Introduction: The Straight Answer on the Gold Buffalo's Status

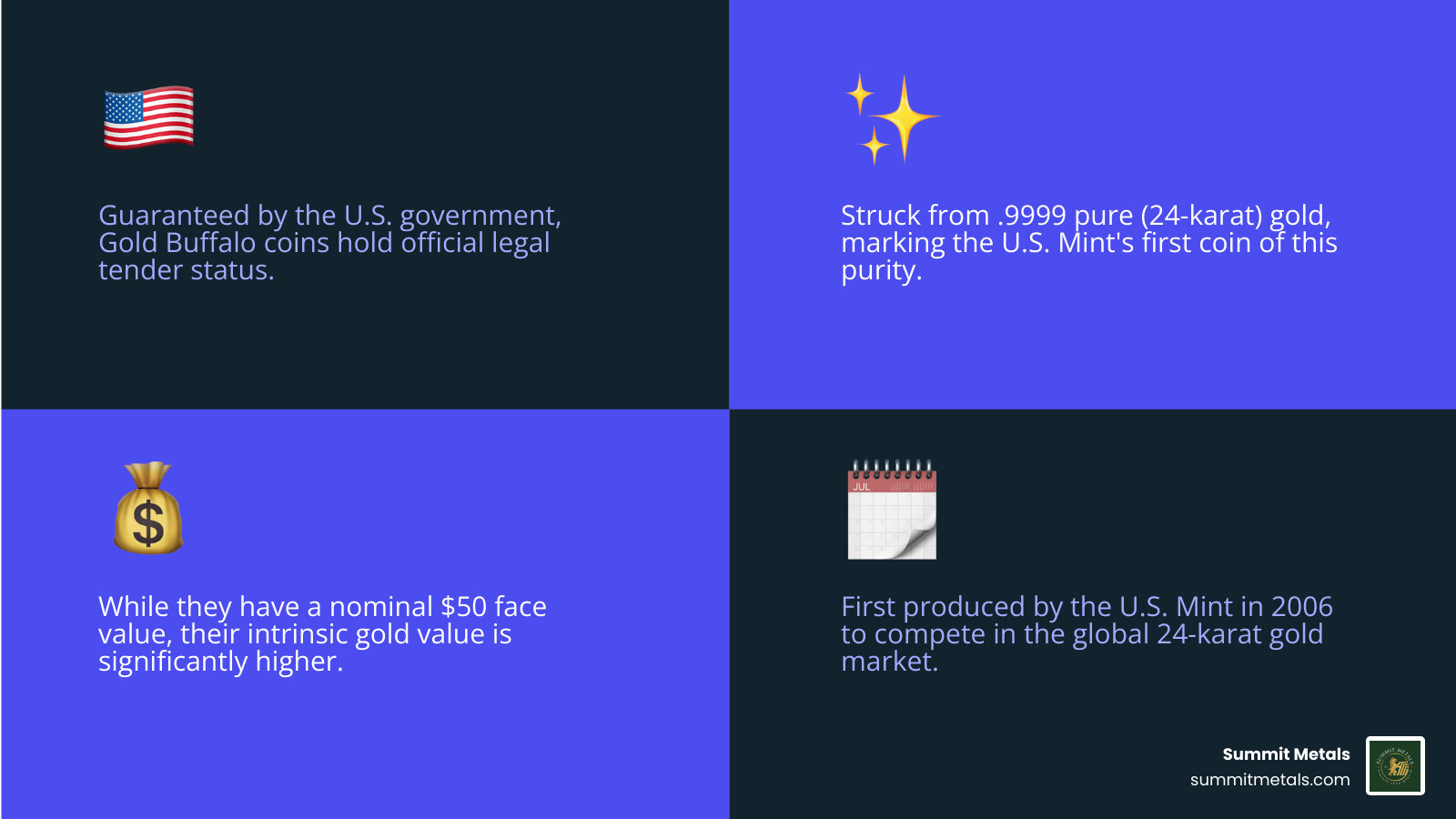

Many people wonder, are gold buffalo coins legal tender in the United States? The simple answer is yes, they are. These beautiful gold coins hold official legal tender status.

Here's a quick breakdown of what that means:

- Legal Tender: Gold Buffalo coins are recognized as legal tender by the U.S. government.

- Government Backing: Their value and purity are guaranteed by the United States.

- Face Value: The one-ounce Gold Buffalo coin carries a nominal face value of $50.

- Purity: They are struck from .9999 pure (24-karat) gold.

- First Minted: The U.S. Mint first produced these coins in 2006.

- Practical Use: While technically legal tender, their intrinsic gold value is far greater than their $50 face value. This means you wouldn't use them to buy groceries.

Understanding the unique status of these coins is key for collectors and investors.

My name is Eric Roach. With over a decade of experience in financial markets, including guiding Fortune-500 companies, I've seen how assets like the Gold Buffalo coin fit into sound financial strategies. My insights help clients steer volatility and understand the nuances of precious metals, including whether are gold buffalo coins legal tender truly impacts their value for wealth preservation.

The Making of an American Icon: History and Design

The story of the American Gold Buffalo coin isn't just about gold; it's a tale deeply woven into American history and the evolution of our coinage. Its creation was a landmark moment, specifically mandated by the Presidential $1 Coin Act of 2005. This wasn't just any old piece of legislation; it was a clear signal for the U.S. Mint to create something truly special: its very first .9999 fine 24-karat gold coin. Talk about a glow-up!

Why did America suddenly need a pure 24-karat gold coin? Well, imagine trying to compete on the world stage when others already have a head start. Countries like Canada, with their popular Maple Leaf coins, and Austria, with their beautiful Philharmonics, had long been offering pure 24-karat gold options to investors. The U.S. Mint saw this and realized it was time to step into the ring with its own champion. The goal was clear: to capture a bigger slice of the global 24-karat gold market and offer investors a pure gold option that was proudly backed by the U.S. government.

Now, let's talk about that iconic look! The design of the Gold Buffalo coin is instantly recognizable and steeped in American heritage. It's actually a wonderful tribute to a classic piece of American numismatic art: James Earle Fraser's iconic 1913 Indian Head, or "Buffalo," Nickel. Fraser's original design was a thoughtful blend, creating a dignified Native American profile using features from three real-life chiefs: Big Tree, Iron Tail, and Two Moons. This powerful and serene profile graces the obverse (that's the front side) of your Gold Buffalo coin, truly capturing a spirit of strength and resilience.

Flip the coin over, and you'll be greeted by the majestic American bison, often lovingly called a "buffalo." This powerful creature was inspired by none other than Black Diamond, a resident bison of the Central Park Zoo back in the day. The bison stands proudly on a mound, symbolizing the vast American plains and the untamed spirit of the nation. It's a design that resonates deeply, beloved by both collectors and investors for its beauty and historical significance.

When it comes to what's inside, the American Gold Buffalo coin holds a full one troy ounce (that's about 31.1035 grams) of pure gold. Its purity is officially guaranteed by the U.S. government at .9999 fine gold, meaning it's a true 24-karat gold coin. These precious coins are primarily struck at the U.S. Mint's renowned facility in West Point, New York. This ensures top-notch quality and adherence to the strictest production standards. The weight, content, and purity of these coins are all officially guaranteed by the United States government, offering an unparalleled level of trust and security for your investment. This rock-solid guarantee is another reason why are gold buffalo coins legal tender is such a straightforward answer!

For even more fascinating details about the coin's rich history, you can explore its Wikipedia page.

So, Are Gold Buffalo Coins Legal Tender in Practice?

Okay, so we've already answered the big question: are gold buffalo coins legal tender? The answer is a resounding yes! But what does "legal tender" actually mean for a gorgeous, high-value gold coin like the American Gold Buffalo? Let's break it down in plain English.

Think of legal tender as the official currency that, by law, has to be accepted to pay off debts. Whether it's taxes, a bill you owe, or settling a personal financial agreement, if it's legal tender, it's the real deal. The U.S. government stands behind it, guaranteeing its validity and value. That's a pretty strong backing!

Now, let's clear up a common mix-up: the difference between 'money' and 'legal tender.' While all legal tender is a form of money, not everything we call 'money' is legal tender. Money is really anything we commonly accept for buying and selling things. For example, a gift card lets you buy stuff, so it acts like money. But you can't use it to pay off a debt if someone demands legal tender, right? A Gold Buffalo coin, though, is special. It's both a representation of serious value (money) and official legal tender that the government backs for debt settlement.

To see this in action, let's put the American Gold Buffalo side-by-side with its equally famous relative, the American Gold Eagle. They're both beautiful, but they have some key differences:

| Feature | American Gold Buffalo | American Gold Eagle |

|---|---|---|

| Purity | .9999 fine (24-karat) gold | .9167 fine (22-karat) gold, alloyed with silver and copper |

| Durability | Softer due to higher purity, more susceptible to scratches | Harder and more durable due to alloy |

| Design | Obverse: Native American profile; Reverse: American Bison | Obverse: Lady Liberty; Reverse: Eagle family (or single eagle since 2021) |

| Face Value | $50 (1 oz) | $50 (1 oz), also $25, $10, $5 for fractional sizes |

| Investor Preference | Preferred by those seeking the purest gold content | Preferred for added durability and a long-standing investment history |

Here's where the legal tender status of a Gold Buffalo gets interesting: in real life, you wouldn't use it to buy groceries! While it technically has a $50 face value and could be used for a $50 purchase, that would be like throwing money away. Why? Because the actual gold inside that coin is worth much more than fifty dollars. As of the time of this publication, a one-ounce Gold Buffalo coin is worth thousands, not just $50. Using it for its face value would be like exchanging a $100 bill for a single dollar. So, while it's legal tender, its true value lies in its pure gold content and its status as a collector's item or investment, not as everyday pocket change.

Why are Gold Buffalo coins legal tender only when made by the U.S. Mint?

This is a really important point that often trips people up. The power to create legal tender coins in the U.S. belongs only to the U.S. Mint. It's a special power the government holds. So, when the U.S. Mint makes a coin, like your Gold Buffalo, it automatically gets that official legal tender status. This means the government guarantees its weight, its purity, and that small face value it carries.

This exclusive right also helps prevent counterfeiting. Only the U.S. Mint can make official U.S. coins. Private companies can make cool gold and silver products, but they can't call them U.S. legal tender. They can't put a face value on them or pretend they're government-issued money.

You've probably seen those 'Silver Buffalo rounds' that look a lot like the old Buffalo Nickel. These are made by private companies. They can use the design because the original Buffalo Nickel design is now public property. But here's the catch: these silver rounds are not legal tender. Even though silver is precious, it's not designated as a legal tender metal for general coinage in the U.S., unlike gold. (The U.S. Mint does make the Silver American Eagle, which is legal tender, but that's an exception.) Private mints can use that famous design on silver, but they must make it clear that it has no official face value and isn't government money.

So, next time you see a silver 'Buffalo' round, remember: if it didn't come from the U.S. Mint and doesn't have an official U.S. face value, it's not legal tender. This special power of the U.S. Mint keeps our national currency strong and trustworthy.

Want to dive deeper into how gold can fit into your investment plan? We've got a fantastic guide for you: Gold Investment 101: Turning Your Savings into Solid Gold.

Are Gold Buffalo coins legal tender for private debts and contracts?

Now, here's where the legal tender status of your Gold Buffalo coin can offer a really neat advantage, especially if you value financial flexibility. Yes, these U.S. government-backed gold coins can actually be used in private contracts or agreements, as long as both parties agree to it.

So, imagine you and someone else agree on a deal. You could, in theory, use your Gold Buffalo coins at their face value (that $50 mark) in that private agreement. This means you have a legal right to offer them this way. Of course, no one in their right mind would accept a coin worth thousands for just $50, but the legal option is there. This gives the Gold Buffalo a special legal standing that plain gold bars or private gold rounds just don't have. Those are just commodities, not official legal tender.

For investors who really value having options and flexibility, especially when the economy feels a bit shaky, the Gold Buffalo's legal tender status offers an extra layer of protection and enforceability. This can be super important for things like notarized agreements or contracts that might end up in court. The legal tender label can give you clear legal ground that other gold products simply don't. While it's always smart to chat with a legal or financial expert for your unique situation, the Gold Buffalo's status just adds another powerful tool to your financial toolkit.

Investing in Gold Buffalos: Value, Taxes, and Smart Strategies

When you hold a Gold Buffalo coin, its tiny $50 face value might make you scratch your head. But here's the secret: its true value shines far beyond that number. We're talking about its intrinsic value, which is directly linked to the current price of gold on the global market. Think of that $50 as just a whisper, while the real worth of your coin shouts loud and clear based on the live gold spot price.

Now, buying a Gold Buffalo isn't just about the gold's spot price. You'll also encounter something called a "premium." This is the little extra you pay above the gold's melt value. Why the extra? Well, it covers all the hard work that goes into making these beautiful coins: the mining, the intricate minting process, and getting them safely from the U.S. Mint to you. High demand and the costs of production naturally influence this premium. For example, at the time of this publication, the premium for a Gold Buffalo coin might range from roughly $97 to $252, bringing the total price to about $2,635.80 to $2,769.89, assuming a gold spot price around $2517.42. Sometimes, these premiums can even climb as high as 10% above the spot price - a sign of just how popular these coins are! In fact, the U.S. Mint struck an impressive 387,000 Gold Buffalo coins in 2023 alone, showing just how many folks are choosing this American icon.

Speaking of value, it's wise to understand the tax side of things when investing in Gold Buffalos. The IRS, or Internal Revenue Service, views these gold coins as "collectibles" when you sell them for a profit, rather than seeing them as regular currency. This means that if your Gold Buffalo coin gains value and you sell it, any profit you make might be subject to capital gains tax. And for collectibles, this tax rate can sometimes be a bit higher than for other types of investments.

Even if a dealer isn't always required to report certain gold coin transactions to the IRS (which can offer a bit of privacy), you are still responsible for reporting your own gains on your tax return. We always recommend chatting with a trusted tax advisor to make sure you're clear on your personal tax duties.

For up-to-the-minute gold prices and to see how gold has performed over time, you can always check out our live chart: Gold Prices Today: Live Gold Price Chart & Historical Data.

Now, let's talk about smart ways to build your gold holdings. At Summit Metals, we're big believers in a strategy called dollar-cost averaging. It sounds fancy, but it's really quite simple: you invest a set amount of money regularly, say, every month, no matter if gold prices are up or down. This approach helps smooth out the ups and downs of the market, as you end up buying more gold when prices are lower and less when they're higher. Over time, this can lead to a really solid average purchase price.

To make this strategy super easy for you, we offer our innovative Autoinvest feature. Imagine contributing to your precious metals portfolio just like you would a 401k, but for solid gold! With Autoinvest, you can set up automated monthly purchases. This takes the guesswork and emotion out of investing, helping you build your wealth consistently and without hassle. It's a disciplined, long-term approach to growing your gold portfolio, ensuring you're always adding to your holdings at competitive rates. We believe this consistent, transparent way of investing is key to securing your financial future with authenticated gold.

Frequently Asked Questions about the American Gold Buffalo

What are the different types of Gold Buffalo coins available?

When you're shopping for American Gold Buffalo coins, you'll encounter two main versions, each serving different purposes for collectors and investors.

The bullion version is what most investors choose. These are the standard investment-grade coins that flow through authorized dealers like Summit Metals. They're produced efficiently for mass distribution, meeting the strong demand from investors seeking pure gold. To put this in perspective, the U.S. Mint struck 387,000 Gold Buffalo bullion coins in 2023 alone – that's serious investor interest!

For collectors who appreciate the finer details, there's the proof version. These coins undergo a specialized minting process where each one is struck multiple times with polished dies. The result? A stunning mirror-like finish with frosted design elements that really make James Earle Fraser's iconic artwork pop. Proof coins typically bear a mint mark (like a "W" for West Point) and are sold directly by the U.S. Mint. They command higher premiums due to their collector appeal and superior finish. In 2023, 14,007 proof Buffalo coins were minted – much more exclusive than their bullion cousins.

Here's something interesting: back in 2008, when gold prices were climbing, the U.S. Mint briefly offered fractional sizes to make these coins more accessible. They produced 1/2 ounce ($25 face value), 1/4 ounce ($10 face value), and 1/10 ounce ($5 face value) versions. While the 1-ounce coin has been minted consistently since 2006, these smaller denominations have only appeared sporadically.

For detailed mintage figures and more specific information on various Gold Buffalo issues, you might find this guide helpful: A guide to different Gold Buffalo issues.

Are Gold Buffalo coins eligible for a Gold IRA?

Absolutely! This is one of the most popular questions we get, and the answer is a resounding yes. Are Gold Buffalo coins legal tender that can improve your retirement portfolio? They certainly are, and their legal tender status is just one reason they're such a smart IRA choice.

Gold Buffalo coins easily meet the IRS's stringent purity requirements for precious metals held within an IRA. The IRS mandates that gold bullion must be at least .995 fine (99.5% pure) to qualify. Since Gold Buffalo coins are .9999 pure (24-karat) gold, they sail past this requirement with room to spare.

Adding Gold Buffalo coins to a Gold IRA allows you to diversify your retirement portfolio with a tangible asset. Think of it as insurance against inflation and economic uncertainty, while still enjoying the tax advantages of an IRA. It's a smart way to blend the stability and long-term value of physical gold with your retirement planning strategy.

Many of our clients use our Autoinvest feature to systematically build their precious metals IRA holdings. Just like contributing to a traditional 401k, you can set up automated monthly purchases that take the emotion and guesswork out of your investment decisions. It's a disciplined approach that helps you build wealth consistently over time.

To learn more about incorporating gold into your financial strategy, check out: Going for Gold: Your Ultimate Guide to the Precious Metal.

What is the historical precedent for using gold as currency in the U.S.?

The question "are Gold Buffalo coins legal tender" becomes even more fascinating when you understand America's deep historical relationship with gold currency. For much of our nation's history, gold coins weren't just investments – they were the money in your pocket.

Before 1933, magnificent gold coins like the Saint-Gaudens Double Eagle ($20 face value), Liberty Head Eagle ($10 face value), and Quarter Eagle ($2.50 face value) were routinely used for everyday transactions. People bought groceries, paid rent, and conducted business with these beautiful gold coins. They formed the backbone of the U.S. monetary system, universally accepted and trusted.

This golden era (pun intended) came to an abrupt end in 1933. During the Great Depression, President Franklin D. Roosevelt issued Executive Order 6102 on April 5, 1933. This sweeping order effectively outlawed private ownership of gold coins, gold bullion, and gold certificates. Citizens were required to surrender their gold to the Federal Reserve in exchange for paper currency. It was a monumental shift that ended gold's role as everyday currency and marked America's departure from the gold standard.

The private ownership of gold was re-legalized in 1974, but the U.S. never returned to a gold-backed currency system. Today's Gold Buffalo coins represent an interesting bridge between past and present – they carry legal tender status like their historical predecessors, but function primarily as investment vehicles and stores of wealth rather than pocket change.

Here's a fascinating detail: gold coins issued before January 30, 1934, are still legally exchangeable into other currency today. This historical precedent underscores gold's enduring role as a symbol of value and stability in the American financial landscape, making modern coins like the Gold Buffalo a continuation of a proud tradition.

Conclusion: Adding the Gold Buffalo to Your Portfolio

So, after diving deep into the fascinating world of the American Gold Buffalo coin, you now have the straight answer: are gold buffalo coins legal tender? Absolutely, yes! They carry that official government backing, providing a unique layer of security. But as we've explored, their true brilliance isn't in their symbolic $50 face value. Oh no, it's in the glittering, guaranteed .9999 pure gold they hold within.

This isn't just any gold coin; it's a piece of American artistry and innovation. With its iconic design, paying homage to the classic Buffalo Nickel, and its status as the U.S. Mint's very first 24-karat gold coin, the Gold Buffalo truly stands out. For many savvy investors, it's become a cornerstone of their precious metals portfolio – a tangible asset that offers a comforting hedge against economic wobbles and a beautiful piece of history to hold onto.

Ready to add this magnificent coin to your own collection or investment strategy? At Summit Metals, we're all about making your precious metals journey clear and confident. Based in Wyoming, with roots in Salt Lake City, Utah, we pride ourselves on transparent, real-time pricing and competitive rates, ensuring you get real value. We believe in authenticated gold investments, so you can always buy with peace of mind.

And here's a smart tip for building your gold holdings consistently: consider our innovative Autoinvest feature. Think of it like setting up a 401k for your precious metals! You can automate monthly purchases of Gold Buffalos or other precious metals, taking the guesswork out and letting you dollar-cost average your way to a stronger portfolio, month after month.

Ready to start building your golden future? We invite you to explore our offerings and experience the Summit Metals difference today. You'll be glad you did.