What Are Bullion Reserve Programs and Why Do They Matter?

A bullion reserve program is a secure system for holding physical precious metals like gold, silver, and platinum to protect wealth and diversify investment portfolios.

Key features include:

- Secure Storage: Bullion is held in highly protected vaults.

- Wealth Protection: Acts as a safe haven against economic instability.

- Diversification: Provides a tangible asset outside of stocks and bonds.

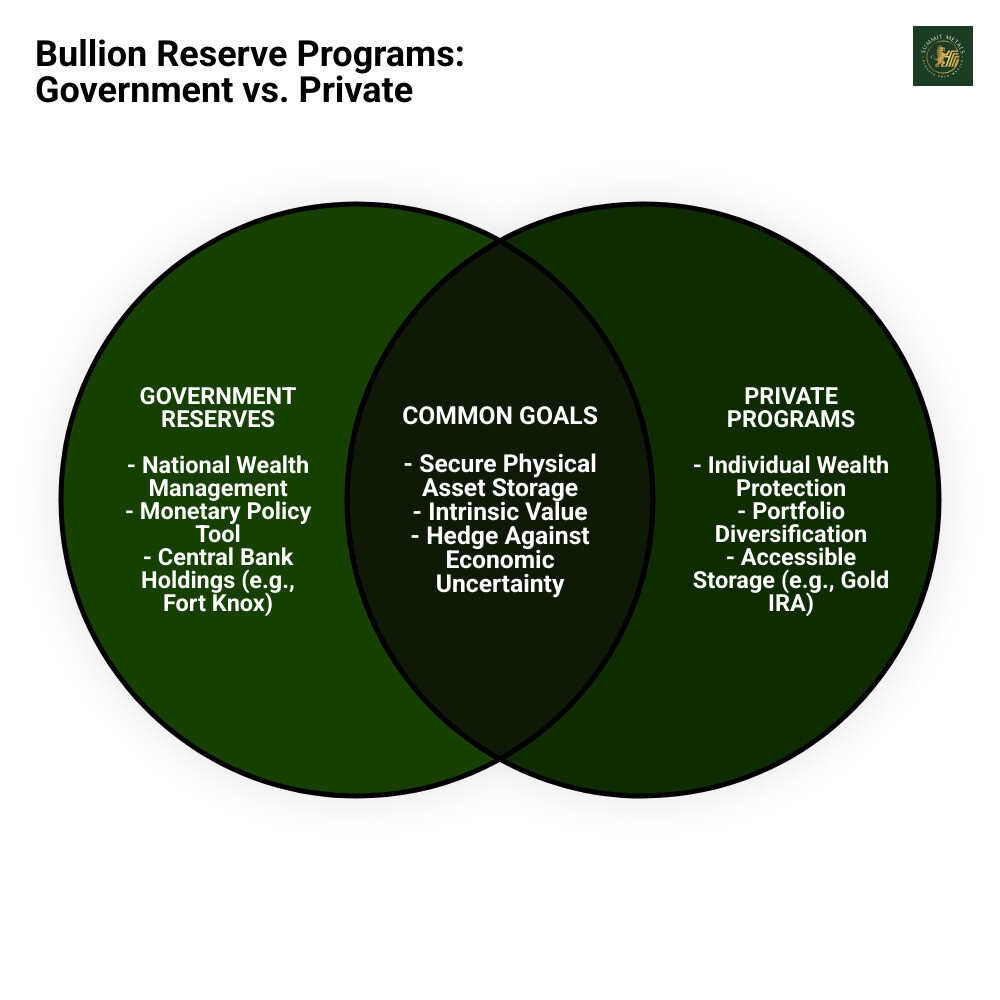

- Two Main Types: Government reserves (like a nation's gold) and private programs for individual investors.

In today's uncertain economy, many investors are turning to physical precious metals as a reliable store of value. Bullion reserve programs offer a structured and secure way to do this.

I'm Eric Roach. My background in investment banking showed me how physical gold and silver can be a strong hedge. I've guided clients on using bullion reserve programs for wealth protection and portfolio resilience. Let's explore how they work.

What is a Bullion Reserve Program and Why is it Important?

A bullion reserve program is an organized system for owning and storing physical precious metals like gold, silver, platinum, and palladium. Bullion refers to metals meeting high purity standards (e.g., 99.5% for gold, 99.9% for silver) in the form of bars, ingots, or investment coins. Unlike paper assets, bullion is a tangible asset with intrinsic value, meaning its worth is not dependent on a government or company promise.

In an unpredictable world, physical precious metals have a long history as a reliable safe haven. They can shield your wealth from inflation and currency devaluation. When economic or global tensions rise, bullion often holds or increases its value, providing financial security. This is why central banks hold large gold reserves to ensure global economic stability. For more on the advantages of physical metals over other vehicles, see our guide on What's the Difference Between Physical Gold, Silver, and ETFs?.

The Role in Wealth Protection

A bullion reserve program excels at wealth protection due to the intrinsic value of precious metals. Gold, for example, has been a store of wealth for millennia because it's a physical asset that governments cannot simply print more of, unlike fiat currency. This scarcity protects against the inflation that devalues savings.

In today's volatile economic climates, the protective power of bullion as a safe-haven asset is clear. When other investments falter, investors often turn to gold and silver, which can drive their prices up and shield wealth from market volatility. Learn more in our article: Price of Gold and Silver Bullion: Essential Investments for Wealth Protection.

A key benefit of a good program is reducing counter-party risk. With physically allocated metals, you hold legal title to your specific assets, not just a claim on a company's books. This means your bullion is safe even if the holding company fails. At Summit Metals, we prioritize true physical ownership of authenticated gold and silver.

The Benefit of Portfolio Diversification

Portfolio diversification means spreading investments to reduce risk. A bullion reserve program is an excellent tool for this. Most portfolios rely on stocks and bonds, which often move together. Precious metals, however, are often uncorrelated assets, meaning their prices don't always move in the same direction as traditional financial assets.

Adding physical bullion can reduce overall portfolio risk and smooth out long-term returns. It creates a more resilient portfolio that can better withstand market shocks, paving the way for long-term growth. Just as central banks buy gold to diversify national reserves, individual investors can benefit from adding gold and silver to their portfolios. Find out why central banks value gold in our article: Why Central Banks Buy Gold and Why You Should Too.

Governmental Bullion Reserves: The Fort Knox Legacy

Beyond individual investments, governments operate large-scale bullion reserve programs. These national gold reserves are vital for a country's financial health, influencing monetary policy and national security. Central banks worldwide hold massive gold reserves due to the metal's enduring value in the global financial system.

The United States Bullion Depository at Fort Knox

The most famous governmental bullion reserve program is the United States Bullion Depository at Fort Knox. Located within a U.S. Army post in Kentucky, this fortified vault was built in 1936 to safeguard the nation's gold reserves away from vulnerable coastal cities.

The building is a fortress of steel-reinforced concrete walls and a bomb-proof roof. Its main vault door weighs 20 short tons and requires multiple staff members with separate combinations to open. The facility is protected by the elite U.S. Mint Police, making it one of the most secure locations on Earth. As you might expect, access is highly restricted and it is not open to the public, a fact confirmed on the official U.S. Mint depository webpage.

Fort Knox has also stored other priceless items during national crises, including the original U.S. Constitution, the Declaration of Independence, and the Magna Carta during World War II.

U.S. Gold Holdings: History and Management

The United States holds the world's largest official gold reserves. As of 2021, this amounted to 8,134 metric tons. Fort Knox holds a significant portion of this: 147.34 million troy ounces, or about 4,583 metric tons, which is over half of all U.S. gold.

The gold is owned by the federal government and acts as security for gold certificates issued to Federal Reserve Banks, a system established by the Gold Reserve Act of 1934. The average fineness of the gold bars at Fort Knox is 91.67% pure gold, though newly minted bars are typically at least 99.5% fine.

While daily operations are secret, the U.S. Treasury has conducted rare inspections to assure the public, such as in 1974 and more recently in 2017 by then-Treasury Secretary Steven Mnuchin, underscoring the public's interest in these vital national assets.

Private Bullion Reserve Programs for Individual Investors

While government reserves like Fort Knox are inaccessible, private bullion reserve programs offer individual investors a similar level of security for their own precious metals. These programs allow you to own physical gold, silver, or other metals without the risks of home storage.

Private programs are accessible, even allowing purchases of small amounts like gold by the gram. They provide top-tier, professional storage that is difficult to replicate at home. A key feature to look for is allocated storage options, which ensures true ownership. Learn more in our guide: Bullion Investing 101: How to Safely Stack Your Wealth.

How a Private Bullion Reserve Program Works

The process is straightforward: you purchase precious metals, and the program provider arranges for secure storage in a specialized, third-party vault. The typical flow includes account setup, purchasing metals online, and choosing storage. For tips on buying online, see our guide on How to Buy Gold and Silver Online Safely.

It is critical to choose allocated or segregated storage. With allocated storage, specific bars or coins are registered in your name, giving you direct legal title. This is far safer than "unallocated" accounts, where you are merely a creditor to a pool of metal. At Summit Metals, we only use allocated storage to ensure our clients have maximum security and clear ownership. A strong program includes third-party auditing, all-risk insurance, and easy access to reports and liquidation services.

Investing Through a Gold IRA/401K

You can include physical gold and silver in your retirement accounts through a Self-Directed IRA (SDIRA). The IRS approves specific types of gold, silver, platinum, and palladium for these accounts, allowing you to diversify your retirement savings beyond stocks and bonds. This offers the security of physical assets with potential tax advantages.

A key rule is that these retirement metals cannot be stored at home; they must be held in an IRS-approved depository. This is a specialized bullion reserve program for retirement funds that ensures compliance and professional security. For details, see The Ultimate Rulebook for Precious Metals IRA Investors.

Costs and Fees in a Bullion Reserve Program

Understanding the costs is essential. Key fees include:

- Premiums over spot price: The difference between the market price of the metal and the price of the physical product. At Summit Metals, our bulk purchasing helps us secure competitive rates.

- Storage fees: An ongoing cost, typically a small percentage of your holdings' value (e.g., as low as 0.09% for gold annually).

- Insurance costs: Often included in the storage fee, providing coverage against theft, damage, or loss.

- Transaction fees: May apply when buying or selling metals.

Always seek a provider with clear, real-time pricing. Knowing all costs upfront helps you maximize your investment. Learn more at Maximizing Retirement Security: Using a Precious Metals IRA to Invest in Gold and Silver.

Safeguarding Your Assets: Security and Storage Protocols

The peace of mind from a bullion reserve program comes from knowing your assets are protected by layers of advanced security. This involves a blend of physical safeguards, digital systems, and legal protections, all verified by independent experts. For more tips, see our guide on Top Tips for Precious Metals Storage: Secure Your Investments.

Physical and Logistical Security

Reputable depositories use virtually impenetrable vaults, often with a Class III vault rating, built with thick, reinforced concrete and steel. These facilities feature 24/7 monitoring, high-definition cameras, alarm systems, motion detectors, and biometric access controls to ensure only authorized personnel can access the assets.

Logistical security is also critical, covering secure transportation and strict handling protocols. Many programs offer geographic diversification, allowing you to store bullion in multiple secure locations worldwide. Summit Metals provides secure storage in the USA, including our trusted locations in Wyoming and Utah, as well as global hubs like Singapore or Switzerland. This strategy protects assets from risks tied to a single region. Explore global options in Where in the World is Your Gold Safest? International Gold Storage Explained.

Auditing, Insurance, and Legal Protections

A robust bullion reserve program builds trust through transparency and legal safeguards.

- Third-party audits are non-negotiable. Independent auditors regularly verify the existence and quantity of stored metals, ensuring records match physical holdings.

- Comprehensive, all-risk insurance is essential. This coverage, often from major insurers like Lloyd’s of London, protects the full market value of your metals against perils like theft, damage, or natural disasters.

- Legal title and segregation are paramount. With allocated storage, your bullion is segregated from the depository's assets and legally titled in your name. This means that in the unlikely event the depository fails, your metals cannot be claimed by its creditors because they are your property. This protection against counterparty risk is why Summit Metals ensures your metals are always legally titled and segregated. Learn more about the importance of ownership in Precious Metals Investment: The Imperative of Holding Physical Gold and Silver.

The Metals in the Vault: What's Being Stored?

A bullion reserve program typically stores gold and silver, but can also include platinum and palladium. These metals come in various forms, offering investors multiple options. To learn about building your holdings, check out The Basics of Gold and Silver Stacking.

Gold and Silver

Gold has been a symbol of wealth for millennia. It doesn't rust or tarnish, making it ideal for long-term storage, and it is a reliable "safe haven" during economic uncertainty. Investment-grade gold ranges in purity from .9167 (22 karat) to .9999 (24 karat).

Silver, sometimes called "poor man's gold," shares many of gold's investment qualities but also has widespread industrial uses in electronics, solar panels, and medicine. This industrial demand can make its price more volatile than gold's. Investment-grade silver is typically .999 fine.

Both metals are available as:

- Bullion bars: Valued purely for their metal content, bars come in various sizes (1 oz, 10 oz, 1 kg) and often have lower premiums, making them ideal for larger investments.

- Bullion coins: Produced by government mints (e.g., American Eagles, Canadian Maple Leafs), their value is tied to their metal content, but they also offer the assurance of government authenticity.

At Summit Metals, we offer both authenticated bars and coins. For a comparison, read Gold Bars vs. Coins.

Platinum and Palladium

Platinum is much rarer than gold. Its price is heavily influenced by industrial demand, particularly for catalytic converters in vehicles, which clean exhaust fumes.

Palladium is even rarer than platinum. Its price has been driven by its vital role in catalytic converters for gasoline cars, making it sensitive to trends in the auto industry and potentially more volatile.

Diversifying across these four metals within your bullion reserve program can be a smart strategy, providing a more complete approach to precious metals investing. For more on physical metals vs. other options, see Physical Bullion vs. Gold & Silver ETFs: Pros and Cons.

Frequently Asked Questions about Bullion Reserve Programs

We get many questions about bullion reserve programs. Here are answers to the most common ones.

Can I visit a government bullion depository like Fort Knox?

Unfortunately, no. Facilities like the United States Bullion Depository are closed to the public for security reasons. Access is extremely restricted, with very few official tours ever granted in the facility's history. The site is designed to be impenetrable, which means keeping everyone out.

What is the difference between allocated and unallocated storage in a private program?

This is a critical distinction of ownership. With allocated storage, specific, segregated bars or coins are registered directly in your name, making you the legal owner of that physical metal. Your assets are protected if the storage company fails. Unallocated storage means you only have a claim to a general pool of metal held by the institution, making you a creditor. This carries significantly higher counterparty risk. At Summit Metals, we only offer allocated storage for maximum security.

Are my precious metals insured in a private bullion reserve program?

Reputable private depositories provide comprehensive, all-risk insurance for the full market value of your stored metals, protecting against theft, damage, and other events. However, you must verify this before choosing a bullion reserve program. Ask for specifics about the insurance provider and coverage. The best programs provide clear documentation of their policy.

Conclusion

Phew! We've covered a lot of ground, haven't we? From the impenetrable vaults of Fort Knox to the smart choices individual investors can make, it's clear that a bullion reserve program is so much more than just a place to store shiny metal. It's a thoughtful, powerful strategy for keeping your wealth safe and sound, come what may in the financial world. It’s about building a tangible hedge against the twists and turns of our modern economy.

The big takeaways are simple yet profound: physical gold and silver aren't just pretty; they hold intrinsic value that paper money can't match. They act as a true safe haven when markets get rocky, and they're fantastic for diversifying your portfolio, giving you a solid footing when other investments might be wobbling. This helps you build a resilient, long-term strategy for your financial well-being.

Now, if you're thinking about diving into a private bullion reserve program (and we hope you are!), remember to do your due diligence. Look for programs that offer allocated storage – this means the metals are truly yours, not just a claim against a pool. Make sure they have comprehensive insurance, so you're covered no matter what. And always, always, demand transparent fee structures so there are no surprises down the road.

At Summit Metals, based right here in Wyoming, USA, we're passionate about making this process easy and trustworthy for you. We provide authenticated gold and silver precious metals for investment, and our secret sauce is simple: transparent, real-time pricing and really competitive rates. We achieve this by purchasing in bulk, which means better value for you. We genuinely believe in earning your trust, because securing your financial future should start with smart, informed decisions and a partner you can count on. We're here to help you confidently steer economic shifts and build that strong, resilient future, serving clients from our locations in Wyoming and Utah, and across the globe.

Ready to understand even more about why physical gold belongs in your portfolio? Dive deeper here: Why Central Banks Buy Gold and Why You Should Too: A Look Into the Power of Physical Gold.