The Truth About Goldbacks and Their Gold Content

Are goldbacks real gold? This question has become increasingly common as more investors find these unique currency notes. Here's the definitive answer:

Yes, Goldbacks contain genuine gold:

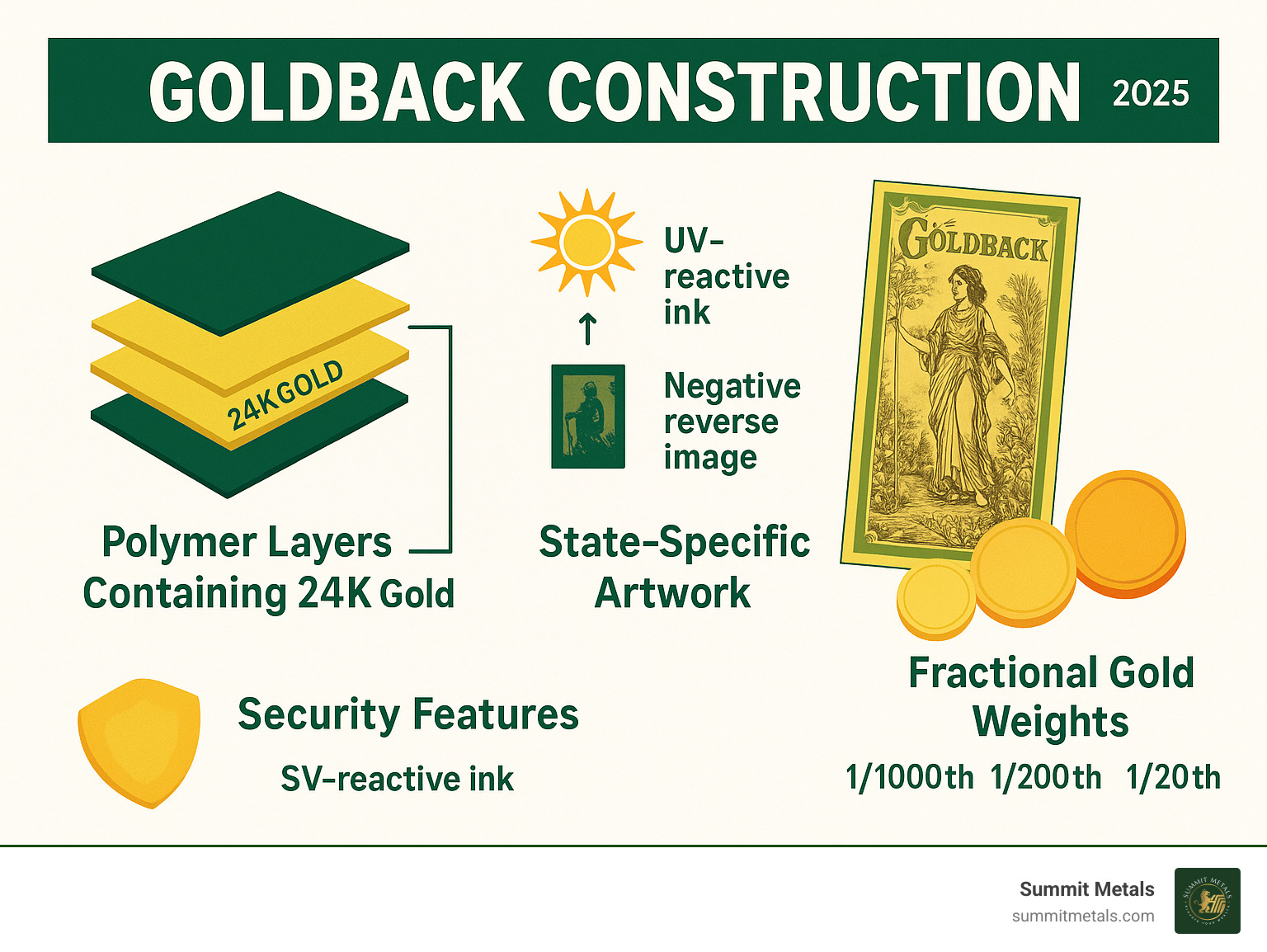

- Made with .999 fine 24-karat gold

- Each note contains precise fractional amounts (1/1000th to 1/20th troy ounce)

- Gold is physically embedded in polymer layers, not just backing the currency

- Value tied directly to current gold spot price

- Manufactured using patented Aurum® vacuum deposition technology

With inflation eroding the purchasing power of traditional currency, many investors are exploring alternative stores of value. Goldbacks represent a fascinating hybrid - combining the intrinsic value of physical gold with the practicality of spendable currency. Unlike paper money "backed" by gold promises, these notes actually contain the precious metal within their structure.

But understanding whether Goldbacks make sense for your portfolio requires looking beyond their gold content. The premium over spot price averages around 100%, and acceptance remains limited to voluntary networks in specific states. For investors seeking fractional gold exposure, traditional options like 1/10 oz American Gold Eagles offer government backing and broader liquidity, though with less divisibility.

As precious metals experts, we've seen how alternative assets can strengthen portfolios during uncertain times. Goldbacks occupy a unique niche between currency and collectible, requiring careful consideration of their premiums, liquidity, and intended use before adding them to your portfolio.

What Are Goldbacks and Are They Made of Real Gold?

Are Goldbacks real gold? The short answer is yes - but let's dive into what makes these unique currency notes so special.

Goldbacks represent something truly in precious metals. Unlike traditional paper money that simply promises to be backed by gold, these notes actually contain the gold itself. Each Goldback is crafted with .999 fine 24-karat gold - the purest form of gold you can find - embedded directly within its structure.

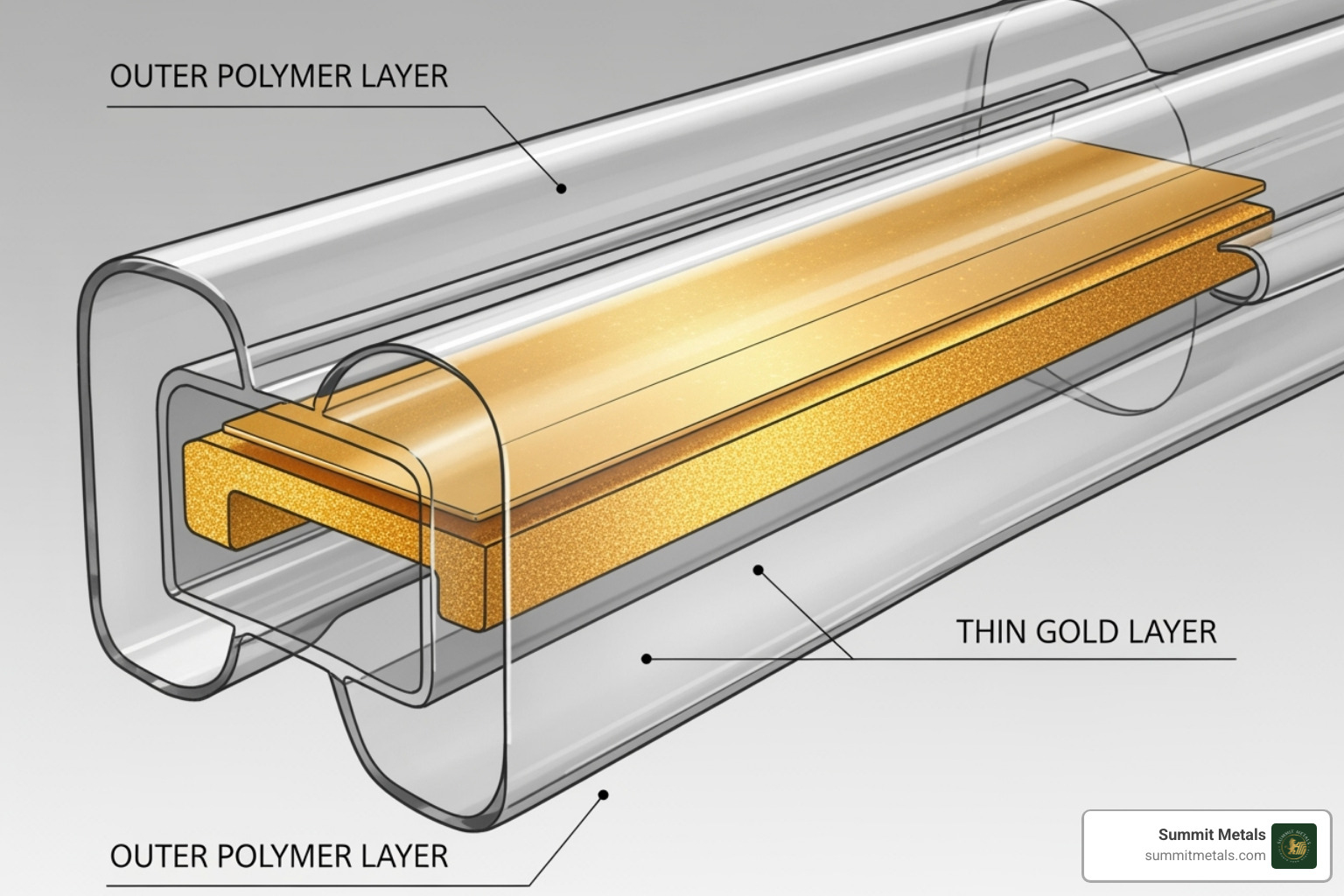

The manufacturing process is where things get really fascinating. These aren't your grandfather's gold certificates. Goldbacks are created using a patented Aurum® technology developed by Valaurum, which uses vacuum deposition to place gold atoms onto polymer sheets with incredible precision. Think of it as building with gold, one atom at a time.

This sophisticated process means when you hold a Goldback, you're literally holding gold in your hand. The metal isn't just painted on or attached - it's woven into the very fabric of the note between protective polymer layers. If you're curious about testing gold authenticity in general, our guide on How to Tell if Gold is Real covers the traditional methods.

The Technology Behind the Note

The engineering behind Goldbacks is nothing short of impressive. The patented process involves atom-by-atom deposition of 24-karat gold onto a polymer film base. This isn't a simple coating job - we're talking about a sophisticated layering system that makes the gold an integral part of the note's structure.

The security features built into this process are remarkable. Each Goldback includes anti-counterfeiting measures like a negative image on the reverse side and UV-reactive ink in newer series (starting with 2025). These features make Goldbacks incredibly difficult to fake - you'd need access to the same high-tech equipment and patented process.

The durability factor is another win. The polymer layers protect the gold from wear while maintaining flexibility. You can fold a Goldback without damaging the gold content, though like any collectible, gentle handling helps preserve its condition. For a detailed look at this fascinating manufacturing process, check out How Goldbacks are Made.

So, are Goldbacks real gold?

Absolutely, Goldbacks are real gold - and this distinction matters more than you might think. They contain verifiable gold with precise fractional weights, typically starting at 1/1000th troy ounce for the smallest denomination. That's incredibly small, but it's genuine 24-karat gold nonetheless.

Here's what makes them unique: Goldbacks are gold-filled, not gold-backed. There's a huge difference. Gold-backed means someone promises to give you gold later. Gold-filled means the gold is right there in your hands, visible and measurable.

Each denomination contains exact amounts of gold. Whether you're holding a 1 Goldback (1/1000th oz) or a 50 Goldback (1/20th oz), you know exactly how much pure gold you own. The newest Florida series even introduced a 1/2 Goldback containing 1/2000th oz of gold - talk about fractional precision.

This physical gold content means their value fluctuates with gold spot prices, just like traditional bullion. But unlike a gold bar you can't easily spend, Goldbacks bridge the gap between investment and currency. Understanding gold purity is crucial when evaluating any gold investment, and our guide on Understanding Karats and Purity in Gold explains why that 24-karat designation matters.

The bottom line? When someone asks "are Goldbacks real gold?" you can confidently say yes - they're as real as any gold coin or bar in your portfolio, just packaged in a completely innovative way.

The History and Purpose of Goldbacks

The story of Goldbacks begins with a simple but powerful idea: what if we could bring real gold back into everyday commerce? In 2019, Goldback Inc., a private company based in Utah, set out to solve a problem that had puzzled precious metals enthusiasts for decades. While gold has always been recognized as sound money, it hadn't been practical for small purchases since the days when gold coins jingled in people's pockets.

The concept wasn't born in a vacuum. A crucial foundation was laid back in 2011 with Utah's Legal Tender Act, which recognized gold and silver coins as voluntary legal tender within state borders. This groundbreaking legislation created fertile ground for innovation in precious metals commerce, essentially giving entrepreneurs permission to think creatively about how gold could function in modern transactions.

What makes this story even more compelling is how quickly the concept caught on. By 2023, the total value of Goldbacks produced had surpassed an impressive $100 million milestone. This wasn't just a novelty item gathering dust on collectors' shelves – people were actually using these notes in real transactions. For a deeper dive into their journey, you can explore A Brief History of the Goldback, and to understand the broader historical context, check out our guide on A Brief History of Gold as Currency and Store of Value.

The driving force behind Goldbacks was concern about inflation and the long-term stability of fiat currency. When you hold a dollar bill, you're holding a promise – but when you hold a Goldback, you're holding actual gold. This fundamental difference appealed to people who wanted their money to maintain its purchasing power over time.

Why Were Goldbacks Created?

Picture this scenario: you walk into a local coffee shop wanting to pay with gold, but the smallest gold coin you have is worth several hundred dollars. You'd either need to buy a lot of coffee or find another way to pay. This is what precious metals experts call the "divisibility problem," and it's exactly what Goldbacks were designed to solve.

Traditional gold investments like coins and bars work wonderfully for wealth storage, but they're simply too valuable for everyday purchases. A single one-ounce gold coin might be worth $2,000 or more – hardly practical for buying groceries or paying for a haircut. Goldbacks bridge this gap by offering fractional gold in denominations as small as 1/1000th of an ounce.

The creators envisioned empowering local economies by giving businesses and consumers a way to transact in sound money without the complications of making change for large gold pieces. Instead of worrying about fluctuating currency values or inflation eating away at savings, people could hold and spend money that maintains its intrinsic value.

This innovation addresses real concerns about fiat currency stability while providing a practical alternative that doesn't require complex calculations or expensive equipment to verify. The goal wasn't to replace traditional currency entirely, but to offer a voluntary option for those who prefer the security of real gold in their transactions. This concept has sparked considerable discussion, as explored in The Goldback: An Alternative to Fiat Currency?.

Goldbacks vs. Traditional Gold Investments

When you're exploring are goldbacks real gold options for your portfolio, it's helpful to see how they stack up against traditional gold investments. Each form of physical gold serves different purposes, and understanding these differences can help you make the right choice for your goals.

Goldbacks typically carry higher premiums over spot price than traditional gold coins or bars. This premium reflects their intricate manufacturing process and their unique role as both currency and collectible. While gold coins and bars are primarily investment vehicles, Goldbacks blur the lines between spending money and precious metals storage.

The beauty of comparing these options lies in understanding what each brings to the table. Traditional gold has been the go-to for wealth preservation for thousands of years, but Goldbacks offer something entirely new: ultra-fractional divisibility that makes gold practical for everyday transactions. We've previously discussed the differences between Gold Bars vs. Coins, and now Goldbacks add another fascinating dimension to the precious metals landscape.

[COMPARISON CHART] Goldbacks vs. Gold Coins vs. Gold Bars

| Feature | Goldbacks | Gold Coins (e.g., Eagles) | Gold Bars |

|---|---|---|---|

| Primary Use | Spending & Collecting | Investment & Collecting | Investment & Wealth Storage |

| Divisibility | Excellent (as low as 1/1000 oz) | Good (down to 1/10 oz) | Poor (typically 1 oz+) |

| Spendability | High (where accepted) | Low (face value << melt value) | Very Low |

| Premium | Highest | Moderate | Lowest |

| Legal Tender | Voluntary/State-level | Yes (Federal) | No |

| Fraud Protection | High-tech security features | Government-backed, difficult to fake | Varies, relies on assay |

Benefits of Gold Coins

Gold coins offer some compelling advantages that have made them favorites among investors for decades. Recognized legal tender with face value provides an extra layer of security - while their melt value far exceeds their face value, this legal tender status offers built-in fraud protection that's hard to replicate.

Government-backed authenticity means coins like the American Gold Eagle come with the full faith and credit of the U.S. Mint behind them. This makes them incredibly difficult to counterfeit and gives buyers confidence in their authenticity. They're also easier to verify and liquidate than bars because their standardized weights and designs are recognized worldwide.

Many gold coins also carry collectible value beyond their gold content. Certain years, mint marks, or conditions can make coins worth significantly more than their melt value, adding another dimension to their investment potential.

Benefits of Gold Bars

For investors focused purely on accumulating gold at the lowest cost, bars shine with their lower premiums per ounce. They typically offer the most gold for your dollar, making them incredibly efficient for larger investments.

Gold bars are also ideal for storing significant wealth in a compact form. Their efficient storage characteristics mean you can hold substantial value in relatively little space - perfect for those building serious precious metals holdings.

Benefits of Goldbacks

What makes Goldbacks special is their ultra-fractional divisibility. At 1/1000th of an ounce for the smallest denomination, they solve the age-old problem of using gold for small transactions. Try buying lunch with a one-ounce gold coin, and you'll quickly appreciate this innovation!

Their unique, artistic designs featuring state-specific imagery and virtues make them genuinely beautiful to own and display. The advanced security features built into their manufacturing process provide robust protection against counterfeiting that rivals or exceeds many government currencies.

Are Goldbacks a good investment?

This question comes up frequently, and the honest answer depends on what you're trying to achieve. Are goldbacks real gold investments? Absolutely - but they serve a different purpose than traditional bullion.

Goldbacks excel at portfolio diversification because they occupy a unique niche between currency and collectible. As a tangible asset with intrinsic value tied directly to gold content, they offer the same inflation protection as other physical gold, but with added utility for small transactions.

The higher premium consideration is important, though. You'll pay more per ounce of gold compared to coins or bars, but you're getting something no other gold product offers: the ability to spend fractional amounts easily. For building a comprehensive precious metals portfolio, consider how Goldbacks might complement rather than replace traditional gold holdings.

Our Gold Investment 101: Turning Your Savings into Solid Gold guide can help you understand how different gold products fit into an overall strategy.

For those looking to build their precious metals holdings consistently, Summit Metals' Autoinvest feature lets you dollar-cost average into gold and silver by shopping with us monthly - just like investing in a 401k, but with physical precious metals you can hold in your hands.

[COMPARISON CHART] Goldbacks vs. Other Fractional Gold Options

| Feature | Goldbacks | Fractional Gold Coins | Fractional Gold Bars |

|---|---|---|---|

| Minimum Size | 1/1000 oz | 1/10 oz | 1 gram (~1/32 oz) |

| Premium | Highest | Moderate | Lower |

| Spendability | High (where accepted) | Moderate | Low |

| Artistic/Collectible Value | High | Moderate | Low |

| Security Features | Advanced | Government-backed | Varies |

The Practicalities of Owning and Using Goldbacks

Here's something fascinating about Goldbacks: they exist in a unique legal space as voluntary local currency. Unlike the U.S. dollar, they're not recognized as federal legal tender, but they don't need to be. Their power comes from state-level legislation and the growing network of businesses that choose to accept them.

Utah blazed the trail with the Utah Legal Tender Act of 2011, creating the legal framework that made Goldbacks possible. Since then, the concept has spread like wildfire across America. Today, you'll find six different state series, each reflecting the unique character and values of its home state.

The current Goldback states include Utah, Nevada, New Hampshire, Wyoming, South Dakota, and Florida - with Florida being the newest addition to the family. What makes each series special isn't just that Goldbacks are real gold, but how each state's culture shines through in the artwork. Utah's series celebrates virtues like Liberty and Justice, while Florida's vibrant designs draw inspiration from Spanish conquistadors and Seminole resistance.

Where Are Goldbacks Accepted?

The acceptance network for Goldbacks is growing steadily, though it requires a bit more planning than using traditional currency. Think of it as a community of businesses that believe in sound money and local economic empowerment. These are often small businesses - local restaurants, farmers markets, precious metals dealers, and service providers who appreciate having customers pay with real gold.

Finding these businesses is easier than you might think. The official Goldback website maintains updated maps of participating merchants for each state, so you can plan your shopping accordingly. The network includes everything from coffee shops to car repair services, creating a mini-economy within the larger economy.

Using Goldbacks involves straightforward math: their value fluctuates with the gold spot price, just like any gold investment. When you want to make a purchase, you simply divide the dollar price by the current dollar value of one Goldback. It's essentially a barter transaction where you're exchanging the gold content for goods or services. To stay current with gold pricing, check our Gold Price Today in USA Per Gram guide.

Criticisms and Downsides

Let's be honest about the challenges. As a trusted precious metals dealer, we believe in giving you the complete picture, including the potential drawbacks of any gold investment.

The premium over spot price is significant - typically around 100%. This covers the advanced Aurum® technology, intricate artwork, and specialized manufacturing process. While this premium reflects their utility and collectibility, it means you're paying considerably more per ounce of gold compared to traditional bullion products.

Limited acceptance remains a reality. Despite steady growth, the merchant network is still concentrated in specific states and communities. You can't walk into any store expecting to use Goldbacks like you would cash or credit cards. Their success depends on voluntary participation from businesses.

They're not traditional investment vehicles in the same way gold bars or coins are. While they contain real gold and serve as a store of value, their higher premium and focus on spendability make them more like collectible currency than pure investment products.

Wear and tear can occur with frequent handling. The polymer construction is durable, but like any currency that changes hands regularly, Goldbacks can show signs of use over time. Minor damage doesn't destroy their gold content, but it might affect their aesthetic appeal and collectibility.

Understanding these limitations helps you make informed decisions about incorporating Goldbacks into your precious metals portfolio. All gold investments fluctuate with market conditions - learn more about this in our guide on Why Gold and Silver Prices Fluctuate.

Frequently Asked Questions about Goldbacks

Let's tackle the most common questions we hear about Goldbacks to help you make an informed decision about these unique precious metal notes.

How much is a Goldback worth?

The beauty of Goldbacks lies in their transparent value system. Are Goldbacks real gold? Absolutely, and their worth reflects this directly. Each Goldback's intrinsic value moves up and down with the current gold spot price because it contains actual .999 fine 24k gold.

Here's how it works: a 1 Goldback note contains exactly 1/1000th troy ounce of gold. So if gold is trading at $2,000 per ounce, your 1 Goldback contains roughly $2 worth of gold. The math is straightforward - take today's spot price and divide it by the fractional amount of gold in your note.

Goldback Inc. makes this even easier by providing daily updated exchange rates on their website. You can find a handy transaction calculator at https://goldback.com/calc to see exactly what your notes are worth at any moment.

What makes this particularly interesting is that gold's performance often surprises investors. The metal's steady appreciation over time means your Goldbacks may be worth more than you initially paid, especially when you factor in compound returns. Our guide on Why Gold's Return Is Higher Than You Think explains this phenomenon in detail.

What are the different Goldback denominations?

Goldbacks come in five main denominations, each containing progressively more gold. The 1 Goldback serves as the base unit with 1/1000th troy ounce of gold. From there, you'll find 5 Goldbacks (1/200th oz), 10 Goldbacks (1/100th oz), 25 Goldbacks (1/40th oz), and 50 Goldbacks (1/20th oz).

The newer Florida series introduced some unique options, including a tiny 1/2 Goldback containing just 1/2000th oz of gold and a larger 100 Goldback with 1/10th oz - making it comparable to fractional gold coins in gold content.

Each denomination showcases stunning artwork depicting different virtues like Liberty, Justice, Truth, and Prudence. The designs incorporate state-specific imagery, from Utah's pioneer heritage to Florida's Spanish colonial history. These aren't just currency notes - they're miniature works of art that tell the story of American values and regional culture.

The artistic element adds a collectible dimension that traditional gold bars simply can't match. While a gold bar is purely functional, Goldbacks blend investment value with aesthetic appeal, much like numismatic coins do in the traditional precious metals world.

How do you store Goldbacks safely?

Thanks to their polymer construction, Goldbacks are surprisingly durable for everyday handling. The gold is sealed between protective layers, making them far more resilient than you might expect. However, proper storage becomes important if you're building a collection or holding them long-term.

Avoid sharp creases - while Goldbacks are flexible, permanent folds can detract from their appearance and potentially affect their value as collectibles. Many owners invest in specialized wallets designed to keep the notes flat, or use protective sleeves similar to those used for collectible trading cards.

For larger holdings, treat them like any other precious metal investment. A home safe provides security and climate control, while professional depository services offer institutional-level protection. The key is keeping them in a stable environment away from extreme temperatures and humidity.

Consider your storage strategy as part of your overall precious metals plan. Just like building a diversified portfolio through Summit Metals' Autoinvest program - where you can dollar-cost average by purchasing precious metals monthly like a 401k - your storage approach should match your investment timeline and goals.

Our comprehensive guide on The Ultimate Guide to Gold and Other Precious Metals Storage covers everything from basic home storage to professional vault services, helping you protect your precious metals investments properly.

Conclusion

So, are goldbacks real gold? Absolutely. Throughout this exploration, we've finded that Goldbacks contain genuine .999 fine 24k gold, precisely embedded within durable polymer layers using cutting-edge Aurum® technology. They're not just paper promises backed by gold somewhere in a vault - the gold is literally there in your hands.

What makes Goldbacks truly fascinating is how they bridge two worlds that rarely meet: the solid reliability of physical gold and the everyday practicality of spendable currency. While traditional gold coins and bars excel at wealth storage, and paper money handles daily transactions, Goldbacks occupy this unique middle ground where you can actually spend fractional amounts of real gold.

Yes, they come with trade-offs. The premium over spot price is significant, and you can't use them everywhere like regular dollars. But for those seeking to diversify beyond traditional investments, Goldbacks offer something genuinely different - a tangible asset that doubles as functional currency in participating communities.

At Summit Metals, we understand that building wealth with precious metals isn't just about buying once and hoping for the best. That's why we're excited to offer our Autoinvest feature, which lets you systematically build your precious metals portfolio month after month. Think of it like contributing to your 401k, but instead of paper assets, you're steadily accumulating real gold and silver. This dollar-cost averaging approach helps smooth out price fluctuations while building your hedge against inflation over time.

Whether you're drawn to the innovative appeal of Goldbacks or prefer the time-tested reliability of traditional bullion, the key is taking that first step. Our transparent, real-time pricing and authenticated products make it easy to start building the precious metals portfolio that's right for your situation.

Ready to secure your financial future with real, tangible assets? Start Your Gold Investment Journey today and find how precious metals can strengthen your wealth strategy for years to come.