Why Silver Britannia Coins Matter for Your Portfolio

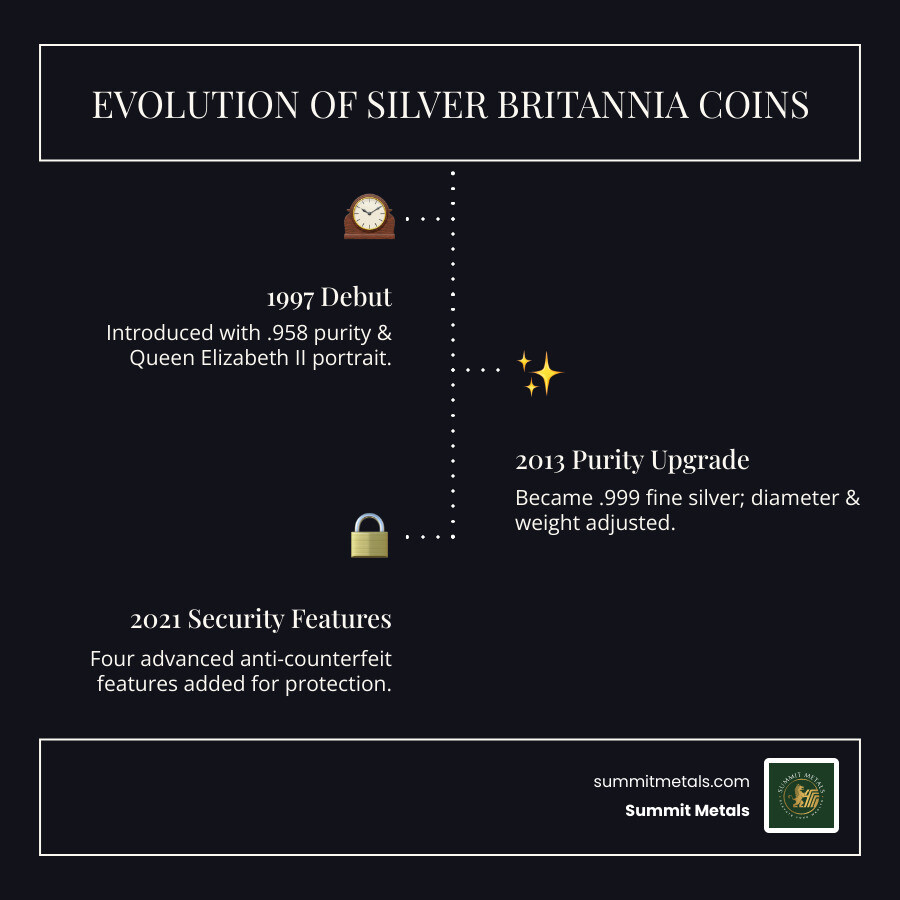

Silver Britannia coins are one-troy-ounce bullion coins from the UK's Royal Mint, first issued in 1997. Since 2013, they have been struck from .999 fine silver (99.9% pure), contain one troy ounce of silver, and have a face value of £2. A 2021 update introduced four groundbreaking anti-counterfeit features, making them among the world's most visually secure bullion coins. For UK residents, they are also exempt from Capital Gains Tax.

The Silver Britannia combines 2,000 years of British heritage with state-of-the-art minting. The coin features Britannia, the female personification of Great Britain, an icon on British coinage since the Roman era.

Investors and collectors choose Silver Britannias for their high purity, advanced security, global recognition, and government backing from the 1,000-year-old Royal Mint. The upgrade to .999 purity in 2013 aligned the Britannia with other top-tier bullion like the American Silver Eagle and Canadian Silver Maple Leaf.

For collectors, certain editions carry significant numismatic value. The 2014 'Mule Britannia' error and rare Lunar Privy marks can fetch substantial premiums over their silver content.

Building a position is simple with Autoinvest at Summit Metals. Set an amount and buy every month—just like contributing to a 401(k). Dollar-cost averaging helps you steadily accumulate Silver Britannia coins at an average price with transparent, real-time pricing and no guesswork about market timing.

I'm Eric Roach. After a decade as a Wall Street M&A advisor managing multi-billion-dollar hedging programs, I now apply that expertise to help individuals protect their wealth with physical precious metals. At Summit Metals, we translate institutional strategies into clear guidance for investors seeking stability.

The Enduring Legacy of Britannia on British Coinage

Britannia is more than a figure on a coin; she is a 2,000-year-old symbol of Britain's strength and maritime heritage.

Her story began when Roman Emperor Hadrian commissioned coins with a female personification of the conquered British Isles. Initially depicted as a dejected figure, her image transformed over centuries. By the reign of Elizabeth I, as Britain's naval power grew, Britannia evolved into a proud guardian of the seas, reflecting the nation's expanding global influence.

The modern image of Britannia was established in 1672 by artist John Roettiers for King Charles II. His design, showing a majestic Britannia with a spear and shield, became so iconic that a public outcry prevented its removal from coinage in 1968. She was instead placed on the new 50p coin in 1969.

Britannia was revived for bullion in 1987 with the Gold Britannia, followed by Silver Britannia coins in 1997. Philip Nathan's standing design—featuring Britannia with a trident, shield, and olive branch—has become the definitive image of the series, capturing both strength and peace.

From Monarch to Monarch: The Obverse Designs

The obverse (front) of every Silver Britannia coin features the reigning British monarch, with portraits evolving over time.

Queen Elizabeth II's reign saw three portraits on the Silver Britannia:

- 1997: Raphael Maklouf's third-generation portrait, showing the Queen in the George IV State Diadem.

- 1998–2015: Ian Rank-Broadley's fourth-generation portrait, praised for its mature realism.

- 2016–2022: Jody Clark's fifth-generation portrait, a contemporary and regal design.

2023 was a historic transition year. Martin Jennings designed the first official portrait of King Charles III, who faces left in accordance with tradition (opposite his mother). Some 2023 coins feature Queen Elizabeth II's final effigy, while others bear King Charles III's first, creating unique collector's items marking this pivotal moment.

The Art of the Reverse: Britannia's Many Faces

While the obverse features the monarch, the reverse (back) of Silver Britannia coins is a canvas for artistic creativity.

Since 2013, Philip Nathan's standing Britannia has been the standard design for bullion coins. Before that, from 1997 to 2012, the Royal Mint alternated designs: Nathan's appeared in even years, while odd years showcased new interpretations by different artists.

Proof coins offer even more variety, often featuring unique designs annually that explore different facets of Britannia's character. For example, the 2017 proof celebrated the coin's 20th anniversary, and the 2022 proof marked 350 years of Britannia on British coinage. These special editions and artistic interpretations make certain years highly desirable for collectors. You can explore the Full Artist Breakdown available here to see the rich variety of designs across the series.

Anatomy of a Britannia: Specifications and Evolution

Every Silver Britannia coin has a face value of £2, making it official UK legal tender. The coin's physical specifications have evolved, with a major change occurring in 2013.

Key Specifications of Silver Britannia Coins

In 2013, the Royal Mint increased the silver purity from .958 fine silver (known as "Britannia silver") to .999 fine silver. This upgrade positioned the Britannia alongside the world's purest bullion coins, like the Canadian Silver Maple Leaf and American Silver Eagle.

This change also adjusted the coin's dimensions. The total weight was reduced from 32.45 grams to 31.21 grams, and the diameter shrank from 40.00mm to 38.61mm. Despite these adjustments, each coin still contains exactly one troy ounce of pure silver, achieved by refining the alloy composition.

| Feature | Pre-2013 Silver Britannia (1997-2012) | Post-2013 Silver Britannia (2013-Present) |

|---|---|---|

| Purity | .958 fine silver (95.8%) | .999 fine silver (99.9%) |

| Total Weight | 32.45g | 31.21g |

| Fine Silver Content | 1 troy ounce (31.1035g) | 1 troy ounce (31.1035g) |

| Diameter | 40.00mm | 38.61mm |

| Face Value | £2 | £2 |

This milestone creates a distinction for collectors between pre-2013 and post-2013 coins. In 2013, the Royal Mint also introduced a larger 5oz silver coin with a £10 face value.

A World-First in Security

In 2021, the Royal Mint introduced four cutting-edge security features, making the Silver Britannia coins the "world's most visually secure bullion coin." These sophisticated anti-counterfeiting measures provide peace of mind for investors.

- Latent Image: Switches between a padlock and a trident when the coin is tilted.

- Surface Animation: A wave pattern in the background appears to ripple as the viewing angle changes.

- Micro-text: The inscription "DECUS ET TUTAMEN" (Latin for "An Ornament and a Safeguard") is engraved in tiny letters.

- Tincture Lines: Heraldic patterns on Britannia's shield represent colors, requiring precision minting.

These features make authentication straightforward. When building a position through Autoinvest—our program for making regular monthly purchases of Silver Britannia coins like a 401(k) contribution—this world-leading security adds tremendous confidence to your strategy. You're not just buying silver; you're acquiring a piece of sophisticated craftsmanship backed by the Royal Mint.

Investing in and Collecting Silver Britannia Coins

Silver Britannia coins appeal to both investors and collectors. Their value is tied to the silver spot price, offering a tangible asset that moves with precious metals markets. However, many Britannias also carry a numismatic premium, especially rare years or limited editions.

For UK residents, these coins are exempt from Capital Gains Tax (CGT), making them highly tax-efficient. While Summit Metals operates under US tax laws, the global recognition and liquidity of Silver Britannia coins make them an excellent choice for investors worldwide, with a robust secondary market.

Many investors ask why they should choose coins over bars. While both are valid investments, coins offer distinct advantages, particularly in security and numismatic potential.

| Feature | Silver Britannia Coins | Silver Bars |

|---|---|---|

| Government Backing | Yes, legal tender (£2 face value) | No, relies on refiner's reputation |

| Face Value/Legal Tender | Yes, sovereign issue | No |

| Fraud Protection | High (official status & 2021+ security features) | Lower (may require deeper testing) |

| Liquidity | Excellent, globally recognized | Good, but may require verification |

| Verification Effort | Quick visual checks + dimensions | Often needs assay or ultrasonic testing |

| Numismatic Potential | Yes, rare editions can gain value | Generally no, value is tied to melt |

| Premiums | Slightly higher over spot price | Typically lower over spot price |

The legal tender status and advanced security features provide an assurance of authenticity that bars lack. Furthermore, the potential for a coin's value to grow beyond its metal content, as seen with the 2014 'Mule' error, is an upside unique to numismatics.

Bullion vs. Proof vs. BU: What's the Difference?

When exploring Silver Britannia coins, you'll find three main types:

- Bullion: The standard investment-grade coin, mass-produced since 2013 with a focus on delivering one troy ounce of .999 fine silver at a low premium. They are ideal for stacking and are often sold in tubes of 25.

- Brilliant Uncirculated (BU): A higher quality strike than bullion, using polished dies for sharper detail. BU coins have limited production runs and appeal to collectors who want superior visual quality without the high cost of proofs.

- Proof: The highest quality, minted for collectors. Struck multiple times with polished dies, they feature frosted designs on mirror-like backgrounds. Since 2013, proofs have unique annual reverse designs and come in presentation boxes with low mintages, commanding the highest premiums.

Rare Varieties and Notable Errors for Collectors

The Silver Britannia coins series includes several rarities that are highly sought after by collectors.

- The 2014 'Mule' Britannia: The most famous error, where ~17,000 coins were struck with an incorrect obverse from the Lunar Year of the Horse series. These command substantial premiums.

- Lunar Privy Mark Series: The 2019 Pig privy mark is exceptionally rare and valuable, reportedly because a large institution bought most of the mintage.

- Rare Issues: Other notable rarities include the 2011 Matte Finish Britannia, S.S. Gairsoppa shipwreck silver coins, the 2017 20th Anniversary Chariot coin, the Oriental Border series (2018-2020), and the limited-mintage 2023 Coronation of King Charles III Britannia.

These examples show how production anomalies and limited mintages can turn a bullion coin into a numismatic treasure.

Building Your Collection with Autoinvest

Consistent, disciplined accumulation is the smartest way to build a precious metals position. Our Autoinvest program at Summit Metals facilitates this through dollar-cost averaging.

By making automated monthly purchases, you invest a fixed amount regularly, buying more Silver Britannia coins when prices are low and fewer when they are high. This strategy averages your purchase price over time and removes the stress of trying to time the market. You build a tangible asset you own outright, with no management fees or counterparty risk. Learn more about our subscription services and start building your silver stack the smart way.

To help you decide if automated buying fits your goals, here is a quick comparison:

| Feature | Autoinvest (Dollar-Cost Averaging) | One-Time Lump-Sum |

|---|---|---|

| Timing Risk | Lower (buys across market cycles) | Higher (depends on purchase day) |

| Average Cost | Smoothed over time | All-in at one price |

| Discipline | Automatic monthly purchases | Requires manual decisions |

| Cash Flow | Budget-friendly installments | Large upfront outlay |

| Emotions | Reduces fear/greed-driven timing | Prone to market timing bias |

| Best For | Building long-term positions steadily | Taking advantage of specific market dips |

Frequently Asked Questions about Silver Britannia Coins

Here are answers to the most common questions we receive about Silver Britannia coins.

Are Silver Britannia coins a good investment?

Yes, they are an excellent investment for several reasons:

- Tangible Value: They are a physical asset whose value is tied to the global silver spot price, providing a hedge against inflation and market volatility.

- Government Backing: As legal tender issued by the 1,000-year-old Royal Mint, they are trusted and recognized worldwide.

- High Purity & Security: Modern Britannias contain .999 fine silver and feature world-leading anti-counterfeiting technology, ensuring their authenticity and value.

- Global Liquidity: Their global recognition ensures a strong secondary market, making them easy to buy and sell.

- Numismatic Potential: Certain rare editions and error coins can appreciate in value far beyond their silver content.

For US investors, their high purity and global trust make them a smart addition to any precious metals portfolio.

What is the difference between a bullion and a proof Britannia?

The primary difference lies in their purpose, finish, and mintage.

- Bullion Britannias are for investment. They are mass-produced to be stacked for their silver content, with prices close to the spot price. They feature the standard standing Britannia design (since 2013).

- Proof Britannias are for collection. They are limited-edition works of art with a flawless, mirror-like finish and frosted details. They feature unique annual designs and command significant premiums due to their rarity and craftsmanship.

Think of it this way: bullion is for stacking, while proof is for showcasing.

How can I verify the authenticity of my Silver Britannia?

Authenticating modern Silver Britannia coins is straightforward, especially for those minted from 2021 onwards.

- Check the Security Features: Tilt the coin to see the latent image (padlock/trident) and the surface animation (waves). Use a magnifying glass to find the micro-text and examine the tincture lines on the shield.

- Verify Specifications: A post-2013 1oz coin should weigh 31.21g and have a diameter of 38.61mm. Pre-2013 coins are slightly larger and heavier. Any deviation is a red flag.

- Compare with Official Images: Look for crisp, sharp details. Mushy lettering or poor strike quality can indicate a counterfeit.

- Buy from a Reputable Dealer: This is the most crucial step. Purchasing from a trusted source like Summit Metals guarantees you receive authenticated, genuine coins. Our Wyoming-based operations prioritize trust and transparency.

For high-value coins, consider professional grading services like NGC or PCGS for certified authentication and encapsulation.

Is Autoinvest better than trying to time the market?

For most investors, yes. Autoinvest spreads purchases across market conditions, reduces timing risk, and instills discipline. Summit Metals' automated monthly buying—similar to a 401(k) contribution—helps you steadily build a position in Silver Britannia coins without second-guessing price moves.

Conclusion

The Silver Britannia coin is more than an ounce of silver; it's a piece of living history that merges ancient symbolism with 21st-century security. From its Roman origins to its modern anti-counterfeiting technology, the Britannia embodies British heritage and minting excellence.

Its dual appeal makes it unique. For investors, it's a tangible, government-backed asset with .999 fine silver purity and global liquidity. For collectors, the hunt for rare errors, proof editions, and unique designs offers a rewarding journey.

At Summit Metals, our Wyoming-based operations are built on trust and transparency. We offer authenticated Silver Britannia coins at competitive, real-time prices. We're here to guide you with the institutional-grade expertise I developed on Wall Street, making precious metals accessible to all.

Building wealth with precious metals is best done with a consistent strategy. Our Autoinvest program simplifies this process through dollar-cost averaging—buy every month, just like investing in a 401(k). Automated purchases allow you to build your position steadily, removing emotion and market-timing stress.

Ready to add the enduring strength of Britannia to your portfolio? Explore our Autopays options to begin your automated investment journey, or browse our full selection of precious metals at Summit Metals. To diversify further, learn more about buying gold. If you're looking to sell, our Sell to Us page offers a seamless process with competitive rates.

Start your Silver Britannia coins collection today and experience the Summit Metals difference.