What Are Goldbacks and Why They Matter

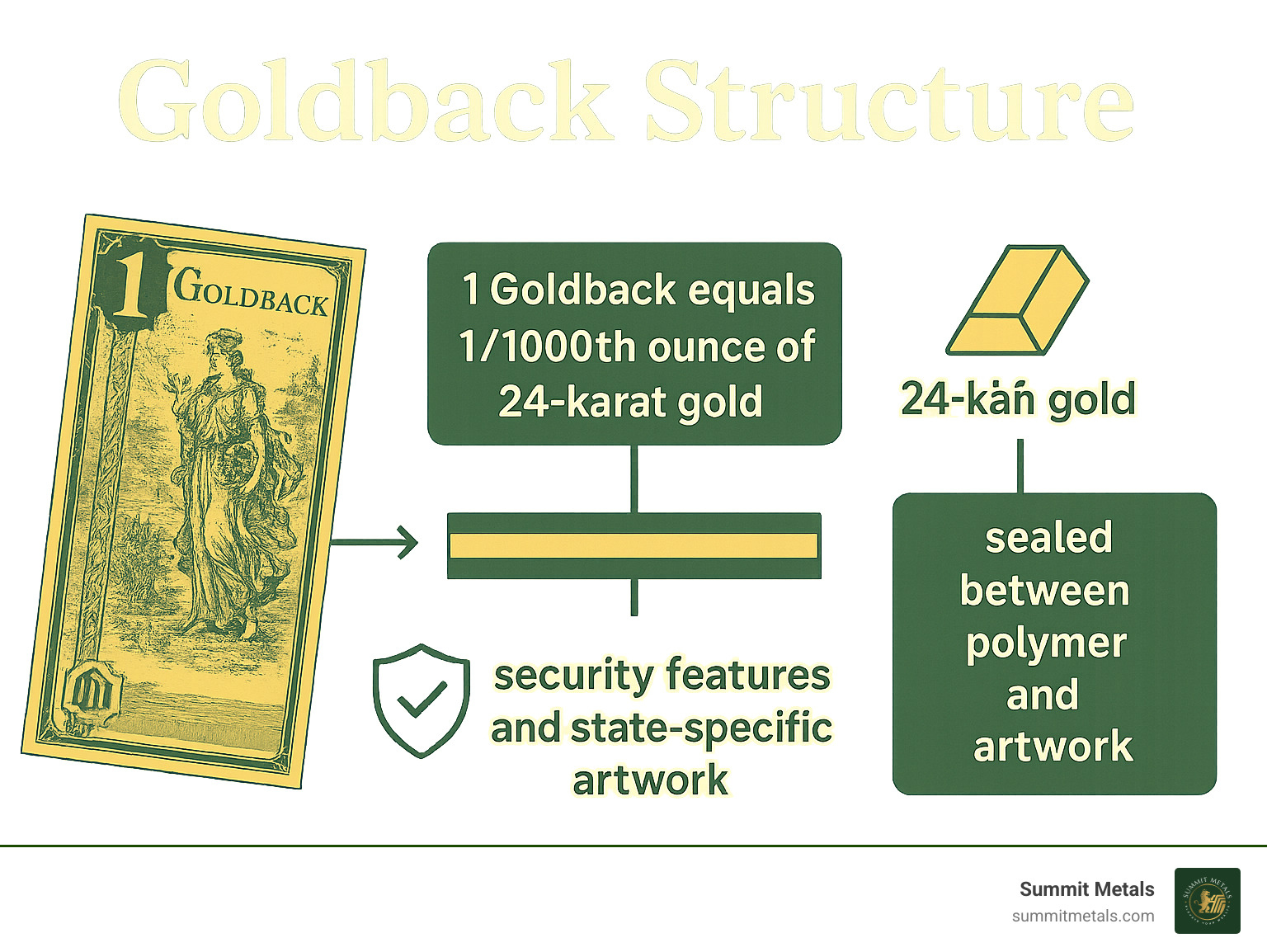

Buying gold backs offers a solution to an age-old problem: how to spend gold in small, practical amounts. Goldbacks are spendable gold currency notes containing precise amounts of 24-karat gold laminated between protective polymer layers, making fractional gold ownership accessible for everyday transactions.

Quick Guide to Buying Goldbacks:

- What they are: Physical gold notes with 1/1000th to 1/20th oz of .999 fine gold.

- Available denominations: 1, 5, 10, 25, and 50 Goldback notes.

- State series: Utah, Nevada, Wyoming, New Hampshire, and South Dakota.

- Primary uses: Investment, bartering, collecting, and voluntary local currency.

- Value basis: Tied directly to the gold spot price plus a manufacturing premium.

- Growth: 82% value increase from 2019-2024, with over 1.28 million people now trading them.

Goldbacks solve what experts call the "2,600-year-old problem" of gold divisibility. While traditional gold coins and bars are impractical for small purchases, Goldbacks bridge this gap by offering fractional gold ownership in a durable, beautiful format. They are now accepted by thousands of businesses across participating states.

The rapid adoption speaks to their utility. As one industry report noted, "as many as 50% of small businesses may accept Goldbacks in states where it has been informally adopted as a local currency." This demonstrates real-world demand for an inflation hedge that doubles as functional currency.

I'm Eric Roach. With over a decade in investment banking and precious metals, I've helped clients use physical assets like Goldbacks for portfolio diversification. My expertise helps everyday investors steer these innovative gold products with confidence.

The Anatomy of a Goldback: From Creation to Currency

This section explores the intricate details of what makes a Goldback a unique physical asset, from its high-tech manufacturing process to its beautiful, state-specific designs.

How Goldbacks Are Made and Secured

A Goldback is far more than a fancy paper note. It's a product of cutting-edge technology from Valaurum, which pioneered a vacuum deposition process to apply microscopic quantities of gold onto a polymer sheet. This allows for incredibly precise measurements of .999 fine 24-karat gold to be embedded within each note. The atomized gold is then sealed between two protective polymer layers, creating a durable, flexible, and tough note that contains an exact, verifiable amount of physical gold.

Goldbacks feature a robust array of security features to prevent counterfeiting. Each note is individually serialized, making it unique and traceable. The intricate artwork, microprinting, and a raised, reversed image on the back are difficult to replicate. For an extra layer of protection, they use UV-reactive ink that reveals hidden designs under ultraviolet light. This multi-layered security makes Goldbacks incredibly difficult to counterfeit, especially given the low payout for faking such small denominations.

This meticulous process ensures Goldbacks are durable enough for a wallet yet beautiful enough for a collection, solving the historical challenge of making gold truly spendable.

Denominations, States, and Symbolism

Goldbacks come in five denominations: 1, 5, 10, 25, and 50. Each corresponds to a precise weight of 24-karat gold, from 1/1000th of a troy ounce for the 1 Goldback note to 1/20th of a troy ounce for the 50 Goldback note. These exact fractional weights make them a tangible and accountable form of currency.

What started in Utah has quickly blossomed into a multi-state phenomenon. Following the Utah Legal Tender Act, the first series was released in 2019. Since then, the movement has expanded:

- Utah (2019): Features virtues important to Utah's history, like Prudence and Liberty.

- Nevada (2020): Depicts figures such as Charity and Justice in a Wild West theme.

- New Hampshire (2021): Carries a Revolutionary War theme with allegories like Fortitude and Liberty.

- Wyoming (2022): Showcases virtues like Reverentia and Audentia with pioneer and Native American imagery.

- South Dakota (2023): Features figures representing concepts like Peace (Pax) and Harmony (Harmonia).

- Florida (2025): An upcoming series showing the continued expansion of the Goldback concept.

Each state series is designed with allegorical figures that embody virtues and historical narratives relevant to that state's culture. This beautiful artwork adds a collectible aspect, appealing to investors, numismatists, and art lovers alike.

For more information about the history of legal tender gold coins, which helped pave the way for modern gold-backed concepts, we encourage you to explore our detailed article: More info about the history of legal tender gold coins.

Goldbacks vs. Other Gold Assets: A Comparative Look

Deciding on the right form of gold depends on your goals. Goldbacks offer unique advantages in spendability, but how do they stack up against other physical gold products available at Summit Metals? Let's break down the key differences to help you make an informed decision.

| Feature | Goldbacks | Gold Coins | Gold Bars |

|---|---|---|---|

| Spendability | Excellent (voluntary local currency, small transactions) | Moderate (less practical for small everyday transactions, higher value) | Low (impractical for transactions, large values) |

| Divisibility | Very High (1/1000th oz increments) | Moderate (fractional coins available, but less granular) | Low (cannot be broken down without melting) |

| Intrinsic Value | High (24K pure gold, verifiable weight) | High (pure gold, verifiable weight, often with collector value) | High (pure gold, verifiable weight) |

| Premiums | Highest (due to complex manufacturing, security, and design) | Moderate to High (due to mintage, collectibility, and government backing) | Lowest (closest to spot price, especially for larger bars) |

| Storage | Easy (flexible, durable polymer notes, fits in wallet) | Easy (standard sizes, fits in coin capsules/tubes) | Moderate (requires secure vaulting for larger sizes) |

| Liquidity | Moderate (growing acceptance in specific regions, can be sold to dealers) | High (globally recognized, easy to sell to dealers and collectors) | High (globally recognized, easy to sell to dealers) |

| Benefits | Spendable, beautiful design, fractional ownership, inflation hedge | Legal tender, government backing, collectible, anti-counterfeiting features | Cost-effective for bulk, efficient storage, simple form of gold ownership |

When you're buying gold backs, you're getting something truly unique. But it's worth understanding how they compare to traditional options.

Gold coins are often considered the "Goldilocks" of precious metals. Their key advantage is their face value, which gives them legal tender status backed by an issuing government. This provides powerful anti-counterfeiting protection, as faking a government coin carries much stiffer penalties than faking a private bar. This legal status and global recognition make coins highly liquid and trusted. However, with even a small 1/10 oz coin worth hundreds of dollars, they remain impractical for small, everyday purchases.

For our detailed comparison guides, check out How to Compare Gold Bars vs. Gold Coins: 5 Factors to Consider and Gold Bars vs. Coins.

Gold bars are the workhorses of precious metals investing, designed to get you the most gold for your dollar. With lower premiums than coins or Goldbacks, bars offer the most efficient storage and straightforward gold ownership. But they are not designed for transactions; their large denominations make them purely an investment vehicle.

This brings us back to why buying gold backs fills a unique niche. They solve the problem of spending gold in small amounts. Their fractional ownership structure, starting at 1/1000th of an ounce, allows you to use real gold for everyday transactions where accepted. Yes, Goldbacks carry the highest premiums, but that premium buys utility—gold that functions like currency. The complex manufacturing, security, and artwork justify the cost for this unique function.

The storage advantage is also remarkable. While bars need vaulting and coins need capsules, Goldbacks slip right into your wallet. They're durable enough for daily carry yet contain verifiable amounts of pure gold.

For investors interested in smaller gold units, our article The Benefits of Buying Fractional Gold: Why Smaller is Often Better Than Waiting for a 1oz Gold Coin explores why fractional ownership is becoming increasingly important.

The choice ultimately comes down to your goals. For bulk acquisition at the lowest cost, choose gold bars. For globally recognized, government-backed metal, choose gold coins. But if you want a divisible, spendable, and beautiful form of physical gold, then buying gold backs could be the perfect addition to your strategy.

A Practical Guide to Buying Goldbacks

Understanding the uses, value, and risks associated with Goldbacks is crucial before making a purchase. Here's what you need to know to get started.

Practical Uses and Where to Spend Them

Unlike gold bars or coins that sit in a safe, Goldbacks are designed for daily life. Their primary uses include:

- Investment: As notes containing real 24-karat gold, they serve as a tangible hedge against inflation, with their value tied to the gold spot price.

- Bartering and Transactions: This is where Goldbacks excel. Their small, fractional denominations make it possible to use physical gold for everyday purchases, like paying a mechanic or buying from a local farmer, without needing to break a high-value coin.

- Collecting: The stunning, state-specific allegorical artwork makes each series a collectible item, appealing to those who appreciate both beauty and intrinsic value.

- Voluntary Local Currency: Though not government-mandated legal tender, Goldbacks are gaining rapid acceptance. Research suggests up to 50% of small businesses in participating states are willing to accept them. You'll find them welcomed by carpenters, mechanics, farmers, and other independent businesses. Many display acceptance stickers, but it never hurts to ask.

For businesses already on board, you can explore resources like the list of Utah businesses accepting Goldbacks to see the growing network in action.

Understanding the Value and Risks When Buying Goldbacks

When buying gold backs, their value is simple to understand: it's the real-time gold spot price plus a premium for manufacturing, security, and design. When Goldbacks launched in 2019, one Goldback traded for about $2.55. By March 2024, it was worth $4.66—an 82% increase in five years, far outpacing the dollar's purchasing power.

The underlying value is solid because it's tied to physical gold. A 1 Goldback contains exactly 1/1000th of a troy ounce of .999 fine gold. You can track current values by checking today's live gold price.

Like any gold investment, Goldbacks are subject to market volatility. Their value will fluctuate with global gold prices. The premiums over spot are higher than for bars because you're paying for the technology that makes gold spendable. Counterfeiting risk is very low due to the complex manufacturing and security layers. For storage, these durable notes fit in your wallet, though larger collections warrant a safe. Our guide on how to store your gold safely covers best practices.

How to Start Buying Goldbacks

Ready to begin buying gold backs? The process is straightforward with a trusted partner.

- Choose a reputable dealer: Look for companies with transparent, real-time pricing and solid customer reviews. At Summit Metals, we offer authenticated precious metals at competitive rates due to our bulk purchasing power.

- Verify authenticity: This is simple when you buy from trusted dealers who guarantee their products and understand the security features.

- Purchase online safely: Use secure websites with clear shipping policies and responsive customer service. Our guide on how to buy gold and silver online safely can help.

- Consider dollar-cost averaging: Making consistent monthly purchases helps smooth out price fluctuations over time. This strategy works well with Goldbacks due to their small, practical denominations.

The growing importance of fractional gold ownership can't be overstated. Our article on why fractional gold is more important than ever explores this trend.

Prices shown are at the time of this publication.

The Future of Goldbacks and Building Your Position

The trajectory of Goldbacks since 2019 has been remarkable. With 1.28 million people trading them and the number of owners increasing 44x by the end of 2023, the momentum is clear. In 2023 alone, the total value of Goldbacks made surpassed $100 million, a testament to their growing demand.

As more states like Florida (2025) introduce their own series, the acceptance network will expand. This growth, combined with economic uncertainty, positions Goldbacks as an increasingly relevant alternative currency. They foster a movement toward sound money principles by enabling local commerce with tangible assets instead of fiat currency.

For those serious about buying gold backs as a long-term strategy, consistency is more effective than trying to time the market. Dollar-cost averaging is a powerful approach that involves investing a fixed amount regularly, regardless of price fluctuations. When prices are high, you buy fewer Goldbacks; when prices dip, your fixed investment buys more. Over time, this strategy smooths out volatility and can result in a lower average cost per unit.

Summit Metals makes this easy with our Autoinvest program. Like a 401k contribution, you can set up automatic monthly purchases of Goldbacks and other authenticated precious metals. This hands-off approach ensures you consistently build your holdings without the stress of market timing. It removes emotion from the equation, allowing your position to grow steadily over time.

As more Americans seek alternatives to traditional currency, Goldbacks are positioned to play an important role in personal finance. Their unique combination of inflation hedge properties, spendability, and collectible appeal makes them a compelling addition to any diversified portfolio.

To understand how gold fits into your broader investment strategy, explore The strategic role of gold in long-term portfolios.

Frequently Asked Questions about Goldbacks

When buying gold backs, you're likely to have some important questions. Here are the most common concerns we hear from investors.

Are Goldbacks legal tender?

Goldbacks are not federal legal tender like the U.S. dollar, meaning businesses are not required by law to accept them. However, they function as a voluntary local currency. Thanks to legislation like the Utah Legal Tender Act, they are completely legal to own and use for transactions wherever two parties willingly agree to accept them as payment. This model allows individuals and businesses to choose to transact with sound, gold-backed money.

How is the value of a Goldback determined?

The value of a Goldback is transparent and directly tied to the real-time spot price of gold. A 1 Goldback note contains exactly 1/1000th of a troy ounce of gold. If gold trades at $2,000 per ounce, the gold in a 1 Goldback is worth $2.00. The retail price you pay includes this base gold value plus a manufacturing premium. This premium covers the sophisticated production process, security features, artwork, and distribution that make raw gold into a spendable currency note.

Can you get the physical gold out of a Goldback?

Yes, the 24-karat gold is physically present and recoverable. This isn't a gold-backed certificate; it's actual .999 fine gold embedded within the polymer. However, destroying the Goldback to extract the gold would be counterproductive. You would lose everything that makes it functional and valuable: the durability, security features, artwork, and its status as a voluntary currency. The primary value of a Goldback lies in its intact form as a verifiable, spendable note.

Conclusion: Are Goldbacks the Right Gold Investment for You?

Goldbacks are a unique innovation in precious metals, fusing gold's intrinsic value with the convenience of currency. They solve the age-old problem of gold divisibility, making them a practical tool for real-world transactions. With an 82% value increase from 2019 to 2024 and over 1.28 million people trading them, they have proven to be more than a novelty.

Buying gold backs makes sense if you seek unparalleled divisibility for bartering or want a beautiful, collectible hedge against inflation. Unlike high-value coins or bars, Goldbacks let you use actual gold for small purchases.

While they carry higher premiums than bullion bars, this premium buys utility that no other gold product offers: advanced security, stunning artwork, and spendable fractional gold. It's the difference between owning gold and being able to use gold.

Goldbacks also represent a tangible way to participate in the sound money movement, supporting local economies built on real value. They complement traditional gold coins and bars by filling the small-transaction gap that other forms of gold cannot address.

At Summit Metals, we've seen how Goldbacks capture the imagination of investors. Our Wyoming-based team is committed to helping you make informed decisions with transparent, real-time pricing and competitive rates.

Building your position is simple. Through our Autoinvest subscription service, you can set up automatic monthly purchases of Goldbacks and other precious metals. This dollar-cost averaging approach helps smooth out market volatility while steadily building your holdings over time.

If you value innovation, beauty, and the ability to use gold in everyday life, then buying gold backs could be an excellent addition to your precious metals portfolio. They're not just an investment—they're a glimpse into the future of sound money.