Finding Value in Discount Silver Coins

Discount silver coins are silver bullion products available at a lower premium over the current spot price of silver. This means you pay less extra for manufacturing, branding, or collector appeal. They offer a smart way to acquire physical silver and maximize your investment.

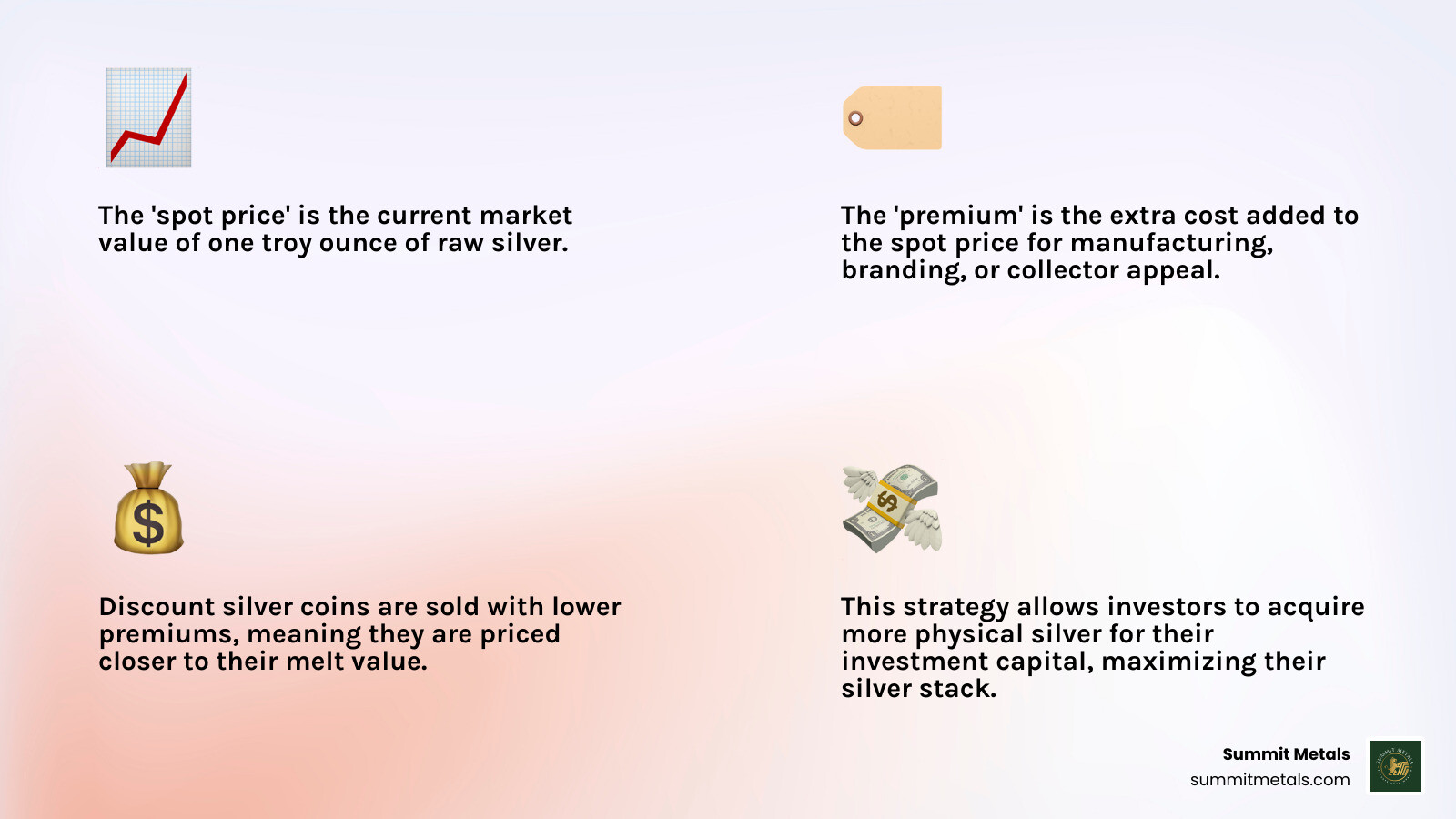

Here's a quick look at what defines them and why they're affordable:

- Affordable Premiums: They sell closer to silver's melt value, reducing the markup you pay.

- Focus on Metal Content: Their value comes primarily from their silver weight and purity, not rarity or condition.

- Accessibility: They are often easier to find and are ideal for building a substantial silver stack.

The main types of discount silver coins you'll encounter are:

- Junk Silver (Constitutional Silver)

- Silver Rounds

- Secondary Market Bullion

What Exactly Are "Discount" Silver Coins?

Let me clear up a common misconception right away. When we talk about discount silver coins, we're definitely not talking about damaged goods or sketchy coins from unknown sources. These are legitimate, investment-grade silver products that simply carry a lower premium over the current market price of silver.

Here's how it works: every silver coin has two main price components. First, there's the spot price – that's the current market value of pure silver per troy ounce. Think of it as the raw material cost. Then there's the premium – the extra amount you pay on top of spot price for things like minting costs, dealer margins, and any collector appeal.

Discount silver coins shine because they keep that premium nice and low. While a popular coin like an American Silver Eagle might carry a higher premium due to its government backing and widespread recognition, discount options focus purely on silver content rather than fancy branding or collector value.

This approach makes perfect sense if your goal is building a substantial silver stack. You're essentially getting more silver for your money because you're not paying extra for packaging, special designs, or numismatic appeal. The value comes directly from the melt value – the actual silver content in the coin.

At Summit Metals, we love this straightforward approach. Our transparent, real-time pricing means you can see exactly what you're paying and why. There's no mystery math or hidden fees – just honest value on authentic silver products.

The beauty of focusing on affordability this way is simple: every dollar you save on premiums is another dollar that goes toward actual silver ownership. It's a smart strategy for anyone serious about precious metals investing.

Want to dive deeper into how this pricing works? Check out our detailed guide: Spot Price vs. Premium: How Precious Metals Pricing Works. Understanding these basics will make you a much more informed silver investor.

Uncovering the Best Deals: Your Guide to Discount Silver Coins

Ready to fill your silver stack without emptying your wallet? This section is your personal treasure map to finding the most common types of low-premium silver available today. We'll show you how to spot those fantastic opportunities to maximize your silver holdings. These aren't just obscure items; they're some of the most accessible and cost-effective ways to get your hands on physical silver.

What Are the Main Types of Discount Silver Coins?

When you're on the hunt for discount silver coins, you'll typically come across three main categories. Each offers its own unique perks and fits different investment styles. Understanding what makes each one special is key to making smart choices for your portfolio.

First up, we have Constitutional Silver, often affectionately called "junk silver." These are old U.S. coins that once circulated but are now valued for their silver content. Then there are Silver Rounds, which are like the no-frills, pure silver workhorses of the bullion world. Finally, we'll talk about Secondary Market Bullion, which means pre-owned, still-valuable official coins.

Here’s a quick overview of how these three types stack up:

| Feature | Constitutional Silver (Junk Silver) | Silver Rounds | Secondary Market Bullion |

|---|---|---|---|

| Silver Content | 90% (pre-1965 US), 40% (1965-1970 Kennedy Halves), 35% (War Nickels) | Typically .999 fine silver (99.9% pure) | .999 or .9999 fine silver, retains original purity |

| Legal Tender Status | Yes, but face value is negligible compared to melt value | No, not government-backed currency | Yes, originally issued as legal tender |

| Typical Premium | Very low, close to melt value | Low, often lower than sovereign coins | Lower than new "Brilliant Uncirculated" versions, varies by condition |

| Best For | Stacking, fractional silver, historical appeal, privacy | Maximizing silver per dollar, pure metal investment | Acquiring well-known sovereign coins at a reduced cost |

Constitutional Silver (Junk Silver): The Historic Bargain

Ah, "junk silver"! Don't let the name fool you. While it might sound a bit rough around the edges, this category is a true gem for smart investors. We're talking about U.S. dimes, quarters, and half dollars minted before 1965. Why that specific year? Because that's when the U.S. government changed the game, removing almost all silver from our circulating coins. Before then, these coins were packed with a solid 90% silver!

Take your everyday pre-1965 dime, quarter, or half dollar – each one is 90% pure silver. Even some Kennedy Half Dollars from 1964 to 1969 had a decent 40% silver content. And if you go back a little further, 'War Nickels' from 1942-1945 surprisingly contained 35% silver. Today, these coins aren't used for their face value; instead, their worth comes directly from their silver content. This makes them a wonderfully cost-effective way to invest.

Their biggest appeal is that super low premium over the current spot price. It makes them a super easy way to get into physical silver. You're essentially buying silver in small, familiar pieces. Plus, they're super easy to trade and everyone recognizes them. Many of our clients love the historical feel of these coins—it's like owning a piece of American history that also helps protect your wealth from inflation. If you're curious how to figure out what these historic beauties are worth, our guide, An Essential Guide to Valuing Constitutional Silver, is a fantastic place to start.

Silver Rounds: The Purest Play on Price

Silver rounds are another fantastic path to picking up discount silver coins. Unlike official government-minted coins, silver rounds come from private mints. This is a big difference: they don't have a face value, aren't considered legal tender, and aren't backed by any central government. Their value comes purely from how much silver they contain and how much they weigh.

Why are their premiums often lower? Private mints simply have fewer rules and costs compared to the big government mints. This means they can often make silver rounds and sell them with much smaller premiums over the spot price. Most silver rounds are made of .999 fine silver, meaning they are 99.9% pure. If your goal is to get as much silver as possible for your money, these are a top-notch choice.

While they might not have the collector appeal or government backing of an American Silver Eagle, silver rounds offer a straightforward, no-fuss way to buy pure silver. You'll find them in all sorts of designs, from classic patterns like the Buffalo to unique new series. If you're just looking to accumulate ounces of silver, silver rounds are often your best bet for getting the most metal for your dollar. To learn more about official coins versus rounds, you can check out our guide on American Eagle Silver Bullion Coins for Sale: Your Ultimate Buying Guide. And for a broader understanding of what makes a currency official, Investopedia has a good explanation of legal tender.

Secondary Market Bullion: Pre-Owned Value

Our third category of discount silver coins is what we call "secondary market bullion." These are typically well-known coins from sovereign mints – like American Silver Eagles, Canadian Maple Leafs, or Austrian Philharmonics – that have been owned before. They might show a little wear, a few minor scratches, or even those pesky "milk spots" (a common cosmetic issue on some newer silver coins).

Here's the great news: even with these small imperfections, these coins still have their full silver content and official weight. Because they aren't "Brilliant Uncirculated" (BU) or fresh from the mint, dealers can offer them at a lower premium than brand-new, perfectly shiny versions. This makes them a fantastic choice for investors who want the recognition and easy tradability of official government-backed coins but are happy to trade a perfect look for a better price per ounce.

The best part? These popular coins are still super easy to buy and sell because they're recognized globally. This category truly offers a sweet spot, giving you the trusted backing of a government mint combined with the advantage of a lower price.

The Smart Investor's Edge: Why Choose Low-Premium Silver?

There's something incredibly satisfying about knowing you're getting the most bang for your buck. That's exactly what discount silver coins deliver – they're the smart investor's secret weapon for building a substantial precious metals portfolio without breaking the bank.

Think of it this way: if you're focused on accumulating silver as a tangible asset and hedge against economic uncertainty, why pay extra for fancy packaging or collector appeal? Low-premium silver cuts through the fluff and gets straight to what matters most – the actual silver content in your hands.

When market volatility strikes or inflation starts eating away at your purchasing power, physical silver becomes your financial anchor. Unlike stocks that can vanish overnight or currencies that can be printed into oblivion, your silver coins represent real, tangible value that you can hold in your hand.

At Summit Metals, we've seen how discount silver coins help our clients build resilient portfolios efficiently. Our Wyoming-based operation focuses on transparent, real-time pricing precisely because we understand that every dollar you save on premiums is another dollar that can go toward accumulating more silver.

For a deeper understanding of how liquidity plays into your precious metals strategy, check out What is the Best Silver/Gold to Buy and Why Liquidity Matters.

Key Benefits of Investing in Discount Silver Coins

The beauty of low-premium silver lies in its practical advantages. When you maximize your silver per dollar, you're essentially getting bulk pricing on one of humanity's oldest stores of value. Every ounce you acquire at a lower premium means more protection against inflation and economic instability.

The high liquidity of constitutional silver and popular rounds makes them incredibly practical investments. Whether you're dealing with a local coin shop or an online dealer, these familiar forms of silver are instantly recognizable and easy to trade. There's no need to explain what you have or prove its authenticity – the market knows these products well.

What really sets physical silver apart is that it's a tangible asset free from counterparty risk. Your silver doesn't depend on a company's balance sheet or a government's promises. It exists independently, providing genuine diversification in your portfolio when traditional investments might be struggling.

Perhaps most importantly, silver serves as a reliable store of value during times of financial uncertainty. History has shown us repeatedly that when paper currencies falter or markets crash, precious metals tend to hold their ground. It's this stability that makes discount silver coins such a compelling choice for building long-term wealth and security.

How to Buy Safely and Secure the Best Value

So, you're ready to dive into discount silver coins! That's fantastic. It’s a truly smart way to invest. But just like with any valuable purchase, it’s super important to buy wisely. You want to make sure you're getting authentic silver and the best possible value for your hard-earned money. Avoiding fakes and finding trustworthy sellers are your top priorities here.

Think of it as laying a strong foundation for your silver stack. To help you with this, we've put together a really helpful guide on how to verify what you're buying: Where to Buy Certified Silver Coins Without Getting Tarnished. Give it a read; it's designed to keep your investment safe!

Understanding the Key Value Factors

To really understand the true value of your discount silver coins, it's helpful to look past just the dollar amount you pay. There are a few key things that influence how much these coins are worth, and knowing them helps you make smart choices.

First off, there's the Spot Price of Silver. This is the big one! It's the current market price for a troy ounce of silver, and it changes all the time. Your coin's value starts right here, based on how much silver it contains. Everything else is added on top of this foundational price.

Next, consider the Coin Condition. Even though we're talking about 'discount' silver, a coin's physical state still matters. A coin that's just a little worn will usually be worth more than one that's heavily damaged or what we call a 'cull.' So, while you might expect some minor marks, severely damaged pieces will have less value.

Then there's Rarity and Mintage. For most discount silver, you're buying for the metal, not the collector's value. But sometimes, even within categories like secondary market bullion, a coin from a very limited production run or a specific year might carry a tiny bit more value. It’s usually not a huge factor for discount silver, though.

Our main focus here is Bullion Value, not numismatic (collector) value. While a few discount silver coins might have a small appeal to collectors, their real purpose for us is the actual silver content they hold. You're buying the metal, pure and simple.

Finally, always pay attention to Purity and Weight Verification. A reputable dealer will always confirm the silver content (like .999 fine for rounds or 90% for junk silver) and the exact weight. This assurance means you know exactly how much silver you're getting.

By keeping these factors in mind, you'll be much better equipped to make informed decisions and truly get the most out of your discount silver coins. And if you're curious about how to get silver at the absolute best price, you might enjoy reading our article on How to Snag Silver Bullion at Spot Price (Yes, Really!).

Choosing a Reputable Dealer

Perhaps the most important step in your journey to acquiring discount silver coins is choosing the right dealer. This isn't just about finding the lowest price; it's about finding a partner you can trust. At Summit Metals, we believe in building relationships based on honesty, clear communication, and excellent service. We're proud to be based right here in Wyoming, USA, providing authenticated gold and silver precious metals for your investment needs.

So, what should you look for when picking a dealer?

First, demand Transparent Pricing. A good dealer will clearly show you the current spot price of silver, the premium they add, and the total price you'll pay. No hidden fees, no surprises. Here at Summit Metals, we're all about real-time pricing that's easy to understand, so you always know exactly what you're paying for.

Second, always check their Customer Reviews and Reputation. What are other people saying? Look for independent reviews on sites like the Better Business Bureau. A dealer with a long history of happy customers and positive feedback is a strong indicator of reliability and trustworthiness.

Third, understand their Shipping and Insurance Policies. When you're buying valuable assets like silver, you need peace of mind. Make sure the dealer offers shipping that's secure, discreet, and fully insured. You want to be confident your precious metals will arrive safely at your doorstep.

Fourth, inquire about their Buyback Policies. A truly customer-focused dealer will make it easy for you to sell your silver back when you decide it's time. This ensures your investment remains liquid and flexible, simplifying your overall precious metals journey.

Finally, consider their Professional Affiliations. Membership in respected industry organizations can signal that a dealer adheres to high ethical standards and best practices. It's an extra layer of reassurance for you.

We work hard to bring you the best value. By purchasing in bulk, we can offer really competitive rates on discount silver coins, and we pass those savings directly to you. Our main goal is to build trust and deliver value to every investor, whether you're just starting your silver collection or adding to a long-standing portfolio.

Frequently Asked Questions about Buying Discount Silver

We often hear similar questions from those exploring discount silver coins. It's great to ask! Let's address some of the most common ones to further clarify your path to smart silver investing. Our goal is always to make your precious metals journey clear and secure.

Are discount silver coins a good investment?

Yes, absolutely! Investing in discount silver coins is an excellent way to acquire physical silver, especially because they come with lower premiums. Think of it this way: you get more pure silver for every dollar you invest. This strategy is crucial for building your wealth over the long term.

These types of silver products serve as a practical and reliable hedge against economic instability, inflation, and even currency devaluation. They help protect your financial future. By focusing on the intrinsic metal value, rather than high numismatic (collector) premiums, you're investing directly in the commodity itself. This makes it a straightforward and often more liquid investment than highly collectible coins. You're buying ounces, pure and simple!

What's the difference between a silver round and a silver coin?

This is a common point of confusion, but it's simpler than you might think! The key difference lies in who makes them and what they represent.

A silver coin is produced by a government mint, like the U.S. Mint or the Royal Canadian Mint. These coins have a legal tender face value, even if it's a small amount compared to their silver content (like $1 for an American Silver Eagle). They are recognized as official currency. Because of this official backing and the costs associated with government minting, these often carry a higher premium.

A silver round, on the other hand, is produced by a private mint. It has no face value and is not legal tender. Its value comes solely from its silver content and weight. Since private mints have fewer overheads and regulations, silver rounds often come with a lower premium. This makes them a more affordable option for simply accumulating pure silver ounces. Both types, however, are generally made of .999 fine silver.

How can I be sure my discount silver coins are real?

Ensuring authenticity is vital, especially when seeking out discount silver coins. The very best way to be sure is to always buy from reputable dealers. Look for ones with a strong track record, transparent pricing, and positive customer reviews. At Summit Metals, we stake our reputation on the authenticity of every single product we sell. We believe in providing authenticated gold and silver precious metals for your investment.

Beyond choosing a trusted source, you can also perform some simple home tests to help verify authenticity. These are good "first checks" to give you peace of mind:

- Magnet Test: Silver isn't magnetic. If a strong magnet sticks to your coin, it's likely not pure silver.

- Weight and Dimension Checks: Use a precise scale and calipers to verify the coin's weight and diameter. You can easily find official specifications online for most common coins.

- Sound Test (Pinging): A pure silver coin will produce a clear, sustained "ping" sound when gently tapped. Base metals, by contrast, tend to create a duller thud.

- Visual Inspection: Look for clear details, proper edges, and consistent finishes. While discount silver coins might have minor wear, obvious signs of poor craftsmanship or incorrect details can be big red flags.

While these tests aren't foolproof, they provide a good first line of defense. The most reliable method remains purchasing from a dealer you trust.

Conclusion

So, we've journeyed through discount silver coins together. What's the big takeaway from all this? It’s simple: investing in these low-premium options is a genuinely smart move for anyone looking to build a robust precious metals portfolio. It's about getting the most silver for your money, plain and simple!

We learned that discount silver coins aren't "damaged goods." Instead, they represent silver products available at a lower premium over the spot price. This means you pay less extra for things like minting, branding, or collector appeal. Whether it's the historical charm of constitutional silver, the pure efficiency of silver rounds, or the pre-owned value of secondary market bullion, each offers a fantastic way to stack more ounces.

The real magic here is that these types of silver are highly liquid and serve as a powerful tangible asset. They’re a reliable hedge against inflation and economic uncertainty, offering long-term value and peace of mind. By focusing on low-premium options like constitutional silver and silver rounds, you can build a substantial and liquid precious metals portfolio without breaking the bank.

Here at Summit Metals, we're proud to be a Wyoming-based dealer dedicated to helping you achieve your investment goals. We stand by our promise of transparent, real-time pricing and competitive rates, which we achieve through our bulk purchasing capabilities. This means you get authenticated gold and silver, ensuring trust and value with every single transaction. We believe in empowering you with the knowledge to make smart decisions for your financial future.

Ready to start your journey or add to your existing silver stack? We invite you to explore our collection of silver products today. The savvy investor's secret to maximizing silver is now yours!