What Your 1855 Gold Dollar Is Worth Today

The 1855 gold dollar coin value ranges from $400 for circulated examples to over $5,600 for uncirculated specimens. Exceptionally rare proof versions have fetched more than $213,000. A coin's ultimate worth depends on its condition (grade), mint mark, and strike quality.

Quick Value Guide:

| Condition | Estimated Value Range |

|---|---|

| Good (G-4) | $400 - $486 |

| Very Fine (VF-20) | $600+ |

| Extremely Fine (EF-40) | $700+ |

| About Uncirculated (AU-50) | $1,700+ |

| Uncirculated (MS-60 to MS-63) | $1,700 - $5,600+ |

| Proof (PR-63) | $213,000+ |

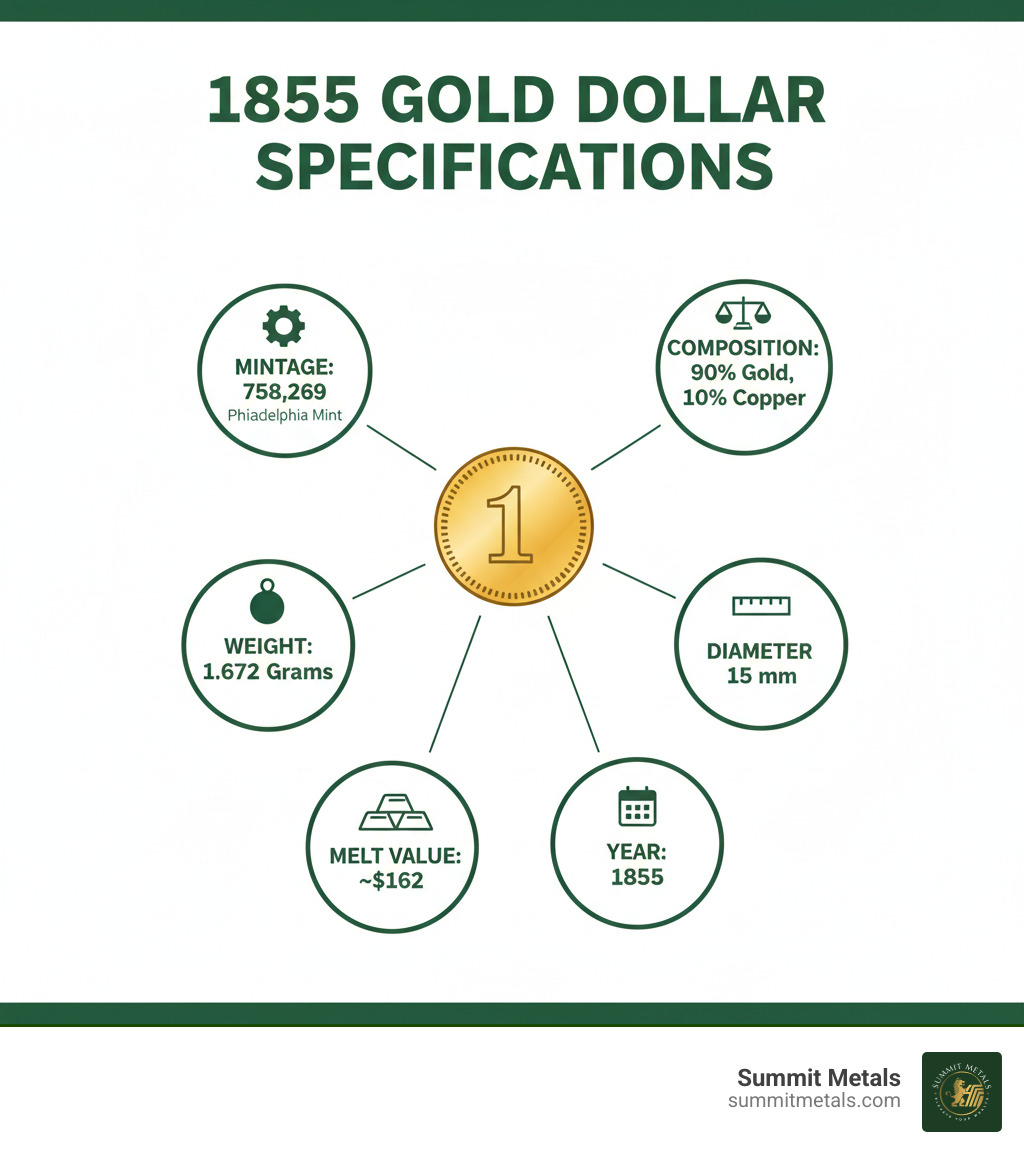

The melt value, based on its 0.04837 troy ounces of 90% gold, is only about $162. This means every authentic 1855 gold dollar has significant numismatic value far exceeding its gold content.

This coin, the Type 2 "Indian Princess Small Head," was only minted for three years (1854-1856) due to design flaws. Its short production run and varying mintages make it a fascinating piece for collectors and investors. As a precious metals investment strategist, I've seen how historic gold coins like the 1855 dollar offer dual value: their intrinsic gold content plus a numismatic premium, making them a powerful asset for portfolio diversification.

Prices shown are at the time of this publication.

The History and Unique Features of the 1855 "Indian Princess"

The story of the 1855 gold dollar begins with the California Gold Rush of 1848. The massive influx of gold prompted Congress to pass the Coinage Act of 1849, authorizing the $20 Double Eagle and the tiny $1 Gold Dollar. These new denominations helped the U.S. Mint convert the gold bounty into circulating currency.

The first gold dollar design (Type 1) by Chief Engraver James B. Longacre was just 13 mm in diameter and widely criticized for being too small and easily lost. In response, the Mint introduced the Type 2 gold dollar in 1854, featuring a new "Indian Princess Small Head" portrait. While beautiful, the high-relief design was too ambitious for the coin's thin planchet. The design wouldn't strike fully, leaving mushy details and creating "clash marks" when the dies struck each other.

These striking problems led the Mint to abandon the Type 2 design after only three years (1854-1856). This brief production window is a key reason for the coin's scarcity and appeal to collectors today. Each coin is composed of 90% gold and 10% copper, weighs 1.672 grams, and measures 15 mm in diameter—a tangible piece of American history when gold was money.

To understand how gold has shaped civilizations throughout history, check out our article on A brief history of gold as currency.

The Different Mints of 1855

The mint that produced your coin is a critical factor in its value. In 1855, four U.S. Mint facilities struck gold dollars.

- Philadelphia (No Mint Mark): The primary mint, it struck 758,269 coins, making these the most common variety.

- Charlotte (C): This North Carolina branch mint produced a very limited number, making any 1855-C a significant rarity.

- Dahlonega (D): The Georgia mint struck a mere 1,811 pieces, making the 1855-D one of the most sought-after coins in the entire series.

- New Orleans (O): Production was higher than the other Southern mints but still far below Philadelphia, giving 1855-O coins a solid premium.

The presence (or absence) of that tiny mint mark can mean the difference between a $500 coin and a $50,000 treasure.

Understanding the "Type 2" Design

The "Type 2" Indian Princess Small Head design is artistically ambitious but was a practical failure. The obverse (front) features a left-facing Indian Princess with "LIBERTY" on her headdress and the date "1855" below. The reverse (back) displays an agricultural wreath encircling the denomination "1 DOLLAR" with "UNITED STATES OF AMERICA" along the rim.

The design was changed from the Type 1 to increase the coin's diameter from 13 mm to 15 mm, making it less easy to lose. However, the weight remained the same, resulting in a thinner coin that could not handle the pressure of the high-relief portrait. This technical flaw is what makes well-struck examples so rare and valuable.

If you're curious about other iconic designs in American gold coinage, our guide on Discovering the Legacy of Liberty Head Gold Coins explores the broader artistic evolution of these historic pieces.

A Guide to the 1855 Gold Dollar Coin Value

Determining your 1855 gold dollar's worth requires understanding coin grading—the process that separates a $400 coin from a $200,000 treasure. The Sheldon Grading Scale (1-70) assesses a coin's condition, with the main distinction being Circulated (shows wear) versus Uncirculated (no wear).

The real value lies in the numismatic premium: the amount above the coin's gold content that collectors pay for rarity, history, and condition. A coin with $162 of gold might sell for $5,000—that's the power of numismatics. For serious transactions, always use professional grading services like PCGS, NGC, or CAC to guarantee authenticity and grade.

To understand how premiums work across the precious metals market, check out our guide on Spot Price vs. Premium: How Precious Metals Pricing Works.

Value of Circulated 1855 Gold Dollars

Most 1855 gold dollars show wear from use. Even heavily worn examples hold substantial value.

- Good (G-4): Heavy wear with main designs visible. Values start around $400 - $486.

- Very Fine (VF-20): Moderate wear, but many fine details remain. Values are typically $600 or more.

- Extremely Fine (EF-40): Light wear on the highest points, with sharp details. Expect to pay $700 or more.

- About Uncirculated (AU-50): Only a trace of wear, with most original mint luster intact. The value jumps significantly to $1,700+.

Uncirculated and Proof 1855 Gold Dollar Coin Value

An uncirculated 1855 gold dollar is in a different league. These Mint State (MS) coins show no wear and look as they did when they left the mint.

- MS-60 to MS-63: These uncirculated grades typically range from $1,709 to $5,613. The price reflects the rarity of coins that escaped circulation.

- Gem Condition (MS-65+): A truly superb, well-struck example is incredibly scarce due to the Type 2 design's striking issues. Only a handful are estimated to exist.

- Proof (PR): Specially struck for collectors with mirror-like surfaces, proof 1855 gold dollars are among the rarest U.S. coins. A single example can command $213,000 or more.

Browse recent auction prices for 1855 Gold Dollars to get a sense of the current market.

What is the Melt Value?

The absolute minimum value of your 1855 gold dollar is its melt value. Each coin contains 0.04837 troy ounces of pure gold, which translates to a melt value of approximately $162.03 at recent prices. This number fluctuates daily with the gold market.

Crucially, the numismatic value of an 1855 gold dollar almost always far exceeds its melt value. Even a heavily worn coin is worth at least double its gold content due to its history, rarity, and collector demand. The gold provides a value floor, while the numismatic premium provides the upside potential.

Stay informed about the gold market by checking today's gold prices regularly.

Prices shown are at the time of this publication.

Factors That Drive the 1855 Gold Dollar Coin Value

Several key factors determine the final 1855 gold dollar coin value. Savvy collectors and investors pay close attention to each one.

Rarity and Mint Mark: Rarity is the foundation of numismatic value. The Philadelphia Mint produced 758,269 coins, making them the most common. In contrast, the Dahlonega Mint produced just 1,811. An 1855-C (Charlotte) or 1855-D (Dahlonega) coin is worth thousands more than a Philadelphia issue in the same grade. The 1855-O (New Orleans) is scarcer than Philadelphia but more common than the other Southern mints.

Strike Quality: This factor is especially important for Type 2 gold dollars. Due to the high-relief design on a thin planchet, many coins were weakly struck, with poor detail in the center. A coin with a sharp, well-defined strike is significantly more valuable than a weakly struck one, even at the same grade.

Clash Marks: These impressions occur when dies strike each other without a coin between them. While technically a minting error, they are so common on Type 2 dollars that they are often seen as characteristic of the issue. Their severity can still influence value.

Eye Appeal: This subjective quality separates good coins from great ones. Two coins with the same grade can have different values based on visual appeal. Collectors prize coins with vibrant original mint luster, attractive natural toning, and clean, damage-free surfaces. Any scratches, nicks, or signs of cleaning will drastically reduce a coin's value.

For those interested in exploring how specific dates and unique characteristics can transform a coin from ordinary to extraordinary, our guide on Is Your Liberty Head Gold Coin a Hidden Fortune? A Deep Dive into Key Dates offers valuable insights.

Investing in Historic Gold: Coins vs. Bars

When building a precious metals portfolio, investors must choose between gold coins and gold bars. While both are tangible gold, they serve different investment goals.

Historic gold coins like the 1855 gold dollar offer dual value potential: they have intrinsic melt value plus a numismatic premium based on rarity and history. This means their value isn't tied solely to the spot price of gold. Furthermore, as legal tender, their authenticity is backed by the U.S. government, and their complex designs offer improved fraud protection compared to simpler gold bars.

Gold bars are ideal for pure bullion investment. They typically carry a lower premium over the spot price, allowing you to acquire more gold for your money. Their value is directly tied to the gold market, making them highly liquid. However, they lack the historical appeal, government guarantee, and collector market demand of historic coins.

| Feature | Gold Coins (like 1855 Gold Dollar) | Gold Bars |

|---|---|---|

| Numismatic Premium | High—rarity and history add value | Low—priced close to spot |

| Government Guarantee | Yes—backed by U.S. government | No—backed only by refiner |

| Fraud Protection | Excellent—complex designs, legal tender | Moderate—simpler designs |

| Historical Value | Very high—a piece of American history | Minimal—bullion value only |

| Divisibility | Excellent—sell individual pieces | Good—various sizes available |

| Resale Market | Dual markets (collectors & bullion) | Primarily bullion dealers |

For a deeper dive into this comparison, check out our guide on Gold Bars vs. Coins.

A Smart Strategy: Dollar-Cost Averaging with Gold

One of the smartest ways to build a gold position is through Dollar-Cost Averaging (DCA). This strategy involves making regular, fixed-amount purchases over time, regardless of price fluctuations. It removes emotion from investing and averages out your cost basis.

When prices are high, your fixed amount buys less gold; when prices are low, it buys more. This disciplined approach is similar to contributing to a 401(k). At Summit Metals, our Autoinvest program makes this easy. You can set up automatic monthly purchases, putting your gold investment on autopilot.

This allows you to consistently build real wealth in physical precious metals without worrying about market timing. It's a proven strategy for accumulating a meaningful position that can hedge against economic uncertainty.

Learn about automated gold investing with Summit Metals Autoinvest.

Prices shown are at the time of this publication.

Frequently Asked Questions about the 1855 Gold Dollar

How can I tell if my 1855 Gold Dollar is real?

Authenticating an 1855 gold dollar involves a few key checks. Here’s what to look for:

- Weight and Diameter: An authentic coin weighs 1.672 grams and is 15 mm in diameter. Use a precise digital scale and calipers to check.

- Design Details: Compare the coin to high-quality images of genuine examples. Counterfeits often miss the subtle details or have an unnatural look.

- Edge: A real 1855 gold dollar has a reeded (ridged) edge. A smooth or lettered edge is a red flag.

- Magnet Test: Gold is not magnetic. If a magnet attracts your coin, it is not genuine.

For absolute certainty, the best method is professional authentication from a service like NGC or PCGS. When buying, always work with a reputable dealer like Summit Metals that guarantees authenticity.

For broader guidance, our article on How to Tell if Gold is Real offers additional techniques.

Where is the best place to sell an 1855 Gold Dollar?

To get the best price for your coin, you have several options:

- Reputable Coin Dealers: Dealers like Summit Metals can offer fair, competitive prices based on real-time market data. We are always interested in purchasing historical gold coins.

- Major Auction Houses: For very rare or high-grade coins (like an 1855-D), auction houses like Stack's Bowers or Heritage can reach top collectors, but they charge significant seller's fees (10-20%).

- Online Marketplaces: Sites like eBay offer a wide audience but come with risks of fraud and high fees. This is generally not recommended for high-value coins unless you are an experienced seller.

Pro Tip: Always get multiple offers. The 1855 gold dollar coin value can vary between buyers based on their inventory and needs.

For more detailed guidance on the selling process, check out our article on Where Can I Sell My Gold Coins for Best Price?.

Is the 1855 Gold Dollar a good investment?

Yes, for many investors, the 1855 gold dollar is an excellent investment. It offers a unique combination of benefits:

- Dual Value: It has intrinsic value from its gold content and numismatic value from its rarity and history. This provides a stable value floor with significant upside potential.

- Proven Rarity: The Type 2 design was only made for three years. The low mintages of the Southern branch mints (C and D) ensure these coins will remain scarce and in demand.

- Historical Significance: The coin is a tangible link to the California Gold Rush, appealing to collectors who value history. This demand helps support its value over time.

- Portfolio Diversification: As a physical asset, it performs independently of stocks and bonds, serving as a hedge against inflation and economic turmoil.

While numismatic values can fluctuate, the 1855 gold dollar's blend of rarity, history, and precious metal content makes it a strong candidate for a diversified investment portfolio.

For a deeper exploration of gold as an investment asset, we invite you to read Is Gold a Good Investment?.

Is Your 1855 Gold Dollar a Hidden Treasure?

The 1855 gold dollar coin value is a testament to how history, rarity, and condition can create extraordinary value. A coin once worth a single dollar can now range from $400 in worn condition to over $213,000 for a pristine proof example. Its melt value of around $162 provides a solid floor, but its true potential lies in its numismatic appeal.

The coin's short three-year production run and the extreme rarity of the Dahlonega (D) and Charlotte (C) mint marks make it a perennial favorite among collectors. The design's infamous striking problems mean that well-struck survivors are true treasures.

At Summit Metals, we believe historic gold coins like the 1855 gold dollar are a cornerstone of a diversified portfolio. They offer a dual value proposition—intrinsic gold content plus numismatic premium—that modern bullion can't match. This provides a hedge against economic uncertainty while also offering appreciation potential from collector demand.

Whether you're evaluating a family heirloom or looking to invest, our Wyoming-based team offers transparent, real-time pricing and expert guidance. We make building wealth in precious metals straightforward. With strategies like dollar-cost averaging through our Autoinvest program, you can steadily grow your gold position over time, just like a 401k.

The 1855 gold dollar is more than a coin; it's a tangible connection to the American story. Sometimes, hidden treasures are waiting in plain sight.

Explore our Guides and Tips for gold investors to continue learning about the exciting world of precious metals investing.