Why Finding the Right Silver Bullion Dealer Matters for Your Investment

Silver bullion dealer selection is one of the most critical decisions you'll make when investing in precious metals. The right dealer can save you hundreds or thousands of dollars through competitive pricing, protect you from counterfeit products, and provide the transparency you need to invest with confidence.

The silver market has experienced dramatic shifts recently. With volatility on the rise and major mints running weeks behind on production, choosing a trustworthy dealer with competitive rates is more important than ever.

Silver offers something gold cannot—affordability. While gold recently surpassed $3,350 per ounce, silver remains accessible at around $33 per ounce, making it an asset that everyday investors can acquire steadily over time. This historical demand continues today through both investment and industrial use.

Why silver matters now:

- Hedge against economic instability: Silver tends to maintain value when currencies weaken.

- Industrial demand: It's essential for electronics, solar panels, and medical applications.

- Supply deficit: The global market faces a projected deficit of 149 million ounces for 2024.

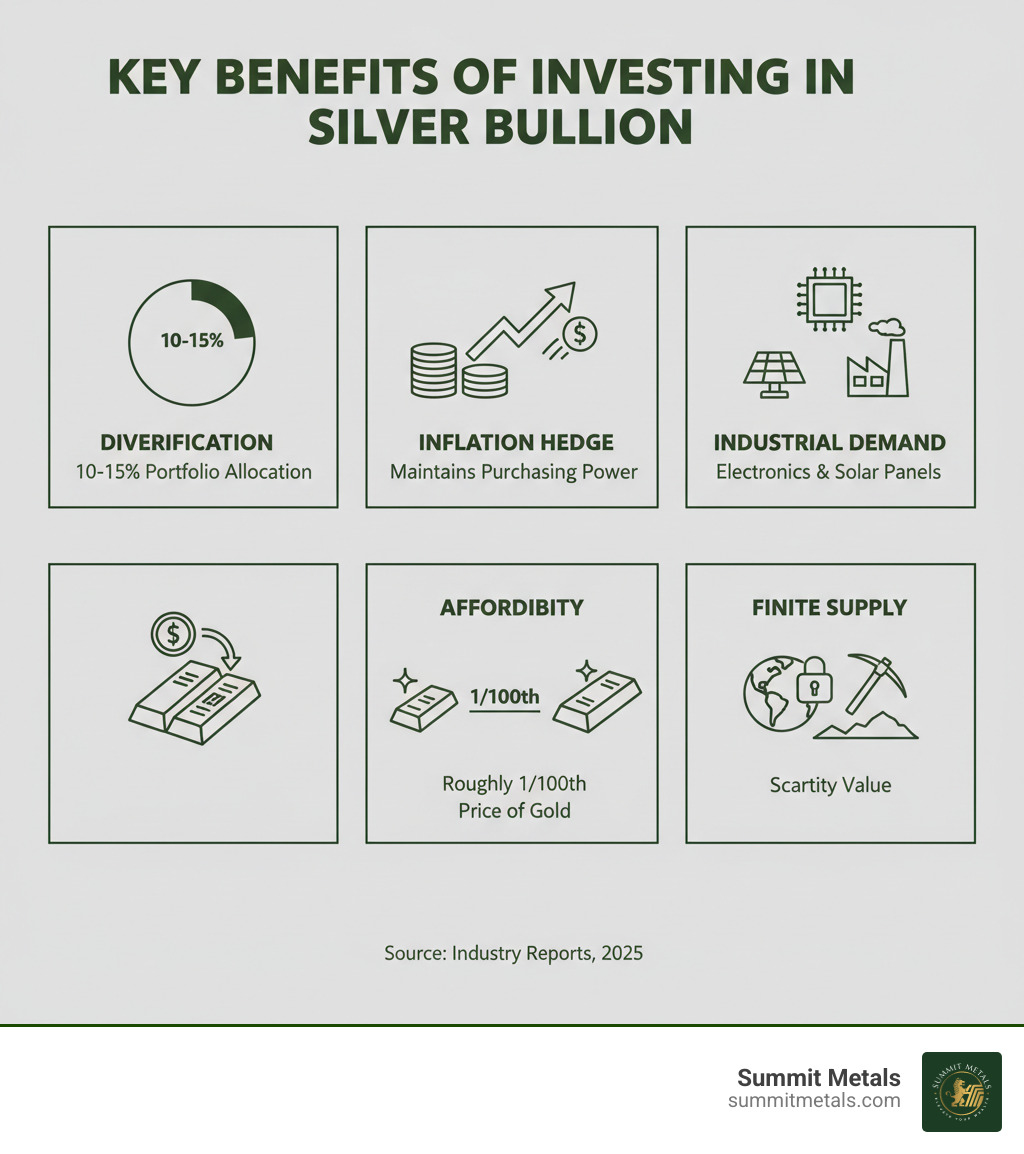

- Finite resource: Like Bitcoin, silver cannot be produced at will by governments.

I'm Eric Roach, and during my decade on Wall Street as an investment-banking and M&A advisor, I guided Fortune-500 clients through multi-billion-dollar hedging programs before creating Lombart, the first flat-fee stock trading company purchased by Morgan Stanley. As a silver bullion dealer advisor, I now help everyday investors use the same institutional strategies to protect wealth through physical precious metals.

Why Invest in Silver Bullion? The Enduring Appeal of a Tangible Asset

When you hold a silver coin, you're holding a real asset that's been valued for thousands of years. This tangible quality is what draws so many investors to silver bullion, especially during times of economic uncertainty.

Portfolio diversification is a primary reason to own silver. Precious metals often move independently of the stock market, providing a cushion against inflation and market swings. Financial advisors often suggest a 10-15% allocation to precious metals.

Silver isn't just a store of value; it's a critical component in the real world. Industrial demand is strong, as silver is used in smartphones, solar panels, medical equipment, and EV batteries. With a projected global supply deficit for 2024, this industrial use helps support its long-term value.

For everyday investors, silver's key advantage is its affordability versus gold. With gold prices topping $3,350 per ounce, silver's price of around $33 makes it accessible. You can accumulate real wealth steadily, one ounce at a time.

Of course, silver comes with price volatility risks. It can swing dramatically in short periods, which is why it's best viewed as a long-term investment. This volatility also creates opportunity, especially for disciplined investors.

This is why dollar-cost averaging is such a powerful strategy for silver. By investing a fixed amount regularly—say, $200 every month—you buy more ounces when prices are low and fewer when they are high. Over time, this smooths out your average cost.

We designed Summit Metals' Autoinvest strategy for this exact purpose. It functions like a 401k, but for physical silver. Set it up once, and your silver stack grows automatically, turning market volatility into an advantage without requiring you to time the market. It’s disciplined investing made effortless.

Finally, you'll need a plan for storage. Physical silver requires secure protection, whether in a home safe, a bank deposit box, or a professional vault. We'll cover these options later, but it's an important consideration from the start.

For a deeper dive, read our guide: Silver Linings: Smart Strategies for Investing in Precious Metal.

Understanding the Risks and How to Mitigate Them

Every investment carries risk, and silver is no different. Understanding and mitigating these risks is key to investing with confidence.

- Market Fluctuations: Silver's price can be volatile. This makes it better for long-term holding rather than short-term trading. Use dollar-cost averaging to smooth out price swings and invest with a multi-year time horizon.

- Premiums Over Spot Price: You will always pay a premium over the market's "spot price" for physical bullion. This covers minting, shipping, and dealer costs. Compare the final, all-in price between dealers to find the best value.

- Counterfeiting Risk: Sophisticated fakes are a real threat. The single best way to avoid them is to buy from a reputable silver bullion dealer who authenticates every product they sell. At Summit Metals, we only sell authenticated products because your trust is our priority.

- Secure Storage: Your silver needs to be stored securely and insured. A home safe, bank box, or professional depository are all viable options, but ensure your holdings are covered by an appropriate insurance policy, as standard homeowner's policies often have limits on precious metals.

These risks are manageable when you buy from trustworthy sources, invest for the long term, and properly secure your physical assets. If you're still weighing your options, this article offers more perspective: Does It Really Make Sense to Invest in Silver?

Understanding Your Options: Silver Coins, Bars, and Rounds

When you buy physical silver, you'll find it in three main forms: coins, bars, and rounds. Each has unique characteristics that affect its price, liquidity, and appeal to different investors.

Government-minted coins, like the American Silver Eagle or Canadian Silver Maple Leaf, are produced by official government mints. They are legal tender with a face value, which adds a layer of trust and makes them easy to recognize and trade globally. This government backing and guaranteed purity mean they often carry higher premiums.

Privately minted bars are produced by private refiners and come in various sizes, from 1 oz to 1,000 oz. Bars typically have lower premiums than coins, making them a favorite for "stackers" who want to acquire the most silver for their money. Reputable bars are stamped with their weight, purity, and often a unique serial number.

Privately minted rounds are coin-shaped but made by private mints and have no face value or legal tender status. They often feature unique, artistic designs, making them popular with collectors. Their premiums are usually between those of government coins and larger bars, offering a good balance of cost and craftsmanship.

A premium is the amount you pay above the silver "spot price." This cost covers mining, manufacturing, shipping, insurance, and the dealer's profit. Government coins have the highest premiums due to their official status. Rounds are typically next, while larger bars offer the lowest premiums per ounce, making them the most cost-effective way to buy in bulk.

Silver Coins vs. Bars vs. Rounds

This table breaks down the key differences to help you decide.

| Factor | Coins | Bars | Rounds |

|---|---|---|---|

| Premium | Highest | Lowest (for large sizes) | Low-to-Medium |

| Liquidity | Highest | High | Medium |

| Storability | Good (stackable) | Best (most compact) | Good (stackable) |

| Authenticity | Easiest to verify | Verifiable (assay/mint marks) | Varies by mint |

| Best For | New investors & collectors | Bulk stackers | Budget-conscious buyers |

| Legal Tender/Face Value | Yes (recognizable, easy resale) | No | No |

| Security Features | Strong (government anti-counterfeiting) | Good (serials/assay) | Varies |

Government Coin vs. Large Silver Bar (e.g., 100 oz): Quick Comparison

| Factor | Government Coin (1 oz) | 100 oz Silver Bar |

|---|---|---|

| Face Value/Legal Tender | Yes; aids recognition and trust | No |

| Anti-Counterfeiting | Robust (micro-engraving, radial lines, etc.) | Good (serial numbers, assay cards) |

| Premiums | Higher per ounce | Lowest per ounce |

| Liquidity | Very high; easy to sell individually | High; best for larger liquidations |

| Storage Efficiency | Good | Excellent (very compact per ounce) |

| Best For | New buyers, gifting, high-recognizability stacks | Cost-per-ounce optimization and bulk stacking |

For a more in-depth look at these options, read: Bars vs. Coins: Unpacking the Differences in Silver Investing.

No matter which format you choose, consider using Summit Metals' Autoinvest to dollar-cost average monthly—just like contributing to a 401k—so your stack grows automatically over time.

How to Choose the Right Online Silver Bullion Dealer

Choosing the right silver bullion dealer is crucial for a successful investment. You need a partner who is reliable, transparent, and easy to work with, especially when buying online.

First, check their reputation and reviews. A great dealer will have a long history of positive customer feedback on independent sites like the Better Business Bureau (BBB) or Shopper Approved. A high rating from thousands of reviews is a strong indicator of a company's commitment to its customers.

Next, insist on pricing transparency. A trustworthy dealer will display real-time prices that move with the market and clearly show the premium you're paying over the spot price. If a dealer's pricing is confusing or hidden, that's a major red flag. At Summit Metals, we are committed to transparent, real-time pricing so you always know you're getting a fair deal.

Consider the product selection. A good dealer should offer a variety of silver coins, bars, and rounds to fit different budgets and goals, from classic American Silver Eagles to cost-effective 100 oz silver bars.

Shipping and insurance policies are critical. Your order should be shipped discreetly, fully insured, and require a signature upon delivery. Always confirm these details before purchasing.

Look at the payment options. Most dealers accept credit cards, PayPal, and wire transfers. For larger orders, a wire transfer often has lower fees. A strong buy-back program is also a plus, giving you a simple and competitive option to liquidate your holdings if needed.

Finally, don't underestimate good customer service. A knowledgeable and helpful team can make all the difference, whether you have a question about a product or the market. Summit Metals also offers Autoinvest—automatic monthly purchases—so you can dollar-cost average without watching the market every day.

For more tips on buying metals online, check out our guide: Don't Get Bent Out of Shape: How to Buy Metal Online.

Online vs. Physical Dealers: Which is Right for You?

When buying silver, you can choose an online silver bullion dealer or a local shop. The best choice depends on what you value most: price, convenience, or in-person service.

Online dealers typically offer a larger selection and more competitive prices due to lower overhead. You can shop 24/7, easily compare prices, and access a wealth of product information and reviews. For most investors, online dealers provide the best combination of choice and value.

Physical dealers offer the ability to see the silver before you buy and take it home immediately. A local dealer can also provide face-to-face advice. Our physical location in Salt Lake City, Utah, offers our local customers this friendly, in-person service combined with our online selection and pricing.

In terms of convenience, online dealers have a clear edge. However, if you prefer instant gratification, a local shop might be your style. Regarding anonymity, large transactions (typically over $10,000) require reporting for both online and physical dealers, so the idea of complete anonymity for significant investments is largely a myth.

For price comparison, online dealers almost always offer lower premiums. To explore more of your options, take a look at: Top Online Retailers for Gold, Silver, and More.

Online vs. Physical Dealers at a Glance

| Factor | Online Dealer | Physical Dealer |

|---|---|---|

| Pricing/Premiums | Often lower due to scale and overhead | Can be higher; varies by store |

| Selection | Broad: coins, rounds, bars, new releases | Limited to in-store inventory |

| Convenience | 24/7 shopping, home delivery | Same-day pickup, in-person guidance |

| Reporting/Anonymity | Similar rules for large transactions | Similar rules for large transactions |

| Buy-Back/Liquidity | Streamlined online quotes and shipping | Immediate in-person offers |

| DCA Tools | Autoinvest monthly buys available | Rarely offered in-store |

Top Online Silver Bullion Dealers: A 2024 Roundup

Finding the right online silver bullion dealer can be overwhelming. To help you choose, we've identified the key factors that separate the best from the rest: reputation, pricing, product selection, and customer service. While many dealers exist, they are not all created equal. Here’s what to look for and how Summit Metals delivers.

Many large, established dealers offer a vast inventory, which can be appealing to collectors seeking rare or niche items. However, this often comes at the cost of higher premiums. You may end up paying more for the brand name and overhead associated with a massive catalog. Other dealers might attract you with low advertised prices but have confusing websites or high shipping fees that erode your savings.

A modern investor should look for a dealer that balances a quality selection with fair, transparent pricing and innovative tools that make investing easier. This is where Summit Metals stands out.

Summit Metals: The Modern Investor's Choice

We built Summit Metals with a simple philosophy: investing in physical silver should be as easy and transparent as any other modern investment. Based in Wyoming, USA, with a location in Salt Lake City, Utah, we are a silver bullion dealer focused on removing the friction and uncertainty from precious metals investing.

Our transparent real-time pricing means you see clear, live prices that update with the market—no hidden markups. By purchasing in bulk, we secure competitive rates and pass the value directly to you. Every product we sell is authenticated, giving you absolute confidence in the purity and quality of your silver.

What truly sets us apart is our Autoinvest subscription feature. Think of it as a 401k for physical silver. You can set up automated monthly purchases to dollar-cost average your way into a larger position over time. This disciplined approach smooths out market volatility and builds your stack consistently, without the need to constantly watch prices or time the market.

We've designed our platform to be seamless from browsing to secure delivery. We're not just selling silver; we're providing a modern solution for wealth preservation that aligns with your long-term financial strategy.

Essential Due Diligence: Verifying Authenticity and Navigating the Market

Beyond choosing a dealer, an informed investor understands the market and knows how to verify their assets. This knowledge is key to investing with confidence.

The silver market has a unique dual role as both an investment and an essential industrial metal. Its price is tied to investor sentiment and global manufacturing. The projected 149 million-ounce supply deficit for 2024 highlights how industrial demand (from solar, EVs, and electronics) is outstripping supply. Watching market trends, like central bank activity and inflation data, can provide useful context.

One helpful tool is the gold-to-silver ratio, which shows how many ounces of silver it takes to buy one ounce of gold. A high ratio may suggest that silver is undervalued relative to gold, potentially indicating a good buying opportunity. For background, see Gold–silver ratio.

Want to learn more? Explore our guide: What is the Gold to Silver Ratio? Is It Important?.

How to Verify Your Silver's Authenticity and Purity

One of the biggest concerns for a bullion buyer is avoiding fakes. Fortunately, there are reliable ways to confirm your silver's authenticity.

Always start by looking for official markings. Government coins have distinct mint marks (see Mint mark). All quality bullion should have purity stamps (e.g., ".999 Fine Silver"). Many bars also come with assay cards—certificates from the refiner guaranteeing weight and purity, often with a matching serial number (learn more about an assay).

Some mints use advanced anti-counterfeiting technology, like microscopic security features. While basic home tests like the "magnet test" (silver is not magnetic) or "ping test" (silver has a distinct ring) can be useful, they are not foolproof. The single best defense against counterfeits is to buy only from a trusted silver bullion dealer who guarantees authenticity.

Understanding Tax Implications

Disclaimer: We are not tax professionals. The information below is for educational purposes only. Please consult a qualified tax professional for advice specific to your situation.

Understanding the tax implications of owning silver is essential. In the U.S., precious metals are typically considered "collectibles" by the IRS. Profits from selling silver held for more than a year may be taxed at the collectibles tax rate of up to 28%. Short-term gains are usually taxed at your regular income rate (see Capital gains tax in the United States).

Tax laws also have regional differences. Some states exempt investment-grade bullion from sales tax, while others do not. Furthermore, dealers may be required to report certain large transactions to the IRS via Form 1099-B. Always keep detailed records of your purchases and sales. Tax rules vary globally, so be sure to research the specific laws for your location before transacting.

Frequently Asked Questions for First-Time Buyers

Starting your journey with physical silver can bring up many questions. Here are concise answers to the most common ones we hear from first-time buyers.

What is the best type of silver for a beginner to buy?

For most beginners, 1 oz government coins like American Silver Eagles or Canadian Maple Leafs are an excellent choice. Their government backing guarantees their purity and weight, and their legal tender status makes them universally recognized and easy to sell. This instant recognizability provides great liquidity.

If your main goal is to acquire the most silver for your money, consider low-premium silver rounds or bars. These are made by private mints and offer the same .999 fine silver content but at a price closer to the spot rate, as you aren't paying extra for a government guarantee.

Many investors do both: they build a core position of recognizable government coins and add to their stack with lower-premium rounds and bars to maximize their total ounces. For more details, see: Your Guide to Silver Coin Investments: What You Need to Know.

How should I store my silver bullion safely?

Physical silver requires a real-world security plan. You have three main options:

- Home Safe: This offers direct access to your silver. Use a high-quality, fireproof safe that is securely bolted down. You must add a special rider to your homeowner's insurance to ensure your bullion is covered for its full value.

- Bank Safety Deposit Box: This provides high security at a bank. Access is limited to banking hours, and the contents are not automatically insured by the bank, so you will still need a separate insurance policy.

- Third-Party Depository: These specialized vaults offer the highest level of security and are fully insured. They are ideal for large holdings and are often required for precious metals held in an IRA. Storage fees apply.

Whichever you choose, insured storage is non-negotiable. For more guidance, read: Silver Surfers Guide: How to Secure Your Precious Metals Online.

How much is a typical premium over the spot price for silver?

The spot price is the wholesale price for large bars of silver traded on global markets. As a retail investor buying a physical product, you will always pay a premium over spot. This premium covers the costs of mining, refining, minting, shipping, insurance, and the dealer's operations.

Premiums vary by product:

- Government Coins: Highest premiums, often 15-30% over spot, for their government guarantee and high liquidity.

- Privately Minted Rounds: Lower premiums, typically in the 10-20% range.

- Silver Bars: Generally the lowest premiums, especially for larger sizes. A 100 oz bar could have a premium as low as 3-8% over spot.

Premiums can rise and fall with market demand. Always compare the final, all-in price from a dealer. At Summit Metals, our real-time pricing ensures you see the full picture. Learn more here: Don't Get Fooled: A Guide to Silver Premiums.

Conclusion

Investing in silver bullion is a rewarding journey toward strengthening your financial portfolio with a real, tangible asset. The key is to arm yourself with the right knowledge and partner with a silver bullion dealer you can trust.

We've covered why silver is a compelling long-term investment, the differences between coins, bars, and rounds, and the importance of due diligence. Silver shines as a hedge against economic uncertainty, and its role in modern technology points to a bright future. By using smart strategies like dollar-cost averaging, you can steadily build your holdings and secure your wealth without stress.

At Summit Metals, we make this process simple and transparent. We are proud to offer clear, real-time pricing and competitive rates, ensuring you get maximum value for your investment. We are committed to empowering you with the tools and knowledge for success.

Ready to build your silver stack with the same ease as contributing to a 401k? Our Autoinvest feature lets you set up automated purchases, allowing your wealth to grow consistently. Take the next step toward a more secure financial future.

Set up your automated silver investment plan today with Summit Metals Autoinvest!