What Makes the 1 oz Gold Eagle America's Most Trusted Gold Coin?

The 1 oz eagle coin is the official gold bullion coin of the United States, produced by the U.S. Mint since 1986. If you're exploring this iconic investment, here's what defines it:

- Weight: 1 troy ounce of pure gold (31.1035 grams)

- Purity: 22-karat (91.67% gold, alloyed with silver and copper for durability)

- Total Weight: 1.0909 oz to account for alloy metals

- Face Value: $50 USD, backed by the U.S. government

- Diameter: 32.7 mm

- Design: Augustus Saint-Gaudens' Lady Liberty on the obverse; bald eagle on the reverse

- IRA Eligible: One of the few 22-karat coins approved for precious metals IRAs

The 1 oz eagle coin stands apart from other gold investments because it combines government backing, global recognition, and intrinsic metal value. Whether you're hedging against inflation, diversifying your portfolio, or building wealth through an Autoinvest strategy--where you dollar-cost average by purchasing gold monthly, just like contributing to a 401(k)--the Gold Eagle offers both security and liquidity.

I'm Eric Roach, and during my decade advising Fortune 500 clients on billion-dollar hedging programs in New York, I learned how institutional investors use gold to protect balance sheets--expertise I now apply to help everyday investors secure their futures with 1 oz eagle coin strategies. This guide will walk you through everything from design history and pricing to buying strategies and IRA eligibility.

Related content about 1 oz eagle coin:

The Anatomy of a 1 oz Eagle Coin: Design, History, and Specs

When you hold a 1 oz eagle coin, you're not just holding gold; you're holding a piece of American history and artistry. From its intricate designs to its precise specifications, every detail tells a story.

Historical Origins and Iconic Designs

The journey of the American Gold Eagle began with the Gold Bullion Coin Act of 1985, which authorized the U.S. Mint to produce these investment-grade coins. The first 1 oz eagle coin was struck in 1986, instantly becoming a symbol of American heritage and financial stability.

The coin's obverse (front) features one of the most revered designs in American numismatic history: Augustus Saint-Gaudens' iconic "Lady Liberty." This majestic full-length figure, with flowing hair, holding a torch of enlightenment and an olive branch of peace, was originally created for the 1907 $20 Double Eagle gold piece. President Theodore Roosevelt himself commissioned Saint-Gaudens to revitalize American coinage, and many consider this design the finest ever to grace a U.S. coin. For the Gold Eagle, Saint-Gaudens' design was thoughtfully updated to include additional stars, acknowledging Alaska and Hawaii's statehood.

The original reverse (back) design, known as the "Family of Eagles," was created by Miley Busiek (now Miley Tucker-Frost) in 1986. Her inspiration reportedly came from watching Ronald Reagan's acceptance speech in 1980. This powerful image depicts a male eagle soaring home to a nest where his mate and hatchlings await, a poignant symbol of family, strength, and security. Interestingly, this made it the first bullion coin whose design was created by a woman.

For many years, the date on the coin was rendered in Roman numerals (1986-1991), adding to its classic appeal. Since 1992, Arabic numerals have been used for clarity and consistency.

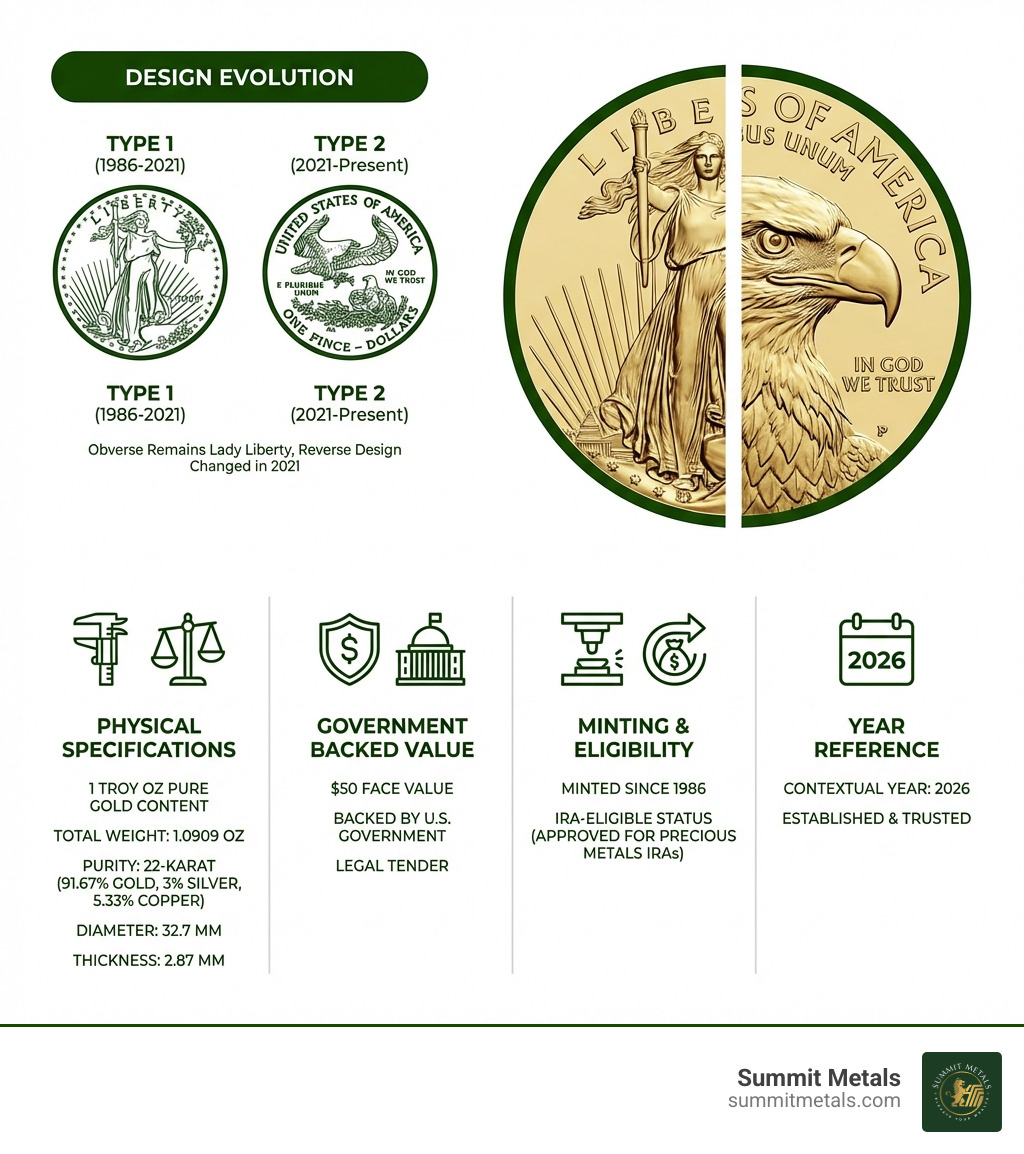

Understanding the Type 1 vs. Type 2 Design Change

A significant update occurred in 2021, marking the 35th anniversary of the American Gold Eagle program. This change introduced what collectors and investors now refer to as "Type 1" and "Type 2" designs.

The Type 1 design refers to the original reverse, featuring Miley Busiek's "Family of Eagles" motif, which was used from 1986-mid-2021.

The Type 2 design, introduced in mid-2021, features a stunning new reverse created by graphic designer and illustrator Jennie Norris. Norris, drawing on her experience as a volunteer raptor handler, designed a detailed, close-up portrait of a bald eagle's head. This "fresh take on a classic icon" symbolizes strength and freedom, and was accompanied by improved security features, though the specific details of these improvements are typically not publicly disclosed by the U.S. Mint. The obverse also saw subtle improvements in 2021, aimed at better reflecting Saint-Gaudens' original vision.

For collectors, the introduction of the Type 2 design created a unique collecting opportunity. The 2021 year saw both Type 1 and Type 2 1 oz eagle coin versions minted, with the 2021 Type 1 having a mintage of 456,500 and the 2021 Type 2 seeing 665,500 released. This makes the 2021 issues particularly significant for those keen on historical sets.

Specifications of the 1 oz eagle coin

The 1 oz eagle coin is engineered with precision, combining intrinsic value with remarkable durability. Here are its key specifications:

- Weight: Each coin contains exactly 1 troy ounce (31.1035 grams) of pure gold.

- Purity: The coin has a purity of 0.9167, which translates to 22-karat gold. This means it's 91.67% pure gold.

- Gross Weight: To account for the alloy metals, the total weight of a 1 oz eagle coin is 1.0909 troy ounces (33.931 grams).

- Alloy Composition: The remaining percentage (8.33%) of the coin's weight is an alloy of 3% silver and 5.33% copper. This specific blend is crucial; it improves the coin's durability and resistance to scratches and wear, making it robust enough for handling and long-term storage, unlike softer 24-karat (99.99% pure) gold coins.

- Diameter: The coin measures 32.7 mm (1.287 inches) across.

- Thickness: It has a thickness of 2.87 mm.

- Face Value: The 1 oz eagle coin carries a legal tender face value of US$50. This nominal value is symbolic; the coin's market value is tied directly to the spot price of its gold content, which far exceeds its face value.

These specifications, particularly the 22-karat purity, make the American Gold Eagle unique among gold bullion coins. It's one of the few 22-karat gold coins that are explicitly approved by the IRS for inclusion in a Precious Metals IRA, a testament to its trusted status.

Investing in Gold Eagles: Value, Pricing, and Strategy

Investing in 1 oz eagle coins offers a blend of security, liquidity, and a tangible connection to wealth. But understanding their true value goes beyond just looking at a price tag.

How is the price of a 1 oz eagle coin determined?

The price of a 1 oz eagle coin is a dynamic figure, influenced by several factors that reflect both the intrinsic value of gold and the coin's market appeal.

Spot Price of Gold: This is the most significant factor. The spot price is the current market price at which one troy ounce of gold can be bought or sold for immediate delivery. It fluctuates constantly based on global supply and demand, economic indicators, geopolitical events, and currency strength. When you see a "live gold price," that's the spot price. We at Summit Metals always provide transparent, real-time pricing, so you know exactly what the market is doing.

-

Premium Over Spot: This is the additional cost added to the spot price. The premium covers the costs of minting, distribution, dealer overhead, and a reasonable profit margin. Premiums for Gold Eagles are typically competitive, often ranging between 3.5% and 5% with reputable dealers. Several factors can influence this premium:

- Supply and Demand: High demand and limited supply (as seen in 2020 due to material and labor shortages at the U.S. Mint) can drive premiums higher.

- Market Fluctuations: During periods of economic uncertainty, investor demand for safe-haven assets like gold increases, which can also push premiums up.

- Coin Condition and Type: Proof and burnished coins, being collector-focused, generally command higher premiums than standard bullion coins. Graded coins (e.g., MS70) also carry higher premiums due to their certified quality and authenticity.

- Fractional Sizes: Smaller fractional Gold Eagles (1/2 oz, 1/4 oz, 1/10 oz) tend to have higher premiums per ounce compared to the 1 oz eagle coin because the fixed costs of minting are spread over less gold.

Dealer Fees: These are incorporated into the premium and cover the dealer's operational costs and profit. We pride ourselves at Summit Metals on competitive rates due to our bulk purchasing, ensuring you get the best value.

Mintage Figures: For collectors, lower mintage figures for a specific year can increase the coin's numismatic value, potentially leading to a higher premium beyond its melt value. We'll dig deeper into this later.

It's crucial for investors to understand that the price you pay for a 1 oz eagle coin will always be the spot price plus a premium. This "spread" is a normal part of the physical gold market.

Bullion, Proof, or Burnished: Which Finish is Right for You?

The American Gold Eagle series offers different finishes, each designed to appeal to distinct types of buyers - from pure investors to avid collectors. Understanding the nuances of each can help you choose the right 1 oz eagle coin for your portfolio.

Bullion Coins: These are the workhorses of the investment world. Struck for general circulation and investment, bullion coins are produced efficiently and in large quantities to meet investor demand. They are valued primarily for their gold content and are typically sold closest to the spot price of gold, with the lowest premiums among the three finishes. They don't have a mint mark. Bullion coins are perfect if your primary goal is to acquire physical gold as a hedge against inflation or for portfolio diversification.

Proof Coins: Produced specifically for collectors, proof coins are struck multiple times with specially prepared dies on polished planchets (coin blanks). This meticulous process results in a stunning mirror-like field and frosted, highly detailed raised design elements, creating a beautiful contrast. Proof coins often have lower mintages than their bullion counterparts and typically come in protective packaging from the U.S. Mint, accompanied by a Certificate of Authenticity. They bear the "W" mint mark of the West Point Mint. Due to their superior finish, limited production, and collector appeal, proof 1 oz eagle coins command significantly higher premiums than bullion versions.

Burnished Coins: Introduced in 2006 for the 20th anniversary of the series, burnished Gold Eagles are a unique collector's item. These coins are struck on specially prepared blanks that have been tumbled in a spinning drum with polishing media (historically wet sand, now often ceramic balls) to achieve a distinctive, frosted, matte-like finish. Each coin is hand-loaded into the coining press, making their production more labor-intensive than bullion coins. Like proof coins, burnished Gold Eagles bear the "W" mint mark from the West Point Mint and are often sold in original mint packaging. They offer a middle ground in terms of premium between bullion and proof, appealing to collectors who appreciate their unique aesthetic and lower mintage figures.

Here's a quick rundown of the key differences:

- Bullion: Investment-focused, high mintage, lowest premium, no mint mark.

- Proof: Collector-focused, aesthetic appeal, lower mintage, highest premium, "W" mint mark.

- Burnished: Collector-focused, unique matte finish, lower mintage, mid-range premium, "W" mint mark.

When deciding, consider your objective: are you seeking the most gold for your dollar (bullion), or are you also interested in numismatic value, aesthetics, and rarity (proof or burnished)?

The Strategic Benefits of Owning Gold Eagles

Owning 1 oz eagle coins offers a unique array of benefits, making them a cornerstone for many investment portfolios, especially here in Utah and Wyoming where tangible assets are often highly valued.

Here’s why we believe Gold Eagles are a smart choice, especially when compared to a standard gold bar:

| Feature | 1 oz Gold Eagle Coin | 1 oz Gold Bar |

|---|---|---|

| Government Guarantee | Backed by the U.S. government for weight and purity. | Backed by the private mint that produced it. |

| Legal Tender | Yes, has a face value of $50, which provides an extra layer of authenticity and legal protection against counterfeiting. | No legal tender status. |

| Liquidity & Recognizability | Instantly recognizable and accepted by dealers worldwide, making it easy to buy and sell. | Highly liquid, but may require assaying or verification, especially for lesser-known brands. |

| Durability | Made of a 22-karat gold alloy (91.67% gold), making it more resistant to scratches and damage. | Typically 24-karat (99.99% pure), which is softer and more susceptible to damage. |

| IRA Eligibility | Explicitly approved for inclusion in a Precious Metals IRA. | Only specific bars meeting certain fineness and manufacturing standards are eligible. |

| Collectibility | Certain years and types (like Proof or Type 1/Type 2) can have numismatic value beyond their gold content. | Generally valued for its gold content only, with little to no numismatic premium. |

These advantages make the 1 oz eagle coin a superior choice for many investors. It's not just a store of value; it's a highly liquid, government-guaranteed asset that's easy to trade and secure. This makes it an ideal vehicle for strategies like Autoinvest, where you can regularly purchase gold to build your holdings over time, similar to a 401(k) plan. For more insights into IRA eligibility, you can explore guides like Unlock Your IRA: The Definitive Guide to American Silver Eagle Eligibility, as the principles often apply to gold as well.

Frequently Asked Questions about the 1 oz Gold Eagle

We get a lot of questions about the American Gold Eagle, and for good reason! It's a significant investment, and understanding it fully is key. Here are some of the most common inquiries we receive:

Are American Gold Eagle coins a good investment?

Absolutely! We firmly believe that 1 oz eagle coins are a strong investment for several compelling reasons. They offer high liquidity, meaning they are easily bought and sold globally. Their backing by the U.S. government provides an unparalleled level of trust and assurance. Most importantly, as a tangible asset with intrinsic metal value, Gold Eagles serve as an excellent hedge against inflation, currency fluctuations, and economic uncertainty. When the stock market gets shaky, gold often provides a stable anchor for your portfolio. We've seen how gold acts as a vital form of financial insurance, protecting wealth when other investments falter. Plus, they have favorable reporting requirements with the IRS when it's time to sell, which can be a nice bonus.

What does "22-karat" mean for a Gold Eagle?

When we say a 1 oz eagle coin is "22-karat," it means the coin is 91.67% pure gold. The remaining 8.33% is an alloy, specifically 3% silver and 5.33% copper. You might wonder why the U.S. Mint doesn't make it 24-karat (99.99% pure), like some other bullion coins. The answer is simple: durability. Pure gold is quite soft and easily scratched or dented. By adding silver and copper, the coin becomes significantly harder and more resistant to wear and tear. This 22-karat standard was actually established for gold circulating coinage over 350 years ago, proving its effectiveness. It ensures your tangible investment can withstand handling and storage over the long term without losing its integrity.

Can I include 1 oz Gold Eagles in my IRA?

Yes, you certainly can! This is one of the most attractive features of the American Gold Eagle. Despite being 22-karat gold (which is less than the 99.9% purity typically required for IRA-eligible precious metals), American Gold Eagles are an unusual and explicit exception. They are specifically approved by the IRS for inclusion in a precious metals Individual Retirement Account (IRA). This makes them an exceptionally popular choice for long-term retirement savings, allowing you to diversify your retirement portfolio with physical gold, protected by the U.S. government's guarantee. For many investors, especially those looking ahead to their golden years, the ability to hold 1 oz eagle coins within a tax-advantaged IRA is a significant advantage. For more details on IRA eligibility for precious metals, you can refer to resources like Unlock Your IRA: The Definitive Guide to American Silver Eagle Eligibility – the principles often extend to gold as well.

Conclusion: Securing Your Piece of American Legacy

The 1 oz eagle coin is more than just a piece of gold; it represents a unique combination of American history, artistry, and sound investment. Its iconic design, rooted in the legacy of Augustus Saint-Gaudens, speaks to a heritage of excellence, while its meticulous specifications ensure a tangible asset of enduring value.

From its historical origins and the thoughtful evolution of its design (from Type 1 to Type 2), to its precise weight and 22-karat purity, every aspect of the 1 oz eagle coin reinforces its status as a premier choice for investors. We've explored how its price is determined by the interplay of spot gold and premiums, and how different finishes - bullion, proof, and burnished - cater to various investment and collecting preferences.

The strategic benefits of owning 1 oz eagle coins are clear: they offer portfolio diversification, act as a powerful hedge against economic uncertainties, and provide the security of a tangible, government-backed asset. With its IRA eligibility, it stands as a cornerstone for long-term financial planning.

At Summit Metals, based in Wyoming with locations in Salt Lake City, Utah, we understand the importance of trust and transparency in precious metals. We provide authenticated gold and silver, offering clear, real-time pricing and competitive rates, so you can make informed decisions with confidence. Whether you're making a one-time purchase or embracing the power of an Autoinvest strategy to consistently build your wealth over time, the 1 oz eagle coin is a timeless asset that secures your financial future.

Ready to add this piece of American legacy to your portfolio? Find more about these remarkable coins and how we can help you acquire them. Everything You Need to Know About American Eagle Coins.