Why Understanding Junk Silver Value Protects Your Investment

How much is a pound of junk silver worth depends on three key factors: the silver content (typically 90% or 40%), the current spot price, and the coin's weight in troy ounces. Here's the quick answer:

Current Melt Value (as of publication):

- 1 pound of 90% silver coins ≈ 10.5 troy ounces pure silver = $987 (at $94/oz spot)

- 1 pound of 40% silver coins ≈ 4.7 troy ounces pure silver = $442 (at $94/oz spot)

- $1 face value of 90% silver = 0.715 troy ounces = $67.48

These values fluctuate daily with the silver spot price. Dealer premiums typically add 2-15% above melt value.

If you've inherited a jar of old quarters or found silver coins at an estate sale, you're holding what investors call "junk silver"—pre-1965 US coins containing 90% silver. Despite the name, these coins are a recognizable and liquid form of silver investment. Unlike modern commemorative coins, junk silver's value tracks the silver market directly, as it carries no numismatic premium for most common dates.

The challenge is that most people don't know how to calculate its true worth. Scammers exploit this knowledge gap, offering pennies on the dollar. During past silver price spikes, uninformed sellers lost thousands by accepting lowball offers.

Understanding how much a pound of junk silver is worth is crucial for making informed decisions, whether you're selling, hedging against inflation, or diversifying your portfolio. The calculation requires converting standard pounds to troy ounces, accounting for silver purity, and applying the current spot price. Missing a step means you could overpay when buying or get shortchanged when selling.

At Summit Metals, we believe precise valuation is the foundation of every sound investment. We help investors apply institutional discipline to their precious metals holdings, ensuring they get fair value every time.

What is Junk Silver and Why is it Valuable?

"Junk silver" is a term for pre-1965 United States dimes, quarters, and half dollars, which were minted with 90% silver content. Also known as "Constitutional Silver," these coins were legal tender before the U.S. government removed silver from circulating coinage with the Coinage Act of 1965.

The switch occurred because rising silver prices made the coins' melt value exceed their face value, leading to hoarding. From 1965 to 1970, some Kennedy half dollars were minted with a reduced 40% silver content, while dimes and quarters became silver-free.

These old coins are valuable to investors for several key reasons:

- Guaranteed Silver Content: Each 90% silver coin contains a precise, verifiable amount of silver, making it a predictable asset.

- Divisibility: Unlike large silver bars, junk silver comes in small denominations, making it easy to liquidate small amounts for flexible transactions.

- Recognizability: As former U.S. currency, these coins are universally identified, reducing the need for complex authentication.

- Inflation Hedge: Like other precious metals, silver has historically served as a hedge against inflation, protecting wealth when fiat currency loses purchasing power.

- Cost-Effective: Junk silver often trades with lower premiums compared to modern bullion coins, making it an efficient way to acquire physical silver based on metal content.

For more historical context on how silver coinage and bullion standards developed over time, you can review the background of early English coinage such as the history of Henry II of England, who introduced key reforms that influenced later monetary systems.

Common Types of US Junk Silver Coins

To identify true junk silver, look for these common coins. Always check the date—a 1965 dime has no silver, but a 1964 dime is 90% silver.

- Roosevelt Dimes (1946-1964): 90% silver.

- Mercury Dimes (1916-1945): 90% silver.

- Washington Quarters (1932-1964): 90% silver.

- Standing Liberty Quarters (1916-1930): 90% silver.

- Walking Liberty Half Dollars (1916-1947): 90% silver.

- Franklin Half Dollars (1948-1963): 90% silver.

- 1964 Kennedy Half Dollars: The only Kennedy half with 90% silver.

- 1965-1970 Kennedy Half Dollars: Contain a reduced 40% silver content.

How to Calculate the Value of Your Junk Silver Holdings

Figuring out how much is a pound of junk silver worth requires attention to a few key details: silver purity, weight, and the current market price of silver.

The primary drivers of value are:

- Silver Spot Price: The live market price for one troy ounce of pure silver, which fluctuates based on global supply and demand.

- Silver Purity: Junk silver is either 90% or 40% pure silver.

- Weight: Precious metals are weighed in troy ounces, not the standard (avoirdupois) ounces. One standard pound equals about 14.583 troy ounces.

A Simple 5-Step Calculation

Let's break down how to calculate the melt value of your junk silver.

Step 1: Identify & Sort Your Coins Separate your coins by type and check the mint date.

- 90% Silver: Dimes, quarters, and half dollars dated 1964 and earlier.

- 40% Silver: Kennedy half dollars dated 1965-1970.

- No Silver: Dimes and quarters dated 1965+ and Kennedy halves dated 1971+ are clad and contain no silver.

Step 2: Determine Purity (90% or 40%) This is determined by the coin's date and type, as identified in Step 1.

Step 3: Weigh in Troy Ounces Use a digital scale set to troy ounces for the most accurate weight. If you don't have a scale, you can use these standard values for actual silver content (ASW):

- $1 face value of 90% silver coins = 0.715 troy ounces of pure silver.

- $1 face value of 40% silver coins = 0.1479 troy ounces of pure silver.

Step 4: Find the Live Silver Spot Price The silver spot price changes constantly. For an accurate valuation, check a live price from a reputable source. You can find real-time pricing on the Summit Metals website or major financial news outlets. For our examples, we'll use a hypothetical spot price of $94.37 per troy ounce.

Step 5: Use the Melt Value Formula The formula is simple:

Total Silver Value = (Total Troy Ounces of Pure Silver) x (Current Silver Spot Price)

To calculate using face value:

Value (90%) = (Total Face Value) x 0.715 x (Spot Price)

Value (40%) = (Total Face Value) x 0.1479 x (Spot Price)

How Much is a Pound of Junk Silver Worth? A Step-by-Step Example

Let's calculate how much is a pound of junk silver worth. A standard "pound" is an avoirdupois pound, but precious metals are measured in troy ounces.

- 1 Avoirdupois Pound = 14.583 Troy Ounces

Due to the alloy composition and slight wear on circulated coins, a simple rule of thumb is used to find the actual silver weight (ASW) in a bulk quantity.

Example Calculation for 1 Pound of 90% Junk Silver:

- One pound (14.583 troy ounces) of 90% silver coins contains approximately 10.5 troy ounces of pure silver.

- Using our example spot price of $94.37/troy ounce:

- Value = 10.5 troy oz * $94.37/troy oz = $990.89

Example Calculation for 1 Pound of 40% Junk Silver:

- One pound (14.583 troy ounces) of 40% silver coins contains approximately 4.7 troy ounces of pure silver.

- Using our example spot price of $94.37/troy ounce:

- Value = 4.7 troy oz * $94.37/troy oz = $443.54

The spot price of silver changes by the minute, so always check the live price before buying or selling. The table below shows how the melt value of a pound of junk silver changes with the market.

| Silver Spot Price (per troy oz) | 1 lb 90% Junk Silver (10.5 troy oz pure) | 1 lb 40% Junk Silver (4.7 troy oz pure) |

|---|---|---|

| $20 | $210.00 | $94.00 |

| $50 | $525.00 | $235.00 |

| $94.37 (current example) | $990.89 | $443.54 |

| $100 | $1,050.00 | $470.00 |

| $150 | $1,575.00 | $705.00 |

Note: These are melt values only and do not include dealer premiums or potential numismatic value.

Beyond Melt Value: Premiums, Exit Strategies, and Smart Investing

While melt value is the baseline, it's not the final price you'll pay or receive. Other factors are crucial for a smart investment strategy.

Dealer Premiums

Dealers charge a "premium" above the spot price to cover their business costs and profit. For junk silver, this premium is typically 2-15% but varies with market demand, quantity, and product type. When selling, dealers buy back at a price slightly below spot.

Numismatic Value

Most junk silver's value is tied to its silver content. However, rare dates, mint marks, or coins in exceptionally high-grade condition can command a "numismatic premium" far above their melt value. For example, a rare 1916-D Mercury Dime is worth much more to a collector than a common 1945 dime. For most worn, common-date coins, numismatic value is negligible.

Exit Strategies and Liquidity

Smart investing requires a clear exit strategy from day one. Junk silver is highly liquid due to its recognizability and divisibility, making it easy to sell. At Summit Metals, we guide you through both buying and selling with transparent pricing and a streamlined process.

Consider a secure exit from the start. Private vault storage, such as in Salt Lake City, Utah, offers security and simplifies liquidation. Stored metals can be sold or transferred quickly, making them highly liquid. When you are ready to realize gains or rebalance your portfolio, you can easily sell to us and convert your holdings back into cash with clear, real-time pricing.

Building Your Holdings with Dollar-Cost Averaging

Dollar-cost averaging (DCA) is an effective strategy for building a silver position over time. It involves investing a fixed amount at regular intervals, which mitigates volatility and removes the emotion from trying to time the market.

Summit Metals' Autoinvest program is designed for disciplined DCA. Much like contributing to a 401k, you can set up automated monthly silver purchases with Summit Metals, buying a consistent dollar amount of junk silver or other bullion each month. This approach helps you build your position steadily, smooths out price swings, and keeps you on track without constant monitoring.

You can customize your Autoinvest plan to match your budget and goals, then let the automated purchases accumulate over time. Set up your monthly silver investment with Autopays and watch your stack grow automatically.

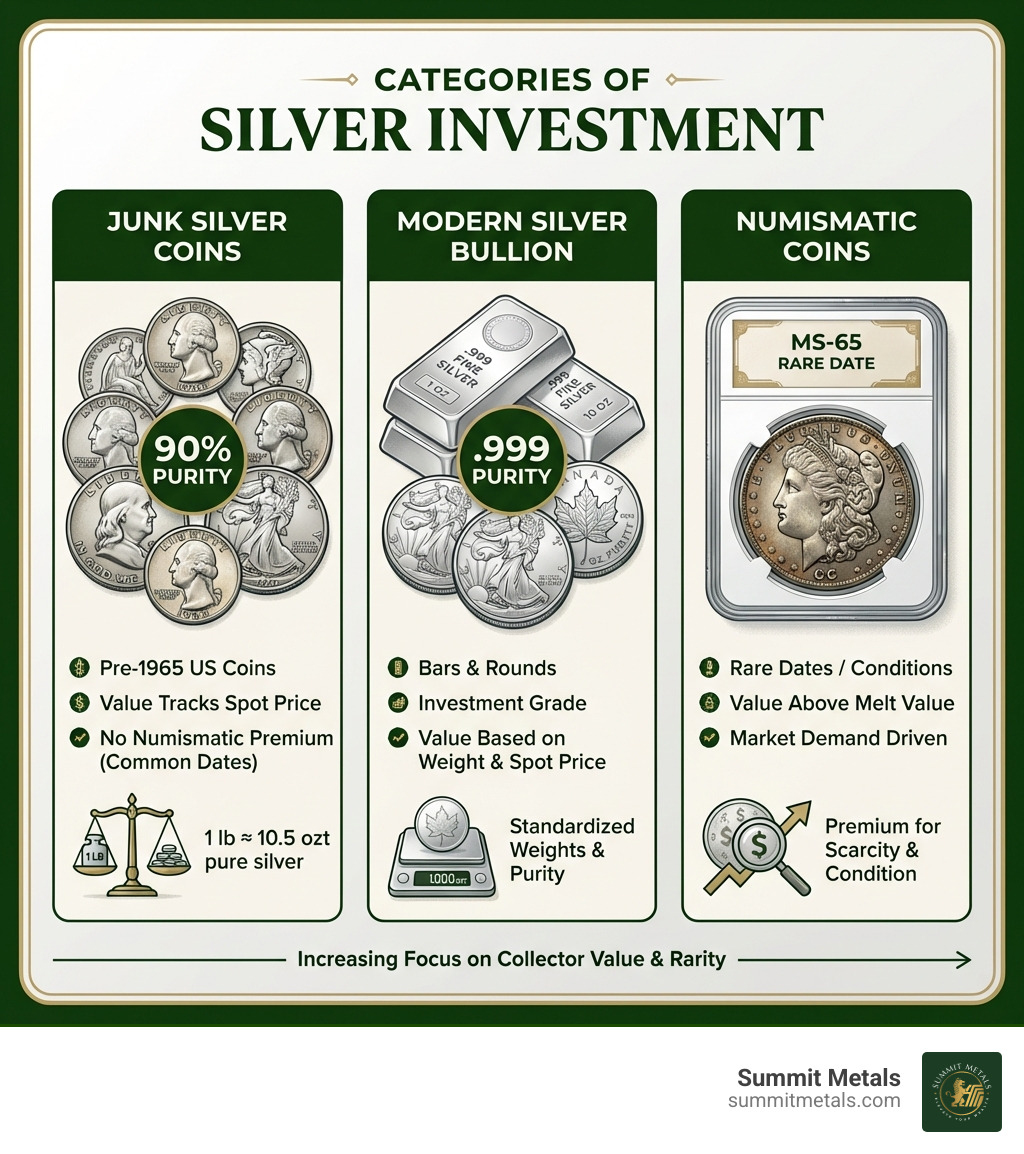

Comparing Junk Silver, Modern Bullion Coins, and Silver Bars

Different silver products serve different roles in a portfolio. Junk silver, modern bullion coins, and bars each have strengths depending on whether you prioritize recognizability, divisibility, or the lowest cost per ounce.

| Feature | Junk Silver Coins (Pre-1965 US) | Modern Bullion Coins (e.g., 1 oz .999 Silver Coins) | Silver Bars (.999 Fine) |

|---|---|---|---|

| Typical Purity | 90% (or 40% for certain halves) | .999 or .9999 | .999 or .9999 |

| Denominations | Dimes, quarters, halves | Usually 1 oz with legal tender face value | 1 oz, 5 oz, 10 oz, 100 oz, kilo, etc. |

| Divisibility | Excellent (small coin values) | Good (1 oz units) | Lower (larger units) |

| Recognizability | Very high as former U.S. currency | High among investors; backed by sovereign mints | High among dealers; less familiar to general public |

| Premiums Over Spot | Low to moderate | Moderate (often higher per ounce than large bars) | Lower per ounce, especially on larger bars |

| Potential Numismatics | Limited, mostly for key dates | Some special issues may gain collector value | Generally none |

| Best Use Case | Barter potential, emergency liquidity, small transactions | Blending recognizability, legal tender status, and bullion purity | Maximizing silver per dollar, large long-term holdings |

Because modern bullion coins also carry a legal tender face value, they introduce an additional layer of protection in some jurisdictions and are widely trusted as fraud-resistant, government-issued products. Junk silver coins share this advantage as former legal tender, giving you both metal content and strong recognizability when it is time to sell or trade.

Frequently Asked Questions about Junk Silver Value

How much is a pound of junk silver worth today?

The value changes daily with the live spot price of silver. As calculated, one pound of 90% junk silver contains about 10.5 troy ounces of pure silver, and one pound of 40% junk silver contains about 4.7 troy ounces.

To find the current value, multiply the pure silver weight by the current spot price. For example, at $25/oz, a pound of 90% junk silver is worth $262.50 (10.5 oz * $25). Always check the live spot price before any transaction.

Where can I find reliable junk silver prices?

Reliable, real-time silver prices are crucial. Good sources include:

- Reputable Online Dealers: Many dealers, including Summit Metals, display live spot prices on their websites.

- Financial News Websites: Major financial news outlets provide live commodity prices.

- Commodity Exchanges: The London Bullion Market Association (LBMA) and the COMEX are key global entities in setting silver prices.

The price you see is the spot price. The price you buy or sell at will include a dealer premium or discount.

How much is a pound of junk silver worth compared to a pound of silver bars?

This question highlights different investment goals. A pound of .999 fine silver bars contains more pure silver (14.583 troy ounces) than a pound of 90% junk silver (10.5 troy ounces). However, the choice depends on your strategy.

| Feature | 90% Junk Silver Coins | .999 Fine Silver Bars/Rounds |

|---|---|---|

| Purity | 90% pure silver (alloyed with copper). | .999 or .9999 fine silver (99.9%+ pure). |

| Recognizability | Highly recognizable as former U.S. currency. | Recognizable as bullion, but less so to the general public. |

| Divisibility | Excellent; easily divided into small units (dimes, quarters). | Low; typically sold in 1 oz+ units. |

| Premiums | Often have slightly higher premiums per ounce than large bars due to handling and divisibility (2-15%+ over spot). | Generally lower premiums per ounce, especially for larger bars (1-10%+ over spot). |

| Numismatic Value | Usually none, but rare dates or high-grade coins can have significant collector value. | Typically none; value is based purely on silver content. |

| Weight per Pound | 1 lb (avoirdupois) = approx. 10.5 troy ounces of pure silver. | 1 lb (avoirdupois) = approx. 14.583 troy ounces of pure silver. |

| Best For | Emergency preparedness, barter, small transactions, and investors who value historical currency. | Maximizing silver per dollar, large-scale investing, and IRA-eligible holdings. |

| Pros | - Highly recognized and divisible. - Lower entry cost per piece. - Historical significance. |

- Higher purity. - Lower premiums on larger sizes. - Compact storage for large amounts. - Often IRA-eligible. |

| Cons | - Lower purity. - Bulkier for large storage. - Slightly higher premiums per pure ounce. |

- Not easily divisible. - Less recognized by the public. - Higher premiums on small fractional sizes. |

The choice between junk silver and silver bars depends on your goals. Junk silver is excellent for divisibility and recognizability. Silver bars are better for maximizing silver content per dollar. Many savvy investors hold a mix of both!

Conclusion

Understanding how much is a pound of junk silver worth is a fundamental skill for any precious metals investor. The true value of your junk silver hinges on three components: its silver purity (90% or 40%), its weight in troy ounces, and the current live spot price of silver.

By applying these principles, you can accurately calculate the melt value of your holdings, protect yourself from scams, and make informed investment decisions. Don't let the term "junk" fool you; these coins are a tangible and liquid store of wealth.

At Summit Metals, we provide transparent, real-time pricing to empower our clients. Whether you're starting out, expanding your holdings with our Autoinvest program, or planning an exit strategy, we offer the insights and services you need for confident investing.

Ready to learn more? Explore more precious metal investment insights on our blog or contact us today. We are committed to ensuring you get fair value, every time.