Your Guide to Liberty 1 oz Fine Silver One Dollar Coins

When you search for "liberty 1 oz fine silver one dollar," you're likely seeing two main types of silver products. It's easy to get them mixed up. One is an official U.S. government coin. The other is a silver round from a private mint. Knowing the difference is key for smart investing.

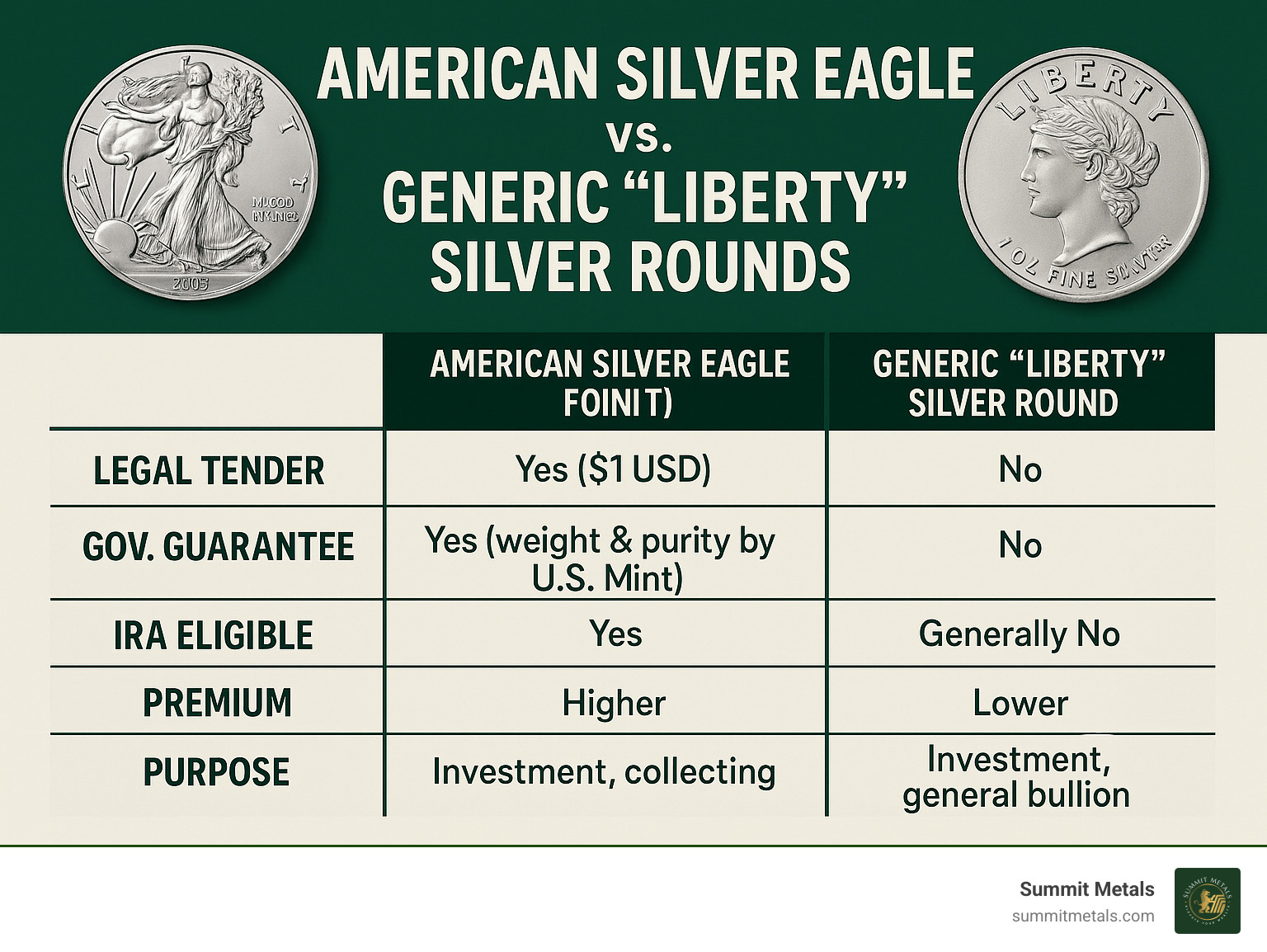

Here's a quick look at what sets them apart:

| Feature | American Silver Eagle (Official Coin) | Generic "Liberty" Silver Round (Private) |

|---|---|---|

| Legal Tender | Yes ($1 USD) | No |

| Gov. Guarantee | Yes (weight & purity by U.S. Mint) | No |

| IRA Eligible | Yes | Generally No |

| Premium | Higher | Lower |

| Purpose | Investment, collecting | Investment, general bullion |

This guide will explain both types. You'll learn their features, history, and why each is popular.

I'm Eric Roach. My background in Wall Street and precious metals helps investors like you understand the liberty 1 oz fine silver one dollar and other tangible assets. I guide clients to protect and grow their wealth with physical gold and silver.

The Official Contender: What is the American Silver Eagle?

When you hear about a "liberty 1 oz fine silver one dollar" coin, chances are your mind immediately pictures the American Silver Eagle. And honestly, that's spot on! This isn't just any silver coin. It's the official silver bullion coin of the United States, a true icon. It even holds legal tender status in the U.S., carrying a face value of one dollar. Of course, its actual silver value is much, much higher, but that legal tender status is a neat touch.

The story behind the American Silver Eagle is pretty neat. It all began with the Liberty Coin Act, approved on July 9, 1985. This law got the ball rolling, and production started in 1986. The big idea? To help sell off silver from the National Defense Stockpile. Even with some initial bumps, this program soared! It quickly became, and still is, the only silver bullion coin whose weight and purity are fully guaranteed by the U.S. government. Talk about peace of mind for investors!

Over time, this coin's design has become instantly recognizable and truly loved. On the front, known as the obverse, you'll find the stunning "Walking Liberty" design by Adolph A. Weinman. This beautiful image actually first appeared on U.S. Half Dollars way back from 1916 to 1947. It shows Lady Liberty confidently walking towards the sunrise, draped in the American flag, holding oak and laurel branches. Many folks believe it's one of the most gorgeous coin designs ever made, truly capturing the spirit of freedom and hope.

Now, the back of the American Silver Eagle, the reverse, has seen some exciting changes! For decades, it proudly displayed the heraldic eagle design by John Mercanti (we call this "Type 1"). Imagine a grand eagle behind a shield, holding an olive branch and arrows. But in 2021, something big happened: the "Type 2" reverse arrived, created by Emily Damstra. This newer design is super dynamic, showing an American bald eagle swooping down to its nest, carrying a big oak branch. It was a fresh look for a beloved coin, keeping its classic feel while adding a modern touch.

It's worth noting that the American Eagle Coin program isn't just about silver! The U.S. Mint also releases annual Gold, Platinum, and Palladium Eagles. This whole program shows the Mint's dedication to offering top-notch precious metal products for investors. Want to learn more? Check out the official details on The American Eagle Coin program. And if you're curious why silver has such a strategic edge in today's changing world, our guide has you covered: More info about silver's strategic edge.

Key Characteristics of a Liberty 1 oz Fine Silver One Dollar Coin

The American Silver Eagle isn't just pretty; its exact features really prove its quality and consistent production. That's what makes it such a trustworthy asset for investors. When we talk about a liberty 1 oz fine silver one dollar coin, especially this one, these physical details are super important.

Every single American Silver Eagle coin holds exactly one troy ounce of silver. And it's incredibly pure: 99.9% fine silver (.999 fine, if you like the technical term!). This high purity is a big reason why it's a top pick for serious investors. For those who love details, one troy ounce weighs about 31.103 grams.

Even with all that silver, the coin's face value is just one dollar. Think of this as more of a legal formality. The coin's real value comes from its silver content, current market prices, and how much collectors want it – which is almost always way more than a dollar!

When it comes to size, the American Silver Eagle is built for consistency. It measures 40.6 mm in diameter and is 2.98 mm thick. These precise dimensions make packaging and checking authenticity super easy. And notice the coin's edge? It's "reeded," meaning it has tiny grooves – exactly 201 reeds, in fact! This isn't just for looks; it's a clever security feature, making it much harder to counterfeit or tamper with.

These exact features, plus the U.S. government's promise of guaranteed weight and purity, firmly place the American Silver Eagle as a top-tier choice for silver investors. Knowing these basics is key when you're building your precious metals collection. If you're just starting, our guide on The basics of gold and silver stacking can give you a great head start!

Design and Mintage: From Type 1 to Type 2

The story of the American Silver Eagle, especially its design changes and how many were made, really shows us how much people want these coins, their artistic beauty, and how they've grown over time. As we mentioned, the front (obverse) has always featured Adolph A. Weinman's classic Walking Liberty design ever since it first appeared in 1986. This unchanging image gives us a nice link to the past, tying today's investors to a long, rich history of coin collecting.

The biggest design change happened on the back, or reverse, of the coin. From 1986 all the way to 2020, the coin featured John Mercanti's heraldic eagle (the "Type 1" design). This grand eagle, with its wings spread, holding an olive branch and arrows, became the face of the American Silver Eagle. But then, 2021 brought a big change: Emily Damstra's "Eagle Landing" reverse, or "Type 2." This lively new design shows an eagle swooping down, carrying an oak branch – a symbol of strength. This update was a huge deal in the coin world, sparking lots of excitement!

Most American Silver Eagle bullion coins come from the U.S. Mint's facility in West Point, New York. But the San Francisco and Philadelphia Mints have also helped out a lot over the years. You'll find uncirculated Silver Eagles from all three mints, sometimes with mint marks like W for West Point, S for San Francisco, or P for Philadelphia. Interestingly, the bullion coins usually don't have a mint mark. The U.S. Mint is actually required by law to produce these coins every year to meet investor demand. That really shows how vital they are in the precious metals market!

Let's explore some key mintage figures that truly show how popular these coins are: The very first year, 1986, saw 5.393 million coins made. This lower starting number makes those early coins quite interesting for collectors! A special mention goes to the 1995-W Proof coin; even though it's a proof and not a regular bullion coin, only 30,125 were made, making it super rare and highly sought after. Talk about a collector's dream! Fast forward to 2015, which was a massive year, with an amazing 47 million Silver Eagles sold – a true peak in demand. In 2020, despite global challenges, 30.089 million coins were still produced, showing consistent strong interest. 2021 was unique because it had both the Type 1 and Type 2 designs, with a total of 28.275 million uncirculated coins produced that year, making collectors eager to grab both versions. By 2022, the mintage was 15.963 million, a bit lower but still a solid number, confirming robust production.

These impressive figures really show the huge size of the American Silver Eagle program and its lasting appeal. Differences in how many coins were made each year, especially for certain dates or special editions, can actually boost a coin's numismatic (collector's) value, on top of its silver value. If you're keen to learn more about the history and value of U.S. silver coinage, our guide, An essential guide to valuing Constitutional Silver, offers some great insights.

Beyond the Eagle: Understanding Private "Liberty" Silver Rounds

While the American Silver Eagle is truly the star when we talk about a "liberty 1 oz fine silver one dollar" coin from the U.S. government, it's super important for investors to know that not every silver product with "Liberty" on it, or a "dollar" denomination, is quite the same. The market is also full of private "Liberty" silver rounds. These pieces might share similar themes and even the same silver content, but they are very different from government-issued coins in their legal standing and purpose.

Think of it this way: the main difference comes down to who made it and what kind of promise comes with it.

- Sovereign Coins, like the American Silver Eagle, are made by government mints. They are considered legal money, and the government itself guarantees their weight and purity. That's a big deal!

- Private Rounds, on the other hand, are made by private companies or refiners. They are not legal money. They usually don't have a face value (or if they do, it's just a symbolic number, not backed by any government). Their weight and purity are guaranteed only by the private company that made them.

This key difference has some real-world effects. Because private rounds don't have that government backing or official legal tender status, they often cost less over the actual silver price. We call this the "premium." This can be a great thing for investors who simply want to get as much silver as possible for their money. If your main goal is just to stack ounces of silver, and you don't care about collecting or official status, private rounds can be a smart choice.

Private mints also have a lot more freedom with their designs. This means you'll find a huge variety of "Liberty"-themed silver rounds out there. They might be inspired by old U.S. coins, or they could show modern artistic takes on freedom. For example, you might see "American Indian Head" rounds or "Trade Unit" rounds that feature Lady Liberty with scales, symbolizing fair trade. This wide range of designs means collectors can find unique pieces they truly love, while investors can find affordable ways to buy physical silver.

However, it's super important to be careful and do your homework when buying private rounds. While many trusted private mints make excellent, high-quality products, there's no government standing behind them. So, you're relying entirely on that private mint's good name for the item's authenticity and purity. Also, be aware that some items advertised as "liberty 1 oz fine silver one dollar" on online marketplaces might actually be replicas or simply commemorative items, not meant for serious investment. Always read the product descriptions very carefully!

Understanding the difference between the actual spot price of silver and the extra amount you pay for a physical product (that "premium" we talked about) is super important when you're thinking about private rounds. For a deeper dive into this, check out our helpful guide on Spot Price vs. Premium: How Precious Metals Pricing Works.

Investment vs. Collection: Analyzing the "Liberty 1 oz Fine Silver One Dollar"

When we talk about the "liberty 1 oz fine silver one dollar" in its various forms, we're really looking at a fascinating crossroads where investing meets collecting. Both the American Silver Eagle and its private "Liberty" silver round cousins offer a tangible way to hold precious metal, but they appeal to different desires.

The American Silver Eagle, being the official U.S. bullion coin, really sets the standard. Its status is backed by the U.S. government, making it incredibly easy to buy and sell anywhere in the world. This makes it a top pick for serious investors who want a secure asset that's always in demand. But it's not just for investors! Its classic design (even with the recent Type 2 update) and known mintage figures also give it significant appeal for collectors. Some years, especially low-mintage proof versions like the famous 1995-W, can fetch prices far beyond their silver value, making them true collector's gems. The beautiful "Walking Liberty" design is often a big draw for those who simply appreciate the artistry.

Private "Liberty" silver rounds, on the other hand, usually catch the eye of investors whose main goal is to get as much silver as possible for the lowest price. Since they aren't legal tender and don't have a government guarantee, they're cheaper to produce and, well, cheaper to buy. While they generally don't have the same "collector's item" vibe as government coins, their wide variety of designs can be very attractive to collectors looking for specific themes or unique artistic takes on "Liberty." For these rounds, their value is almost entirely tied to the pure silver they contain.

To help you see the differences at a glance, here’s a quick comparison:

| Factor | American Silver Eagle (Official Coin) | Generic "Liberty" Silver Round (Private) |

|---|---|---|

| Government Guarantee | Yes (weight & purity by U.S. Mint) | No (guaranteed by private mint) |

| IRA Eligibility | Yes (IRS-approved) | Generally No |

| Liquidity | Very High (globally recognized) | Moderate (rely on dealer buybacks) |

| Premium Over Spot | Higher | Lower |

| Collectibility | High (numismatic value for certain years/types) | Low (primarily bullion value, some niche collecting) |

Both types of 1 oz silver products offer you a way to own physical silver. Your choice often comes down to what you're hoping to achieve and how much risk you're comfortable with. If security, easy selling, and the chance for collector value are high on your list, the American Silver Eagle is likely your champion. If your goal is simply to stack as many silver ounces as possible for the best price, private rounds are a fantastic alternative. Both can certainly find a home in a well-rounded portfolio. For a deeper dive into whether silver makes sense for your investment strategy, explore Does It Really Make Sense to Invest in Silver?.

Is a Liberty 1 oz Fine Silver One Dollar a Good Investment?

We truly believe that investing in a liberty 1 oz fine silver one dollar coin, especially the American Silver Eagle, offers some really strong benefits for savvy investors. Here’s why it’s often considered a smart move:

First off, there's a big perk: IRA eligibility. The American Silver Eagle can be held within a Self-Directed Individual Retirement Account (IRA). This means you can add physical silver to your retirement savings, potentially enjoying some nice tax benefits. Just remember to always check with IRS Publication 590-A or a trusted financial advisor for the latest rules.

Silver has also historically been a solid hedge against inflation. Think of it this way: when regular money starts losing its buying power, tangible assets like silver tend to hold their value, or even go up. Many people find that holding physical silver just feels more secure than paper money, especially when the economy feels a bit shaky.

Adding physical silver to your portfolio also helps with diversification. It's like not putting all your eggs in one basket! Silver's price often moves differently than stocks and bonds, which can act as a cushion when other parts of the market dip. It's truly a great way to balance any retirement portfolio.

Another huge advantage is its high liquidity and global recognition. The American Silver Eagle is one of the most famous and widely traded silver bullion coins in the entire world. This means it's super easy to buy and sell almost anywhere, giving you quick access to your investment if you need to convert it to cash. Just imagine, over 300 million Silver Eagles have been minted to date, with a staggering 47 million sold in 2015 alone – that's how popular and easy to trade they are!

Finally, that government guarantee we keep talking about is a massive peace of mind. Knowing that the U.S. government stands behind the weight and purity of every American Silver Eagle gives it an best level of trust and assurance, setting it apart from any privately minted silver product.

While we can't predict the future, silver's track record, especially the American Silver Eagle's, as a reliable store of value and a tangible asset, makes it a valuable part of any plan to protect your wealth. For more insights into why being able to easily buy and sell your precious metals matters, you can read our article: What is the Best Silver & Gold to Buy and Why Liquidity Matters.

Packaging and Purchasing

So, you're ready to get your hands on some liberty 1 oz fine silver one dollar coins? Great choice! Knowing how they're typically packaged and where to buy them is a big step toward a smooth and confident purchase.

American Silver Eagles are packaged to keep them in brilliant condition and make them easy to handle, whether you're buying one or many.

- For smaller orders or individual collector pieces, you'll often find coins nestled in individual plastic flips or capsules. These little protectors keep them safe from scratches and keep that beautiful shine.

- If you're looking for larger quantities, American Silver Eagle bullion coins come neatly stacked in sturdy plastic mint tubes, with 20 coins per tube. These tubes are specially designed by the U.S. Mint to keep your coins secure and pristine.

- For the truly serious investors, American Silver Eagle bullion coins are available in huge quantities – 500 coins, to be exact – packed into what we affectionately call "Monster Boxes." These boxes hold 25 mint tubes, each with 20 coins, and come sealed by the U.S. Mint. It's an extra layer of assurance that your coins are untouched and in perfect condition.

When it's time to buy, American Silver Eagles are mainly sold through a network of "Authorized Purchasers" chosen by the U.S. Mint. These are typically large dealers who buy directly from the Mint, and then they sell to smaller dealers and, of course, to you! This system helps make sure everything is regulated and runs smoothly.

For individual investors like you, it's super important to buy from reputable dealers. A good dealer will always be transparent about pricing, guarantee that your coins are authentic, and make sure they're shipped to you securely. Here at Summit Metals, we're proud to sell authenticated gold and silver precious metals for investment. Our secret sauce? Transparent, real-time pricing and really competitive rates, all thanks to our smart bulk purchasing strategies. This means you can trust us, knowing you're getting great value, whether you're investing from Wyoming, Utah, or anywhere else in the world. We're all about making your journey into tangible assets as clear and secure as possible.

To learn even more about staying safe when buying precious metals, our guide on How to Buy Gold and Silver Online Safely is an excellent resource.

Conclusion

So, after diving deep into "liberty 1 oz fine silver one dollar" coins, what have we learned? It’s clear that the American Silver Eagle stands tall as the shining star. It's truly the benchmark for silver bullion.

Its status as official U.S. legal tender, backed by the U.S. government's guarantee of weight and purity, makes it a top-tier investment. Think of it as a gold standard, but for silver! This coin is recognized worldwide and is super easy to buy or sell. Plus, it can even be part of your retirement savings in a Self-Directed IRA. That's pretty neat for protecting your wealth over time and diversifying your portfolio.

Then we have the private "Liberty" silver rounds. They offer a great way to grab silver at a lower cost. But remember, they don't have that official government backing or legal tender status. They're fantastic for simply stacking ounces of silver, offering variety in design, but they're not quite the same as the government-issued coins when it comes to official assurances or numismatic value.

So, here’s the big takeaway: your choice depends on your goals. If you're looking for the ultimate in security, global recognition, and potential collectibility, the American Silver Eagle is your go-to. It’s a solid investment-grade bullion piece. If your main goal is to acquire as much silver as possible for the lowest premium, private rounds can be a smart addition to your stack.

At Summit Metals, we get it. Trust and clear value are everything when you're investing in precious metals. That's why we're committed to offering authenticated gold and silver. Our transparent, real-time pricing and competitive rates come from our smart bulk purchasing. We make sure you get true value.

For investors who value the solid security and global recognition of the official liberty 1 oz fine silver one dollar coin, checking out our silver products is a natural next step. We’re here to help you secure your wealth with confidence.