Understanding Your Fine Silver Dollar Coin

A fine silver dollar coin is more than just a piece of metal. It's a tangible asset, a collector's item, and a piece of history all in one.

Here’s what you need to know about fine silver dollar coins, especially the popular American Silver Eagle:

- Purity: Each coin contains 1 troy ounce of .999 fine silver, making it one of the purest silver coins ever struck by the U.S. Mint.

- Weight: Weighs precisely 31.1 grams (1 troy ounce).

- Face Value: Carries a nominal face value of $1, fully guaranteed by the U.S. government.

- Official Status: The American Silver Eagle is the official U.S. silver bullion coin, first minted in 1986.

- Purpose: Valued by investors for its silver content and by collectors for its iconic designs and historical significance.

These coins offer a unique blend of intrinsic value and numismatic appeal. They represent a solid way to diversify your assets and protect against economic shifts. This guide will explore everything you need to know about these remarkable pieces.

Meet Eric Roach. With over a decade of experience in investment banking and M&A, Eric translates Wall Street expertise into clear guidance for individuals navigating physical gold and fine silver dollar coin investments.

Fine silver dollar coin vocab to learn:

- Buy Certified Silver

- Precious Metals Investment

- silver eagle 1 ounce

The American Silver Eagle: A Legacy in Precious Metal

Let's explore the fascinating story of the American Silver Eagle, a coin that truly holds a special place in precious metals. Its journey began with a brilliant idea: why not take the U.S. government's vast silver reserves and turn them into something tangible and accessible for everyone? This vision led to a landmark moment in 1985.

That's when the Liberty Coin Act of 1985 was passed, giving the U.S. Mint the green light to produce an official silver bullion coin. Fast forward to November 24, 1986, and the very first American Silver Eagle coins were released! From that day on, this beautiful fine silver dollar coin has stood proudly as the official silver bullion coin of the United States. And here's the best part: it carries the full backing of the U.S. government. That means its weight and purity are guaranteed, offering an best level of trust and security for you, whether you're investing or collecting.

The creation of the American Silver Eagle was a clever move, designed to use the national silver stockpile without causing any ripples in the global silver market. This careful planning helped ensure the coin's immediate credibility and popularity. To truly understand its foundation, you can explore The authorizing Liberty Coin Act that brought it to life.

Iconic Designs: A Symbol of American Freedom

The American Silver Eagle isn't just valuable for its silver content; it's also a stunning piece of art that beautifully captures the spirit of American freedom.

On the front, or obverse, you'll find the timeless "Walking Liberty" design by Adolph A. Weinman. This iconic image, first seen on U.S. half dollars from 1916 to 1947, shows Lady Liberty confidently striding towards a rising sun. She's draped in the American flag, holding branches of laurel and oak – symbols of both civil and military honor. "LIBERTY" is proudly displayed above, with "IN GOD WE TRUST" and the mintage year below. This depiction is often called one of the most beautiful coin designs ever, inspiring hope and confidence. For the newer "Type 2" coins introduced in 2021, Weinman's original design was subtly refreshed, even including his traditional artist's mark.

For many years, the back, or reverse, of the American Silver Eagle featured John Mercanti's classic "Heraldic Eagle" design (known as Type 1). This majestic image showed an eagle with widespread wings, holding an olive branch (for peace) and arrows (for readiness). A shield covered its chest, and thirteen stars, representing the original colonies, shimmered above its head. This design graced the coin from 1986 until 2021.

However, in 2021, to celebrate the coin's 35th anniversary and give it a fresh look, the U.S. Mint introduced a brand new reverse design, called Type 2. This captivating image, created by Emily Damstra, shows a bald eagle gracefully descending, clutching an oak branch. It's a dynamic design that symbolizes the strength and resilience of America. This updated reverse also includes clever new security features, like a special reeded edge variation, making it even harder to counterfeit. The reverse still includes "UNITED STATES OF AMERICA," "E PLURIBUS UNUM," "1 OZ. FINE SILVER," and "ONE DOLLAR," clearly stating its origin, motto, weight, and value.

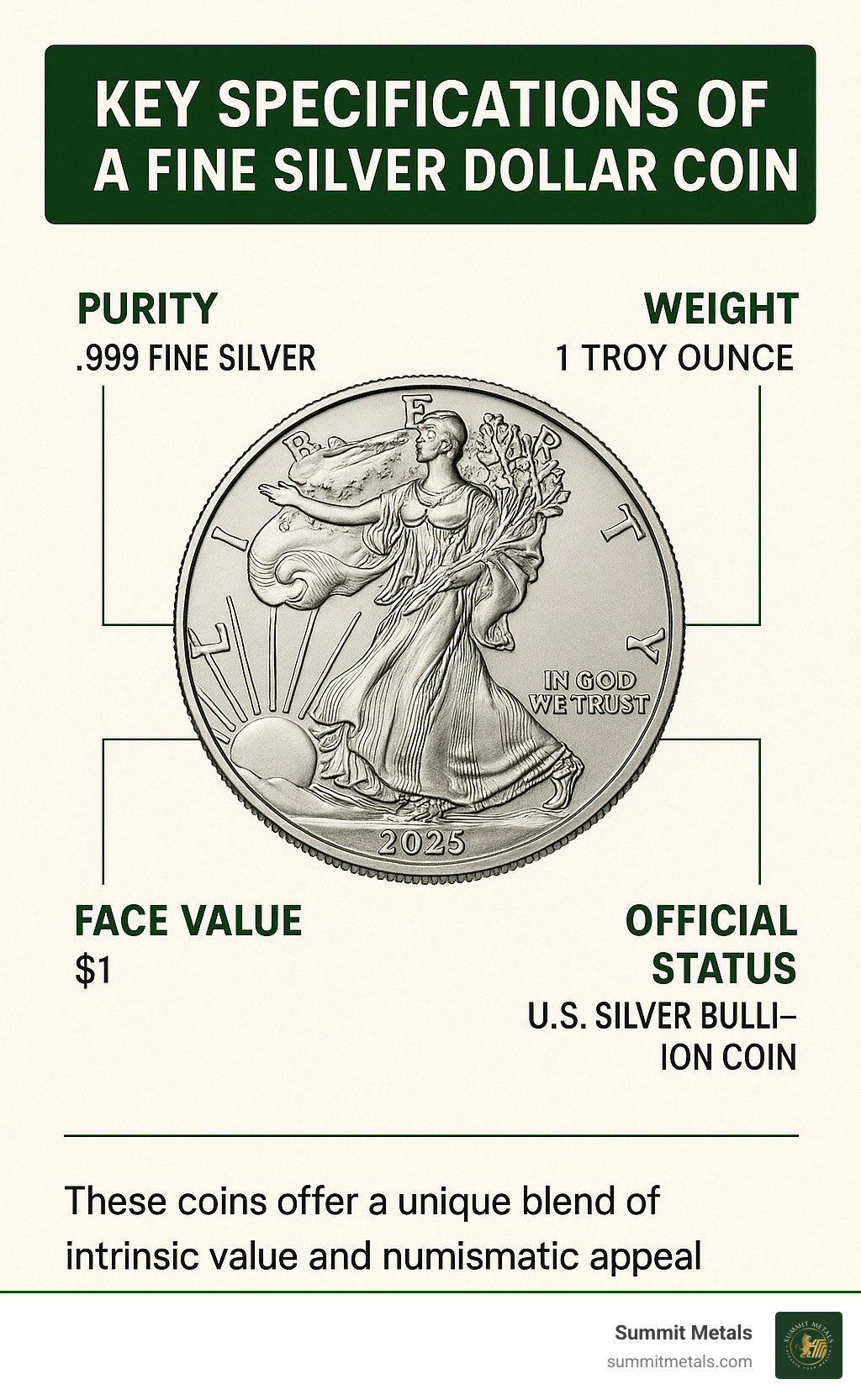

Key Specifications of this Fine Silver Dollar Coin

When you're considering a fine silver dollar coin like the American Silver Eagle, understanding its exact specifications is key to knowing its true value and authenticity. These coins are made with incredible precision, meeting the highest standards set by the U.S. Mint.

Every American Silver Eagle contains 1 troy ounce of .999 fine silver. What does that mean? It means the coin is 99.9% pure silver, making it one of the purest silver coins ever struck by the U.S. Mint. This high purity is super important for investors, as it ensures the coin's value is almost entirely based on its precious metal content.

Each coin weighs exactly 31.103 grams, which, as we mentioned, is equal to 1 troy ounce. It has a diameter of 40.6 mm and a thickness of 2.98 mm. These consistent measurements mean that every coin you get will be exactly the same high quality.

Now, here's something that often surprises people: despite its significant silver content and market value, the American Silver Eagle has a nominal face value of just $1. This face value is officially guaranteed by the U.S. government, confirming its status as legal tender. However, it's really important to understand that the coin's market value, which changes with the price of silver, is much, much higher than that $1. For example, at the time of this publication, a 2025 American Silver Eagle is priced around $49.99! So, while it's technically legal tender, its main purpose is as a valuable silver investment, not something you'd use to buy a cup of coffee. Its legal tender status mainly serves to confirm it's a genuine, government-backed coin.

Investing in a Fine Silver Dollar Coin: Bullion vs. Collector Editions

When you're looking to bring a fine silver dollar coin like the American Silver Eagle into your life, you'll find there are two main paths: investing in bullion coins or pursuing collector editions. Think of them as two sides of the same coin (pun intended!). Both offer wonderful benefits, and knowing the difference can help you pick the perfect strategy for your precious metals journey.

Bullion Coins: The Foundation of Your Silver Stack

For many, fine silver dollar coin bullion is the bedrock of their precious metals portfolio. These American Silver Eagles are truly investment-grade assets, serving as a tangible way to hold wealth and even act as a bit of a shield against inflation or economic bumps. Their value largely dances with the daily price of silver itself.

Now, when you go to buy these beautiful coins, you'll notice their price is a little bit more than the current silver spot price. This small extra amount, called a "premium," helps cover things like the mint's cost to make the coin, shipping, and the dealer's work. Premiums can actually change quite a bit! For example, during the COVID-19 pandemic, when everyone wanted silver, premiums on Silver Eagles soared. But more recently, we've seen 2024 American Silver Eagles priced more affordably than their 2022 and 2023 friends, showing how dynamic these premiums can be.

Here's a neat perk: American Silver Eagle bullion coins are eligible to be held in Precious Metals Individual Retirement Accounts (IRAs). Since 1997, you've been able to tuck physical silver like these coins into your retirement savings, which can offer some interesting tax advantages. It's always smart to chat with a financial expert or accountant to see how this fits your personal plan. If you're curious about the nitty-gritty, the IRS has all the details on rules for precious metals in IRAs.

You'll usually find that bullion Silver Eagles don't have a mint mark stamped on them. While most are made at the West Point Mint, this lack of a mark helps tell them apart from their collectible cousins. The U.S. Mint doesn't sell these directly to us, the public. Instead, they go through a trusted network of authorized purchasers, like Summit Metals, which makes it easy for us to get our hands on them.

Proof and Collectible Coins: The Numismatist's Pursuit

If you're someone who appreciates artistry and rarity, then proof and other collectible versions of the American Silver Eagle might be calling your name. These aren't just about the silver content; they're about the coin's beauty, its story, and its unique appeal to collectors. Because they're made with extra care and often in much smaller numbers, they usually come with a higher price tag.

Imagine a coin with a background so shiny it looks like a mirror, while the design details stand out with a frosty, sculpted look. That's a proof Silver Eagle! They're struck multiple times with special dies and blanks to get that stunning effect. These are produced in far fewer quantities than the bullion coins. For instance, in 2022, the U.S. Mint made about 16 million bullion Silver Eagles, but only around 1 million proof versions, and a tiny 200,000 burnished ones. Talk about rare!

Unlike their bullion counterparts, proof and other special issues typically boast a mint mark. You might see a "W" for West Point, an "S" for San Francisco, or a "P" for Philadelphia, telling you exactly where that special coin was born. Collectors love these marks as they help identify different versions and can even hint at their rarity. These special coins also often come in fancy U.S. Mint packaging, sometimes even with a certificate of authenticity – a little birth certificate for your coin!

For those who want extra peace of mind, you can get your Silver Eagles "certified" by independent services like PCGS (Professional Coin Grading Service), NGC (Numismatic Guaranty Corporation), and CAC (Certified Acceptance Corporation). They'll grade your coin on a scale of 1-70 (70 being perfect!) and seal it in a tamper-proof holder. You might even find special labels like "First Day of Issue" or "Early Release," which can add to their allure. Even brilliant uncirculated bullion coins, if they're well-kept, can fetch a nice premium over time compared to just their silver melt value. And don't forget burnished Silver Eagles, which have a unique matte finish and also get that special 'W' mintmark from West Point.

A Smart Strategy: Dollar-Cost Averaging with Silver

Let's be honest, the precious metals market can feel like a roller coaster! Prices go up, prices go down, and it can be tough to figure out the "perfect" time to buy. That's why we absolutely love a strategy called dollar-cost averaging, especially when you're building your collection of fine silver dollar coin treasures.

Here's how it works: Instead of trying to guess the market's next move and buying a huge chunk of silver all at once, you simply decide to invest a set amount of money at regular times. For example, you might decide to buy a few American Silver Eagles every single month, no matter what the price is that day.

This clever approach helps smooth out those market ups and downs. When silver prices are higher, your set amount of money naturally buys fewer coins. But when prices dip, that same amount buys you more! Over time, this averages out your purchase price, taking a lot of the stress and guesswork out of investing. It's a disciplined way to build your silver holdings without constantly watching the market.

At Summit Metals, we truly believe in the power of consistent, steady investing. That's exactly why we champion our Autoinvest program! It's kind of like investing in your 401k, where a little bit comes out of each paycheck to grow your retirement savings. Our Autoinvest service lets you set up regular monthly purchases of fine silver dollar coin and other precious metals. This helps you steadily build a significant position over time, leading to long-term wealth preservation without having to obsess over market fluctuations. It's a straightforward, smart way to weave precious metals into your financial plan, ensuring you're always accumulating these tangible assets. Ready to get started? Start building your silver portfolio with Autoinvest today!

How to Purchase and Store Your Silver Eagles

Acquiring your fine silver dollar coin starts with finding trustworthy sources, and proper storage becomes your next priority once these beautiful coins are in your hands.

The U.S. Mint doesn't sell American Silver Eagles directly to collectors like us. Instead, they work through a network of authorized purchasers who buy in massive quantities and then distribute to smaller dealers and individual investors. This system keeps the market flowing smoothly, but it also means choosing your dealer carefully matters more than ever.

When you're ready to buy, stick with reputable dealers who have proven track records and transparent pricing. At Summit Metals, we believe in showing you exactly what you're paying and why. Our bulk purchasing power means better rates for you, and our Wyoming-based team ensures every coin meets our strict authenticity standards. There's nothing worse than finding a counterfeit coin in your collection months later.

Understanding Packaging and Mint Marks

Your Silver Eagles will arrive packaged differently depending on how many you purchase. Individual capsules protect single coins from scratches and environmental damage. These clear plastic holders are perfect for displaying your favorite pieces while keeping them safe.

When you buy in larger quantities, you'll encounter mint tubes containing exactly 20 coins each. These sturdy plastic tubes stack nicely and make storage efficient. The real excitement comes with Monster Boxes - those impressive green containers holding 25 tubes for a total of 500 coins. There are also smaller versions called mini monster boxes with 100 coins for those building their stack more gradually.

The West Point Mint produces most of the Silver Eagles you'll encounter, though they don't always carry a mint mark on bullion versions. Philadelphia Mint and San Francisco Mint facilities sometimes step in during high-demand periods or for special editions. When they do, you'll see those distinctive P, W, or S mint marks that collectors love to hunt for.

During the crazy demand of 2020, Philadelphia actually jumped in to help meet the overwhelming public interest in silver. It's fascinating how these production shifts create different varieties that become part of the coin's story.

Tips for Safely Storing Your Fine Silver Dollar Coin

Protecting your fine silver dollar coin investment goes beyond just keeping them secure - you want to preserve their pristine condition for years to come.

Handling your coins properly starts the moment you receive them. Always grab them by the edges, never touching the faces where Lady Liberty walks or the eagle soars. Cotton gloves might feel excessive, but the oils from your fingertips can leave permanent marks that diminish value over time.

Airtight containers become your coins' best friends. Whether you keep them in individual capsules or the original mint tubes, you're creating a barrier against humidity and air that causes tarnishing. Silver naturally wants to react with sulfur compounds in the air, turning that beautiful bright finish into a dull, dark patina.

Climate control makes a huge difference in preservation. Cool, dry spaces work best - think basement safe rather than hot attic storage. Some collectors swear by silica gel packets tucked into their storage containers to absorb any lingering moisture.

For security, consider your options carefully. A quality home safe anchored properly protects against theft and fire. But when your collection grows substantial, third-party depositories offer professional-grade storage with climate control, insurance, and security systems that most of us can't match at home.

Keep detailed records of what you own - year, type, condition, and where you bought each coin. This inventory helps with insurance claims and makes it easier to track your investment's performance over time.

These coins are meant to last generations. A little extra care now preserves both their beauty and their value for whoever inherits your silver legacy.

Frequently Asked Questions about American Silver Eagles

When people find fine silver dollar coin investing, they naturally have questions. We've been helping investors steer these waters for years, and these are the questions that come up most often. Let's clear up some common confusion and help you understand what makes these coins so special.

Is a Silver Eagle really worth only one dollar?

This question makes us smile every time we hear it – and we hear it a lot! It's the perfect example of how legal tender value and real-world value can be worlds apart.

Yes, your American Silver Eagle does have a $1 face value stamped right on it. This makes it official U.S. currency, backed by the government. You could technically walk into a store and spend it for a dollar.

But here's where it gets interesting: that same coin contains 1 troy ounce of .999 fine silver. The silver alone is worth far more than a dollar. At the time of this publication, a 2025 American Silver Eagle sells for around $49.99 – nearly 50 times its face value!

The $1 designation serves an important purpose, though. It's the government's way of saying "this is authentic, and we guarantee what's in it." Think of it as a certificate of authenticity rather than a price tag. The real value comes from the precious metal content, plus the premium for minting and distribution.

So while you could spend your Silver Eagle for a dollar, it would be like using a $50 bill to buy a candy bar. Technically possible, but not very smart!

Why was the Silver Eagle's reverse design changed in 2021?

After 35 years of the same design, the U.S. Mint decided it was time for a fresh look. The 2021 design change wasn't just about aesthetics – though the new "Landing Eagle" by Emily Damstra is absolutely stunning.

The timing was perfect for celebrating the 35th anniversary of the American Silver Eagle series. John Mercanti's original heraldic eagle had served admirably since 1986, but the Mint wanted to modernize the coin while keeping its iconic status.

More importantly, the redesign allowed for improved security features. The new Type 2 coins include subtle anti-counterfeiting measures, like variations in the reeded edge that make counterfeiting much more difficult. These security upgrades protect both investors and the integrity of the entire silver market.

The change also gave the Mint a chance to refresh Weinman's "Walking Liberty" design on the front, incorporating details from his original plaster models that weren't fully captured in earlier versions. It's like getting a high-definition remaster of a classic film.

What is the difference between a Type 1 and Type 2 Silver Eagle?

The Type 1 versus Type 2 distinction is all about timing and design. If you're building a collection, understanding this difference helps you appreciate what you're buying.

Type 1 Silver Eagles were minted from 1986 through mid-2021. These feature Mercanti's heraldic eagle on the back – the classic design with spread wings, shield, olive branch, and arrows, surrounded by 13 stars representing the original colonies.

Type 2 Silver Eagles started in mid-2021 and continue today. The back now shows Damstra's "Landing Eagle" – a more dynamic image of a bald eagle descending with an oak branch, as if adding to its nest. The front also received subtle improvements, bringing out details from Weinman's original artwork that weren't visible before.

Both types contain exactly the same 1 troy ounce of .999 fine silver, so their intrinsic value is identical. However, collectors often view them differently. Type 1 coins represent the "classic era" of Silver Eagles, while Type 2 coins mark the beginning of a new chapter.

For investors focused purely on silver content, the type doesn't matter much. But if you're interested in the numismatic side, having examples of both types gives you a complete picture of Silver Eagle history. It's fascinating to see how coin design evolves while maintaining the same high standards of purity and craftsmanship.

Conclusion: The Timeless Appeal of Silver Dollars

The fine silver dollar coin, especially the American Silver Eagle, represents something truly special in today's investment landscape. We've journeyed through its fascinating history, from the Liberty Coin Act of 1985 to its status as America's official silver bullion coin. We've admired the artistic beauty of Adolph A. Weinman's "Walking Liberty" design and Emily Damstra's modern "Landing Eagle" reverse that ushered in the Type 2 era.

What makes these coins so compelling isn't just their beauty or historical significance. It's their unique combination of government backing, intrinsic value, and accessibility. Each coin contains exactly 1 troy ounce of .999 fine silver, guaranteed by the U.S. government, yet trades at market prices that reflect the true value of precious metals.

Whether you're drawn to bullion coins for investment or proof editions for collecting, the American Silver Eagle offers something meaningful. The bullion versions provide a straightforward way to own physical silver, eligible for precious metals IRAs and priced close to spot silver values. The collectible versions offer numismatic appeal with their mirror finishes, limited mintages, and special packaging.

We've seen how dollar-cost averaging through regular monthly purchases can be a game-changer for building wealth over time. Just like contributing to a 401k, this disciplined approach removes the guesswork from timing the market. It's a strategy that transforms the volatility of precious metals into an opportunity for steady accumulation.

At Summit Metals, we understand that investing in physical silver should be straightforward and trustworthy. Our transparent pricing and competitive rates, achieved through bulk purchasing, ensure you get genuine value without hidden surprises. We believe that a fine silver dollar coin deserves a place in every diversified portfolio as both a hedge against uncertainty and a tangible asset you can hold in your hands.

The enduring appeal of these silver dollars lies in their ability to bridge the gap between investment and heritage. They're not just metal - they're pieces of American history that happen to be excellent stores of value.

Ready to start your silver journey? Start building your silver portfolio with Autoinvest and experience the peace of mind that comes with owning one of America's most trusted precious metal investments.