What Defines "Investment Grade" Gold?

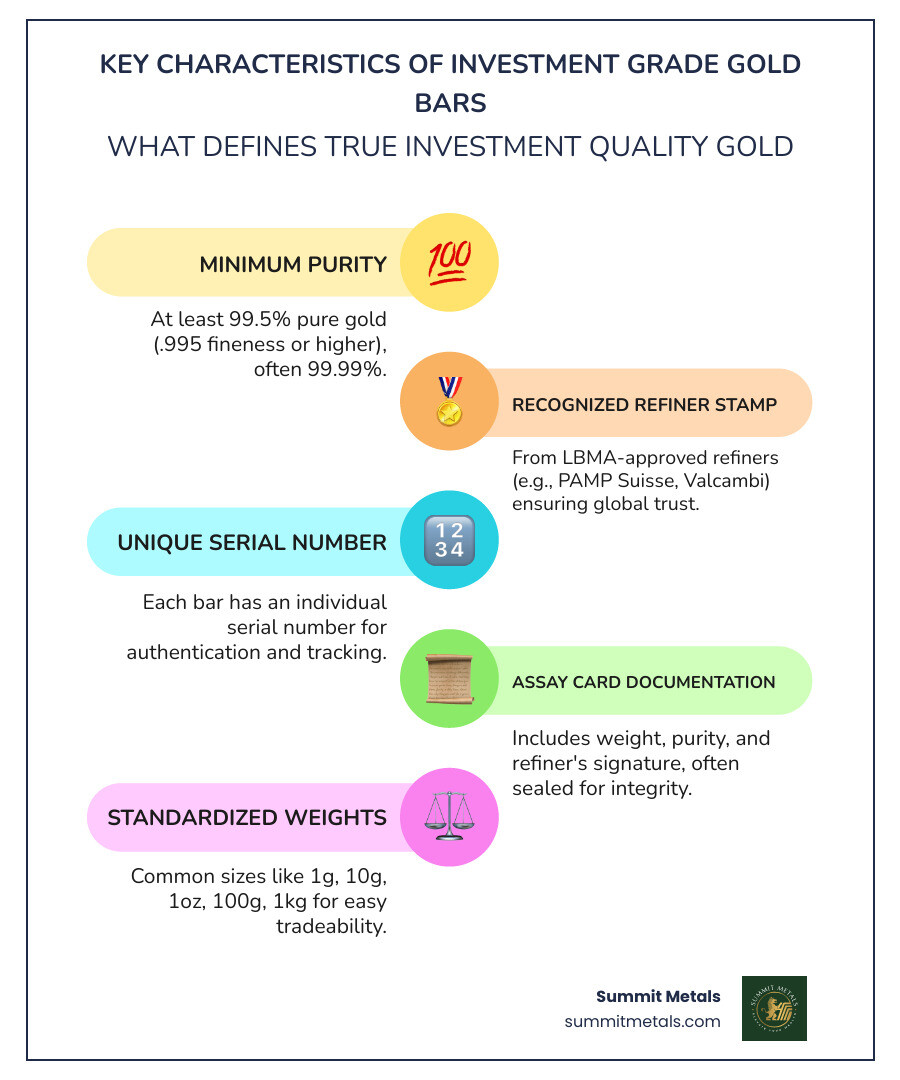

Investment grade gold bars represent one of the most direct ways to own physical gold, valued purely for their intrinsic metal content. Unlike jewelry or collectible coins, their worth isn't tied to artistic design or numismatic rarity, making them a cost-effective choice for investors. Here's what qualifies a gold bar as "investment grade":

- Minimum purity: 99.5% (.995 fineness) pure gold

- Recognized refiners: Produced by LBMA-approved or other reputable mints

- Proper documentation: Often includes assay cards with serial numbers, weight, and purity

- Standard forms: Available in weights from 1 gram to 1 kilogram and beyond

- Tax advantages: VAT-exempt in many jurisdictions (like the UK and EU)

Gold has served as a store of value for millennia, and today, both central banks and individual investors use it as a hedge against inflation and economic uncertainty. The beauty of gold bars lies in their simplicity. You're not betting on a company's stock price but holding a tangible asset that has maintained purchasing power across centuries—one that can't be devalued by government printing or monetary policy.

When we talk about investment grade gold bars, we're referring to gold that meets specific criteria ensuring it is highly liquid, globally recognized, and valued for its metal content. This distinction is crucial for investors who want their holdings to be easily tradable based on the global spot price.

The Purity Standard: From Karats to Fineness

The most critical aspect of investment grade gold bars is purity. A bar must contain at least 99.5% pure gold, expressed in fineness (e.g., .995, .999, or .9999). While jewelry uses karats, investment gold uses the more precise fineness measurement. The higher the purity, the closer the bar's value is to the pure gold spot price. This standard ensures you are paying for gold, not for less valuable alloyed metals.

The Role of the LBMA and "Good Delivery"

The London Bullion Market Association (LBMA) sets the global standard for the over-the-counter (OTC) bullion market. Its "Good Delivery List" is a roster of approved refiners whose bars meet stringent quality specifications. For an investment grade gold bar to be truly liquid worldwide, it should come from an LBMA-approved refiner. These standards are so trusted that central banks and large institutions exclusively use LBMA-approved bullion, often in the form of large 400-ounce "Good Delivery Bars," for their reserves. This oversight provides stability and trust in the international gold market.

A Guide to the Types of Investment Grade Gold Bars

Once you understand what makes a gold bar "investment grade," the next step is exploring the different types available. There's an option for every investor, from those just starting out to those making a substantial commitment. The variety in investment grade gold bars allows you to match your investment strategy to your financial goals, whether you prefer something small and affordable or a larger bar that offers better value per ounce.

Cast vs. Minted Bars: What's the Difference?

Investment grade gold bars come in two main styles, distinguished by their manufacturing process.

Cast bars are made by pouring molten gold into a mold. This creates a bar with a rustic, slightly irregular surface and a classic "poured gold" look. Because the process is simpler, cast bars typically have lower premiums over the spot price, making them a cost-effective choice for maximizing your gold holdings. Larger bars (1 kg and up) are almost always cast.

Minted bars undergo additional processing. They are cut to precise dimensions, polished reação, and stamped with intricate designs, the refiner's mark, purity, weight, and a serial number. This gives them a sleek, professional appearance. The extra steps mean a slightly higher premium, but many investors appreciate the aesthetic and improved security features. Smaller bars (up to 100 grams) are usually minted.

Both types contain the same amount of gold and hold the same intrinsic value. The choice comes down to whether you prioritize cost-efficiency or appearance. For a detailed comparison, check out The Ultimate Comparison of 1kg Swiss Gold Bars.

Common Weights and Reputable Refiners

Investment grade gold bars are accessible at various price points, with weights measured in grams (1g, 10g, 100g, 1kg) and troy ounces (1 oz, 10 oz). This variety makes it easy to start, no matter your budget.

Fractional bars (under one ounce) are excellent for new investors or those wanting flexibility, as they are easier to store and sell in small quantities. For those building wealth systematically, Summit Metals' Autoinvest program is an ideal solution. You can automatically purchase gold each month, similar to a 401(k) contribution, allowing you to build your position steadily over time without trying to time the market. Learn more about Autoinvest options here. For more on starting small, read Fractional Gold Bars: An Affordable Entry Point for Gold Investors.

The refiner's reputation is as critical as the bar's weight and purity. Stick with recognized names, preferably those on the LBMA Good Delivery List, to ensure your investment is liquid and trusted globally. Top-tier refiners include PAMP Suisse, Valcambi, and Argor-Heraeus from Switzerland, Australia's Perth Mint, and European giants like Metalor, Umicore, and Degussa. Buying bars from these refiners through a reputable dealer like Summit Metals ensures your investment maintains maximum value and tradability.

The Investment Case: Why Choose Gold Bars Over Coins?

When adding physical gold to your portfolio, you'll face a key choice: bars or coins? While both are valid investments, investment grade gold bars offer compelling benefits for serious investors focused on cost-efficiency.

Gold has earned its reputation as a portfolio stabilizer. It tends to hold its value—or even appreciate—when stocks fall or inflation rises, making it a powerful hedge. It's not about short-term gains but about holding a tangible asset that has preserved wealth for millennia. For a deeper look at gold's role in your strategy, see The Midas Touch: Exploring the Benefits of Gold Investment.

Gold Bars vs. Gold Coins: A Head-to-Head Comparison

Let's break down the practical differences. For investors focused on accumulating the maximum amount of gold for their money, bars are often the more cost-effective choice. However, coins offer unique advantages投资者 might find appealing.

| Feature | Investment Grade Gold Bars | Investment Grade Gold Coins |

|---|---|---|

| Premiums | Generally lower premiums over spot price, especially for larger sizes | Higher premiums due to minting costs, intricate designs, and legal tender status |

| Liquidity | Highly liquid, especially from recognized refiners. Resale value tied directly to gold content | Highly liquid and globally recognized. Easier to sell in smaller increments |

| Storage Efficiency | More space-efficient for larger quantities due to compact, stackable shape | Less space-efficient for the same weight due to protective capsules and bulkier designs |

| Legal Tender Status | Not legal tender. Value is purely based on gold content | Often legal tender (e.g., American Gold Eagle), with a face value protected by the issuing government |

| Counterfeit Protection | Rely on assay cards, serial numbers, and refiner hallmarks | Legal tender status offers additional fraud protection backed by government authority |

| Numismatic Value | None. Purely valued for metal content | Can develop collector value over time, potentially adding to the premium |

In short, investment grade gold bars get you more gold for your dollar. But coins, backed by governments as legal tender, offer an extra layer of confidence and fraud protection. For a complete analysis, check out Bars or Coins? Your Ultimate Gold Investment Showdown.

Understanding Premiums and Tax Benefits for investment grade gold bars

When you buy an investment grade gold bar, you pay a premium over the spot price to cover refining, manufacturing, and distribution. Understanding premiums helps you invest smarter.

Larger gold bars almost always have lower premiums per ounce due to economies of scale. It costs less per ounce to produce one 1-kilogram bar than ten 100-gram bars. If you're making a substantial purchase, larger bars mean you'll pay less in total premiums and get more gold for your money.

This principle works perfectly with dollar-cost averaging. At Summit Metals, our Autoinvest program lets you buy gold regularly, just like a 401(k) contribution. By purchasing a fixed dollar amount over time, you smooth out price fluctuations and build your holdings systematically, removing emotion from your investment decisions.

Regarding taxes, while some regions like the UK and EU offer VAT exemption for investment grade gold bars (as detailed in HM Revenue & Customs guidance), the US situation is different. In the United States, profits from selling gold are typically subject to capital gains tax. The IRS classifies precious metals as collectibles, which can mean a higher tax rate. We always recommend consulting a qualified tax professional, especially for investors in Utah and across the US, to understand the implications for your portfolio and explore tax-efficient structures like a self-directed IRA.

How to Buy and Secure Your Investment Grade Gold Bars

Once you've decided to invest in investment grade gold bars, the next steps are smart purchasing and secure storage. For investors in Utah and beyond, knowing how to verify and protect your assets is paramount. If you're considering larger quantities, Golden Opportunities Await: Mastering Bulk Gold Purchasing can guide you.

Verifying Authenticity: Protecting Your Purchase

Counterfeits are a real concern, but reputable refiners and dealers use multiple layers of protection to ensure you get the real deal.

- Assay Cards: Most minted bars come in tamper-evident packaging with an assay card listing the bar's unique serial number, weight, and purity. This card is the bar's certificate of authenticity.

- Serial Numbers: Unique serial numbers are stamped directly onto bars, corresponding to the assay card and creating a verifiable link.

- Refiner's Mark: Every legitimate bar bears the hallmark of its refiner. Familiarizing yourself with the marks of LBMA-approved refiners like PAMP Suisse or Valcambi helps you spot genuine products.

- Advanced Security: Modern refiners use cutting-edge technology. PAMP Suisse's Veriscan® technology creates a scannable surface profile, while Münze Österreich's KINEGRAM® is a holographic security element.

The most important step is buying from a reputable dealer. At Summit Metals, we sell only authenticated precious metals. We've done the verification for you, so you can invest with confidence.

Smart Storage Solutions for Your Gold

Where you store your investment grade gold bars depends on your holdings, risk tolerance, and need for access.

- Home Safes: Offer convenience and immediate access for smaller amounts. However, this option carries risks of theft and may have limited coverage under homeowner's insurance.

- Bank Deposit Boxes: Provide professional security at a local Utah bank. Access is limited to banking hours, and contents are not FDIC-insured, requiring separate private insurance.

- Professional Vaults: The gold standard for serious investors. Facilities like Citadel Global Depository Services offer state-of-the-art security and full insurance. Storing gold in a professional vault keeps it in the "chain of integrity," simplifying future sales by avoiding costly re-authentication.

Buying Online and Dollar-Cost Averaging Your Gold Investment

Buying gold online from a reputable dealer like Summit Metals offers significant advantages:

- Transparent Pricing: See real-time prices reflecting the current gold spot price.

- Wider Selection: Browse bars from multiple refiners and in various weights to fit your strategy.

- Convenience: Shop anytime, anywhere, without pressure.

- Competitive Rates: Our bulk purchasing power allows us to pass savings directly to you, giving you more gold for your dollar.

This is where smart investing meets modern convenience: dollar-cost averaging through our Autoinvest program. Like contributing to a 401(k), you can set up automatic monthly purchases of investment grade gold bars. This disciplined strategy removes emotion and market-timing stress. When prices are high, your fixed amount buys less; when prices dip, you automatically buy more, averaging your cost over time.

Put your gold investment on autopilot and watch your holdings grow. Explore our Autopay options to start building tangible wealth with a proven, methodical approach.

Frequently Asked Questions about Investment Grade Gold Bars

It's natural to have questions when starting with physical gold. Here are concise answers to the most common queries about investment grade gold bars.

What is the best size gold bar to buy for a new investor?

For new investors, the 1-ounce (1 oz) gold bar is often the best choice. It offers a great balance of affordability, low premiums, and high liquidity. The 100-gram (100g) gold bar is another excellent option for those with more capital, as it typically provides even better value per ounce.

While smaller fractional bars (1g, 5g, etc.) are an affordable entry point, they carry significantly higher premiums due to manufacturing costs, making them less ideal for serious wealth accumulation. For more on this, see Fractional Gold Bars: An Affordable Entry Point for Gold Investors.

Are all gold bars considered "investment grade"?

No. The term "investment grade" is specific. To qualify, investment grade gold bars must meet two key criteria:

- Purity: A minimum of 99.5% (.995 fineness) pure gold.

- Refiner: Produced by a recognized, reputable refiner, ideally one on the LBMA Good Delivery List.

Gold used in jewelry or bars from uncertified sources will not meet these standards and will lack the liquidity and trust of true investment grade bullion. Always look for the fineness mark (.999 or .9999) and a reputable refiner's hallmark.

Can I include investment grade gold bars in my IRA?

Yes, holding investment grade gold bars in a self-directed IRA is a smart way to add a tangible asset to your tax-advantaged retirement portfolio. However, you must follow IRS rules:

- Purity: The gold must be at least 99.5% pure. Most bars from top refiners easily meet this, often at .9999 purity.

- Storage: The IRS requires that IRA-held gold be stored with an approved custodian in a professional depository. You cannot take personal possession of it.

Working with a dealer like Summit Metals can help you steer the process of setting up a gold IRA correctly. For a complete overview, explore our IRA Gold Investment: A Comprehensive Guide to Securing Your Future.

Conclusion: Securing Your Wealth with Gold Bars

Investment grade gold bars offer a direct, cost-effective path to owning physical gold. By focusing on purity, reputable refiners, and smart purchasing, you can build a tangible store of wealth that stands apart from paper assets.

The beauty of gold bars is their simplicity. You accumulate pure gold at competitive rates, with larger bars offering lower premiums and more gold for your dollar. This makes them the ideal choice for investors focused on long-term wealth preservation.

For centuries, gold has been a reliable hedge against inflation and economic turmoil. It represents real, tangible wealth that cannot be devalued by policy decisions. Whether you are diversifying your portfolio or building a legacy, investment grade gold bars provide a time-tested solution.

At Summit Metals, we make gold investing accessible and strategic. Our Autoinvest program allows you to build your holdings systematically through dollar-cost averaging, removing emotion and market volatility from the equation. We are committed to your financial security, providing authenticated gold and silver with transparent, real-time pricing and competitive rates.

Ready to take the next step? Learn more about securing your future with an IRA Gold Investment and find how gold can strengthen your retirement strategy.