If you’ve ever wondered what a whole pound of silver is actually worth in cold, hard cash, you’re not alone. It’s a question that comes up more often than you’d think, especially when people hear silver prices quoted per ounce and start doing mental math.

Here’s the thing though – that mental math might be leading you astray. The answer isn’t as simple as multiplying by 16, because precious metals live in their own special world of weights and measures.

The short answer? As of mid-2025, one standard pound of pure silver is worth approximately $540, given silver’s current market price around $37 per troy ounce. But there’s more to this story, and understanding the details will help you make smarter decisions whether you’re buying, selling, or just trying to figure out what that silver collection in your closet is worth.

Whether you’re interested in coins for fractional ownership or bars for lower premiums, understanding pound-to-ounce conversions is crucial for any silver investor.

Let’s break it all down.

Troy Ounce vs Regular Ounce: Why Silver Weight Matters

Before we dive into calculations, we need to address the elephant in the room: precious metals are weighed differently than almost everything else in your daily life.

When you step on your bathroom scale or weigh ingredients for dinner, you’re using what’s called the avoirdupois system. But silver, gold, and other precious metals are measured using something called troy weight. This isn’t just a technicality – it actually changes the math significantly.

What Is a Troy Ounce? Silver Weight Explained

Here’s where it gets interesting:

Troy Ounce: Weighs about 31.1 grams (heavier than a standard ounce of 28.35 g). [This is the unit used for silver, gold, and other precious metals]

Troy Pound: Contains exactly 12 troy ounces (not 16!). One troy pound weighs about 373.2 grams. Interestingly, the troy pound isn’t commonly used in modern bullion trading – prices are almost always quoted per troy ounce.

Standard Pound (Avoirdupois): This is your everyday pound – the one used for groceries, body weight, and pretty much everything else in the U.S. It contains 16 standard ounces and weighs about 453.6 grams.

Here’s the key insight: If you put a pound of silver on a regular scale, that 453.6 g equals about 14.58 troy ounces of silver. In other words, a standard pound of silver contains about 2.58 more troy ounces than a troy pound (because troy ounces are heavier individual units).

Think of it this way: one standard pound of silver weighs roughly 80 grams more than one troy pound. Bullion dealers typically think in troy ounces, so that’s the system we’ll use throughout our calculations.

For practical investing, most dealers offer silver in standard troy ounce denominations like 1 oz coins, 5 oz bars, or 10 oz bars, making it easy to build up to pound quantities through multiple purchases.

Current Silver Spot Price: How Much Silver Costs Today

The spot price of silver is the live market value for one troy ounce of pure silver. This price moves throughout the day as silver trades on global exchanges around the world.

As of August 2025, silver is trading around $37 per troy ounce. This spot price becomes the foundation for determining how much any quantity of silver is worth.

But here’s something crucial to understand: silver’s price is anything but static. It rises and falls based on market conditions, and these swings can be dramatic.

Silver Price History: 25-Year Price Range Analysis

For perspective, silver’s price volatility over the past 25 years shows dramatic swings:

Silver’s 25-Year Price Range:

-

Lows: Around $4 per ounce (2001-2002)

-

Highs: Near $49 per ounce (April 2011 peak)

-

Current: $37 per ounce (2025) - on the higher end of historical range

Impact on Pound Values:

-

At $50/oz peak: One pound worth over $700

-

At $5/oz low: One pound barely worth $60

-

At $37/oz current: One pound worth approximately $540

This history shows just how much the value of a pound of silver can fluctuate over time. Today’s $37/oz price puts silver on the higher end of its historical range, reflecting strong demand and various economic factors in 2025.

It’s always wise to check an updated spot price when valuing your silver, since the market can move daily. You can find real-time silver prices on financial news sites or bullion dealer platforms – we publish current pricing based on the live spot market (not some outdated figure).

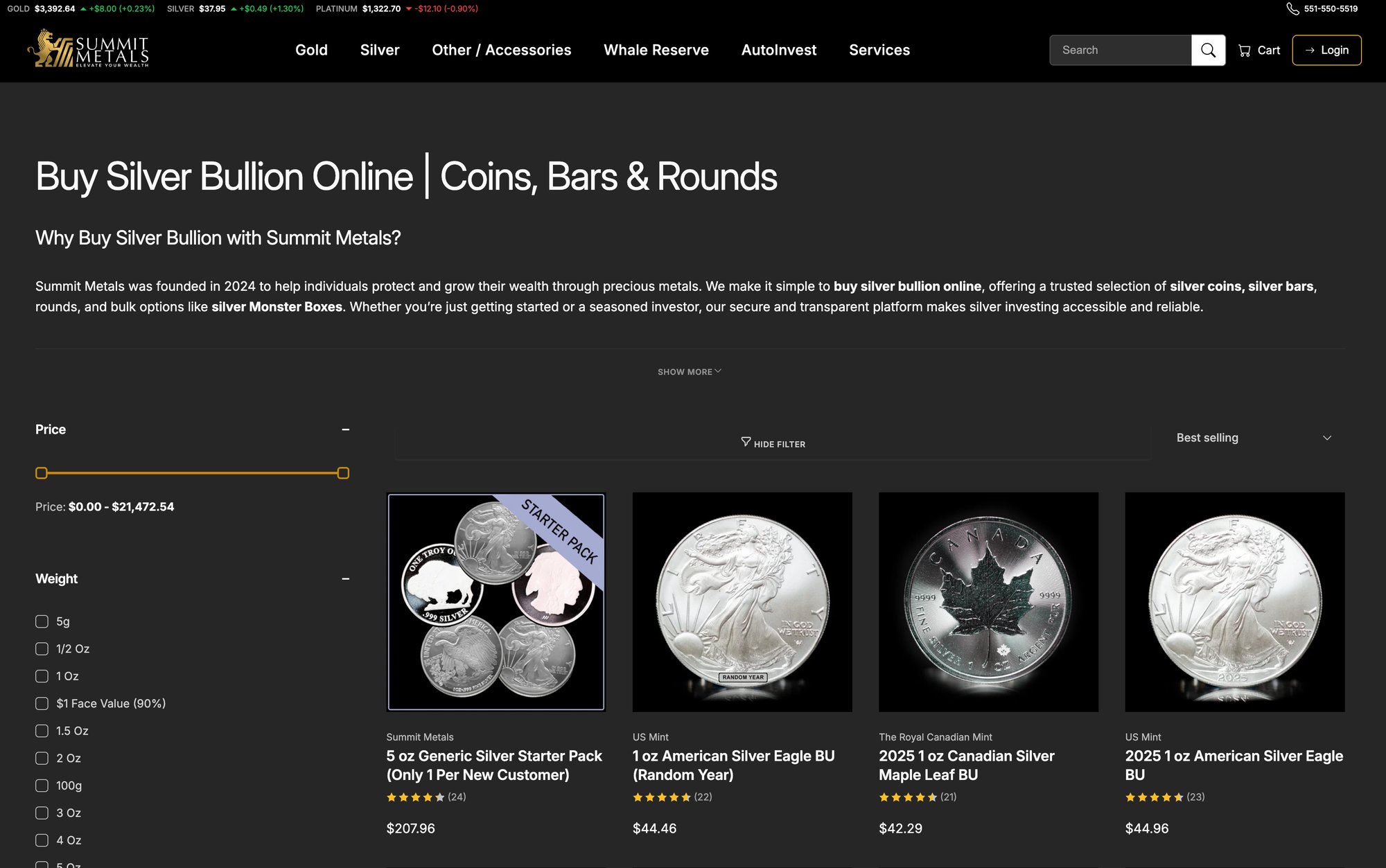

Whether you’re tracking prices for US Mint silver products like American Silver Eagles or Canadian silver coins like Maple Leafs, staying current with spot prices helps you recognize fair market value for any silver purchase or sale.

Silver Value Calculator: Converting Troy Ounces to Pounds

Now that we understand the weight systems and current pricing, let’s work through the actual calculations.

How to Calculate Silver Value: Step-by-Step Formula

Step 1: Identify the weight in troy ounces

-

If you mean a standard avoirdupois pound of silver (453.6 g), that equals about 14.58 troy ounces of silver

-

If you specifically had a troy pound, that’s exactly 12 troy ounces by definition

Step 2: Use the current spot price per troy ounce

- We’re using $37/oz as our example, since that’s roughly the market price at the moment

Step 3: Multiply to get the total value

Pound of Silver Value at Current Prices

Standard 1 lb of .999 silver (≈14.58 troy oz):

14.58 × $37 ≈ $540 in melt value

1 troy pound of .999 silver (12 troy oz):

12 × $37 = $444 (approximately)

Common Silver Calculation Mistakes to Avoid

Many people instinctively multiply the ounce price by 16, but this leads to an incorrect answer. Using 16 × $37 would give $592, which significantly overstates a pound’s value. The correct calculation uses approximately 14.58 troy ounces for a standard pound of silver.

So roughly $540 is the answer at today’s rates for a pound of pure silver.

If Silver Price Changes: Value Impact Examples

If the spot price moves, you can adjust the math accordingly:

If silver rose to $50/oz:

14.58 × $50 = $729

If silver dropped to $20/oz:

14.58 × $20 = $292

Once you know the weight conversion, you can always find the current answer with a calculator and the live spot price.

This calculation method works for any silver form – whether you’re evaluating premium government coins, lower-premium silver bars, or even bulk silver options for larger investments.

What Affects Silver Prices? 5 Key Market Factors

Understanding what makes silver prices move helps you better grasp why that pound of silver’s value isn’t carved in stone. Silver, like other commodities, responds to various market forces. Here are the major factors that influence silver’s price on any given day:

1. Industrial Silver Demand: Electronics and Solar Impact

Silver isn’t just for coins and jewelry – it’s a critical component in electronics, solar panels, medical instruments, and much more. High demand from manufacturers (for example, booming solar panel production) can drive up silver’s price. On the flip side, if industrial activity slows, it can soften demand.

This industrial demand factor affects all forms of physical silver, from specialty mint products to standard bullion bars, since the underlying commodity drives pricing across all product categories.

2. Silver as Safe Haven Investment During Market Uncertainty

Silver also shines as an investment metal. In times of economic uncertainty or high inflation, investors often flock to silver as a safe-haven asset, increasing demand and price. Surges in coin and bar buying (or silver ETFs) can push prices higher, especially when global investors seek refuge from volatile stock or currency markets.

This demand manifests across different silver forms – prestigious government coins often see premium increases during high-demand periods, while efficient bullion bars provide cost-effective exposure to silver’s safe-haven properties.

3. How Dollar Strength Affects Silver Prices

Since silver is traded globally in U.S. dollars, its price is inversely tied to the dollar’s strength. A weak dollar makes silver cheaper for overseas buyers, often lifting silver’s price in USD terms. Conversely, a strong dollar can put downward pressure on silver prices.

Think of it this way: if the dollar loses purchasing power, hard assets like silver become relatively more valuable.

4. Silver Mining Costs and Supply Impact on Prices

Silver’s price is partly determined by how much new silver comes out of the ground. If major mines slow production or shut down, supply tightens and prices tend to rise. Additionally, higher energy and labor costs make mining more expensive – if it costs miners more to produce each ounce, they need higher market prices to justify production.

Conversely, big new silver discoveries or improved mining efficiency can increase supply and potentially ease prices.

5. Economic Events That Drive Silver Price Changes

War, trade disputes, political instability, pandemics – events that shake investor confidence often boost safe-haven demand for precious metals, silver included. For example, during financial crises or geopolitical conflicts, silver buying may spike (along with gold) as people seek a stable store of value, driving prices up.

These factors often interact in complex ways. Silver’s dual role as both an industrial commodity and investment metal makes its price dynamics unique – it can be volatile, sometimes even more so than gold.

The main point is that the value of a pound of silver is not fixed. It ebbs and flows with market conditions, which is why staying informed about broader economic trends matters if you’re holding significant amounts of silver.

Silver Purity Types: .999 vs Sterling vs 90% Silver Value

So far, we’ve assumed pure silver (99.9% fine) in our pound calculations. But what if your silver isn’t pure? Many silver items – like old coins, jewelry, or silverware – are made of alloys (mixed metals) such as sterling silver, which is 92.5% silver. The purity directly affects the metal’s worth by weight.

Silver Purity Comparison

Purity Level |

Silver Content |

Value per Pound* |

Common Uses |

|---|---|---|---|

.999 Fine Silver |

99.9% pure |

≈$540 |

Modern bullion bars, investment coins |

Sterling Silver (.925) |

92.5% silver |

≈$500 |

High-quality tableware, jewelry, older coins |

90% Silver |

90% silver |

≈$486 |

Pre-1965 U.S. coins (“junk silver”) |

*Based on current $37/oz spot price

What Is .999 Fine Silver? Pure Silver Explained

This is basically pure silver, commonly used in bullion bars and modern investment coins. One pound of .999 silver contains one pound of actual silver (100% of its weight is silver), so our calculated values (≈**$540** at current prices) apply fully.

Sterling Silver Value: How Much Is .925 Silver Worth?

Sterling is 92.5% silver and 7.5% copper. It’s used in high-quality tableware, jewelry, and older silver coins. One pound of sterling silver contains 0.925 pounds of pure silver – roughly 420 grams of silver out of 453.6 g total.

This means a pound of sterling is worth about 92.5% of the value of a pound of pure silver. At today’s spot price, a pound of sterling silver would be around $500 in silver value (since 0.925 × $540 ≈ $500). The remaining weight is base metal that doesn’t add value in the melt calculation.

90% Silver Coins Value: Pre-1965 Coin Worth

Older U.S. coins (pre-1965 dimes, quarters, half-dollars) are 90% silver. One pound of such coins would have 0.90 pounds of pure silver content, worth about 90% of the pure-silver pound value (roughly $486 at current rates). Collectors call these “junk silver” coins, and they trade based on their melt value by weight. These pre-1965 US coins offer an accessible way to own fractional amounts of silver, often with lower premiums than modern US Mint silver products.

Silver Purity Impact on Value: Quick Reference

If you’re calculating the worth of a silver item, always adjust for purity. Multiply the total weight by the percentage of silver content, then apply the spot price. Most bullion products clearly state their purity (e.g., “1 oz .999 fine silver coin” or “Sterling”).

In a melt-value scenario (selling to a refiner or scrap buyer), you’ll only be paid for the actual silver weight. Always know what you have – pure versus alloy makes a real difference in value.

Silver Coin Premiums: Why Silver Costs More Than Spot Price

We’ve talked about spot value – the theoretical market value of raw silver. However, if you go out to buy a pound of physical silver, you’ll likely pay more than spot. And if you sell your silver, you might get slightly less than spot. These differences come from premiums and dealer spreads, which are important practical aspects of a metal’s “worth.”

Silver Coin Premiums Explained: Why Pay Over Spot?

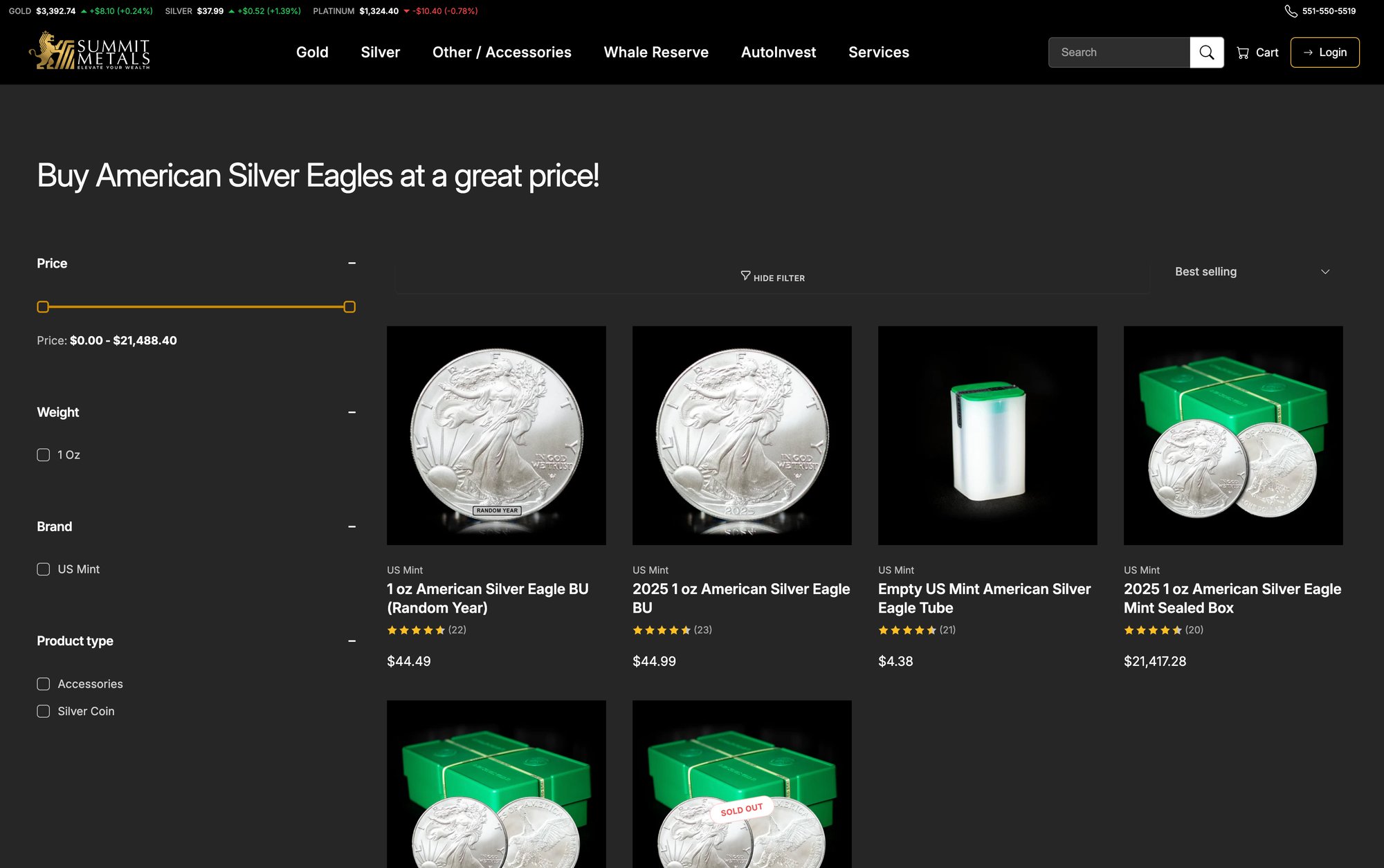

When you buy bullion (coins, bars, rounds), dealers add a premium over spot. This premium covers fabrication costs, distribution, and the dealer’s margin. Premiums vary significantly by product:

Silver Premium Comparison: Coins vs Bars vs Rounds

Government-Minted Coins (Higher Premiums):

-

American Silver Eagles: ≈$44 per ounce (vs. $37 spot = $7 premium, nearly 20%)

-

Canadian Silver Maple Leafs: Similar premium to Eagles

-

British Silver Britannias: Similar premium to Eagles

Private Mint Products (Lower Premiums):

-

Generic silver rounds: ≈$40 per ounce (vs. $37 spot = $3 premium, ~8%)

-

Larger silver bars: Lower premiums than coins

-

Private mint bars: More silver content per dollar spent

If you were buying a whole pound of silver, the form you choose affects the total price: 1-pound worth of Silver Eagles will cost more than 1-pound worth of generic silver bars, due to those per-ounce premiums.

Cheapest Way to Buy Silver: Building Large Positions

For building to pound quantities cost-effectively, many investors combine different forms:

Balanced Approach:

-

Some 1 oz silver coins for liquidity and recognition

-

Plus larger silver bars to minimize per-ounce premiums on bulk holdings

Bulk Optimization:

- 100 oz silver bars or bulk silver options often provide the best value per ounce

Middle Ground:

- 5 oz and 10 oz silver bars offer better premiums than 1 oz products while remaining more divisible than 100 oz bars

The trade-off: Well-known coins can be easier to resell and verify, whereas bars and rounds give you more silver for your dollar.

Selling Silver Coins: What Dealers Pay vs Spot Price

When selling physical silver, dealers typically pay just under the spot price (often called the bid price). The small difference between what they pay and the spot value represents the dealer’s profit for handling the transaction or refining the metal.

The spread can be very tight for common silver bars and coins in good condition (sometimes at spot or just a few percent below for desirable items), or wider for less common or damaged pieces. For instance, a shop might pay you slightly less per ounce for a bag of miscellaneous sterling scrap compared to a pristine 100 oz bar.

Liquidity matters: Widely recognized products (like a 1 oz Maple Leaf coin or a 100 oz COMEX bar) are easier for dealers to resell, so you’ll get closer to spot for those. Niche or obscure items might fetch less.

It’s always smart to check with multiple reputable sources for buyback quotes if you’re selling a large amount.

Choosing a Silver Dealer: Red Flags and Trust Signals

Because the value of a pound of silver is significant, trust becomes crucial in any transaction. You want to deal with reputable dealers whether buying or selling.

A trustworthy dealer provides clear, real-time pricing (no hidden markups or outdated quotes) and guarantees the authenticity and purity of their silver products.

At Summit Metals, we make this process transparent. Our live pricing system and buy-back program ensure you know exactly what your silver is worth when you buy or sell it. We pride ourselves on narrow bid-ask spreads for standard bullion products, reflecting fair market value.

Our transparent approach extends across our entire range, from premium government-minted coins to cost-effective private mint bars, ensuring you always know you’re getting fair value regardless of which silver products best fit your investment strategy.

All of our silver is independently tested with advanced methods (X-ray, electromagnetic analysis) before it’s shipped or placed in our vault. We also display live spot prices on our website and update product prices accordingly in real time.

In short, we don’t just sell silver – we verify it and price it transparently, so you can feel confident that the “pound of silver” you buy is exactly what it should be, and that you’re paying (or receiving) a fair price for its true silver content.

Silver Pound Value Today: Complete Price Breakdown

To recap the key points:

A pound of silver is worth approximately $500-$550 at recent market prices, but the exact number depends on several factors:

-

The weight standard (troy vs avoirdupois)

-

The current spot price

-

The purity of the silver

Always remember that precious metals are quoted in troy ounces – a fact that can change your calculation by several dozen dollars when figuring per-pound values.

Silver’s worth isn’t static. It fluctuates with supply and demand, economic sentiment, and currency values. Over time, prices can swing substantially, so the dollar value of a pound of silver in your possession today might be quite different next year.

How to Value Your Silver: Essential Tools and Tips

The good news is that with basic knowledge, you can easily estimate your silver’s value anytime:

-

Check the live silver price – many sources update by the minute. Our website shows up-to-the-minute spot prices

-

Multiply by the troy ounces you have – and adjust for purity if needed

-

Factor in the marketplace realities – if you’re buying, expect to pay a bit more (premium) for convenience or popular coins; if you’re selling, you may receive slightly less (the dealer’s buying price)

Silver Investment Strategies: Dollar-Cost Averaging and Storage

For investors looking to build silver positions systematically, consider options like dollar-cost averaging through subscription programs or secure storage solutions for larger holdings. Silver can also play a role in retirement planning through precious metals IRAs, providing portfolio diversification and inflation protection.

Many successful silver investors diversify across different product types – combining highly recognizable coins for liquidity with cost-effective bars for bulk accumulation. Automated investment programs can help you build toward pound quantities over time without trying to time the market.

Silver as Wealth Protection: Beyond Just Investment Returns

In the end, that pound of silver represents real, tangible wealth. At around $540, a pound of pure silver today could buy you a high-end smartphone, a week’s vacation, or a decent stock of groceries – not bad for a chunk of shiny metal!

Yet many investors hold silver for deeper reasons: as a hedge against inflation, an investment in industrial growth, or a form of savings outside of paper currency. Whatever your reason, understanding how silver is priced and measured helps you make informed decisions.

Silver Investment Strategy: Key Takeaways for Smart Buying

Knowledge is power in the precious metals world. Now that you understand how much a pound of silver is worth – and how to calculate it accurately – you’re better equipped to buy, sell, or simply appreciate those shiny ounces (or pounds) in your collection.

Stay informed, keep an eye on the market, and you’ll always get the most out of your silver holdings. And if you ever need guidance, we’re here to help with transparent pricing, quality bullion, and expert support every step of the way.

Whether you’re interested in starting with affordable 1 oz options, exploring specialty collectible silver, or need assistance with larger investment planning, we’re here to support your precious metals journey.

Happy stacking!

Sources: Recent market data and bullion industry references have been used to ensure accuracy and currency of information. Silver price and conversion figures are based on mid-2025 market conditions. Historical price range and factor analysis reference 25-year silver price trends and commodity research. Summit Metals operational details are cited to illustrate industry practices in purity assurance and pricing transparency. All monetary values are in U.S. dollars.