The Ultimate Battle: Style Meets Investment Value

Is gold or silver more popular? The answer depends on whether you're talking fashion or finance. Here's what the data shows:

Fashion Trends (2024-2025):

- Silver is surging - 50% increase in jewelry searches, +314% social buzz for silver rings

- Gold remains classic - Still dominates engagement rings and luxury markets

- Mixed metals trending - Breaking traditional "one or the other" rules

Investment Popularity:

- Gold leads by value - 88 times more expensive per ounce than silver

- Silver attracts growth seekers - Higher volatility offers bigger potential returns

- Both serve different roles - Gold for stability, silver for affordability and growth

The jewelry world is experiencing what designer Jenny Bird calls "gold fatigue" - a shift toward silver's minimalist, sculptural appeal after years of chunky gold dominance. Meanwhile, luxury retailer Net-a-Porter reports customers gravitating toward "a more minimalist and modern approach to dressing" with silver pieces.

But popularity isn't just about trends. Gold's 88-to-1 price advantage over silver makes it the preferred store of wealth for serious investors, while silver's affordability attracts those seeking precious metal exposure without the hefty price tag.

As Eric Roach, a former Wall Street investment banker who guided Fortune-500 clients through multi-billion-dollar transactions, I've seen how both metals serve different purposes in building wealth. Understanding is gold or silver more popular requires looking beyond surface trends to the deeper roles each metal plays in both fashion and financial security.

The Fashion Verdict: Is Gold or Silver More Popular in Jewelry?

Right now, the jewelry world is experiencing something fascinating. For years, gold dominated our jewelry boxes with its warm, luxurious glow. But recently, there's been a noticeable shift that's got fashion insiders talking. Is gold or silver more popular in today's jewelry scene? The answer might surprise you.

The fashion landscape is evolving, and silver is making a serious comeback while gold maintains its classic appeal. What's really exciting is how personal style is trumping traditional rules, leading to some beautiful mixed-metal trends that let you wear exactly what makes you feel confident.

Why Silver is Stealing the Spotlight

Silver is having a major moment, and the numbers tell the story. There's been a 50% increase in searches for silver jewelry over the past year, while social media buzz around silver rings has exploded by 314%. That's not just a trend – that's a full-scale silver revolution.

What's driving this silver surge? Designer Jenny Bird puts it perfectly: we're experiencing "gold fatigue." After years of chunky gold chains and stacked rings, people are craving something fresh and modern.

Silver's appeal lies in its minimalist aesthetic and sculptural possibilities. The current trend favors clean lines, high-shine finishes, and pieces that feel more like wearable art than traditional jewelry. Think bold geometric shapes, architectural designs, and statement pieces that catch the light beautifully.

The runways are backing this up too. Chanel has been showcasing stunning silver pieces, from extra-long drop earrings to sleek chain designs. The message is clear: silver isn't just trendy – it's sophisticated and forward-thinking.

Gold's Unwavering Reign as a Classic

While silver is stealing headlines, gold hasn't lost its crown. There's something about gold's timeless sophistication that keeps it relevant generation after generation. It's still the go-to choice for life's biggest moments – think engagement rings, wedding bands, and heirloom pieces.

Gold represents more than just fashion; it's a symbol of luxury and enduring value. Whether you prefer delicate gold chains or bold, chunky statement pieces, gold jewelry carries a weight of tradition and prestige that's hard to match.

Current gold trends are embracing both bold and chunky pieces that make a statement and nature-inspired designs featuring botanical motifs and organic shapes. The beauty of gold lies in its versatility – it works equally well for everyday wear and special occasions.

The Mixed Metal Trend

Here's where things get really exciting: you don't have to choose anymore. The mixed metal trend is breaking down old fashion rules and opening up a world of personal expression.

Designer Jenny Bird says it best: "Follow your heart, not rules." This approach to jewelry styling is liberating and lets you create looks that truly reflect your personality.

Mixing metals successfully is about finding balance and ensuring your pieces complement each other in style, even if they differ in color. You might pair delicate silver chains with bold gold rings, or stack mixed-metal bracelets for a rich, layered effect.

The key is confidence. When you wear what you love, regardless of whether it "matches" traditional rules, you're making a statement about authenticity and personal style. This trend reflects a broader shift in fashion toward individual expression over rigid guidelines.

So when someone asks is gold or silver more popular, the real answer might be: why not both? The most popular choice is the one that makes you feel like the best version of yourself.

Beyond the Runway: Comparing Gold and Silver as Precious Metals

When fashion fades and trends come and go, gold and silver remain valuable for reasons that go far deeper than their looks. Is gold or silver more popular in the investment world? The answer reveals fascinating differences between these two precious metals that every investor should understand.

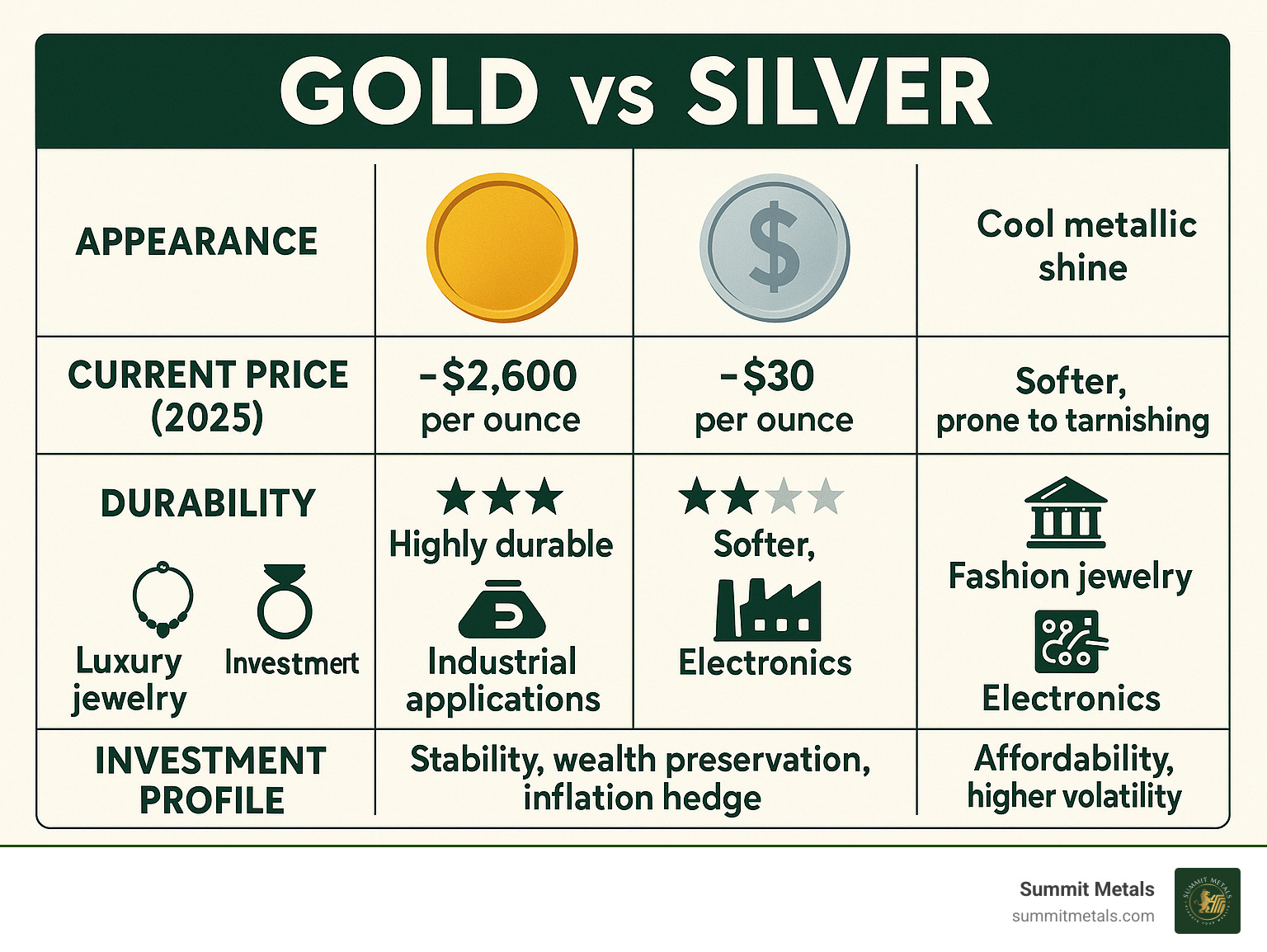

The most eye-catching difference is price. Gold currently costs about 88 times more per ounce than silver - we're talking roughly $2,600 for gold versus $30 for silver at the time of this publication. That's not just a number on a chart; it fundamentally shapes how each metal fits into your financial strategy.

This massive price gap explains why gold has earned its reputation as the ultimate store of wealth. When central banks want to back their currencies or wealthy families want to preserve generational wealth, they turn to gold. Silver, meanwhile, plays a completely different game - it's the scrappy younger sibling that offers affordability and explosive growth potential.

But here's where it gets really interesting: silver isn't just sitting pretty in jewelry boxes. This metal works for a living in ways that gold simply doesn't. Silver powers everything from solar panels to electric vehicles, creating industrial demand that can send prices soaring when supply gets tight. Gold, on the other hand, mostly sits in vaults looking valuable - which is exactly what makes it so stable.

Both metals serve as safe haven assets during economic storms, but they dance to different rhythms. Silver typically moves 2-3 times more dramatically than gold - when precious metals rally, silver often leads the charge upward, and when they fall, silver usually takes the bigger hit.

The market size tells another part of the story. Gold's market dwarfs silver's by over 80 times, making gold more liquid but silver more susceptible to supply disruptions. Think of gold as the steady ocean and silver as the rushing river - both valuable, but behaving very differently.

| Metric | Gold | Silver |

|---|---|---|

| Price/oz | Very high ($2,600 at publication) | Relatively low ($30 at publication) |

| Volatility | Lower, more stable | Higher, more volatile (2-3x gold's volatility) |

| Industrial Demand | Limited (electronics, dentistry) | Significant (electronics, solar, medical, EVs) |

| Market Size | Over 80 times larger than silver's market | Smaller, more susceptible to price swings |

| Primary Role | Store of value, wealth preservation, hedge | Affordability, growth potential, industrial asset |

Understanding these fundamental differences helps answer whether gold or silver is more popular for your specific investment goals. Gold attracts those seeking stability and wealth preservation, while silver appeals to investors hunting for growth and looking for an affordable entry point into precious metals.

Is Gold or Silver More Popular for Investors?

When it comes to investment, is gold or silver more popular becomes less about trendy appeal and more about building wealth strategically. Both metals play distinct roles in a smart portfolio, and the "winner" often depends on what you're trying to achieve with your money.

Think of it this way: gold is like the reliable friend who's always there when you need them, while silver is the exciting friend with bigger dreams and higher energy. Both have their place in your life—and your investment strategy.

A key tool that helps investors steer this choice is the Gold-Silver Ratio. This simple number tells you how many ounces of silver it takes to buy one ounce of gold. When the ratio is historically high, silver might be undervalued compared to gold. When it's low, gold might be the better deal. It's like having a compass for precious metals investing.

The Case for Gold: Stability and Security

Gold has earned its reputation as the ultimate financial security blanket over thousands of years. When economies shake, currencies wobble, or inflation starts eating away at your purchasing power, gold tends to hold its ground—or even shine brighter.

What makes gold so appealing to investors? Its stability is legendary. While silver can swing wildly in price, gold moves more like a steady river than a rushing rapids. This makes it perfect for wealth preservation, especially if you're thinking long-term or approaching retirement.

Gold also offers exceptional liquidity—you can convert it to cash almost anywhere in the world. It's like having a universal currency that governments can't print more of. For investors asking Is Gold a Good Investment?, the answer often comes down to wanting that rock-solid foundation in their portfolio.

The Case for Silver: Growth and Affordability

Silver tells a different story—one of affordability meeting opportunity. With silver trading at around $30 per ounce compared to gold's $2,600, you can own significantly more physical metal for the same investment. That lower entry price makes silver incredibly attractive for new investors or those building their stack gradually.

But here's where silver gets really interesting: it's not just a precious metal, it's an industrial powerhouse. Unlike gold, which mostly sits pretty in vaults and jewelry, silver works hard in solar panels, electronics, medical devices, and electric vehicles. This dual identity as both money and industrial commodity creates unique demand drivers that gold simply doesn't have.

Yes, silver is more volatile—it can swing 2-3 times as much as gold in either direction. But for growth-focused investors, that volatility represents opportunity. When silver moves, it really moves. Those asking Is Silver a Good Investment? often get excited about its potential for bigger returns, especially with the green energy boom driving industrial demand.

The Smart Approach: Building Your Stack with Autoinvest

Here's the thing about is gold or silver more popular for investing: the smartest investors don't pick sides—they pick both. A balanced approach gives you gold's stability and silver's growth potential, creating a more resilient portfolio.

But how do you build that balance without constantly worrying about timing the market? That's where The Power of Dollar Cost Averaging comes in. Instead of trying to guess whether prices will go up or down next month, you invest the same amount regularly, smoothing out the bumps over time.

Our Autoinvest program makes this incredibly simple. Just like contributing to your 401k, you can set up automatic monthly purchases of gold, silver, or both. Whether you want to invest $100 or $1,000 each month, Autoinvest handles the heavy lifting. You're building your precious metals stack consistently, without the stress of watching daily price movements or second-guessing your timing.

This automated approach takes the emotion out of investing and puts time on your side. Market up? You're benefiting from your existing holdings. Market down? You're buying more metal for the same dollars. It's the kind of steady, disciplined strategy that builds real wealth over time.

How to Invest: Choosing the Right Gold and Silver Products

Now that you've decided precious metals belong in your portfolio, it's time for the fun part: choosing what to buy. Think of it like shopping for a car – you wouldn't buy the first one you see without understanding the differences between models, right? The same goes for gold and silver.

When people ask is gold or silver more popular for investment, the answer often depends on how you're buying them. Coins and bars each have their own personalities and benefits. Our comprehensive guide to The Basics of Gold and Silver Stacking covers the fundamentals, but let's dive into what makes each option special.

Gold and Silver Coins: Portability and Protection

Coins are like the Swiss Army knives of precious metals investing. They're versatile, trusted, and come with built-in protection that bars simply can't match. When you buy a coin like The American Silver Eagle or the iconic Buffalo Gold Coin, you're not just buying precious metal – you're buying a government-backed guarantee.

Here's what makes coins special: they have legal tender status with face value. That $50 face value on a Buffalo Gold coin means the U.S. government stands behind it. This backing provides powerful anti-counterfeiting protection that makes coins incredibly liquid and trusted worldwide. Try explaining what a random gold bar is to someone, then show them an American Eagle – which one do you think they'll trust more?

The portability factor is huge too. Coins come in smaller denominations, making them perfect for flexible transactions. Need to sell just a portion of your holdings? Much easier with coins than trying to shave off a piece of a gold bar! Yes, you'll pay a slightly higher premium over spot price compared to bars, but this premium often pays for itself through easier liquidity and collectibility potential.

Gold and Silver Bars: Maximizing Your Investment

If coins are Swiss Army knives, then bars are like precision tools – designed for one purpose and excellent at it. That purpose? Getting the most precious metal for your money. When you want to maximize your metal acquisition and aren't concerned with collectibility, bars are your best friend.

The magic of bars lies in their lower premiums over spot price. Understanding Spot Price vs. Premium becomes crucial here – you're paying much closer to the actual market value of the metal. Think of it as buying in bulk at Costco versus buying single items at a convenience store.

Bars offer incredible flexibility in sizing too. You can start small with gram or ounce bars, or go big with kilo bars if you're serious about building wealth. Their uniform shapes make storage efficient, whether you're using a home safe or professional vault storage. While they won't win any beauty contests like ornate coins, bars are the workhorses of precious metals investing.

| Feature | Gold & Silver Coins | Gold & Silver Bars |

|---|---|---|

| Primary Goal | Liquidity, trust, and government backing | Maximizing metal quantity for cost |

| Key Advantage | Legal tender status provides anti-counterfeit security | Lower premiums over spot price |

| Liquidity | Extremely high; easily recognized and traded globally | High, but may require assay verification for private sales |

| Cost | Higher premium to cover minting and design | Lower premium, closer to the metal's spot price |

| Best For | Investors prioritizing security, flexibility, and easy resale | Investors focused on bulk accumulation and cost-efficiency |

The choice between coins and bars often comes down to your goals. Want maximum protection and liquidity? Coins are your answer. Focused on accumulating the most metal possible? Bars deliver the best value. Many smart investors do both – coins for flexibility and bars for bulk accumulation.

Whether you choose coins or bars, our Autoinvest program makes building your stack effortless. Just like your 401k contributions, you can set up automatic monthly purchases to dollar-cost average your way into precious metals ownership, removing the guesswork and emotional decisions from the equation.

Frequently Asked Questions about Gold and Silver

Whether you're drawn to the current silver trend or prefer gold's timeless appeal, we get plenty of questions beyond just "is gold or silver more popular" in today's market. Let's tackle some of the most common questions about choosing, wearing, and caring for these precious metals.

Which metal is better for my skin tone?

Here's where fashion meets personal style! While there are some traditional guidelines, the most important rule is wearing what makes you feel amazing.

Cool undertones (think blue or purple veins on your wrist) typically shine in silver, platinum, and white gold. These metals complement the natural coolness in your complexion beautifully. Warm undertones (green-tinted veins, peachy or golden skin) often look stunning in yellow gold, rose gold, and copper tones that echo your skin's natural warmth.

Got neutral undertones? Lucky you! Both gold and silver will likely look fantastic, giving you complete freedom to follow trends or stick with classics. With the current mixed-metal trend we discussed earlier, you can even wear both at once.

The truth is, confidence trumps any color theory. If you love how silver makes you feel during its current popularity surge, or if gold's classic appeal speaks to your heart, that's your perfect choice.

How do I care for my gold and silver?

Proper care keeps your precious metals looking their best, regardless of which metal is trending. Each requires slightly different attention due to their unique properties.

Silver needs a bit more TLC since it naturally tarnishes when exposed to air and moisture. Store your silver pieces in airtight bags or with anti-tarnish strips. When that inevitable darkening appears, gently clean with a soft cloth and specialized silver cleaner, or try a mild soap-and-water solution. Avoid harsh chemicals, chlorine from pools, and excessive moisture.

Gold is your low-maintenance friend. It's naturally more durable and resistant to tarnishing, especially in higher karat weights. A simple warm soapy water bath with a soft brush, followed by gentle drying with a soft cloth, keeps gold gleaming. Store pieces separately to prevent scratching.

For both metals, remove jewelry before showering, swimming, or applying lotions and perfumes. These substances can dull even the most beautiful pieces over time.

How much gold and silver should I own for investment?

This question goes beyond fashion trends to your financial future. While there's no universal answer since everyone's situation differs, most financial advisors suggest allocating 5-10% of your total investment portfolio to precious metals.

This allocation serves as your hedge against inflation and economic uncertainty. Your risk tolerance and investment goals should guide your specific choices. Some investors prefer gold's stability, others are drawn to silver's growth potential, and many choose both for diversification.

The key is viewing precious metals as long-term wealth preservation tools rather than short-term speculation. Whether gold or silver is more popular in any given year matters less than building consistent holdings over time.

This is where our Autoinvest program really shines. Just like contributing to your 401k, you can set up regular monthly purchases that smooth out market volatility through dollar-cost averaging. It takes the guesswork out of timing and builds your precious metals stack steadily.

For detailed guidance custom to your situation, check out our comprehensive guide: How Much Gold, Silver Should I Have?

Conclusion: Your Personal Verdict on Gold vs. Silver

So, is gold or silver more popular? After diving deep into both fashion trends and investment strategies, the answer is beautifully complex. It's like asking whether coffee or tea is better - it all depends on your taste, your goals, and what you're looking for.

In the jewelry world, we're witnessing silver's spectacular comeback. The 50% surge in searches and 314% increase in social buzz for silver rings tells a compelling story. Fashion lovers are embracing silver's minimalist appeal, sculptural designs, and that fresh break from what designer Jenny Bird calls "gold fatigue." But let's be honest - gold's timeless sophistication isn't going anywhere. Those classic gold hoops and statement chains continue to symbolize luxury and celebration, especially for life's biggest moments.

The mixed metal trend might be the most exciting development of all. It's freeing us from the old "pick a lane" mentality and encouraging genuine personal expression. Why choose when you can beautifully blend both?

From an investment standpoint, both metals serve distinct but equally valuable roles. Gold offers the stability and wealth preservation that has made it humanity's go-to store of value for millennia. Meanwhile, silver provides affordability and growth potential, backed by its crucial industrial applications in everything from solar panels to electric vehicles.

Here's the truth: there's no single "better" metal. The best choice is the one that resonates with your personal style and aligns with your financial goals. Whether you're drawn to silver's modern edge or gold's classic warmth, whether you're seeking portfolio stability or growth potential, the right answer is your answer.

At Summit Metals, we're here to support whatever path you choose. Based in Wyoming, we specialize in authenticated gold and silver with transparent, real-time pricing that our bulk purchasing power makes possible. We believe in building trust through value, helping you make informed decisions about your precious metals journey.

Ready to start building your stack? Consider our Autoinvest program - it's like contributing to your 401k, but for precious metals. By dollar-cost averaging with consistent monthly purchases, you can build your holdings steadily while smoothing out market volatility.

Whether you're team silver, team gold, or team "why not both," we're here to help you Learn What to Buy and Why Liquidity Matters. Your precious metals journey starts with understanding your options - and we're excited to be part of that adventure.