Why Building Your Own Gold Reserve Matters Now

American gold reserve can refer to the U.S. government's stockpile or the personal holdings you build to protect your wealth. While the government's 261.5 million ounces are inaccessible, you can create your own reserve through trusted dealers like Summit Metals.

Quick Answer: What You Need to Know About American Gold Reserve

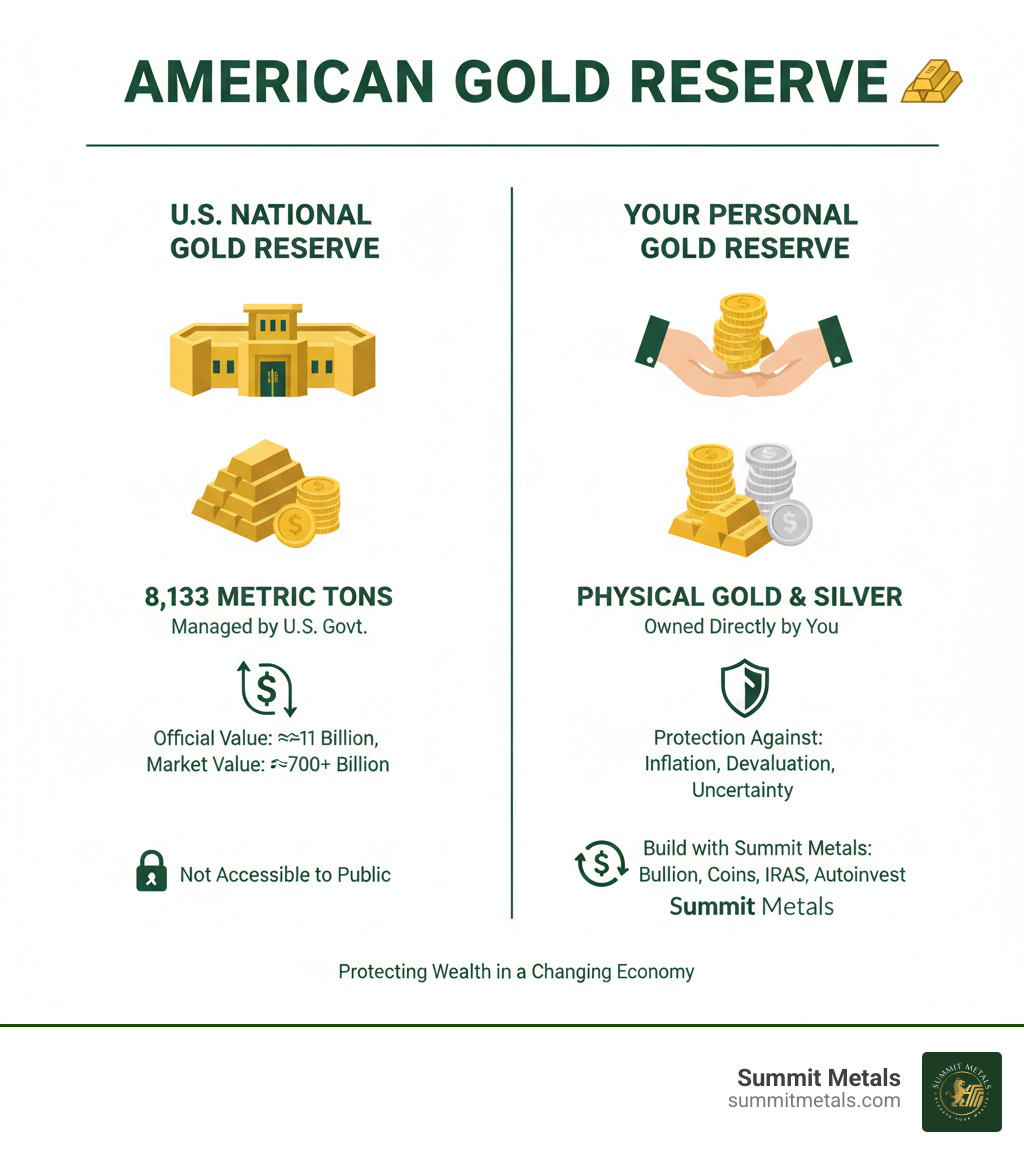

- U.S. Government Reserve: 8,133 metric tons, officially valued at $11 billion but with a market value recently exceeding $1 trillion.

- Your Personal Reserve: Physical gold and silver you own directly to protect against inflation and economic uncertainty.

- How to Start: Work with a transparent dealer offering bullion, coins, and IRA options.

- Best Strategy: Use dollar-cost averaging through a program like Summit Metals' Autoinvest to build holdings consistently.

The massive gap between the U.S. Treasury's official $11 billion book value for its gold and the $1 trillion+ market value highlights gold's enduring power. The government values its gold at just $42.22 per ounce, while the market price has soared.

Gold has outperformed the S&P 500 in 2024 and continues to do so in 2025, reaching all-time highs. With persistent inflation eroding purchasing power, many Americans are considering building their own gold reserve.

Success depends on finding a dealer you can trust. Unlike stocks, physical gold requires evaluating the company selling it. You need transparent pricing, authentic products, and guidance that puts your interests first.

I'm Eric Roach, and after a decade on Wall Street, I now help everyday investors apply the same defensive strategies institutions use by building personal american gold reserve portfolios with physical metals.

What is the "American Gold Reserve" Concept and What Does Summit Metals Offer?

When you hear "american gold reserve," you might think of Fort Knox, but a more relevant meaning for your financial future is the personal gold holdings you build to protect your wealth.

At Summit Metals, we focus on helping Americans build their own american gold reserve through transparent pricing, education, and high-value products. Based in Wyoming with locations including Salt Lake City, Utah, our philosophy is simple: empower you with knowledge and help you make decisions without high-pressure sales tactics.

With over 20 years in the business, we offer everything you need for a solid precious metals portfolio. Our IRA rollovers let you move existing retirement funds into physical gold and silver, protecting your nest egg from inflation. Our gold and silver packages provide options for both new and experienced investors.

Our most popular service is Autoinvest, a monthly purchase program that works like a 401k. Instead of trying to time the market, you invest a set amount each month. This dollar-cost averaging approach helps you build your american gold reserve steadily and automatically. It's a disciplined, consistent strategy for long-term wealth building.

We achieve competitive pricing through bulk purchasing, so you get more metal for your money. Our pricing is transparent and updates in real-time, so you always know what you're paying versus the spot price. For more on finding a trustworthy partner, read our article Your Golden Compass: Navigating to a Reputable Gold Dealer.

Why People Invest in Gold, According to Summit Metals

Gold is a financial fortress that has protected wealth for millennia. Here’s why our clients choose gold, especially amid economic uncertainty:

- Hedge Against Inflation: The Federal Reserve can print dollars, but no one can print gold. This scarcity helps gold maintain its purchasing power when the dollar weakens.

- Tangible Asset: Unlike stocks or digital balances, physical gold is a real asset you can hold. It offers security that paper assets can't match during a crisis.

- Store of Value: Gold has outlasted every currency and empire, proving itself as a reliable store of value throughout history.

- Portfolio Diversification: Gold often moves in the opposite direction of stocks and bonds, helping to stabilize your overall wealth during market downturns.

Gold has also outperformed the S&P 500 in 2024 and continues to surge in 2025. This performance reflects a growing recognition of its intrinsic value. For a deeper dive, see our article The Midas Touch: Exploring the Benefits of Gold Investment.

How Summit Metals Addresses IRA Rollovers and Packages

Protecting your retirement savings from inflation is crucial. We make it straightforward to safeguard your 401k or IRA with physical gold and silver through our IRA rollovers.

While the process might sound complex, we handle the heavy lifting. We help you transfer funds from an existing retirement account into a Self-Directed IRA designed to hold physical precious metals. We work with trusted custodians and IRS-approved depositories to ensure your metals are stored securely and in full compliance with federal regulations.

Our gold and silver packages are designed for different goals and budgets, including bullion, certified coins, or a strategic mix. All products offered for IRAs meet the strict IRS purity requirements. With our transparent pricing, you'll see exactly what you're paying above the spot price, with no hidden fees.

Ready to secure your retirement? Our guide explains it all: Maximizing Retirement Security: Using a Precious Metals IRA to Invest in Gold and Silver with SummitMetals.com.

A Closer Look at Summit Metals' Products: Rare Coins vs. Bullion

Building your personal american gold reserve requires choosing the right type of gold. At Summit Metals, we help investors understand the difference between bullion and rare coins to create a winning strategy.

We specialize in authenticated gold and silver across several categories:

- Bullion Products: Includes bars and popular coins like the American Gold Eagle or Canadian Maple Leaf. Their value is tied almost entirely to their metal content, and they trade close to the spot price.

- Pre-1933 American Rare Coins: These historical pieces, like the Saint-Gaudens Double Eagle, carry both intrinsic metal value and significant numismatic (collector) value that can appreciate independently of gold's price.

- Modern American Rare Coins: Contemporary U.S. coins with limited mintages or special finishes that command premiums above their melt value.

Understanding which products align with your goals is key. If you want price efficiency, bullion may be best. For historical significance and collector appreciation, Pre-1933 coins could be a better fit. Our guide can help you decide: How to Compare Gold Bars vs. Gold Coins: 5 Factors to Consider.

Evaluating the Products at Summit Metals

Not all gold is created equal. Our Pre-1933 American rare coins, such as the Liberty Head Gold Coins, are pieces of American history. They offer a dual value proposition: their intrinsic metal value plus numismatic value based on scarcity and historical significance. In a hot market, these coins can sell for double or triple the price of standard bullion.

Similarly, our modern American rare coins have a fixed and limited supply, which can contribute to their long-term appreciation. Some investors also value the historical precedent that numismatic coins were exempt from the 1933 government gold recall, offering peace of mind.

Crucially, we don't use high-pressure sales tactics or leverage schemes. Our philosophy is education first. We want you to understand what you're buying and why it makes sense for your personal american gold reserve.

[COMPARISON TABLE] Gold Coins vs. Gold Bars: Which is Right for You?

Choosing between gold coins and bars is a common question. Both have a place in a diversified portfolio.

| Feature | Gold Coins (Summit Metals) | Gold Bars (Summit Metals) |

|---|---|---|

| Legal Tender Status | Yes | No |

| Divisibility | High | Moderate |

| Collectible Value | Potentially High | Low |

| Counterfeit Protection | Improved (face value, design, grading) | Standard (assay, serial) |

| Liquidity | High | High |

| Fraud Protection | Face value, government backing | Assay, serial number |

Benefits of owning gold coins: Legal tender status, collectible value, improved fraud protection, and government backing.

The legal tender status of gold coins means they are recognized currency backed by the U.S. government, offering a layer of fraud protection that bars don't have. Divisibility is another advantage, as it's easier to sell a few one-ounce coins than to break up a larger bar. Finally, the collectible value of rare or certified coins can create an additional layer of appreciation beyond the gold price.

Both coins and bars offer excellent liquidity, but coins often have broader market appeal. The bottom line is that coins offer unique benefits, while bars excel at maximizing metal content per dollar. Many successful investors own both. To start building your holdings with consistent monthly purchases, ask about our Autoinvest program.

The Broader Context: The Real American Gold Reserve and Market Trends

Understanding the U.S. government's gold reserve helps explain why gold is a critical asset. The United States holds the world's largest official gold reserves: 8,133 metric tons (261.5 million ounces). The bulk of this treasure is stored at the legendary Fort Knox in Kentucky.

Here's the interesting part: the U.S. Treasury values this gold at a statutory price of $42.22 per ounce, a figure set in 1973. This gives the reserves an official book value of just over $11 billion. In reality, with gold's market price soaring, the actual value recently crossed the $1 trillion mark—more than 90 times the official value.

This massive gap is a powerful testament to gold's role as a wealth protector. While we can't access Fort Knox, we can apply the same protective strategy to our personal finances. The US gold hoard totals about 261.5 million ounces, according to Treasury data, reinforcing the government's own reliance on the metal.

What's driving gold to record highs? A perfect storm of economic uncertainty, trade tensions, geopolitical conflicts, and government budget gaps. When the world feels unstable, gold becomes the anchor people trust.

Understanding the Real American Gold Reserve at Fort Knox

The Gold Reserve Act of 1934 nationalized gold and required the Federal Reserve to surrender its holdings to the U.S. Treasury. This fundamentally changed America's relationship with gold and devalued the dollar to stimulate the economy.

Today, there's occasional debate about whether the U.S. should revalue its gold to market prices. Doing so could inject hundreds of billions into federal coffers, but the idea has been dismissed due to complex implications for the financial system. Unlike many countries, the U.S. holds gold directly, with the Federal Reserve holding certificates against it.

What's clear is that central banks worldwide understand gold's importance. Emerging market nations are actively increasing their gold holdings to hedge against geopolitical risks and currency devaluation. When the world's most sophisticated financial institutions are buying gold, it sends a powerful signal to individual investors.

If gold is good enough to anchor national economies, it should play a role in your personal financial strategy. The same forces driving central banks apply to building your own american gold reserve. Learn more in our guide: Why Central Banks Buy Gold (And Why You Should Too): A Look Into the Power of Physical Gold.

A Smarter Way to Invest: Transparency and Consistency with Summit Metals

The dealer you choose to build your personal american gold reserve matters as much as the gold itself. Many investors get burned by dealers who use high-pressure tactics and opaque pricing. We built Summit Metals on a different foundation: transparency.

Our pricing is simple: the current spot price plus a fair premium. No smoke and mirrors. Understanding how pricing works is crucial. The spot price is the live market rate for gold, while the premium covers minting, distribution, and the dealer's markup. We explain this in our guide on Spot Price vs. Premium: How Precious Metals Pricing Works.

Transparency is only half the equation; the other is consistency. The smartest investors don't try to time the market. They use Dollar-Cost Averaging (DCA), investing a fixed amount regularly. When prices dip, you buy more ounces; when they rise, you buy fewer. This smooths out volatility and removes emotion from investing, just like contributing to a 401k.

Building Wealth with "Autoinvest" from Summit Metals

We created our Autoinvest program to make Dollar-Cost Averaging effortless. It's a 401k-style approach for physical gold and silver. You set a monthly investment amount, and we automatically purchase metals on your behalf. It's consistent, automated wealth building.

The benefits of Autoinvest are clear:

- Reduced Market Timing Risk: You're not trying to predict gold's next move; you're buying through all market conditions.

- Budget Flexibility: Build your reserve gradually with amounts that fit your monthly cash flow, rather than needing a large lump sum.

- Avoid Emotional Decisions: Autoinvest cuts through the noise of market highs and lows, keeping your strategy on track.

We've seen clients build substantial holdings of real, tangible wealth with this disciplined approach. For a deeper look, check out The Power of Dollar Cost Averaging in Gold and Silver Investments.

[COMPARISON CHART] One-Time Purchase vs. Autoinvest (Dollar Cost Averaging)

| Feature | One-Time Purchase | Autoinvest (Summit Metals) |

|---|---|---|

| Market Timing Risk | High | Low |

| Purchase Frequency | Once | Monthly (automated) |

| Budget Flexibility | Low | High |

| Emotional Investing | More likely | Less likely |

| Long-Term Growth | Variable | Smoother, consistent |

Benefits of Autoinvest: Reduces market timing risk, encourages disciplined saving, and helps build wealth over time.

Frequently Asked Questions about Gold Investing

Here are answers to some of the most common questions we receive from clients building their american gold reserve.

Are numismatic gold coins really seizure-proof?

This question stems from Executive Order 6102 in 1933, which forced Americans to surrender gold but exempted "rare and unusual coins." While private gold ownership is no longer restricted (since 1974), this has created a belief that numismatic coins might offer protection against future government actions.

The argument is that if a recall were to happen again (a highly unlikely scenario), collectibles might be protected as they were in 1933. However, there is legal uncertainty here. The landscape has changed, and no one can guarantee what might happen in a hypothetical future. Many investors still find comfort in the historical precedent and the distinction of numismatic coins as collectibles rather than just monetary instruments.

We help you understand these nuances to make the right choice for your situation. For a broader look, see Physical Bullion vs. Gold & Silver ETFs: Pros and Cons.

How does gold compare to Bitcoin as an investment?

While both are seen as alternative assets, gold and Bitcoin are fundamentally different.

- Tangibility & History: Gold is a physical asset you can hold, with a thousands-of-years history as a store of value. Bitcoin is a 15-year-old digital asset that exists only as code.

- Volatility: Gold is stable compared to Bitcoin, which can experience extreme price swings. Gold has never lost 50% of its value overnight; Bitcoin has.

- Regulatory Risk: Gold operates within established legal frameworks. Bitcoin's regulatory future is still evolving, adding a layer of uncertainty.

- Counterparty Risk: Physical gold has minimal counterparty risk. Bitcoin relies on exchanges, digital wallets, and network security, all of which can fail or be compromised.

At Summit Metals, we focus on the proven, tangible security of physical precious metals for building a defensive american gold reserve. For more comparisons, see Gold or Silver? Unpacking Today's Hottest Jewelry Trend.

What are the advantages of certified gold coins?

Certified gold coins are authenticated, graded, and encapsulated by third-party services like PCGS or NGC. This process offers several key advantages for your american gold reserve:

- Guaranteed Authenticity and Condition: Certification virtually eliminates counterfeiting concerns and verifies the coin's quality.

- Higher Premium Potential: Certified rare coins are valued on scarcity and condition, not just melt value. Research shows they can sell for double or triple the price of bullion in strong markets.

- Fixed and Limited Supply: Unlike modern bullion, the supply of historical coins is fixed, which can drive up value as demand grows.

- Improved Liquidity: Standardized grading makes certified coins easy to buy and sell in a global market with confidence.

- Historical Seizure Protection Context: The "collectible" nature of these coins provided an exemption during the 1933 gold confiscation, a precedent some investors value.

Working with a reputable dealer is crucial when investing in certified coins. Learn more in our guide: Strike Gold with These Certified Gold Coin Dealers.

Conclusion: Finding a Trusted Partner for Your Gold Investments

Building your personal american gold reserve is about acquiring precious metals and partnering with a dealer who has your back. In a world of inflation and economic uncertainty, that partnership is more important than ever.

We've seen why gold is a critical asset, from Fort Knox's trillion-dollar holdings to the defensive strategies you can apply to your own portfolio.

Summit Metals offers a different approach. We focus on education, transparency, and real value—not high-pressure sales. Our bulk purchasing power means you get more metal for your money, and our Autoinvest program makes consistent investing simple.

Whether you're interested in rare coins, modern bullion, or a precious metals IRA, we have the expertise to match your goals. The advantages of working with Summit Metals are clear: authenticated products, competitive rates, and a team that prioritizes your long-term success.

The government's gold reserve crossed the trillion-dollar mark for a reason—gold works. Now it's your turn to harness that power for your financial security.

Ready to take the next step? Visit our website or reach out to our team. We'll walk you through every option, from iconic American Eagle Coins to strategic IRA rollovers. Let's build your financial fortress together.