Understanding Precious Metal Brokers and Their Role in Your Investment Journey

A precious metal broker acts as your professional intermediary in the gold and silver markets, helping you buy, sell, and manage precious metals investments while navigating the complexities of pricing, authenticity, and storage.

What Precious Metal Brokers Do:

- Trading Services: Facilitate buying and selling of gold, silver, platinum, and palladium

- Price Findy: Provide transparent, real-time pricing based on spot prices plus premiums

- Authentication: Ensure product authenticity through authorized dealer relationships

- Storage Solutions: Offer secure, insured storage options for your metals

- Expert Guidance: Provide market analysis and investment education

- Payment Processing: Handle secure transactions with multiple payment methods

The precious metals industry has evolved dramatically from the simple coin shops of decades past. Today's market offers everything from online platforms providing 24/7 access to brick and mortar companies with world-class showrooms. Companies like Canadian PMX have operated for over 25 years, while industry leaders like Kitco have been serving investors since 1977, and APMEX has facilitated over $18 billion in sales since 2000.

Whether you're seeking to diversify your portfolio, hedge against inflation, or preserve wealth for future generations, the right broker becomes your trusted partner in navigating market volatility and securing competitive pricing.

I'm Eric Roach, and during my decade as an investment banking advisor in New York, I've guided Fortune-500 clients through complex hedging programs and multi-billion-dollar transactions—experience that now helps everyday investors work effectively with a precious metal broker to protect and grow their wealth. Today, I channel that institutional expertise into helping individuals understand how physical gold and silver can serve as resilient hedges alongside traditional portfolios.

Why Precious Metals? The Foundation of a Resilient Portfolio

Picture this: while your neighbor's stock portfolio is doing gymnastics during the latest market downturn, your precious metals are sitting there like the steady friend who never panics. That's the magic of gold and silver—they've been the ultimate "chill pill" for portfolios for thousands of years.

When I worked with Fortune-500 clients in New York, I watched them consistently allocate portions of their portfolios to precious metals. Why? Because smart money understands that precious metals act as a hedge against inflation better than almost any other asset class. While your dollar might buy less coffee next year, that same ounce of gold will likely maintain—or even increase—its purchasing power.

The beauty of precious metals lies in their low correlation to stocks and bonds. When the stock market catches a cold, gold and silver often stay healthy. This isn't just theory—it's been proven time and again during economic uncertainty. Remember 2008? While many portfolios got hammered, precious metals provided crucial stability for those who owned them.

Portfolio diversification isn't just a fancy financial term—it's your financial safety net. By adding precious metals to your mix, you're essentially building a more resilient foundation. Our comprehensive guide on Maximizing Your Investment in a Chaotic Global Economy: Why Gold and Silver Are Essential for Portfolio Diversification in 2024 shows exactly how this works in today's volatile markets.

Here's something that really drives the point home: central banks worldwide are buying gold at record levels. These aren't emotional investors making impulse purchases—these are the world's most sophisticated financial institutions protecting their reserves. If it's good enough for central banks, shouldn't it be part of your strategy too? Our article Why Central Banks Buy Gold (and Why You Should Too): A Look Into the Power of Physical Gold explores this fascinating trend.

What makes precious metals truly special is that they're tangible assets—real things you can hold. In our digital world of ones and zeros, there's something deeply reassuring about owning physical wealth that can't disappear with a computer glitch or bank failure. They serve as a store of value that has survived every currency collapse, every empire's fall, and every financial crisis in human history.

The smartest approach? Consider setting up regular precious metals purchases through our Autoinvest program. Just like contributing to your 401k every month, consistent investing in gold and silver helps smooth out price fluctuations while building long-term wealth. When you work with a trusted precious metal broker like Summit Metals, you get transparent pricing and the peace of mind that comes with authentic, properly stored metals.

Whether you're just starting your investment journey or looking to strengthen an existing portfolio, precious metals offer something that few other assets can: genuine financial security that has stood the test of time.

The Broker's Blueprint: The Essential Services of a Precious Metal Broker

Think of a precious metal broker as your trusted guide through the exciting world of gold and silver investing. Just like you wouldn't climb Mount Everest without a sherpa, navigating the precious metals market is much easier with an experienced professional by your side.

The heart of what any good precious metal broker does is trading services - helping you buy and sell bullion with confidence. This isn't just about processing your order and shipping a box. A quality broker maintains direct relationships with major mints like the Royal Canadian Mint and U.S. Mint, ensuring you get authentic products at competitive prices.

When it comes time to sell your metals, the process should be just as smooth. Your broker should offer transparent, fair pricing that reflects current market conditions. Our comprehensive guide on Selling Gold and Silver walks you through exactly what to expect during this process.

Secure storage solutions represent another crucial service that separates professional brokers from casual dealers. After all, what good is owning precious metals if you're constantly worried about where to keep them safe? Reputable brokers partner with fully insured, independent vault facilities that protect your investment from theft, damage, and other risks.

The importance of proper insurance cannot be overstated here. Your precious metals represent real wealth, and they deserve institutional-grade protection. Professional storage facilities offer exactly that - giving you peace of mind while your metals appreciate in value.

Educational resources and market analysis might be the most valuable service a broker provides, even though it often goes unappreciated. The best brokers don't just sell you metal and disappear. They empower you with the knowledge needed to make smart investment decisions over time.

This means providing access to real-time pricing, market commentary, and analysis of factors that drive precious metals prices. Whether it's central bank buying patterns, industrial demand for silver in solar panels and electric vehicles, or geopolitical events affecting global markets, staying informed helps you invest strategically. Following reputable financial news outlets and market data providers (for example, the London Bullion Market Association) will help you stay on top of these important trends.

A professional precious metal broker also handles all the technical details that can overwhelm new investors. This includes processing payments securely through multiple methods - whether you prefer wire transfers, credit cards, or personal checks. They should be transparent about any fees, processing times, and transaction limits upfront.

The shipping and handling process deserves special attention too. Your metals should arrive in discreet packaging with full insurance coverage. No need to advertise to the neighborhood what's in that box!

At Summit Metals, we understand that investing in precious metals is about more than just buying shiny objects. It's about building long-term wealth and protecting your financial future. That's why we focus on providing transparent, real-time pricing and the kind of personalized service that helps you succeed as an investor.

Finding Your Golden Partner: How to Choose a Reputable Broker

When it comes to precious metals investing, your precious metal broker is more than just a vendor—they're your trusted partner in building wealth. Think of it like choosing a doctor or financial advisor; you want someone with proven credentials, a stellar reputation, and your best interests at heart.

Reputation and history tell the story of a broker's reliability. Look for companies that have been in business for decades. This longevity isn't just impressive—it's reassuring proof that they've weathered multiple market cycles and consistently delivered value to thousands of investors.

Licensing and accreditation requirements vary by location, but they matter enormously. While the precious metals industry remains federally unregulated in many areas, some states require specific licensing and bonding for dealers. Always verify that your chosen broker meets all applicable regulatory requirements.

A BBB A+ rating serves as an independent seal of approval, reflecting a commitment to ethical practices and customer satisfaction. These ratings aren't handed out lightly—they're earned through consistent, transparent business practices.

Real customer experiences reveal the truth about any broker's service quality. Look for brokers with an impressive track record, such as hundreds of thousands of customer reviews with a high overall satisfaction rating. Reading testimonials gives you insight into what your experience might be like, from selection and service to delivery speed.

Authorized distributor status protects you from counterfeits and ensures authenticity. A reputable broker should be an authorized reseller for major government mints like the Royal Canadian Mint or the U.S. Mint. This direct relationship guarantees you're receiving genuine products with verified purity and weight. Our comprehensive guide, Identifying Reputable Bullion Dealers: Avoiding Counterfeits, dives deeper into this crucial protection.

Some investors find comfort in a physical presence—that "brick and mortar" reassurance. Some established brokers offer world-class showrooms, which can provide tangible security, especially for larger transactions or when you simply want to see and touch your investment options.

What to Expect from a Top-Tier Precious Metal Broker

Outstanding precious metal brokers distinguish themselves through exceptional service standards that go far beyond basic buying and selling.

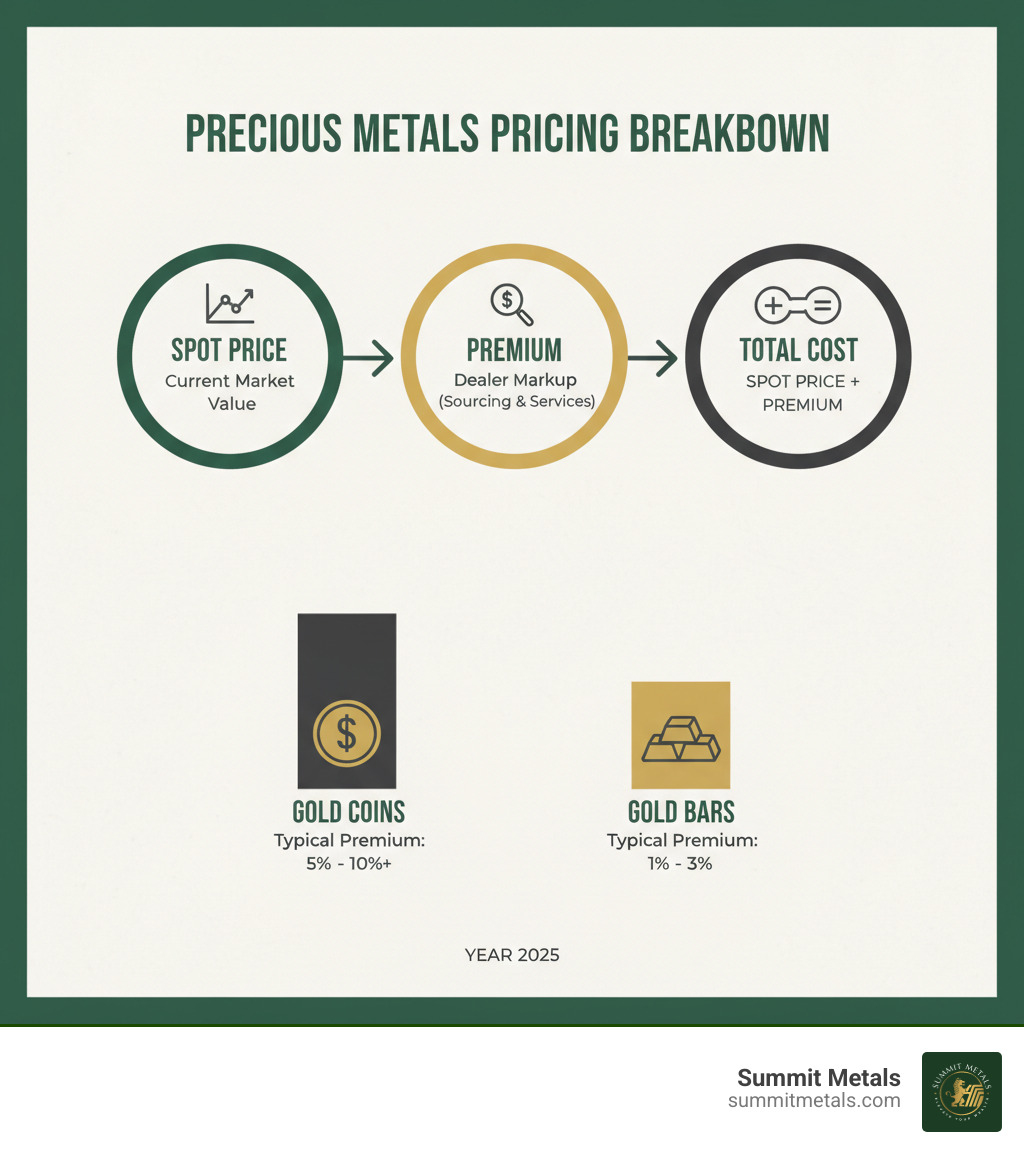

Transparent pricing forms the foundation of trust. Top-tier brokers clearly display both spot prices and premiums, explaining exactly what you're paying and why. Our detailed article, Spot Price vs. Premium: How Precious Metals Pricing Works, breaks down these important concepts. At Summit Metals, we pride ourselves on transparent, real-time pricing and competitive rates achieved through our bulk purchasing power.

Low premiums and clear fees mean more of your money goes toward actual precious metals rather than excessive markups. Every cost should be disclosed upfront—transaction fees, storage charges, shipping costs, and any other expenses. No surprises, no hidden fees.

Price match guarantees demonstrate confidence in competitive pricing. Some leading brokers offer to match lower advertised prices from competitors, showing their commitment to providing genuine value to customers.

Expert guidance and personalized service transform your investing experience. Customer testimonials consistently highlight knowledgeable staff members who patiently answer questions and provide custom advice. This personalized attention helps you steer complex decisions and build confidence in your investment strategy.

The right broker becomes your trusted advisor, educator, and partner in building long-term wealth through precious metals.

Navigating the Modern Marketplace: Online Precious Metal Brokers

The world of precious metals investing has transformed dramatically over the past decade. While your grandfather might have driven downtown to visit his local coin shop, today's investors have something far more powerful at their fingertips: the ability to research, compare, and purchase gold and silver from the comfort of their living room at 2 AM in their pajamas.

The Digital Revolution in Precious Metals

Online precious metal broker platforms have fundamentally changed how we invest in gold and silver. At Summit Metals, we've acceptd this digital change because we understand that modern investors value both convenience and transparency. Our online platform provides 24/7 access to authenticated precious metals with real-time pricing that updates as market conditions change.

The beauty of online investing lies in its accessibility. You're no longer limited by business hours or geographic location. Whether you're a night owl who prefers to research investments after the kids go to bed, or a busy professional squeezing in portfolio management during lunch breaks, online platforms work around your schedule, not the other way around.

Lower Overhead, Better Prices

Here's where online platforms really shine: lower premiums. Traditional brick-and-mortar stores have significant overhead costs—rent for prime retail locations, showroom displays, larger staff, and higher insurance costs. Online brokers like Summit Metals can pass those savings directly to you through more competitive pricing and lower premiums over spot price.

Our bulk purchasing power allows us to negotiate better rates with mints and refineries, and without the overhead of a physical storefront, we can offer these savings to our customers. This means more of your investment dollar goes toward actual precious metals rather than covering operational expenses.

Wider Selection, Better Choices

Physical stores are limited by their display cases and storage capacity. Online platforms offer access to a vastly wider selection of products from multiple mints and refineries worldwide. Whether you're interested in American Silver Eagles, Canadian Maple Leafs, or specialty bars from respected refineries, online brokers can source products that might take weeks to special-order through traditional dealers.

| Feature | Summit Metals Online Platform | Traditional In-Person Buying |

|---|---|---|

| Convenience | 24/7 access from anywhere, shop in your pajamas | Limited business hours, requires travel time |

| Pricing | Lower premiums due to reduced overhead, transparent real-time pricing | Higher premiums due to physical overhead costs |

| Personal Service | Dedicated customer support via phone, email, and chat | Face-to-face consultations and relationship building |

| Product Selection | Vast inventory from multiple global sources, always updated | Limited to physical inventory on hand |

Security and Discretion

One concern many new investors have about buying precious metals online is security. The good news? Reputable online precious metal brokers have perfected the art of secure online shopping and discreet shipping. Our guide on How to Buy Gold and Silver Online Safely walks you through the entire process step by step.

Professional online brokers use discreet packaging that doesn't advertise what's inside, and shipments are fully insured from the moment they leave the warehouse until they reach your doorstep. Many investors actually prefer the privacy of online transactions over walking into a physical store.

Personalized Support in a Digital World

Don't think that choosing an online platform means sacrificing personal service. At Summit Metals, our team provides personalized support through multiple channels. Whether you prefer to call and speak with a real person, send an email with detailed questions, or use live chat for quick clarifications, we're here to guide you through your precious metals journey.

The combination of digital convenience and human expertise creates the best of both worlds—you get the efficiency and competitive pricing of online platforms with the reassurance of knowledgeable professionals who understand your investment goals.

Your First Steps into Precious Metals: A Beginner's Guide

Welcome to the exciting world of precious metals! If you're a new investor, the journey can seem daunting, but with the right guidance, it's a straightforward path to building a more resilient portfolio. At Summit Metals, we're here to make your first steps confident ones.

The most important first step? Understanding your investment goals and risk tolerance. Are you looking to preserve wealth for retirement, hedge against inflation, or diversify your portfolio? Your answers will shape which metals make sense for your situation.

When it comes to the metals themselves, you have four main options to consider. Gold remains the classic choice—it's been preserving wealth for thousands of years and offers excellent liquidity worldwide. Silver brings more volatility but also exciting industrial demand from solar panels and electric vehicles. Platinum trades as both a precious and industrial metal, while palladium serves primarily automotive applications and can be quite volatile.

Our comprehensive guide, Metal Heads Unite: How to Start Your Precious Metals Investment Journey, walks you through each metal's unique characteristics. For deeper dives, check out our articles on whether gold or silver make good investments for your specific situation.

Choosing Your Investment Vehicle

Once you've decided which metals interest you, the next choice is physical bullion—and here you'll encounter the classic coins versus bars decision. Both offer the security of tangible ownership, but they serve different investor needs.

Gold coins like the American Gold Eagle or Canadian Maple Leaf come with unique advantages, including government backing that provides built-in fraud protection. Gold bars shine when you're focused purely on cost efficiency for bulk purchases.

| Feature | Gold Coins | Gold Bars |

|---|---|---|

| Cost | Higher premium per ounce | Lower premium per ounce |

| Security | Face value & legal tender status provide excellent fraud protection | Verified by refiner's assay certificate |

| Liquidity | Extremely high, easily recognized worldwide | High, but may require verification |

| Storage | Easy to store in smaller quantities | More compact for bulk storage |

| Flexibility | Available in fractional sizes (1/10 oz, 1/4 oz) for smaller budgets | Best for large, single investments |

| Extra Value | May develop collectible (numismatic) value | Value is tied strictly to metal content |

The fraud protection aspect of coins deserves special attention. Government-minted coins undergo rigorous quality control and include sophisticated security features that make counterfeiting extremely difficult. This gives you extra confidence when buying from any precious metal broker and makes resale much smoother.

Our detailed comparison in Bars or Coins? Your Ultimate Gold Investment Showdown explores this choice further. You might also consider how physical metals compare to paper alternatives in our guide on Physical Bullion vs. Gold & Silver ETFs: Pros and Cons.

How to Buy from a Precious Metal Broker

Working with a precious metal broker is simpler than you might expect. The process starts with account setup—most reputable brokers require basic verification to comply with financial regulations and ensure security.

Payment methods vary by broker, each with different advantages. Wire transfers work best for larger purchases, often carrying lower fees and faster processing times. Credit cards offer convenience for smaller amounts but typically include percentage fees. Checks and money orders usually process fee-free but take longer to clear. Some brokers even accept PayPal for added flexibility.

The final step involves shipping and insurance. Professional brokers handle secure, insured delivery with discreet packaging—your precious metals arrive in unmarked boxes to protect your privacy. Our guide on How to Buy Gold and Silver Online Safely covers all the security details you should know.

Smart Investing Strategies for Beginners

The smartest approach for new precious metals investors? Dollar-Cost Averaging (DCA). This strategy involves investing fixed amounts at regular intervals, regardless of current prices. When metals cost more, your money buys less. When prices drop, you get more for the same investment. Over time, this averages out your purchase price and removes the stress of trying to time the market perfectly.

Summit Metals' Autoinvest feature makes dollar-cost averaging effortless. You can buy precious metals every month, just like investing in a 401k. This consistent monthly investing builds wealth over time while significantly reducing market timing risk. It's automated wealth building that requires no constant market watching or decision-making stress.

The power of this approach becomes clear over time. Our article on The Power of Dollar Cost Averaging in Gold and Silver Investments shows how regular investments can smooth out market volatility and build substantial holdings.

Staying informed remains crucial for long-term success. Precious metals respond to economic news, geopolitical events, and currency changes. Following reliable financial news sources helps you understand market movements without getting overwhelmed by daily price fluctuations.

The key is starting with a clear plan, choosing quality products from reputable sources, and maintaining consistency in your approach. With these fundamentals in place, precious metals can serve as a valuable cornerstone in your investment portfolio for years to come.

Conclusion: Partnering for a Secure Financial Future

Your journey into precious metals investing doesn't have to be a solo adventure. Throughout this guide, we've seen how the right precious metal broker transforms what could be an overwhelming experience into a clear, strategic path toward financial security.

The foundation we've built is solid: precious metals serve as your portfolio's anchor during economic storms, offering protection against inflation and market volatility that traditional investments simply can't match. When central banks worldwide are increasing their gold reserves, they're sending a clear message about the enduring value of these tangible assets.

But having the right products is only half the equation. The precious metal broker you choose becomes your trusted navigator, providing everything from transparent pricing and secure storage to the educational resources that help you make informed decisions. Whether you prefer the convenience of online platforms or the personal touch of a brick-and-mortar showroom, the key is finding a partner who puts your financial goals first.

At Summit Metals, we've built our reputation on exactly that foundation. Based in Wyoming and serving investors nationwide, we provide authenticated gold and silver with the transparent, real-time pricing you deserve. Our bulk purchasing power means competitive rates for you, while our commitment to trust ensures you're never left guessing about costs or quality.

For those ready to build wealth systematically, our Autoinvest feature offers something special. Just like contributing to your 401k, you can dollar-cost average your way into precious metals with consistent monthly purchases. This approach takes the guesswork out of market timing while building your financial resilience one month at a time. It's wealth building made simple.

The path forward is clearer than you might think. Whether you're taking your first steps with a single silver coin or building a comprehensive precious metals portfolio, the right broker makes all the difference. At Summit Metals, we're not just selling you gold and silver—we're partnering with you for the long haul, helping you build the kind of financial security that lasts.

Ready to take that next step? Start your automated investment journey today with Summit Metals. Let's build your resilient financial future together, one precious metal purchase at a time.