Why the American Gold Rate Today Matters for Your Financial Future

The american gold rate today stands at $4,127.03 per ounce as of November 11, 2025. Here's a snapshot of the current market:

| Metric | Current Price | Change |

|---|---|---|

| Gold per ounce | $4,127.03 | +$84.10 |

| 24K Gold per gram | $83.00 | -$4.00 |

| 22K Gold per gram | $78.00 | -$4.00 |

| 18K Gold per gram | $63.80 | -$3.30 |

| Gold-to-Silver Ratio | 81.7:1 | — |

Prices shown are at the time of this publication.

If you're looking to protect your wealth from inflation, hedge against economic uncertainty, or diversify your portfolio, you're in the right place. Gold has climbed 56.59% year-to-date, outperforming the S&P 500 and demonstrating its value as a key financial asset.

The daily gold rate matters because prices shift constantly, driven by Federal Reserve policy, inflation data, and geopolitical events. Understanding these forces is key to building a resilient investment strategy, whether you're buying your first gold coin or using an Autoinvest program to dollar-cost average your purchases.

Gold isn't just a shiny metal—it's a finite, globally recognized store of value that governments can't print. I'm Eric Roach, and after a decade on Wall Street advising on risk management, I now help everyday investors use precious metals to safeguard their portfolios, just as large institutions do.

What is the American Gold Rate Today?

If you've searched for the american gold rate today, you're looking at a live number that changes constantly. As of November 11, 2025, at 01:21 PM ET, the spot price for one ounce of gold is $4,127.03. This is the benchmark price for raw, unprocessed gold for immediate delivery.

Today's price reflects a significant $84.10 increase, continuing a rally that has captured investor attention. For smaller units, gold is trading at $132.69 per gram and $132,687.10 per kilogram. Prices shown are at the time of this publication.

Since gold prices shift by the second, staying informed is crucial. You can track live movements with a Gold Price chart by TradingView or explore historical trends in our guide on live gold price charts and historical data. Understanding this benchmark is the first step to making smart decisions about buying precious metals.

Today's Gold Price by Karat (per gram)

When buying gold, especially jewelry, prices are quoted by karat—a measure of purity.

- 24K Gold (99.9% pure): The choice for serious investors. As of February 14, 2025, it was priced at $83 per gram.

- 22K Gold (91.67% pure): A durable blend popular for coins like the American Gold Eagle. It was trading at $78 per gram.

- 18K Gold (75% pure): Widely used in fine jewelry for its resilience. It was priced at $63.80 per gram.

These prices are benchmarks and can vary by dealer and product. Learn more about how purity affects value in our guide on Understanding Karats and Purity in Gold.

Recent Price Movements for the American Gold Rate Today

The american gold rate today reflects a story of remarkable strength. Gold surged $84.10 per ounce in today's session, extending a powerful weekly rally as investors seek safe-haven assets.

On a monthly basis, gold is approaching record territory. Year-to-date, it has climbed an extraordinary +56.59% (+$1,485.17), outpacing most traditional investments. This performance isn't just a short-term spike; gold has a long history of preserving wealth, delivering an average annual return of approximately 7.78% from 1971 to 2022.

This track record, combined with today's rally, highlights why gold is a trusted store of value. Understanding these trends is vital, whether you're timing a purchase or using a disciplined strategy like dollar-cost averaging with Autoinvest. Prices shown are at the time of this publication.

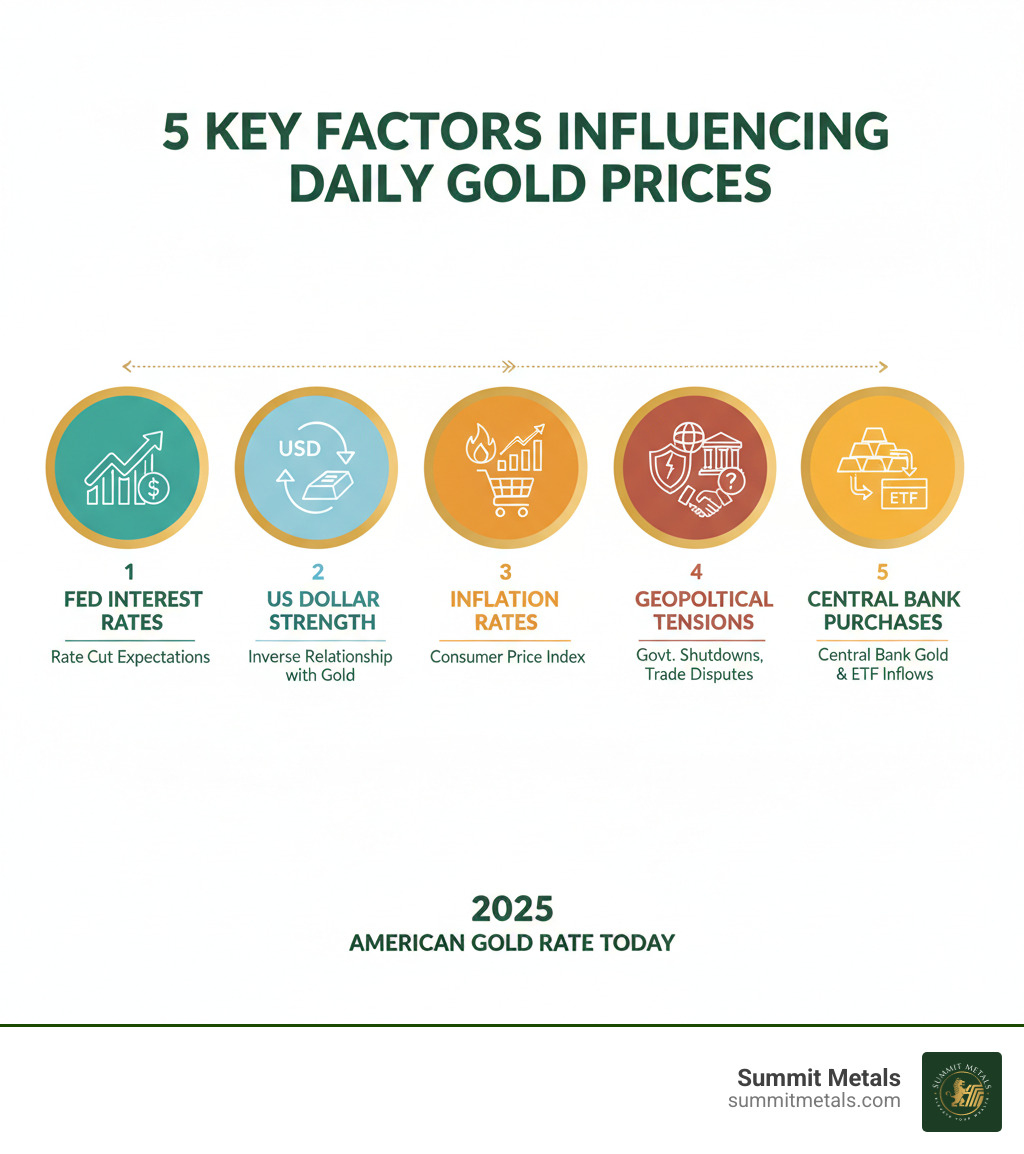

Key Factors Driving the US Gold Price

The american gold rate today is influenced by a dynamic mix of economic forces, policy decisions, and global events. Understanding these drivers is key to smart investing.

- US Dollar Value: Gold has an inverse relationship with the dollar. When the dollar weakens, gold typically rises as it becomes cheaper for international buyers.

- Inflation: As inflation erodes the purchasing power of paper money, investors turn to gold as a tangible store of value, driving its price up.

- Federal Reserve Policy: Interest rate decisions are crucial. While rate hikes can make interest-bearing assets more attractive, the prospect of rate cuts often causes gold to surge. Current odds for a December rate cut are at 65%, according to a fresh CNBC article on rate cut expectations, boosting today's gold rate.

- Economic Data: Negative economic indicators like slowing GDP growth or weak employment figures can push investors toward the safety of gold.

- Geopolitical Risk: Political instability, conflicts, and trade disputes create market uncertainty, increasing demand for gold as a safe-haven asset.

- Central Bank Buying: When central banks and large funds (ETFs) buy gold in large quantities, it signals strong institutional confidence and adds significant demand.

For a deeper dive, explore The Interplay of Interest Rates, the Dollar, and Gold Prices.

How Economic and Geopolitical Events Impact the American Gold Rate Today

Events like government shutdowns or trade disputes can cause immediate shifts in the american gold rate today. They disrupt economic activity and lower investor confidence, driving capital into the perceived safety of gold.

Because gold trades on a global market nearly 24/7, a risk event anywhere in the world can impact prices everywhere. This is why gold is known as a premier safe-haven asset; it tends to perform well when other investments falter due to economic or political turmoil. This counterbalancing effect is a core reason for including precious metals in a diversified portfolio.

Understanding these drivers is especially useful when building a position over time with our Autoinvest program, which allows you to dollar-cost average through market volatility. Learn more about gold's protective qualities in our guide, Why Gold and Silver: Understanding Their Value as Safe Haven Assets.

A Guide to Investing in Gold in the US

Ready to move beyond tracking the american gold rate today and start building your portfolio? At Summit Metals, we make investing in precious metals straightforward.

The most direct way to invest is by owning physical gold—tangible coins and bars that act as a hedge against inflation and currency devaluation. For retirement planning, Gold IRAs offer a tax-advantaged way to hold physical gold, diversifying your portfolio beyond traditional stocks and bonds. Many of our products are IRA-eligible, and we can connect you with trusted custodians.

Before investing, consider your goals. Gold is typically a long-term store of value and a portfolio stabilizer. To see if it fits your investment strategy, read our guide on Is Gold a Good Investment.

Physical Gold: Bars vs. Coins

When buying physical gold, you'll choose between bars and coins. Both are excellent options, but they serve different investor needs.

| Feature | Gold Bars | Gold Coins |

|---|---|---|

| Premiums | Lower, especially for larger sizes | Slightly higher |

| Liquidity | High, especially for standard sizes | Very high, easily recognizable |

| Government Backing | No (from private mints) | Yes (e.g., U.S. Mint's American Eagle) |

| Fraud Protection | Relies on dealer reputation | Improved; counterfeiting is a federal crime |

| Best For | Maximizing ounces for your dollar | Flexibility, trust, and divisibility |

Gold bars are ideal for investors focused on acquiring the most gold for their money, as they have lower premiums over the spot price. Gold coins, like the American Gold Eagle, offer unique benefits such as government backing and legal tender status, which provides an extra layer of authenticity and fraud protection. Coins are also easily divisible and may have collectible value.

For a detailed breakdown, see our article: Bars or Coins: Your Ultimate Gold Investment Showdown.

Smart Investment Strategy: Dollar-Cost Averaging with Autoinvest

Trying to time the market is nearly impossible. A smarter approach is Dollar-Cost Averaging (DCA): investing a fixed amount at regular intervals. This strategy smooths out your average purchase price over time, as you buy more gold when prices are low and less when they are high.

At Summit Metals, we've simplified this with our Autoinvest program. It's like a 401(k) for precious metals. You set a monthly investment amount, and we automatically purchase authenticated gold and silver for you. This automated investing approach removes emotion and guesswork, allowing you to build wealth systematically.

With our transparent pricing and competitive rates, you get excellent value with every purchase. Ready to put your gold investing on autopilot? Learn about The Power of Dollar-Cost Averaging in Gold and Silver Investments and see How to Buy Gold and Silver Automatically.

Tracking Gold Prices and Key Market Indicators

Staying informed about the american gold rate today is essential, as gold trades nearly 24/7 across global markets.

While real-time data gives you an immediate pulse on the market, analyzing historical trends provides crucial context. Seeing how gold has performed during past recessions, inflation spikes, and geopolitical crises helps you build a confident long-term strategy.

Beyond the spot price, watch key market indicators like yearly highs and lows, ETF inflows, and central bank buying activity. These metrics reveal institutional demand and broader market sentiment. For comprehensive tracking, platforms like Kitco offer Live Gold Prices | Gold News And Analysis | Mining News, which combines real-time pricing with expert commentary.

The Gold-to-Silver Ratio: What US Investors Should Know

An underused but powerful tool is the gold-to-silver ratio. Currently at 81.7:1, it means 81.7 ounces of silver are needed to buy one ounce of gold. This ratio helps you gauge the relative value between the two metals.

A high ratio, like today's, suggests that silver may be undervalued compared to gold, presenting a potential buying opportunity. Investors often use this signal to allocate funds to silver, anticipating the ratio will narrow toward its historical average. Because silver has significant industrial use in addition to its monetary value, it can be more volatile but also offer greater upside potential.

Understanding this ratio can improve your investment timing and portfolio balance. To explore this concept further, read What is the Gold-to-Silver Ratio? Is It Important?.

Frequently Asked Questions about the American Gold Rate Today

Let's clear up some common questions about how gold pricing works.

How is the spot price of gold determined in the US?

The american gold rate today is determined by global trading on exchanges like COMEX. The price is derived from the most actively traded gold futures contracts, which reflect real-time global supply and demand. Factors like mining output, central bank buying, and investor sentiment all influence this price. It's not set by a committee but by the collective actions of buyers and sellers worldwide.

What's the difference between the spot price and the retail price I pay?

The spot price is the wholesale benchmark for raw, unfabricated gold. The retail price you pay is the spot price plus a dealer premium. This premium covers the real-world costs of turning raw gold into a finished product, including:

- Fabrication costs (minting and refining)

- Secure shipping and insurance

- Dealer operational expenses

Think of it as the difference between the price of raw wheat and a finished loaf of bread. At Summit Metals, we are transparent about our premiums, which are kept competitive through our bulk purchasing power.

Can I buy gold at the spot price?

No, individual investors cannot buy physical gold products at the spot price. The spot price is a benchmark for large, institutional transactions of raw metal. All retail products like coins and bars are sold with a premium to cover the costs of manufacturing and distribution.

Be wary of "spot price deals," as they often have hidden requirements. Our approach at Summit Metals is to offer transparent, competitive pricing without gimmicks. To smooth out price fluctuations and premiums over time, consider our Autoinvest program, which allows you to dollar-cost average your purchases automatically each month, similar to a 401(k) contribution.

Conclusion

The american gold rate today is more than a number; it's a key indicator for building lasting wealth. We've covered how factors like Fed policy and inflation shape the price, the practical differences between bars and coins, and how to invest systematically using our Autoinvest program.

Staying informed about market drivers and using tools like the gold-to-silver ratio allows you to make strategic decisions. Portfolio diversification with gold is a proven strategy for hedging against economic uncertainty. With a historical average annual return of 7.78% since 1971 and a 56.59% gain year-to-date, gold's value as both a hedge and a growth asset is clear.

At Summit Metals, we are committed to transparency and value. Based in Wyoming, we serve investors nationwide, offering competitive rates on authenticated precious metals thanks to our bulk purchasing power. Our real-time, transparent pricing ensures you invest with confidence.

Ready to take the next step? Explore our live gold price charts and historical data to guide your next investment. Start protecting and growing your wealth with authenticated gold and silver today.