Why Secure Precious Metals Storage Matters

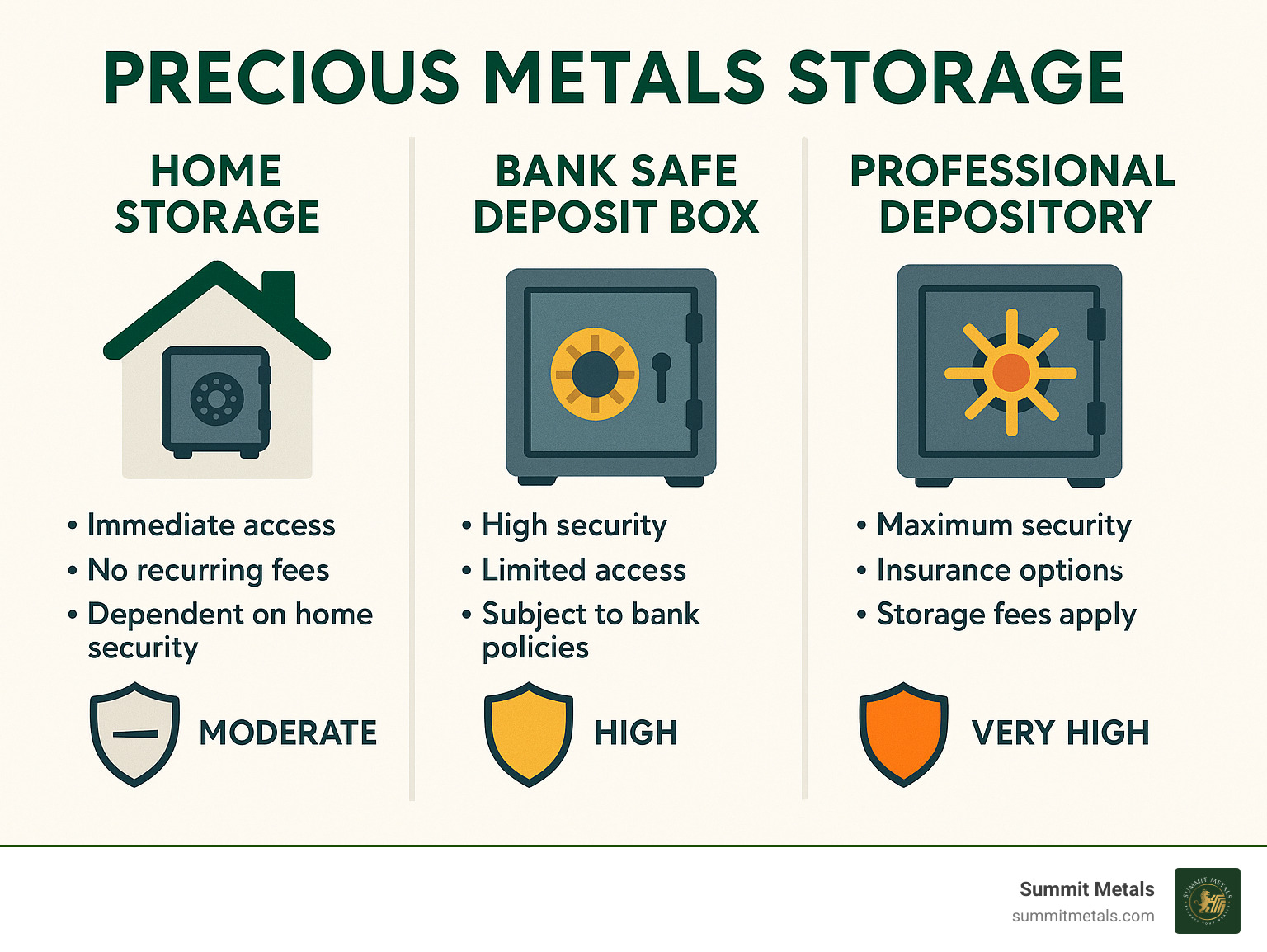

When you invest in precious metals storage, you need a safe place for your assets. There are three main ways to store your gold, silver, or other metals:

- At Home: You keep your metals in your own secure location.

- Bank Safe Deposit Box: You rent a box at a local bank.

- Professional Depository/Vault: A specialized facility stores your metals for you.

Buying gold and silver is a smart move for many, helping to protect wealth from inflation and economic uncertainty. But acquiring the metals is only half the battle. Knowing how to store them safely is just as important, bringing peace of mind that your valuable assets are secure.

Eric Roach brings deep expertise to precious metals storage. With a background in advising on complex financial strategies, he now guides individuals on protecting wealth with physical gold and silver, using his understanding of market cycles and risk management to help clients secure their assets.

Key Considerations Before Choosing Your Storage Method

Picking the right precious metals storage solution requires careful thought. You want something that fits your budget, gives you peace of mind, and effectively protects your assets. Let's walk through the key factors to guide your decision.

Security is paramount. Your gold and silver are real wealth, needing protection from theft, damage, or loss. Options range from a basic home safe to a professional vault with armed guards and biometric scanners. Your choice depends on your investment size and risk tolerance.

Accessibility is a balancing act. Do you need immediate access, or is this a long-term investment? The most secure options, like professional vaults, may involve a short wait to access your metals, while home storage offers instant access. The trade-off is often security for convenience.

Cost is more than just storage fees. Home storage involves upfront costs for a quality safe and potentially higher insurance premiums. Professional depositories charge annual fees, typically a percentage of your holdings' value, but these often include comprehensive insurance and security. Prices shown are at the time of this publication.

Insurance coverage is a critical factor. Many homeowner's policies offer little to no coverage for precious metals without an expensive rider. Bank safe deposit boxes are typically not insured by the bank or the FDIC. In contrast, professional depositories usually offer comprehensive, all-risk insurance covering the full market value of your metals.

Finally, size and weight matter more than you might think. Gold is incredibly dense, meaning a large value can fit in a small space. Silver is much bulkier. An ounce of silver takes up significantly more space than an ounce of gold—requiring up to 70 times more storage space for the same dollar value. For example, $100,000 in gold bars might fit in a shoebox, while the same value in silver would require a much larger container. This size difference dramatically affects your storage options and costs.

For silver investors, our guide on Top Storage For Silver Best Practices For Safekeeping Your Investment dives deeper into the unique challenges of storing this bulkier metal.

Comparing Your Main Precious Metals Storage Options

Let's explore the three main ways to safeguard your physical precious metals. This is where you balance accessibility, cost, and security to find the right fit for your peace of mind.

Storing Precious Metals at Home: Pros and Cons

Keeping your precious metals storage at home offers the appeal of having your wealth within reach.

The primary benefits are immediate access 24/7, no ongoing fees after your initial setup, and complete control over your assets, ensuring privacy and independence.

However, there are serious downsides. The biggest is the high theft risk, as keeping significant wealth at home can make you a target. Another crucial point is insurance limitations. Standard homeowner's policies offer very little coverage for precious metals without a special, often costly, rider. Your home is also vulnerable to natural disasters like floods or fires, which can damage or destroy your metals.

To mitigate these risks, you need serious security measures. This includes a high-quality home safe that is permanently bolted down. Look for safes with a TL rating (e.g., TL-15), which indicates how long it can resist professional tools. A TL-15 rating, for example, means the safe can withstand an attack for at least 15 minutes. Your safe should also be fireproof and waterproof, and backed by a robust home alarm system.

For more ideas on home security, check out Secure storage solutions for precious metals.

Bank Safe Deposit Boxes: Convenient but Risky?

Bank safe deposit boxes are a traditional choice for storing valuables, offering apparent convenience and affordability for your precious metals storage.

The affordability is a draw, with annual costs for a box often ranging from $50 to $200. (Prices shown are at the time of this publication.) Your box also benefits from the bank's general security measures.

However, there are significant risks. Limited access hours mean you can only retrieve your metals when the bank is open, which could be a problem during a crisis or "bank holiday." Critically, the contents of a safe deposit box are NOT FDIC insured. If the bank fails or your metals are lost or stolen, the bank is typically not liable.

There is also a government access risk. Laws like the Patriot Act can grant the government access to box contents under certain conditions. Furthermore, the historical confiscation risk, such as the U.S. government's 1933 gold confiscation from the banking system, is a precedent that concerns some investors. Finally, some banks have updated their agreements to prohibit storing items like cash or coins, which could put your precious metals in violation of your rental agreement.

Professional Vaults: The Ultimate in Security

For precious metals storage, professional third-party depositories are the gold standard for serious investors.

The primary benefit is the highest security. These vaults use state-of-the-art, layered security that far exceeds personal or bank capabilities. This includes bulletproof construction, biometric access, "man traps," armed guards, 24/7 surveillance, and alarms linked directly to law enforcement.

Another huge advantage is full insurance. Unlike other options, professional vaults offer comprehensive, all-risk insurance, often backed by reputable insurers like Lloyd's of London. This protects your metals against theft, damage, and disaster at their full market value.

Reputable depositories also undergo regular internal and external audits to verify that all client holdings are accounted for. Many offer online management portals to monitor your assets and easy liquidation services when you're ready to sell. For those seeking geopolitical diversification, many providers also offer international storage options in stable countries like Canada, Singapore, or Switzerland.

If you're thinking about including precious metals in your retirement accounts, understanding professional storage is key. Our guide on Maximizing Retirement Security Using A Precious Metals IRA To Invest In Gold And Silver With Summitmetals Com can give you more details. And if you're curious about global options, explore Where In The World Is Your Gold Safest International Gold Storage Explained.

A Deep Dive into Professional Vault Services

Understanding the specifics of third-party depositories is crucial for making an informed decision that protects your wealth for the long term. Let's look at what makes professional precious metals storage the top choice for many.

Allocated vs. Segregated: Which Type of Precious Metals Storage is Best?

When exploring professional depositories, you'll encounter two key terms: "allocated" and "segregated" storage. Knowing the difference is vital.

With allocated storage, you own a specific quantity and type of metal which is stored alongside identical items from other clients. While your ownership is legally recorded, you would receive an equivalent item upon withdrawal, not necessarily the exact one you deposited. It's a great option for common bullion items.

Segregated storage means your specific metals are physically separated in a private, uniquely identified compartment. The exact items you deposit are the exact items you get back. This method is ideal for rare collectible coins or specific bars where the individual item's identity matters.

In both allocated and segregated storage, you retain full legal ownership. Your metals are not assets of the storage provider and are generally safe even if the facility faces financial trouble.

A quick word of caution about unallocated storage: This structure means you are an unsecured creditor to the institution holding the metal, not the direct owner. If the institution fails, you risk losing your investment. We strongly advise against this option.

Here’s a quick comparison of the two main types of professional precious metals storage:

| Feature | Allocated Storage | Segregated Storage |

|---|---|---|

| Ownership | Client retains direct legal ownership of a specific quantity and type of metal. | Client retains direct legal ownership of specific, identified items. |

| Physical Storage | Metals are often pooled with other clients' metals, but recorded under the client's name. | Metals are physically separated and stored in individual, dedicated compartments for each client. |

| Fungibility | Metals are treated as fungible; you receive equivalent items upon withdrawal. | Metals are non-fungible; you receive the exact same items you deposited. |

| Best For | Most investors, larger quantities of common bullion (e.g., standard gold/silver bars), cost-conscious investors. | Collectors of numismatic coins, rare items, investors who want absolute certainty of receiving their original items. |

| Cost | Typically less expensive than segregated storage. | Generally more expensive due to dedicated space and tracking. |

| Security | High security, but specific item identity not guaranteed on return. | Highest security, with guarantee of specific item return. |

Security and Insurance in a Professional Depository

The security and insurance at professional depositories are designed to protect your assets against virtually any threat. This is where professional precious metals storage truly shines.

As mentioned, these facilities use multi-layered security protocols. The most significant benefit, however, is the comprehensive insurance. Reputable depositories carry "all-risk" insurance policies, often underwritten by prestigious firms like Lloyd's of London. This protects your metals against physical loss, theft, and damage from disasters, covering their full market value as prices change.

Crucially, most professional depositories are non-bank entities, holding your assets outside the traditional banking system. This offers an extra layer of protection from bank failures or financial regulations. Transparency is ensured through regular internal and external audits, which verify that all stored assets are present and accounted for.

The Costs of Professional Precious Metals Storage

Understanding the costs of professional precious metals storage is key to budgeting your investment. Prices shown are at the time of this publication.

Fees are typically an annual percentage of your holdings' market value, often expressed in "basis points" (100 basis points = 1.00%). Competitive rates generally range from 0.28% to 0.65% per year. Many providers offer tiered pricing, where the percentage decreases as the value of your holdings increases, giving better rates to larger investors.

Most providers also have a minimum monthly or annual fee to cover administrative costs, regardless of your holdings' value. When you want to take physical possession, expect fees for shipping and handling. A major advantage is easy liquidation; many depositories facilitate direct buy-backs or work with affiliated dealers like Summit Metals, allowing you to sell directly from the vault.

How to Choose the Right Provider for Your Needs

Selecting the right precious metals storage provider is a critical decision that impacts the safety and accessibility of your assets. Here are the key points to consider.

- Location: Do you prefer domestic storage for convenience (like our secure facilities in Wyoming or Utah) or international storage for geopolitical diversification? Choose a country with a stable political and economic environment.

- Security Protocols: Ask for specifics on their layered security. This includes vault specifications, biometric access, armed guards, 24/7 surveillance, and alarm response protocols.

- Insurance Details: Confirm they offer "all-risk" insurance that covers the full, regularly adjusted market value of your metals. Ask who the underwriter is—a reputable name like Lloyd's of London is a positive sign.

- Fee Transparency: Get a clear, upfront breakdown of all costs, including annual storage fees, minimums, and any setup or withdrawal charges. A reputable provider will have straightforward pricing.

- Reputation and History: How long have they been in business? Look for a company with a long, reliable track record and positive independent reviews.

- Storage Types Offered: Ensure they offer the type of storage you need, whether allocated or segregated. Be sure to avoid "unallocated" storage due to the higher risks involved.

- Audit Reports: Ask about their auditing practices. Are they regularly audited by independent third parties? This provides verifiable proof that your metals are accounted for.

- Customer Service: How easy is it to contact them? Do they offer online account management? Responsive customer service can make a big difference.

Choosing an independent, third-party precious metals storage provider is generally safer than relying on the dealer who sold you the metals. It separates your wealth from any dealer risk. As a company that deals in authenticated gold and silver, Summit Metals helps our clients steer these choices, ensuring their investments are not only acquired transparently but also stored securely.

For investors interested in the specific regulations related to IRA-held precious metals, our guide, The Ultimate Rulebook For Precious Metals IRA Investors, offers comprehensive insights.

Frequently Asked Questions about Precious Metals Storage

It's natural to have questions when securing your valuable assets. Let's tackle some common inquiries about precious metals storage.

Can the government confiscate gold from a private vault?

This is a common concern, largely due to historical events like the U.S. government's 1933 Executive Order 6102, which targeted gold held within the banking system. The key difference today is that private depositories are not banks. They operate outside the traditional banking system, meaning your assets are not on a bank's balance sheet or subject to the same regulations. While no method is 100% immune to extreme government actions, storing assets in a private, non-bank vault is widely considered to offer a stronger firewall against confiscation compared to a bank safe deposit box.

How much does it cost to store precious metals professionally?

Professional precious metals storage costs are typically an annual percentage of your holdings' market value, often expressed in "basis points" (100 basis points = 1.00%). Competitive rates generally range from 0.28% to 0.65% per year, with lower rates often available for larger holdings. Segregated storage is usually slightly more expensive than allocated storage. Most providers also have a minimum monthly or annual fee to cover administrative costs, often starting around $10-$20 per month. While some older options might cost up to 1.5% annually, the current market is much more competitive. Prices shown are at the time of this publication.

Is it better to store gold domestically or internationally?

This depends on your personal goals and risk tolerance. There are good reasons for both domestic and international precious metals storage.

Domestic storage (in secure U.S. facilities like those in Wyoming or Utah) offers easier access, lower shipping costs, and a familiar legal environment. It's convenient if you want to be able to visit your holdings or need quick physical access. The downside is that your assets remain within a single political and economic system.

International storage (in stable hubs like Canada, Singapore, or Switzerland) provides geopolitical diversification. This protects your assets from potential domestic instability or unfavorable regulations. The trade-offs can include higher shipping costs and less immediate access. Many savvy investors use a hybrid approach, storing some metals domestically and others internationally to get the best of both worlds.

Conclusion: Securing Your Legacy

Choosing the right precious metals storage solution is as important as the investment itself. It’s about building a fortress around your wealth that provides true peace of mind, knowing your assets are safe and accessible when needed.

For most serious investors, professional depositories are the gold standard. They offer an best combination of advanced security, comprehensive insurance, and professional convenience that cannot be replicated at home or in a bank.

While professional storage has annual fees, typically ranging from 0.28% to 0.65%, this cost is often a small price to pay for the benefits. When weighed against the risks of home storage—like theft, disaster, and insurance gaps—the value of military-grade security, full insurance, and professional management is clear.

Securing your assets is the final, crucial step in your investment journey. You've made the smart choice to invest in precious metals; now you're ensuring that choice is protected for years to come.

At Summit Metals, we understand this journey. Based in Wyoming, USA, we've built our reputation on providing authenticated gold and silver with transparent, real-time pricing and competitive rates. We know our job doesn't end at the point of sale. Trust and value are the cornerstones of our business, which is why we are committed to helping you steer your precious metals storage options.

Whether you're considering our facilities in Wyoming and Utah or need worldwide storage solutions, we're here to guide you. Your investment deserves to be not just acquired wisely, but protected diligently.

Ready to give your precious metals the security they deserve? Learn about our secure depository services and take that final step toward true peace of mind.