Why 100 oz Silver Bars Are the Investor's Sweet Spot

100 oz silver bars are the most popular size for investors looking to acquire physical silver in bulk. They represent a strategic middle ground, offering significant value without the handling issues of larger institutional bars. Here's what makes them stand out:

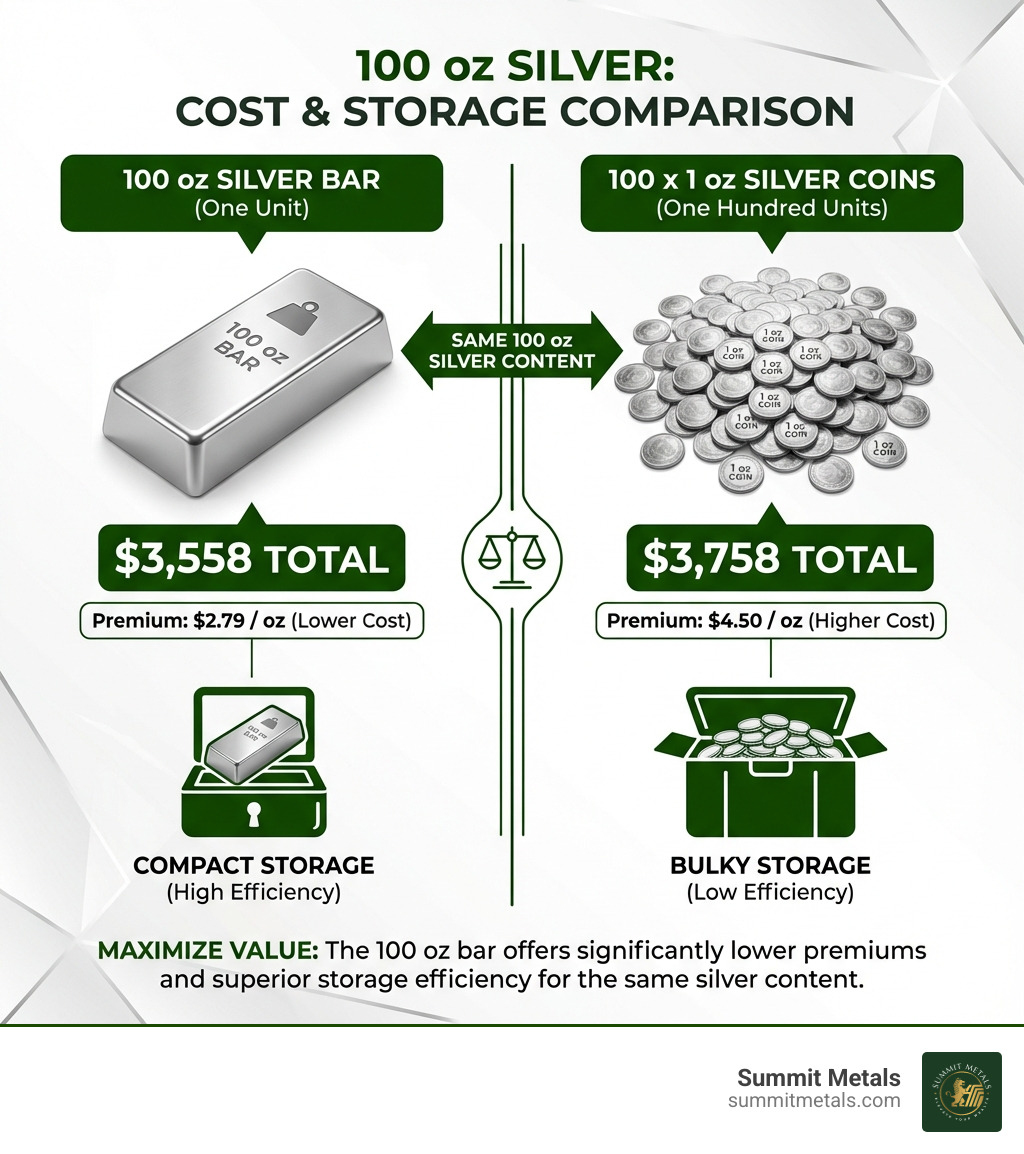

- Lower premiums: As little as $2.79 per ounce over spot price—far cheaper than coins or smaller bars.

- Substantial Weight: Each bar contains 100 troy ounces (3,110.35 grams) of .999 or .9999 fine silver.

- Efficient Portability: Large enough to be cost-effective, yet small enough to store securely at home or in a depository.

- Wide Selection: Available from world-renowned mints like the Royal Canadian Mint and PAMP Suisse, as well as trusted generic refiners.

- IRA-Eligible: Most newly minted 100 oz bars meet the purity requirements for self-directed precious metals IRAs.

Price vs. Smaller Formats:

| Product | Premium over spot | Storage efficiency |

|---|---|---|

| 100 oz bar | Lowest | Highest |

| 10 oz bar | Medium | Medium |

| 1 oz coin | Highest | Lowest |

Premiums are indicative and subject to change.

If you're serious about building a silver position, the 100 oz bar hits the sweet spot. It's ten times the size of a 10 oz bar but carries a much lower premium per ounce. Unlike massive 1,000 oz bars used on exchange floors, a 100 oz bar is something you can actually hold, store, and liquidate when needed.

This balance makes them the go-to choice for investors who want meaningful exposure without paying high coin premiums. Whether you're hedging against inflation or diversifying a portfolio, 100 oz bars deliver the most silver per dollar spent.

Consider this: the same investment buys you significantly more silver in a 100 oz bar form versus 1 oz coins once you factor in premiums. Over a multi-year stacking plan, those extra ounces compound into real wealth.

Why Go Big? The Strategic Advantages of 100 oz Silver

For serious investors, the 100 oz silver bar is a clear favorite because it perfectly balances significant quantity with practical handling. Buying in 100 oz increments is incredibly efficient, meaning fewer transactions and a more streamlined process for building your holdings.

This bulk acquisition translates directly into cost-effectiveness through lower premiums per ounce. With 100 oz silver bars, you pay significantly less over the spot price compared to smaller bars or coins, maximizing your investment and getting the most metal for your money.

Efficient storage is another key benefit. A single 100 oz bar takes up far less space than one hundred 1 oz coins, simplifying secure storage in a home safe, bank vault, or third-party depository. This density of value makes it a powerful tangible asset and a hedge against inflation, as physical silver has historically maintained its purchasing power during economic uncertainty. For readers who want more background on silver's role through history, see the overview of silver as an investment.

Finally, over 50% of silver sold annually goes to industrial applications like electronics and solar panels. This constant, baseline demand underpins silver's long-term value, providing a fundamental floor that many other investments lack.

To make accumulating these larger bars easier, Summit Metals offers AutoInvest, a dollar-cost-averaging program that lets you buy silver automatically on a recurring schedule. Much like contributing to a 401(k), you can set a monthly budget and steadily build a position in 100 oz bars without trying to time the market.

[INFOGRAPHIC] Buying in Bulk vs. Smaller Units

Imagine two investors each putting the same dollar amount into silver:

- Investor A buys 1 oz coins every month.

- Investor B uses Summit Metals' AutoInvest to accumulate toward 100 oz bars.

Because 100 oz bars carry lower premiums and are more space-efficient, Investor B typically ends up with more total silver ounces over the same time period. Dollar-cost averaging through AutoInvest helps smooth out price swings, while bulk formats maximize ounces per dollar.

Key Features of a 100 oz silver bar

Understanding the core characteristics of a 100 oz silver bar is crucial. These are precisely manufactured bullion products with specific standards.

- Weight: A standard bar contains exactly 100 troy ounces (3,110.35 grams) of silver.

- Purity: Most bars are .999 (99.9%) or .9999 (99.99%) pure silver, ensuring their recognition and liquidity in the global market.

- Hallmarks: These markings provide critical information, including the mint stamp (manufacturer), weight, purity, and often a unique serial number for security and traceability.

- Manufacturing Style: Bars are either cast (poured into a mold, often with a rustic look and lower premium) or struck (cut and stamped like a coin, with sharp designs and a higher-end finish). Both offer the same intrinsic value based on their silver content.

Comparing 100 oz silver bars to Coins and Smaller Bars

Choosing the right format for your silver investment depends on your goals. While 100 oz silver bars are ideal for bulk accumulation, it's helpful to see how they stack up against other popular options.

| Feature | 100 oz Silver Bar | 10 oz Silver Bar | 1 oz Silver Coin |

|---|---|---|---|

| Premiums over Spot | Lowest | Medium | Highest |

| Liquidity | Good, especially with reputable refiners | Excellent, widely traded | Excellent, highly liquid |

| Divisibility | Low (difficult to sell small portions) | Medium (can sell in 10 oz chunks) | High (easy to sell small portions) |

| Storage Space | Most efficient per ounce | Good efficiency | Least efficient per ounce |

| Portability | Moderate (heavy, but manageable) | High (easily transportable) | Highest (fits in pockets) |

| Face Value/Fraud Protection | None | None | Yes (sovereign coins carry legal tender face value) |

As the table shows, 100 oz silver bars shine in cost-effectiveness and storage efficiency. However, smaller bars and coins offer greater divisibility. A crucial advantage of sovereign coins, like the American Silver Eagle, is their government-backed legal tender face value. This provides an additional layer of trust and protection against counterfeiting that bars do not have. For a deeper dive, check out our article on Bars or Coins: Unpacking the Differences in Silver Investing.

Additional Comparison: Silver Bars vs. Gold Coins

Many investors also weigh silver bars against owning gold coins:

| Feature | 100 oz Silver Bar | 1 oz Gold Coin |

|---|---|---|

| Typical Ticket Size | Lower total cost per bar | Higher cost per coin |

| Premiums over Spot | Low per ounce | Often moderate per ounce |

| Volatility per Dollar Invested | Higher (silver is more volatile) | Typically lower volatility |

| Storage Density | Good, but bulkier per dollar than gold | Extremely high value in small space |

| Legal Tender / Face Value | None | Yes, legal tender face value backed by issuing government |

| Fraud / Recognition Protection | Relies on bar hallmarks and testing | Strong; government-minted with standardized designs and security features |

Gold coins combine high value in a compact form with a legal tender face value, which can improve trust and recognition worldwide. Silver bars, by contrast, excel at delivering maximum ounces for each dollar, making them ideal for investors aiming to build large positions in physical metal.

The best choice depends on your strategy. For serious stackers aiming for maximum silver at the lowest premium, the 100 oz silver bar is hard to beat, especially when combined with Summit Metals' AutoInvest program to automate monthly purchases.

A Roundup of the Best 100 oz Silver Bars

When we talk about 100 oz silver bars, we're not just discussing a single product. The market offers a fascinating array of options, each with its own history, aesthetic, and sometimes, a unique premium. Let's explore some of the best 100 oz silver bars available today.

Premium and Sovereign Mint Bars

These bars are sought after for their guaranteed purity and recognizable branding, which can make them easier to sell. They typically command a slightly higher premium.

- Royal Canadian Mint (RCM): Renowned for exceptional quality, RCM bars boast an impressive .9999 purity and feature crisp designs with unique serial numbers.

- PAMP Suisse: From Switzerland, PAMP Suisse is synonymous with luxury, often featuring the famous "Lady Fortuna" design. Their global recognition is a draw for many investors.

- The Royal Mint (Britannia): The UK's Royal Mint offers bars with the iconic Britannia design, a symbol of quality and British heritage.

- Asahi: After acquiring Johnson Matthey's refining assets, Asahi quickly became a major player, offering bars known for their quality and reliability.

Vintage and Collectible Bars

Sometimes, a bar's value extends beyond its metal content. Vintage bars carry a story and often a higher premium driven by collector demand.

- Engelhard & Johnson Matthey: Though no longer actively minting, bars from these refining giants are highly sought after by collectors. Their history and scarcity can lead to significantly higher premiums.

- Historical Significance: Some vintage bars have very low estimated mintages, turning a bullion investment into a collectible item with numismatic value beyond the silver content.

Generic and Varied Condition Bars

For investors focused purely on accumulating as much silver as possible at the lowest cost, generic bars are the champions.

- Lowest Premium Over Spot: These bars are offered at the smallest premium because you're buying for intrinsic metal value, not brand name or perfect condition.

- Ideal for Bulk Stacking: If your goal is to stack silver as a hedge, these are your go-to. They provide the most ounces for your dollar, as we discuss in The Best Bang for Your Buck: Generic Silver Bars Explained.

- Condition Varies: "Varied condition" means some bars may be nearly new, while others show wear or toning. Toning is a natural oxidation that does not affect the silver's intrinsic value.

- Value in Silver Content: Regardless of appearance, the most important aspect is that these bars contain 100 troy ounces of .999+ fine silver. Their value is tied directly to their guaranteed silver content.

Your Complete Guide to Buying 100 oz Silver

Purchasing 100 oz silver bars is a significant investment. Navigating the process requires a clear understanding of pricing, dealers, payment, and storage. We're here to guide you through every step.

Understanding Pricing and Finding a Dealer

The price of a 100 oz silver bar has two main components: the spot price and the premium.

- Spot Price: The live market price for one troy ounce of silver. Reputable dealers like Summit Metals use an up-to-the-second feed for pricing. For context on how spot prices are formed in global markets, see the overview of precious metal pricing.

- Premiums: The amount added to the spot price to cover business costs. 100 oz silver bars have lower premiums per ounce than smaller products, making them cost-effective for bulk buying.

Finding a reputable dealer is paramount. Look for dealers with transparent pricing, excellent customer reviews, and a strong track record. For a comprehensive list of trusted sources, consult our guide on Silver Bullion Dealers: A Roundup of Top Online Retailers. Always ask about their authentication process to ensure the purity and weight of the bars they sell.

To help you decide where 100 oz bars fit into your broader plan, consider how consistent, scheduled purchases can lower the impact of volatility. Summit Metals' AutoInvest program lets you set a recurring monthly purchase amount, so you can steadily build towards full 100 oz bars over time rather than making a single large purchase.

Payment, Shipping, and Storage Options

Once you've chosen your bars, the next steps are payment, shipping, and storage.

- Payment Methods: Common options include bank wire (often the lowest premium), check/ACH, credit/debit card (higher premium), and cryptocurrency.

- Shipping: Ensure your dealer provides discreet, unmarked packaging and that all orders are fully insured against loss or damage in transit. Larger orders typically require a signature upon delivery.

- Storage: You have several options for storing your 100 oz silver bars. A home safe is suitable for smaller quantities but carries security risks. For greater security, many investors use bank safe deposit boxes or professional third-party depositories, which offer high-security, insured storage for precious metals. Understanding the pros and cons of each storage method is crucial for protecting your investment.

At Summit Metals, we pride ourselves on transparent, real-time pricing and competitive rates. Our physical location in Salt Lake City, Utah, also provides options for local transactions.

Automate Your Stacking with AutoInvest

Building a significant silver position doesn't require a single large purchase. Many savvy investors use dollar-cost averaging, and our AutoInvest program makes this easy.

Dollar-cost averaging involves investing a fixed amount at regular intervals, regardless of price fluctuations. This mitigates market volatility—when prices are low, you buy more ounces, and when they are high, you buy fewer. Over time, this can lead to a lower average cost per ounce.

Think of it like a 401k: you consistently contribute a set amount, building your position steadily. Summit Metals' AutoInvest brings this powerful, disciplined approach to physical silver. You can set up recurring purchases of 100 oz silver bars or smaller products that accumulate toward full bars, ensuring you invest consistently every month.

By treating your silver stacking like a monthly 401k contribution, you avoid emotional, one-off decisions and instead follow a rules-based plan custom to your goals. Ready to start? Set up your silver savings plan with Summit Metals today.

Decision Helper: One-Time Purchase vs. AutoInvest

| Approach | Best For | Main Advantages | Key Considerations |

|---|---|---|---|

| Single Large 100 oz Bar Purchase | Investors with cash on hand who want immediate bulk exposure | Instant ownership of full bar, takes immediate advantage of current premiums | Requires timing a larger outlay; more exposure to short-term price at purchase date |

| Monthly AutoInvest (Dollar-Cost Averaging) | Investors who prefer steady, budgeted contributions | Smooths out volatility, feels like a 401k-style plan, easier on cash flow | Takes time to build up to each 100 oz bar; total ounces accumulate gradually |

Navigating Risks and Tax Implications

Investing in 100 oz silver bars, like any investment, comes with considerations. While the benefits are compelling, it's crucial to be aware of potential risks and understand the tax implications.

Risks Associated with 100 oz Silver Bars

- Price Volatility: Silver prices can fluctuate significantly based on supply, demand, and economic news. Market conditions can change rapidly. Historical charts of silver prices show how quickly the market can move.

- Liquidity: While generally liquid, 100 oz silver bars may be slightly less flexible to sell than smaller 1 oz coins if you need to liquidate only a small portion of your holdings.

- Storage Security: Storing bars at home carries risks of theft or loss. A 100 oz bar is a valuable item, making professional, insured storage a wise choice for many investors.

- Counterfeit Risks: Counterfeiting is a risk in the precious metals market. Always purchase from trusted dealers like Summit Metals that authenticate their products.

Using a structured approach such as monthly AutoInvest can help reduce the emotional impact of volatility. By committing to a fixed recurring purchase rather than reacting to short-term price swings, you can stick to your long-term plan more easily.

Tax Implications

Understanding the tax treatment of precious metals is essential before buying or selling.

- Capital Gains Tax: In the US, profit from selling silver is generally subject to capital gains tax. Physical precious metals are often classified as "collectibles" by the IRS.

- Collectibles Tax Rate: Long-term capital gains (from assets held over a year) on collectibles may be taxed at a higher rate (up to 28%) than gains from stocks. Short-term gains are taxed at your ordinary income rate.

- Reporting and Sales Tax: Dealers may be required to report certain sales to the IRS. Additionally, sales tax on bullion varies by state; some states exempt it entirely, while others do not. Check your local laws before purchasing.

Given the complexities, we always advise consulting with a qualified tax advisor for personalized advice.

Comparison: Tax & Risk Considerations by Product Type

| Feature | 100 oz Silver Bar | 1 oz Silver Coin (Bullion) | 1 oz Gold Coin (Bullion) |

|---|---|---|---|

| US Federal Tax Category | Typically treated as collectible | Typically treated as collectible | Typically treated as collectible |

| Long-Term Max Collectibles Rate | Up to 28% (if gain) | Up to 28% (if gain) | Up to 28% (if gain) |

| Typical Counterfeit Protection | Hallmarks, serial numbers, testing | Hallmarks, government-minted design | Hallmarks, government-minted design with face value |

| Face Value / Legal Tender | None | Yes for sovereign bullion coins | Yes for sovereign bullion coins |

Sovereign coins benefit from government-backed legal tender status, which supports global recognition and can improve fraud protection. Large silver bars, however, remain the most efficient way to gain substantial physical exposure per dollar invested.

Frequently Asked Questions about 100 oz Silver Bars

We know you've got questions, and we're here to provide clear, straightforward answers about 100 oz silver bars.

What is a fair price for a 100 oz silver bar?

A fair price is the current spot price of silver plus a reasonable premium. The spot price is the live market price for one troy ounce. The premium is the dealer's charge to cover business costs. For 100 oz silver bars, this premium is much lower per ounce than for smaller items.

To determine a fair price:

- Check the current spot price. You can reference live market data from major financial news sites or see background information on the silver market.

- Compare dealer prices for the same type of bar.

- Payment methods matter; bank wires and checks typically secure a lower price than credit cards.

A fair price will always be competitive and reflect current market dynamics. If you prefer not to time the market, using Summit Metals’ AutoInvest to buy on a fixed schedule can help average out your cost over time.

Are 100 oz silver bars IRA-eligible?

Yes, many 100 oz silver bars are eligible for a Precious Metals IRA, allowing you to hold physical silver in a tax-advantaged retirement account.

For a bar to be IRA-approved, it must meet specific requirements:

- Purity: The silver must be at least .999 fine.

- Approved Mints: The bar must be produced by a recognized refiner or national mint.

- Storage: The metals must be held by an IRS-approved third-party depository, not at home.

For more details on eligibility, see our guide: Bar None: The Best - Understanding Certified Silver Bars. Always confirm a specific bar's eligibility with your IRA custodian before purchase.

How do I sell my 100 oz silver bar?

Selling your 100 oz silver bar is a simple process.

- Find a Reputable Buyer: Your original dealer is often the best place to start. At Summit Metals, we actively buy back precious metals.

- Lock in a Price: Contact the dealer to get a buyback quote based on the current spot price.

- Ship or Deliver: You can ship the bar securely to an online dealer or conduct an in-person transaction at a local shop, like our location in Salt Lake City, Utah.

- Receive Payment: Once the dealer verifies your bar, they will issue payment via check, bank wire, or ACH.

When you're ready, we make the process easy and transparent. Sell your precious metals to us at Summit Metals.

FAQ Comparison: Bars vs. Coins for Selling and Planning

| Question | 100 oz Silver Bar | 1 oz Silver Coin |

|---|---|---|

| Ease of Selling a Small Amount | Less flexible (large unit size) | Very flexible; can sell a few coins at a time |

| Typical Use in AutoInvest Plans | Great target for long-term stacking; work toward full bars | Ideal for smaller monthly budgets and higher divisibility |

| Best Fit For | Investors focused on bulk ounces and efficient storage | Investors prioritizing flexibility, small trade sizes, and legal tender designs |

Combining both—using AutoInvest to steadily accumulate and balancing between coins for flexibility and bars for efficiency—can give you a diversified, practical physical metals strategy.

Conclusion: Making Your Move in the Silver Market

Investing in 100 oz silver bars offers a unique combination of advantages that make them a cornerstone for many precious metals portfolios. We've explored why these "heavy metal" investments are considered the sweet spot for serious stackers: their cost-effectiveness due to lower premiums, efficient storage, and the tangible security they provide as a hedge against economic uncertainties. From the pristine quality of sovereign mints to the value-driven appeal of generic bars, there's a 100 oz silver bar for every investor's strategy.

We understand that making a significant investment in physical silver requires trust and clear information. That's why at Summit Metals, based in Wyoming, we are committed to transparent, real-time pricing and competitive rates, ensuring you get the best value for your authenticated gold and silver precious metals. Whether you're looking to make a one-time purchase or build your stack consistently through our AutoInvest program—contributing every month the way you would to a 401k—we are here to support your wealth preservation journey.

As you consider your next steps in the silver market, remember the power of the 100 oz silver bar to provide meaningful exposure and long-term security. It's more than just metal; it's a strategic asset for a resilient financial future.

To see how physical silver fits into the broader precious metals landscape, you can also review background resources on precious metal investing, then tailor your approach with Summit Metals’ product range and AutoInvest tools.

Ready to make your move? Explore our full range of silver investment options and find how Summit Metals can help you achieve your financial goals.