Why Silver Bar Premiums Matter for Every Investor

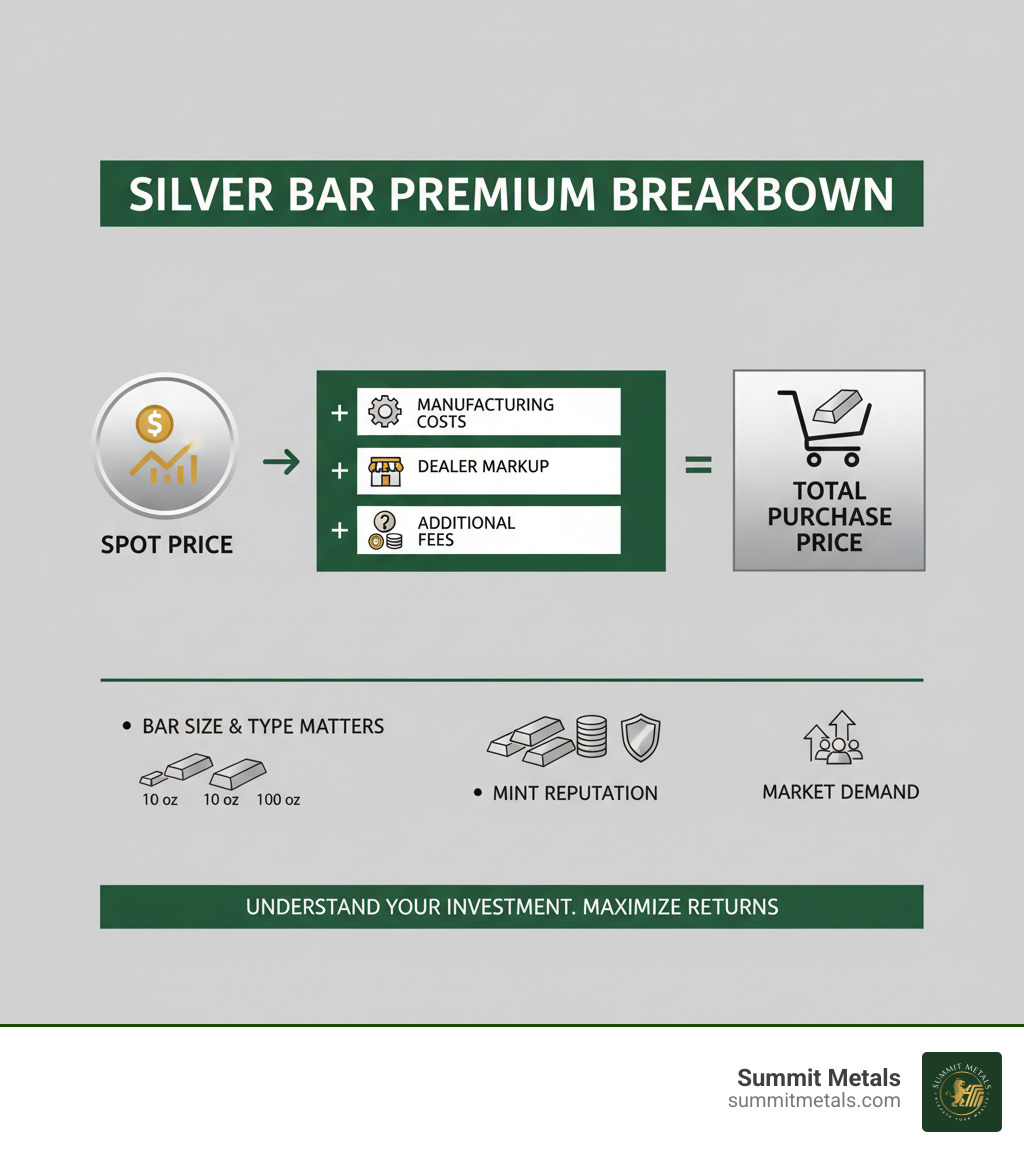

Understanding the silver bar premium—the amount you pay over silver's spot price—is crucial for any precious metals investor. This premium covers manufacturing, distribution, and dealer costs, directly impacting your returns and how much silver you can buy.

Key Silver Bar Premium Facts:

- 10 oz silver bars: Typically 3-5% premium ($1-$1.50 per ounce over spot)

- 1 oz silver bars: Usually around $2 premium per ounce

- 100 oz silver bars: Often have the lowest premiums per ounce

- Cast bars: Generally cheaper than minted bars

- Generic bars: Lower premiums than branded or collectible bars

If silver's spot price is $25 per ounce, you might pay $26.50-$27 for an ounce in a 10 oz bar. That $1.50-$2 difference is the premium. Knowing how to minimize it can save you hundreds or thousands of dollars on larger purchases.

Premium calculation is simple: Silver Spot Price + Premium + Taxes (if applicable) + Shipping = Your Total Cost

Factors like market demand, bar size, and production method drive these premiums. Smart investors learn to steer these variables to maximize their silver holdings.

I'm Eric Roach, and with a decade of experience on Wall Street, I've helped clients use precious metals for defensive strategies, including optimizing silver bar premium costs. My institutional experience now helps individual investors make smarter decisions when building their silver positions.

Quick look at silver bar premium:

- buy silver bars

- investing in bullion

- American silver eagle

What is a Silver Premium and How is it Calculated?

When you buy silver, the price is always higher than the quoted "spot price." This difference is the silver bar premium, a critical concept for any investor. It's not a ripoff; it's the cost of turning raw metal into a finished product.

Spot price is the current market value of raw silver per ounce, traded by large institutions. This price fluctuates constantly during trading hours, which you can track on Live Silver Price Charts.

As an individual investor, you can't buy raw silver at spot price. You're purchasing a finished product that has been manufactured, packaged, and delivered.

The silver bar premium covers these real-world costs. Fabrication costs include melting, casting, and quality testing. Distribution expenses cover shipping, storage, and insurance. Finally, the dealer's markup allows them to operate their business.

For example: If silver's spot price is $25 per ounce and you buy a 10 oz bar for $270, you've paid a $2 per ounce premium. ($270 ÷ 10 oz = $27/oz, and $27 - $25 spot = $2 premium). This can be expressed as a dollar amount or a percentage (in this case, 8%).

The basic math is: Silver Spot Price + Premium = Your Base Cost

However, your total cost also includes potential sales taxes and shipping fees. Some states exempt precious metals from sales tax, while others do not. Online orders may have shipping costs of $30-$50.

So, the complete formula is: Spot Price + Premium + Taxes + Shipping = Your Final Cost

This is why compare the total cost per ounce when shopping. A dealer with a slightly higher premium might be cheaper overall if they offer free shipping or are in a tax-free state.

Understanding this breakdown helps you spot good deals and avoid overpaying. For a deeper dive, check out our guide on Spot Price vs. Premium: How Precious Metals Pricing Works.

The key takeaway? Silver bar premiums are the cost of turning raw metal into a tangible investment. Smart investors learn to minimize these costs while acquiring quality, trustworthy products.

Key Factors That Drive the Silver Bar Premium

The silver bar premium isn't arbitrary; it's a reflection of real, shifting market forces. Think of it like the price of gas—it fluctuates based on supply, demand, and world events.

During economic uncertainty, inflation fears, or political turmoil, people flock to silver as a safe haven. When demand spikes, as it did during the COVID-19 pandemic, premiums rise. At the same time, silver's dual role as an industrial metal in smartphones, cars, and solar panels creates a steady demand baseline. Supply chain disruptions can also cause premiums to soar when mints can't produce bars fast enough to meet demand.

Looking at the Historical Price of Silver Graph shows how prices and premiums have weathered wars, recessions, and bull markets. Understanding these patterns helps inform buying decisions.

How Size and Weight Impact Your Cost Per Ounce

Here's where you can save money: the size of your silver bar has a huge impact on your premium. Larger bars cost less per ounce.

It takes nearly the same amount of work to manufacture a 1-ounce bar as it does a 10-ounce bar. By choosing a larger bar, you spread those fixed costs over more silver, lowering the per-ounce premium.

- 1-ounce silver bars often carry premiums around $2 per ounce over spot.

- 10-ounce silver bars typically run about 3-5% over spot, or $1-$1.50 per ounce.

- 100-ounce silver bars offer some of the lowest premiums available.

If silver is $25/oz, a 1-ounce bar might cost $27, while each ounce in a 10-ounce bar might cost $26.50. That 50-cent difference adds up quickly. The trade-off is flexibility. It's easier to sell a few 1-ounce bars than part of a 100-ounce bar. Many investors find 10-ounce bars offer the best balance of low premiums and liquidity.

For more options, check out The 7 Best Places to Buy Silver Bars.

Minted vs. Cast Bars: Does Production Style Matter?

You'll notice two distinct styles of silver bars, and their production method directly affects the silver bar premium.

Minted bars are struck under high pressure, creating sharp edges, mirror-like finishes, and intricate designs. This extra craftsmanship and precision result in higher premiums.

Cast bars are made by pouring molten silver into an open mold. This creates a rugged, unique bar with a matte finish. From a pure investment standpoint, cast bars usually offer better value because you're paying for silver content, not appearance. If your goal is to stack as much silver as possible for the lowest cost, cast bars are often your best bet.

Our guide Bar None: The Best Understanding Certified Silver Bars dives deeper into these differences.

How Design and Brand Affect the Silver Bar Premium

Not all bars are equal. The brand and design also affect the premium. Reputable mints like PAMP Suisse or the Royal Canadian Mint command higher premiums because they guarantee purity (.999 or .9999 fine) and are trusted worldwide, making them easy to sell.

Collectible and art bars feature elaborate designs or limited mintages and carry much higher premiums that you're unlikely to recoup upon sale. For investment purposes, stick with investment-grade bullion bars from trusted mints. You might pay a bit more upfront for a premium brand, but you're buying peace of mind and easier resale.

The Definitive PAMP 1kg Silver Bar Comparison shows how premium brands maintain their value over time.

Bars vs. Rounds vs. Coins: A Premium Comparison

When building your silver portfolio, you'll encounter three main options: bars, rounds, and sovereign coins. Understanding their silver bar premium differences can save you money while meeting your goals.

If your goal is maximum ounces for your dollar, bars and generic rounds are ideal. If you value government backing and potential collectibility, sovereign coins may be worth the higher cost.

| Feature | Silver Bars | Silver Rounds | Sovereign Coins |

|---|---|---|---|

| Typical Premium | Lowest, especially for larger sizes | Low to moderate | Highest |

| Liquidity | Very high, especially for standard sizes | High | Very high, universally recognized |

| Collectibility | Low (unless limited edition/art bar) | Low (unless specific series/design) | Moderate to High (numismatic potential) |

| Key Investor Benefit | Maximize silver weight per dollar spent | Cost-effective, recognizable 1 oz units | Government-backed, legal tender, fraud protection, numismatic potential |

Silver Bars and Generic Rounds: The Low-Premium Choice

For pure accumulation, silver bars and generic rounds are the most cost-effective options. Produced by private mints, these products focus on silver content, not collectibility. Since they aren't legal tender, they don't carry a government-mandated premium. A 10-ounce generic bar might have a 3-5% premium, while the same weight in sovereign coins could cost 30-40% more.

These products track the spot price closely and are highly liquid with dealers. They are the perfect choice for a dollar-cost averaging strategy, like Summit Metals' Autoinvest program, where you can build your stack with consistent monthly purchases while minimizing premium drag. Check out Get Your Rounds In: Where to Purchase Silver Rounds for more guidance.

Sovereign Coins: Why You Pay More

Government-minted coins like American Silver Eagles and Canadian Silver Maple Leafs command higher premiums, but they offer unique benefits:

- Government Backing: As legal tender, they have a face value that provides real fraud protection. If you are sold a counterfeit, you have legal recourse.

- Anti-Counterfeiting Features: Modern mints invest heavily in security features that are difficult to fake, protecting your investment.

- Universal Recognition: A Silver Eagle or Maple Leaf is instantly recognized and can be sold at coin shops worldwide.

- Numismatic Potential: Certain years or mint marks can develop collectible value beyond their silver content.

The premium is substantial—often $6-$10 more per ounce—but these benefits can align with certain investment strategies. Explore American Silver Eagle 101 or Your Guide to the Canadian Silver Maple Coin to learn more.

How to Minimize Premiums and Maximize Your Silver Stack

Minimizing the silver bar premium is key to maximizing your silver stack. While premiums are a necessary part of the market, strategic management can help you get more silver for your money.

Let's explore practical strategies that can help you get more silver for your investment dollars.

What is an Acceptable Silver Bar Premium?

So, what's a fair premium? For 10-ounce silver bars, a premium of 3-5% over spot (around $1-$1.50 per ounce) is a good benchmark in the current market. However, this can fluctuate based on availability and demand.

What's acceptable depends on your personal tolerance. Some investors are comfortable with a 5% premium, while others set a higher walk-away price. The best approach is to compare real-time pricing from several reputable dealers before buying. Think in both percentages and dollar amounts to find the best value.

New vs. Secondhand: Finding the Best Value

Consider the secondary market to find great value. New bars are pristine but come with the full premium. Secondhand bars, which are previously owned, trade much closer to spot price because the initial premium has already been absorbed.

Reputable dealers like Summit Metals test and verify the authenticity and purity of all secondhand products, so you can buy with confidence. For investors focused on accumulating maximum weight, secondhand bars are an incredibly cost-effective choice.

The "Autoinvest" Strategy: Using Dollar-Cost Averaging

Trying to time the market for the lowest spot price and premium is nearly impossible. A better approach is dollar-cost averaging. By investing a fixed amount regularly, you buy more ounces when prices are low and fewer when they are high, averaging your cost over time.

This strategy removes emotion from investing. Summit Metals' Autoinvest program automates this process. You can set up recurring monthly purchases, similar to a 401(k), to build your silver position steadily without stressing over short-term market moves. This is a powerful way to build your stack, and you might find that learning How to Snag Silver Bullion at Spot Price (Yes, Really!) becomes easier as a consistent customer.

Learn more about The Power of Dollar-Cost Averaging in Gold and Silver Investments and how this time-tested strategy can strengthen your portfolio.

Frequently Asked Questions About Silver Premiums

Why are premiums on smaller silver bars higher per ounce?

The economics of manufacturing are the reason. Fixed costs for labor, machinery, and packaging are similar whether making a 1 oz or 10 oz bar. When these costs are spread over a single ounce of silver instead of ten or a hundred, the per-ounce premium is naturally higher.

This non-linear cost scaling is why you'll typically pay around $2 over spot for a 1-ounce bar, but only $1-$1.50 over spot per ounce for a 10-ounce bar. Those fixed production costs have more ounces to hide behind in larger bars, resulting in a lower silver bar premium per ounce.

Where can I find silver with the most competitive premiums?

Finding the best premiums requires some research, but the savings are worth it. Here are some tips:

- Reputable online dealers often have the lowest overhead and pass savings to you. Their bulk purchasing power means better prices. At Summit Metals, our transparent pricing reflects this advantage.

- Compare prices across several dealers before buying. Look for special promotions where dealers offer silver at $1-$1.50 over spot.

- Choose generic products like bars and rounds from private mints, which consistently have lower premiums than government coins.

- Buy in larger quantities to lower your per-ounce cost. A 100-ounce bar will have a much lower premium per ounce than one hundred 1-ounce bars.

- Sign up for dealer newsletters for flash sales and special offers.

For additional insights, check out our guide on Online vs. Local: Where to Sell Silver.

Have silver premiums always been this high?

No, current premiums are significantly higher than historical norms. The recent surge is dramatic, especially for government-minted coins, but even generic products now carry higher premiums.

The pandemic impact beginning in 2020 created a perfect storm: supply chain disruptions and refinery shutdowns occurred just as investor demand for safe-haven assets exploded. These supply issues have had lasting effects.

Furthermore, sustained investor demand has become a market feature due to economic volatility, inflation, and failures in other investment sectors. This, combined with silver's critical role in green energy (solar, EVs), has kept pressure on both spot prices and premiums.

Today's premiums reflect these real-world market dynamics. Using a strategy like our Autoinvest program helps you dollar-cost average through these fluctuations, building your position steadily over time.

Conclusion: Invest Smarter, Not Harder

Understanding the silver bar premium is the key to investing smarter. You now know that premiums are the necessary cost above spot price and that you can manage them strategically.

Here are the key takeaways:

- Size matters: Larger bars have lower per-ounce premiums.

- Style affects price: Cast bars are typically a better value than minted bars for pure investment.

- Product type is a choice: Generic bars and rounds offer the most silver for your dollar, while sovereign coins provide government backing for a higher premium.

You are in control. By choosing larger sizes, considering the secondary market from reputable dealers, and shopping around, you can minimize your costs. Our Autoinvest program simplifies this further, allowing you to use dollar-cost averaging to build your stack consistently, just like a 401(k).

At Summit Metals, we are committed to transparency. Our real-time pricing reflects our bulk purchasing power, with no hidden fees. We're here in Wyoming, working hard to get you the most silver for your investment dollar.

You are now equipped to build your silver stack with confidence. Ready to put this knowledge to work? Start building your stack today, knowing every premium dollar is working toward your financial security. For deeper insights, check out Learn What Is the Best Silver & Gold to Buy and Why Liquidity Matters.