our comprehensive guide: American Silver Eagle 101.

2026 British Silver Britannia: The Pinnacle of Security

If the Eagle is the patriot, the British Britannia is the security specialist. The Royal Mint has made this coin a fortress against counterfeiters.

The 2026 release celebrates the 30th anniversary of the modern silver Britannia. The obverse features Martin Jennings' portrait of King Charles III, while Philip Nathan's classic Britannia design commands the reverse. This 2026 1oz silver coin contains .9999 fine silver with a £2 legal tender face value.

What truly sets the Britannia apart are its four advanced security features: a latent image that shifts from a padlock to a trident, micro-text along the inner rim, surface animation on the background waves, and tincture lines on the shield. This suite of features makes counterfeiting nearly impossible.

The Britannia is also IRA eligible, giving American investors a secure, internationally recognized option. When buying monthly through Autoinvest, these security features provide peace of mind that your investment is authentic.

Dive deeper into this sophisticated series with our guide: Silver Britannia Coins: The Ultimate Collectors and Investors Guide.

2026 Australian Lunar Series III: Year of the Horse

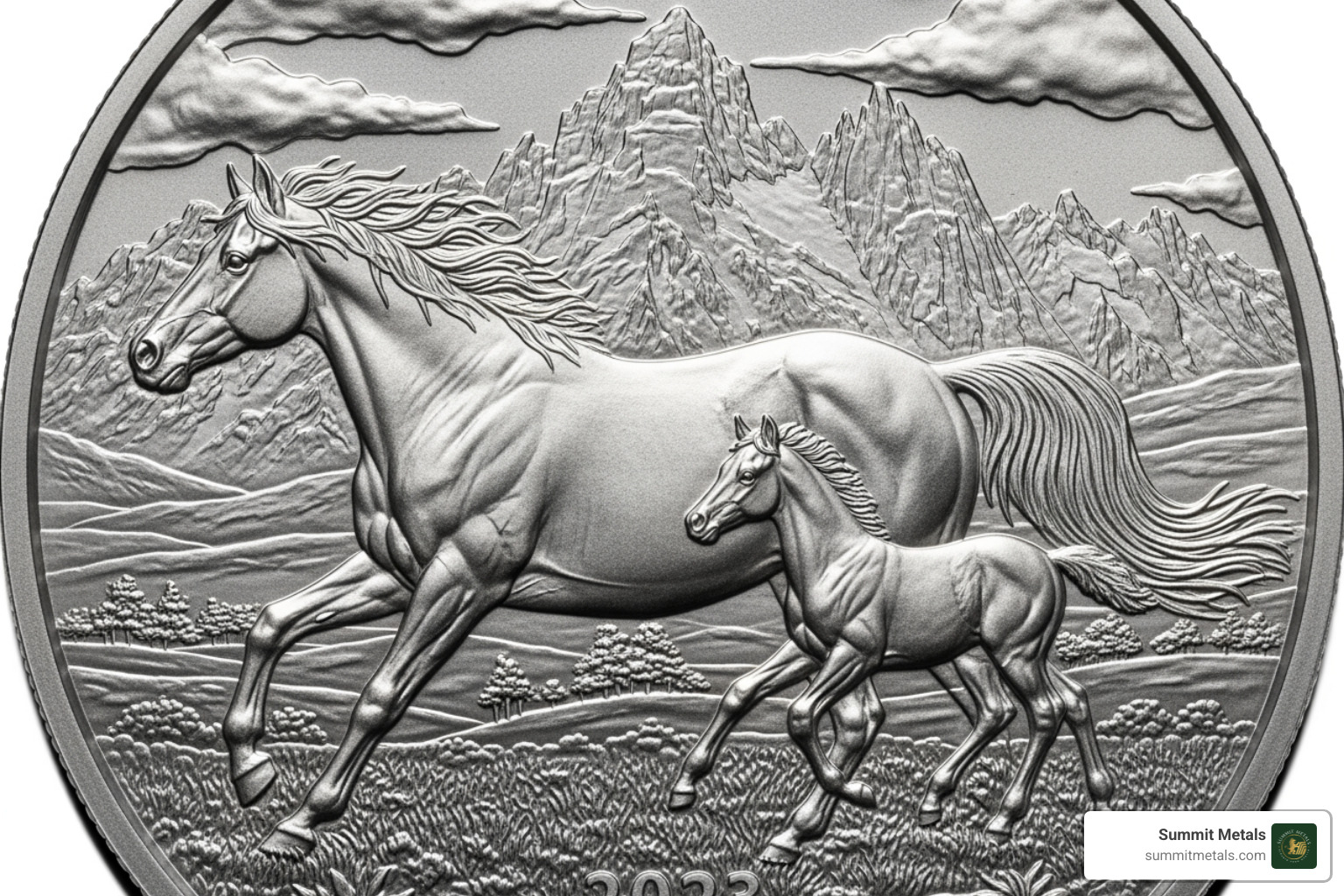

The Perth Mint's Lunar Series combines cultural symbolism with stunning artistry. The 2026 Year of the Horse is the seventh animal in the 12-year Chinese zodiac cycle for Series III.

King Charles III's effigy appears on the obverse, while the reverse captures a mare and foal galloping through grasslands. The design includes the Chinese character for 'Horse' and The Perth Mint's 'P' mintmark. Those born in the Year of the Horse are said to be independent, charismatic, and adventurous, symbolizing energy and success. This resonates across cultures, making the coin broadly appealing.

The Perth Mint strikes this coin from .9999 fine silver, among the purest available. The maximum mintage of 300,000 adds collectibility. Security comes from a micro-laser engraved letter on the reverse, visible only under magnification. The coin is also IRA approved, making it another excellent choice for retirement diversification.

Learn more about why precious metals protect your wealth: Why Gold and Silver? Understanding Their Value as Safe Haven Assets.

2026 Canadian Silver Maple Leaf: A Treasured Privy Mark

The Royal Canadian Mint (RCM) is known for purity and innovation. The 2026 Treasured Silver Maple Leaf with a Year of the Horse privy mark continues this tradition as a "Premium Bullion" release.

King Charles III appears on the obverse, while the reverse showcases Canada's beloved Maple Leaf design with a detailed Year of the Horse privy mark. The RCM's 99.99% pure silver composition is a hallmark of quality. What makes this coin stand out is its limited mintage of just 25,000 coins worldwide, making it the scarcest of these four major releases.

As a Premium Bullion product, it arrives in custom-themed packaging. Security is improved by radial lines that create a light-diffracting pattern and proprietary MINTSHIELD™ surface protection that reduces milk spots. While standard Maple Leafs are IRA eligible, confirm this special edition's status with your dealer before adding it to a retirement account.

Explore Canada's rich numismatic history with our guide: Canadian Coins: Your Pocket-Sized Guide to Numismatic Wonders.

Investment Deep Dive: Analyzing Your 2026 1oz Silver Coin Options

Choosing the right 2026 1oz silver coin requires looking beyond the design. Let's analyze the specifications that influence your coin's melt value and its potential collectibility premium.

Side-by-Side: What Really Matters

| Feature | 2026 American Silver Eagle | 2026 British Silver Britannia | 2026 Australian Lunar Horse | 2026 Canadian Silver Maple Leaf |

|---|---|---|---|---|

| Mint | US Mint | The Royal Mint | The Perth Mint | Royal Canadian Mint |

| Purity | .999 Fine Silver | .9999 Fine Silver | .9999 Fine Silver | .9999 Fine Silver |

| Mintage | TBA (Typically high) | TBA (Typically high for bullion) | 300,000 | 25,000 (Limited Edition) |

| Legal Tender | $1 USD | £2 GBP | $1 AUD | $5 CAD |

| Security Features | Laser Engraved Master Dies, Reeded Edge | Micro-text, Latent Image, Surface Animation, Tincture Lines | Micro-laser Engraved Letter | Radial Lines, MINTSHIELD™ Protection |

| IRA Status | Eligible | Eligible | Eligible | Generally Eligible (confirm for privy mark) |

| Primary Appeal | Patriotism, Liquidity, 40th Anniversary | Security, Iconic Design, History | Cultural Significance, Collectibility, Artistry | Purity, Collectibility, Scarcity |

Understanding Bullion Value vs. Numismatic Value

Every silver coin has two sources of value. Bullion value is the worth of the silver itself, based on the current spot price. Numismatic value is the premium paid above melt value for factors like rarity, historical significance, and condition. The 2026 Canadian Silver Maple Leaf, with only 25,000 minted, is positioned to command a significant numismatic premium. Similarly, the 2026 American Silver Eagle's dual anniversary gives it "key-date" potential that collectors recognize.

Why Mintage Numbers Matter

The total number of coins produced directly affects scarcity, which drives collector demand. The Canadian Maple Leaf's cap at 25,000 pieces makes it the rarest of the bunch, which typically translates to higher premiums. The Australian Lunar Horse, limited to 300,000, is more limited than unlimited mintage coins. The American Silver Eagle and British Britannia are produced based on demand, making them excellent for bullion value and liquidity, but their numismatic potential relies more on special circumstances like anniversaries.

The Purity Question: Does .999 vs .9999 Really Matter?

For most investors, the difference between .999 (99.9% pure) and .9999 (99.99% pure) silver is minimal in value. However, the .9999 purity of the Canadian Maple Leaf and Australian Lunar Horse represents the pinnacle of silver refinement. It's a point of pride for these mints and can influence market perception, even if the actual silver content difference is negligible.

Security Features: Your Shield Against Counterfeits

As counterfeiters grow more sophisticated, security features are critical. The British Britannia leads with its four-layer approach, while the Canadian Maple Leaf uses radial lines and MINTSHIELD™ technology to deter fakes and prevent milk spots. The Australian Lunar Horse includes a micro-laser engraved letter, and the 2026 Silver Eagle benefits from new laser-engraved master dies. These features guarantee you're buying genuine silver.

IRA Eligibility: Building Tax-Advantaged Wealth

For American investors, IRA eligibility allows for tax-advantaged precious metals investing. The 2026 American Silver Eagle, British Silver Britannia, and Australian Lunar Horse are all approved for self-directed IRAs. The Canadian Silver Maple Leaf generally qualifies, but it's wise to confirm special editions with your custodian. IRA eligibility makes these coins ideal for building a position over time through an Autoinvest program, where you dollar-cost average into silver just as you would with a 401(k).

If you're wondering whether silver deserves a place in your investment strategy, we've explored that question in depth here: Is Silver a Good Investment?.

Coins vs. Bars: Which Path Makes Sense for You?

New investors often ask: should I buy coins or bars?

| Feature | 1oz Silver Coin | 1oz Silver Bar |

|---|---|---|

| Legal Tender | Yes (has face value) | No |

| Government Backing | Face value and authenticity guaranteed | Relies on refiner reputation |

| Collectibility | High (design, mintage, history) | Low (generic design) |

| Premium over Spot | Generally higher | Generally lower |

| Liquidity | High (globally recognized) | High |

Coins offer legal tender status and a government guarantee of authenticity, plus numismatic potential from design and rarity. Bars are a cost-effective way to acquire pure silver by weight, typically with lower premiums. Many investors hold both: bars for weight and coins for liquidity and collectibility. Consider starting an Autoinvest program to purchase silver regularly and smooth out price volatility through dollar-cost averaging.

How to Invest Smartly in 2026 Silver Coins

Investing in anticipated releases like the 2026 1oz silver coin lineup requires a smart approach. Let's explore how to maximize your investment while building a secure silver stack.

The Power of Dollar-Cost Averaging

One of the smartest strategies is Dollar-Cost Averaging (DCA). Instead of trying to time the market, DCA involves investing a fixed amount at regular intervals. This strategy averages out your purchase price over time, reducing volatility risk, similar to how 401(k) contributions work.

Our Autoinvest program at Summit Metals makes this effortless. Set up recurring purchases of the 2026 1oz silver coin releases you want, and we'll automatically process your order each month. It's hands-off investing that removes emotion and keeps you consistently building your stack.

Building Your Stack Strategically

Building a silver stack is a marathon. The 2026 releases offer exceptional opportunities. Start with coins that match your goals: the American Silver Eagle for liquidity, the British Britannia for security, or the limited-mintage Canadian Maple Leaf and Australian Lunar Horse for collectibility. Diversifying your holdings between different mints and designs provides flexibility and exposes you to different markets.

Understanding What You're Really Paying

When you purchase silver coins, you pay the spot price plus a premium. Premiums cover the costs of mining, refining, minting, and distribution, and also reflect factors like mintage limits and collector demand. For example, the 2026 Canadian Maple Leaf's premium will likely be higher due to its low mintage of 25,000.

At Summit Metals, our bulk purchasing power allows us to offer competitive premiums with transparent, real-time pricing. For a deeper understanding of how premiums work, read our guide: Don't Get Fooled: A Guide to Silver Premiums.

Choosing a Dealer You Can Trust

Your dealer matters as much as the coins you buy. Look for established dealers with transparent, real-time pricing, clear shipping and insurance policies, and positive customer reviews. Verify they sell authenticated products from recognized mints.

We built Summit Metals on these principles. Operating from Wyoming, USA, we provide transparent pricing powered by live data from Xignite.com. Our bulk purchasing relationships with major mints translate into competitive rates for you. For more guidance, visit: Identifying Reputable Bullion Dealers: Avoiding Counterfeits.

Protecting Your Investment Through Proper Storage

Proper storage is vital. Use airtight capsules to prevent tarnish and scratches. Store them in a cool, dry place and handle coins by their edges. For security, consider a quality home safe or professional depository storage, which is required for IRA-held metals.

We've created a comprehensive resource covering all storage options: From Eagles to Ingots: Your Guide to Storing All Types of Silver.

Staying Informed with Live Market Data

Silver prices move constantly. We display live spot prices on our website, updated continuously using data from Xignite.com. This transparency helps you make informed decisions. However, if you're using Dollar-Cost Averaging through our Autoinvest program, short-term price movements matter less. You're building wealth through consistent accumulation, letting time and market averaging work for you.

Frequently Asked Questions about the 2026 1oz Silver Coin

What is the significance of the 'Year of the Horse' for 2026 coins?

The Horse is the seventh animal in the 12-year Chinese zodiac cycle, symbolizing energy, success, and freedom. This theme gives coins like the Australian Lunar and the privy-marked Canadian Maple Leaf broad, cross-cultural appeal, especially in Asian markets where the zodiac holds deep meaning. This widespread interest increases collector demand and numismatic value beyond the silver content alone, making them highly sought-after releases.

Are 2026 1oz silver coins a good investment?

Yes. All 2026 1oz silver coin releases offer the intrinsic value of a tangible asset that acts as a hedge against inflation and provides portfolio diversification. What makes 2026 unique is the high potential for numismatic appreciation. The American Silver Eagle's 40th anniversary and the limited mintage of the Canadian Horse privy mark (only 25,000) create scarcity and historical significance that collectors value. This can drive prices well above the spot value over time.

For a deeper understanding of how precious metals fit into a modern investment strategy, explore our guide: Maximizing Your Investment in a Chaotic Global Economy: Why Gold and Silver Are Essential for Portfolio Diversification in 2024.

Consider using our Autoinvest program to build your silver holdings systematically. Regular monthly purchases allow you to dollar-cost average, removing the stress of timing the market and helping you steadily accumulate these valuable coins.

Where can I buy a 2026 1oz silver coin?

Purchase from established online bullion dealers with transparent, real-time pricing. Authentication is critical, so choose a dealer that guarantees their products and works directly with mints or authorized distributors. Counterfeits are a real risk, so buying from a trusted source is your best protection.

At Summit Metals, we offer competitive rates due to our bulk purchasing power and provide transparent, live pricing so you always know what you're paying. We operate from Wyoming with a commitment to trust and value, guaranteeing the authenticity of every coin we sell. If you're in Utah, you can also explore local options with our guide: Utah Silver Shopping Made Easy: Find Trusted Dealers Near You.

Our guide can help you spot the warning signs of a bad dealer: Identifying Reputable Bullion Dealers: Avoiding Counterfeits.

Conclusion: Securing Your 2026 Silver Investment

The year 2026 is genuinely special for precious metals investors. The silver coin lineup is exceptional, combining historic anniversaries, rich cultural themes, and advanced security features. From the 40th Anniversary American Silver Eagle to the scarce Canadian Maple Leaf with its Horse privy mark, there is a meaningful option for every portfolio.

These aren't just coins—they're tangible assets that hold intrinsic value. The 2026 1oz silver coin releases represent different paths to the same destination: protecting your wealth and potentially growing it through both bullion value and numismatic appreciation.

At Summit Metals, we make precious metals investment straightforward. Our transparent, real-time pricing and bulk purchasing power translate to competitive rates for you. We operate from Wyoming with a commitment to trust and value that our clients depend on.

Building your silver stack doesn't have to happen all at once. Consistent monthly investments through our Autoinvest program let you dollar-cost average into these historic 2026 releases, taking the stress out of timing the market.

The limited mintages on certain 2026 coins won't last forever. Neither will the opportunity to own first-year releases commemorating such significant milestones. Start or grow your precious metals portfolio today by exploring our extensive collection of silver bullion. Your future self will thank you for the security that physical silver provides.