Why Financial Privacy Matters in Gold Investing

The search to buy gold anonymously reflects a growing concern for financial privacy. However, the reality is more complex than many investors realize.

Quick Answer:

- True anonymity is nearly impossible due to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

- Cash purchases under $10,000 may avoid ID requirements at some dealers, but this is not guaranteed.

- Private sales carry significant risks, including fraud and counterfeit products.

- Maximum privacy with security is best achieved through reputable dealers with discrete practices.

The desire for discretion in precious metals investing is understandable. Many investors prefer to keep their financial strategies private for personal security or estate planning. While some dealers allow small cash purchases without ID, federal regulations require them to report suspicious activities and large transactions, making complete anonymity extremely difficult.

It's crucial to distinguish between buying gold privately through legitimate channels and attempting truly anonymous purchases that could violate reporting laws. This guide will help you steer these complex waters, focusing on strategies that maximize privacy and security within legal boundaries.

The Legal Labyrinth: Understanding KYC and Reporting Laws

Know Your Customer (KYC) and Anti-Money Laundering (AML) laws are the backbone of modern financial regulation, designed to prevent criminals from using the precious metals market to wash dirty money. The USA PATRIOT Act gave these regulations significant power, requiring dealers to verify customer identities and report suspicious activity.

The most well-known rule is the $10,000 cash transaction threshold. If you use cash for a purchase over this amount (or in a series of related transactions), the dealer must file a report with the IRS. However, certain gold items on the IRS's Reportable Items List also trigger reporting requirements, regardless of the payment method. Regulations in other regions, like the European Union, can be even stricter, with some countries requiring ID for purchases as low as €2,000.

Why Reputable Dealers Ask for Identification

When a reputable dealer like Summit Metals asks for your ID, it's not to be intrusive—it's to comply with the law and protect both you and their business. Compliance is mandatory. By following KYC rules, dealers actively prevent financial crime and protect you, the buyer. A dealer who skips these steps puts you at risk of future legal complications.

Transaction legitimacy is also crucial for when you decide to sell. Proper documentation from a reputable dealer proves you acquired your metals legally, building trust and ensuring you can liquidate your investment without issues.

Tax Implications of Gold Transactions

Regardless of how you buy gold anonymously or privately, any profit you make from selling it is subject to capital gains tax.

When you sell certain gold items back to a dealer, they may be required to file Form 1099-B with the IRS, reporting the proceeds. You are then responsible for calculating and reporting any gains on your tax return. Even private, person-to-person sales create a taxable event if you realize a profit.

Reporting profits to the IRS is not optional. Attempting to hide gains can lead to severe penalties. The smartest approach is to consult a tax professional who understands precious metals. Proper planning, such as using dollar-cost averaging through our Autoinvest program to establish a clear cost basis, can help you legally minimize your tax burden. For more on this, see Your Golden Compass: Navigating Investment Strategies.

How to Buy Gold with Maximum Privacy: Methods and Realities

While true anonymity is rare, you can maximize your financial discretion. The most viable options for private gold purchases involve private sales or transactions at local coin shops, though both come with unique challenges. Cash remains the most private payment method, as it doesn't leave an electronic trail like digital payments.

Practical Steps to Buy Gold Privately with Cash

The key to buying gold privately is to work within reporting thresholds. Most dealers do not require identification for small quantities purchased with cash, typically amounts well below the $10,000 reporting limit.

- Stay below reporting thresholds: Making multiple, smaller purchases over time is a common strategy. For example, instead of one $15,000 purchase, you might make three separate $5,000 purchases.

- Use in-person transactions: Paying with cash at a local coin shop creates no digital footprint connecting you to the purchase.

- Verify seller reputation: When operating outside of fully regulated channels, doing your homework is critical. Check business history, read reviews, and consider a small test purchase first. Building a relationship with a reputable local dealer is key.

The Reality of Anonymity When Buying Gold with Digital Payment Methods

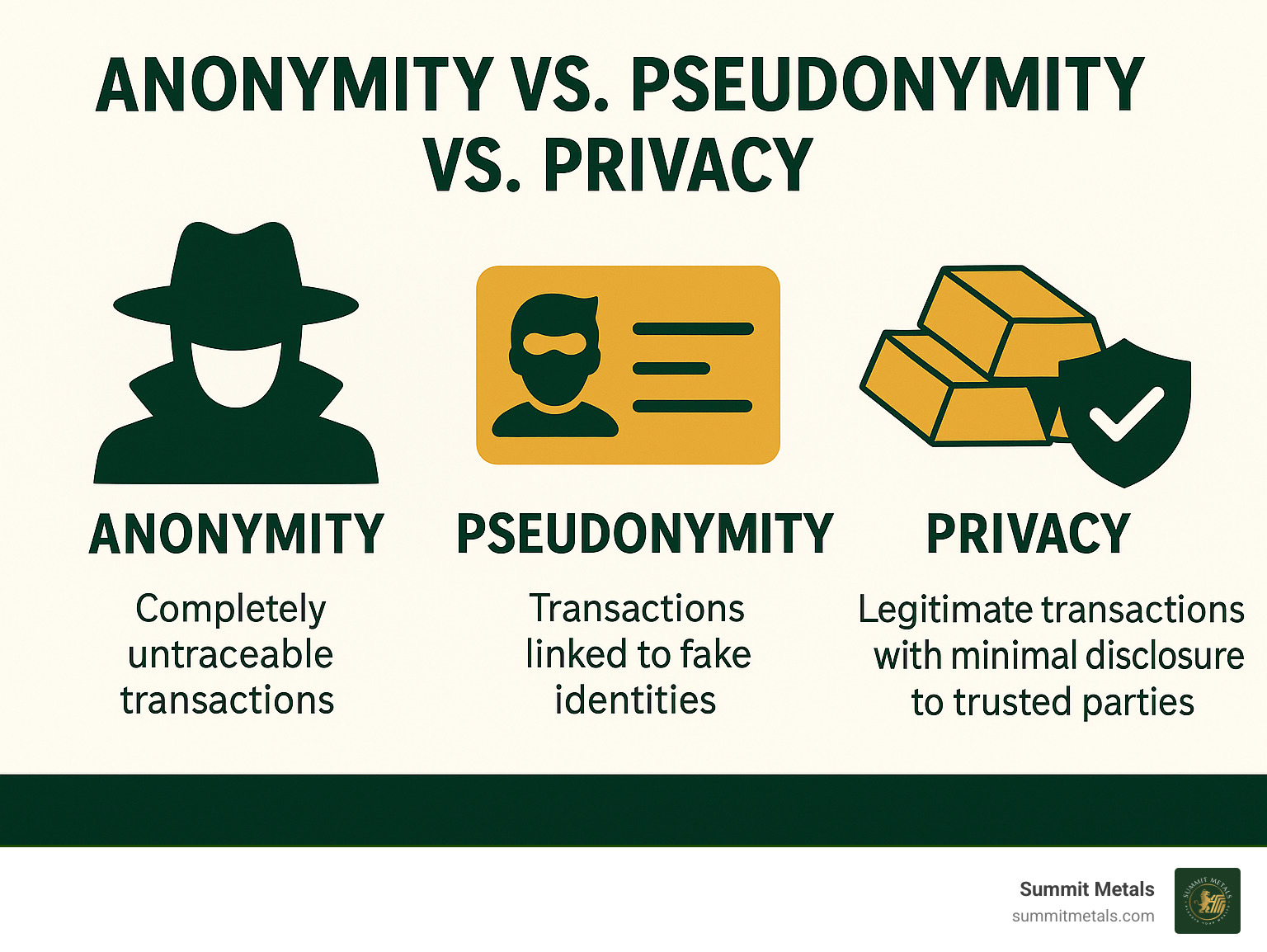

Using cryptocurrency to buy gold anonymously is a common misconception. Bitcoin transactions are not anonymous; they are pseudonymous. Every transaction is recorded on a public blockchain, and while your name isn't directly attached, sophisticated analysis can often trace transactions back to your identity.

Most reputable dealers have limited acceptance of crypto, and those who do still require ID for larger purchases to comply with KYC/AML laws. Even privacy-focused coins or mixing services don't guarantee anonymity when you convert digital assets into physical gold with a regulated dealer.

The bottom line: Digital payments offer some privacy but are not a truly anonymous solution. Cash remains the most private option, within its legal limits and risks.

Weighing the Risks vs. Rewards of Private Purchases

Let's be honest: the idea of buying gold anonymously sounds appealing, especially when we're concerned about financial privacy. But before we dive into private purchases, we need to have a serious conversation about what we're really getting into.

| Feature | Transparent Gold Purchases (Reputable Dealers) | Private Gold Purchases (Anonymous) |

|---|---|---|

| Risk of Scams | Very Low (due to reputation, guarantees, and legal compliance) | High (dealing with unknown individuals, lack of recourse) |

| Price Premiums | Fair, market-driven, with transparent dealer premiums | Can be lower or much higher; often less transparent |

| Legal Standing | Fully compliant with KYC/AML and tax laws; clear ownership records. | Potential for legal issues if thresholds are ignored; murky ownership. |

| Verifiability | Authenticity guaranteed by dealer and established supply chains. | Difficult to verify authenticity; high risk of counterfeit products. |

| Quality Assurance | High (LBMA certified, assays) | Low (no guarantees, difficult to assess purity without tools) |

| Recourse | Strong (legal protection, customer service, dispute resolution) | Very low to non-existent |

| Convenience | High (online ordering, insured shipping, secure storage options) | Variable (requires in-person meetings, cash handling) |

Counterfeit products and quality issues are rampant in the anonymous market. Investors can lose thousands on gold-plated tungsten bars or coins of lower purity than advertised. Furthermore, legal sanctions are a real possibility if you unknowingly cross reporting thresholds or purchase illicitly sourced gold. The potential financial loss often far outweighs any savings from avoiding dealer premiums.

How to Verify Gold Quality Without a Paper Trail

When buying privately, you are your own quality control. Here are some methods to verify authenticity:

- Check for reputable mint marks: Look for stamps from established government mints, but be aware that these can also be faked.

- Use an acid test: These kits can determine purity levels, though they leave a small mark on the metal.

- Try the magnet test: Pure gold is not magnetic. If a strong magnet attracts your item, it's not pure gold.

- Verify weight and dimensions: Gold has a specific density. Compare the item's weight and measurements to official specifications.

- Hire a professional appraiser: For significant purchases, an appraiser can use specialized equipment like X-ray fluorescence scanners for precise, non-destructive analysis.

For more details, see Going for Gold: Your Ultimate Guide to the Precious Metal.

Physical vs. Digital Gold: Which Offers More Privacy?

Physical gold offers far more privacy. Tangible assets like coins and bars can be bought with cash below reporting thresholds, creating a minimal paper trail. In contrast, digital gold accounts and ETFs are inherently traceable, as every transaction is linked to your brokerage account and Social Security number. Even gold-backed cryptocurrencies are pseudonymous and can often be traced. The trade-off for the privacy of physical gold is the responsibility of secure storage.

For insights on gold ownership, see Buy Physical Gold: The Growing Power Shift in the Gold Market from East to West.

Smart Alternatives: Prioritizing Privacy and Security

Chasing complete anonymity often leads to legal headaches and financial risks. The smarter approach is to focus on privacy and security through legitimate channels. A secure investment strategy should support your portfolio diversification and bring peace of mind, not create new problems. Reputable dealers understand the desire for discretion and offer ways to protect your privacy while remaining fully compliant.

Building Your Portfolio Discreetly with Reputable Dealers

Working with an established precious metals dealer provides benefits you won't find in a private sale. You get transparent pricing, authenticity guarantees, and insured shipping that protects your investment until it's in your hands. Many dealers also offer professional vault storage, enhancing both security and privacy by keeping your holdings off-site. The peace of mind from a dealer's authenticity guarantee alone is invaluable, eliminating the risk of buying counterfeit metal.

Learn more by reading How to Buy Gold and Silver Online Safely.

Automating Your Investment with "Autoinvest"

For privacy-minded investors, building a portfolio gradually is an excellent strategy. An "Autoinvest" plan accomplishes this by using dollar-cost averaging. You set up consistent monthly purchases, similar to a 401k contribution. This method mitigates market volatility, as your fixed dollar amount buys more gold when prices are low and less when they are high.

This system allows you to build wealth steadily without making single large transactions that might draw unwanted attention. Each purchase remains well below reporting thresholds while consistently growing your holdings. Summit Metals makes this easy: set up your monthly purchase once and let it run automatically. This systematic approach removes emotion from investing and ensures you're always building your stack.

For more on this strategy, read The Basics of Gold and Silver Stacking.

Comparison Charts to Guide Your Gold Purchase Decisions

One of the most common questions I hear from investors is whether they should buy gold anonymously in the form of coins or bars. This decision becomes even more important when privacy is a priority, as each option offers different advantages for discrete investing.

Let me break down the key differences that matter most when building your precious metals portfolio:

| Feature | Gold Coins | Gold Bars |

|---|---|---|

| Face Value | Yes, government-backed face value (e.g., American Gold Eagle) | No, value is based purely on melt weight and purity. |

| Fraud Protection | High. Intricate designs and government minting make them hard to counterfeit. | Lower. Simpler designs can be easier to counterfeit. Relies on assay cards and serial numbers which can be faked. |

| Liquidity | Very high. Globally recognized and easy to sell in smaller increments. | High, but larger bars can be harder to liquidate in portions. |

| Storage | Compact and easy to store in smaller quantities. | More space-efficient for bulk storage, but large bars are cumbersome. |

| Resale Market | Strong among collectors and investors. Premiums can be higher for rare coins. | Strong, driven by melt value. Premiums are typically lower than coins. |

| Premium over Spot | Often higher due to minting costs and design. | Generally lower, closer to the spot price of gold. |

| Privacy (relative) | Smaller denominations can be traded more discreetly below reporting thresholds. | Larger bars represent higher-value transactions, more likely to trigger reporting. |

Gold coins are often the better choice for privacy-focused investors. Government-backed coins like the American Gold Eagle have legal tender status, which acts as a powerful fraud deterrent. Their intricate, anti-counterfeiting designs are crucial when you can't rely on dealer guarantees in a private transaction.

The smaller denominations of coins also work in your favor, helping you stay below reporting thresholds. You can build a portfolio gradually with Summit Metals' Autoinvest program, accumulating coins over time. This flexibility is key—when it's time to sell, you can liquidate individual coins instead of an entire large bar, giving you more control and helping maintain your privacy. While bars have lower premiums, the security and flexibility of coins often justify the cost for a discreet investor.

Frequently Asked Questions about Buying Gold Privately

Here are answers to some of the most common questions about buying gold with privacy in mind.

What is the maximum amount of gold I can buy without ID in the US?

In the U.S., the federal guideline for reporting is for cash transactions over $10,000. A dealer is typically not required to ask for ID or file a report for cash purchases under this amount. However, this is not a guarantee of anonymity. Dealers can set their own, stricter policies and may ask for ID for any transaction. Furthermore, dealers are required to report any activity they deem suspicious, regardless of the amount or payment method. Structuring purchases to avoid the $10,000 threshold is illegal.

Are private, person-to-person gold sales taxable?

Yes. If you sell gold for more than you paid for it, the profit is a capital gain and is subject to tax. This applies to all sales, whether to a dealer or in a private, person-to-person transaction. The responsibility to report the gain on your tax return and pay the tax is yours, even if no Form 1099-B is issued. Failure to do so can result in significant penalties.

Is it safer to buy gold coins or gold bars for privacy?

For private transactions where you must verify authenticity yourself, gold coins are generally safer than gold bars. Government-minted coins, like the American Gold Eagle or Canadian Maple Leaf, have intricate designs, specific dimensions, and a legal tender face value that make them extremely difficult to counterfeit convincingly. This provides a layer of security that is harder to replicate in generic gold bars, whose assay cards and serial numbers can be faked. The recognizability of official coins makes them easier for a non-expert to verify.

Conclusion

The journey to buy gold anonymously is, as we've explored, legally complex and fraught with significant risks. True anonymity is largely a myth in today's regulated financial world, especially for substantial investments. Trying to achieve it often opens us up to the dangers of scams, counterfeit products, and serious legal repercussions.

A smarter and far more secure approach focuses not on absolute anonymity, but on privacy and security through transparent, legitimate channels. Building a precious metals portfolio should provide financial security and peace of mind, not legal anxiety or constant worry about authenticity.

We believe in empowering our clients with knowledge and providing a trusted path to investing. Summit Metals offers authenticated gold and silver precious metals, ensuring trust and value for investors. Our transparent, real-time pricing and competitive rates, achieved through bulk purchasing, mean we don't have to compromise on security or authenticity for the sake of discretion.

Start building your secure gold portfolio today by learning about Gold Bars vs. Coins