Why Silver Coins Are Your Gateway to Precious Metals Investment

How do I buy silver coins is one of the most common questions from investors looking to diversify their portfolios with precious metals. Here's your quick answer:

- Choose reputable online dealers like Summit Metals for authentic products and competitive pricing

- Start with popular bullion coins such as American Silver Eagles or Canadian Silver Maple Leafs

- Understand the total cost including spot price plus premiums

- Ensure secure storage through home safes, bank deposit boxes, or professional depositories

- Verify authenticity by buying from trusted dealers with proper certifications

Silver coins offer a tangible way to protect your wealth against economic uncertainty. Unlike digital assets that can be hacked or erased, physical silver provides real ownership of a precious metal that has served as money for thousands of years.

The appeal is clear: silver serves as both an inflation hedge and portfolio diversifier. Research shows that silver's annual gains correlate with large company stocks only about 40% of the time, making it an effective counterbalance to traditional investments. Plus, with industrial demand driving 90% of silver consumption, this precious metal offers unique upside potential.

Whether you're concerned about market volatility, currency debasement, or simply want to own something tangible, silver coins provide an accessible entry point into precious metals investing. At current prices, you can start building a position without the higher costs associated with gold.

I'm Eric Roach, and my decade-plus experience in investment banking and M&A has taught me how Fortune-500 companies use precious metals to hedge risk and preserve capital. I've helped countless investors understand how do I buy silver coins and build defensive strategies that protect wealth through market cycles.

Why Invest in Silver Coins? Understanding the Appeal

If you're wondering how do I buy silver coins, you're already thinking about diversification. Unlike paper money printed at will or digital assets that rely on servers, silver is a limited, tangible commodity that has preserved wealth for millennia.

Silver’s value comes from two sources:

- Monetary demand – investors and central banks hold it as a hedge against inflation and currency risk.

- Industrial demand – roughly 50%-60% of annual consumption goes into electronics, solar panels, medical uses and green energy.

That dual demand sets a price floor and gives silver a different return pattern than stocks or bonds. A recent study found silver’s annual gains correlated with large-cap U.S. equities only about 0.40 between 1999-2022, meaning it can rise when mainstream assets fall. Even a 5% allocation has been shown to improve risk-adjusted returns in multi-asset portfolios.

The Role of Silver in a Modern Portfolio

- Inflation hedge: Silver has historically held purchasing power when consumer prices spike.

- Crisis insurance: It is no one’s liability, so there is no counter-party risk.

- Upside potential: Growing green-tech demand gives silver more room to run than most traditional hedges.

For a deeper dive, see Is Silver a Good Investment?

Silver vs. Gold: Key Differences for Investors

- Affordability: One ounce of gold costs 70-90× an ounce of silver, so newcomers can start smaller.

- Volatility: Silver moves faster both up and down, rewarding disciplined buyers who add on dips.

- Storage: The same dollar value of silver takes up more space, but its smaller units are handy for potential barter.

The gold-to-silver ratio has spent long stretches above 80:1 in recent years—well above its 20th-century average—hinting that silver may be undervalued. Learn more in Turning Volatility into Opportunity: A Guide to a Silver Buy and Stacking.

A Beginner's Guide to the Types of Silver Coins

Silver coins fall into three broad categories, each playing a different role in an investor’s strategy.

1. Silver Bullion Coins

- Purpose: Pure metal exposure at a modest premium.

- Specs: Usually .999 or .9999 fine silver, 1 troy oz.

- Popular choices: American Silver Eagle, Canadian Maple Leaf, Austrian Philharmonic, British Britannia, Australian Kangaroo.

- Why they shine: Government guarantee of weight and purity, worldwide liquidity.

See Starter Stack Attack: Understanding Silver Bullion Starter Packs.

2. Numismatic (Collectible) Coins

- Value drivers: Rarity, age, historical significance, and condition—not just metal content.

- Example: High-grade Morgan or Peace dollars.

- Good for: Hobbyists or those seeking non-correlated collectibles.

- Caution: Premiums can dwarf melt value, so they’re rarely the cheapest way to stack silver.

More details: Collectible Silver Coins Guide

3. Constitutional ("Junk") Silver

- What it is: Pre-1965 U.S. dimes, quarters, half-dollars—90% silver, 10% copper.

- Silver content: $1 face = ~0.715 oz pure silver.

- Strengths: Low premiums, fractional pieces ideal for small transactions.

- Consider if: You want maximum ounces per dollar and potential barter utility.

See An Essential Guide to Valuing Constitutional Silver

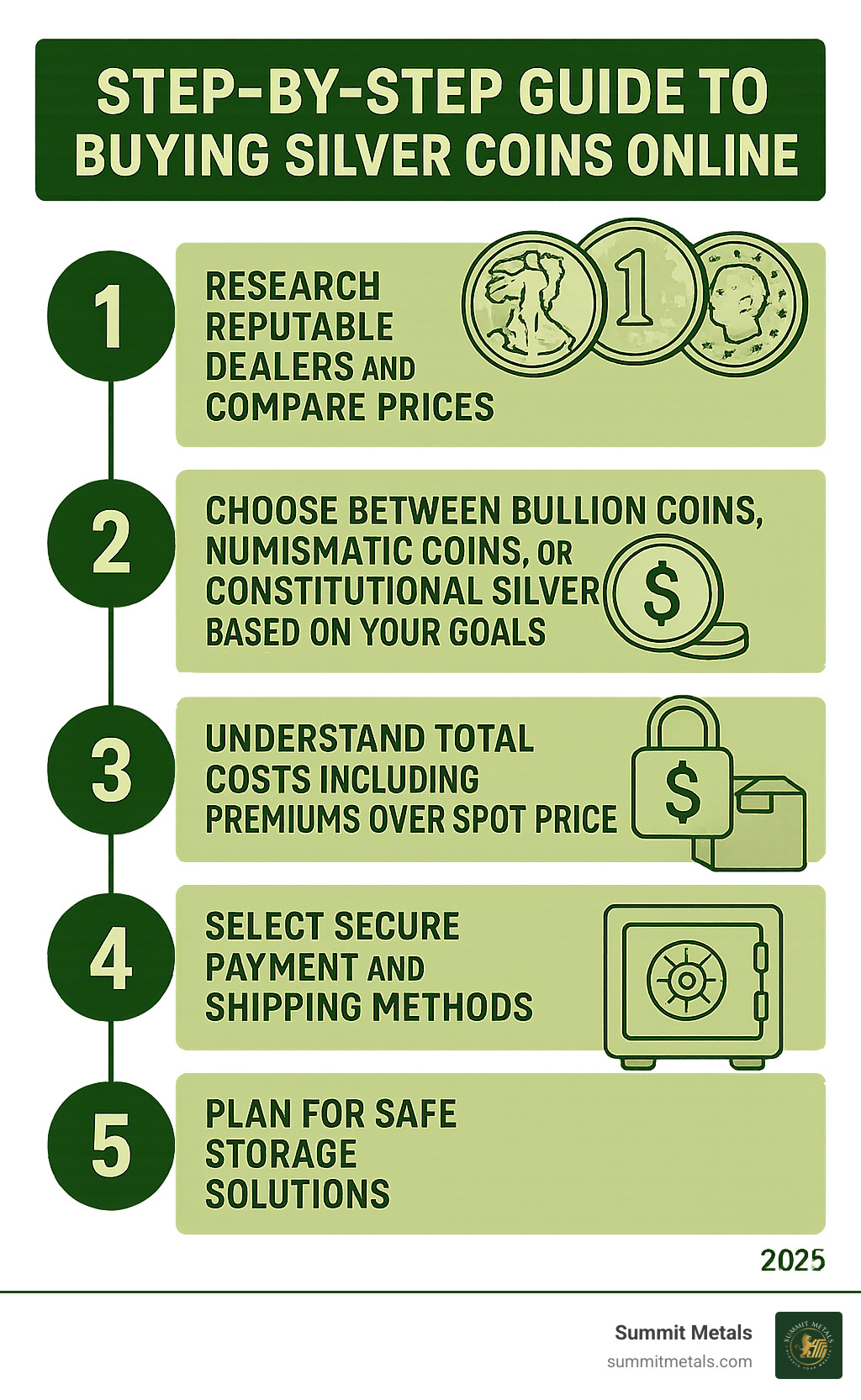

How Do I Buy Silver Coins? A Step-by-Step Process

Follow these three streamlined steps for a secure first purchase.

1. Choose a Trusted Source

| Option | Pros | Cons |

|---|---|---|

| Online dealers (e.g. Summit Metals) | Best pricing, widest inventory, insured delivery | Must wait for shipping |

| Local coin shop | Inspect coins in person, instant pickup | Higher premiums, limited stock |

| Coin shows | Compare multiple dealers in a day | Travel time, prices vary |

Tip: Verify any dealer’s BBB rating and customer reviews before wiring funds. How to Buy Gold and Silver Online Safely

2. Understand Total Cost

- Spot price: Live market quote per ounce.

- Premium: Dealer markup to cover minting, shipping and profit.

- Shipping & insurance: Often free above a minimum order at reputable online dealers.

Check both spot and premium so you know your all-in price. More detail: Spot Price vs. Premium

3. Pay & Take Delivery Safely

- Payment methods: Credit card (buyer protections) or bank wire (lower fee for large orders).

- Shipping: Always insured, always tracked. Require adult signature.

- Upon arrival: Inspect packaging, confirm weight/count, then move coins directly to your chosen storage.

For scam-avoidance tips, read Identifying Reputable Bullion Dealers: Avoiding Counterfeits.

Beyond Coins: Other Silver Investment Options

While silver coins are an excellent way to invest in physical silver, they're not the only option available. Understanding the full range of silver investment choices helps you build a well-rounded precious metals portfolio that meets your specific goals and circumstances.

Silver bars represent another popular form of physical silver investment. These rectangular pieces of silver are produced by both government and private mints and typically offer lower premiums than coins due to simpler production processes and reduced minting costs.

The key differences between physical coins and silver bars become apparent when you examine their characteristics side by side:

| Factor | Physical Coins | Silver Bars |

|---|---|---|

| Premiums | Higher due to minting costs | Lower, especially for larger sizes |

| Storage | Easier to store in small quantities | More efficient for large quantities |

| Liquidity | Highly liquid, globally recognized | Good liquidity, especially popular brands |

| Counterparty Risk | None - direct ownership | None - direct ownership |

Silver bars come in various sizes, from 1-ounce pieces suitable for small investors to 1,000-ounce bars used by institutions. The larger the bar, the lower the premium per ounce, making them cost-effective for accumulating significant silver positions without paying the higher premiums associated with coins.

Popular bar sizes include 10-ounce, 100-ounce, and 1-kilogram bars, which offer a good balance between affordability and manageable size. These bars are produced by reputable refiners and carry hallmarks indicating weight, purity, and producer information, ensuring authenticity and value.

For investors focused purely on silver accumulation at the lowest cost, bars often provide better value than coins. However, coins offer advantages in terms of recognition, fractional liquidity, and ease of authentication that make them preferable for many investors, especially those just starting their precious metals journey.

The choice between coins and bars often comes down to your investment goals. If you're asking yourself "how do I buy silver coins" because you want maximum liquidity and recognition, coins are likely your best choice. If you're focused on accumulating the most silver for your dollar, bars deserve serious consideration.

Physical Bullion vs. Gold & Silver ETFs: Pros and Cons explores the differences between physical ownership and paper-based silver investments.

Frequently Asked Questions about Buying Silver Coins

What’s the difference between a silver coin and a silver round?

- Coin: Minted by a government, carries a face value, legal tender, usually slightly higher premium.

- Round: Minted by a private refinery, no face value, often the lowest premium over spot.

Should I buy bullion coins or constitutional silver first?

- Bullion coins: Best liquidity and purity; great core holding.

- Constitutional silver: Cheapest way to get fractional pieces; useful for barter.

Many investors start with one-ounce bullion coins, then add junk silver for diversification.

How do I store silver securely?

- Home safe: Immediate access; ensure it’s fire-resistant and bolted down.

- Bank safe-deposit box: Low cost; limited access hours.

- Professional depository: Highest security and insurance; small annual fee.

Match your storage choice to the size of your stack and your need for access.

Conclusion

You now have everything you need to confidently answer how do I buy silver coins and start building your precious metals portfolio. Silver coins offer something truly special in today's uncertain economic climate – they're tangible assets that you can hold in your hand, assets that maintain their value regardless of what happens to stock markets or government policies.

The beauty of silver investing lies in its simplicity once you understand the basics. Start with a clear strategy that matches your goals and budget. Maybe you're drawn to the global recognition of American Silver Eagles, or perhaps the affordability of constitutional silver appeals to you. Either way, the most important step is taking that first step.

Research truly is your best friend in this journey. The more you understand about silver markets, pricing factors, and different coin types, the better decisions you'll make. Don't worry about becoming an expert overnight – even seasoned investors continue learning throughout their careers. Stay curious about market conditions and keep exploring different products as your knowledge grows.

Working with reputable dealers makes all the difference between a smooth, confident purchase and a stressful experience filled with doubts. At Summit Metals, our Wyoming-based operation combines the reliability of domestic business with competitive pricing that comes from our bulk purchasing power. We believe in transparent, real-time pricing because you deserve to know exactly what you're paying and why.

Silver investing is typically a marathon, not a sprint. The same volatility that creates opportunities also requires patience and discipline. Think of your silver coins as a foundation – solid, reliable wealth that can serve you and your family for generations. It's not about getting rich quick; it's about preserving what you've already worked hard to earn.

The peace of mind that comes from owning physical silver is hard to put a price on. When you hold a silver coin, you're holding something that has been valued by civilizations for thousands of years. That's not going to change because of a software glitch or a government policy change.

Your silver journey starts today with the confidence that comes from knowledge. You understand the different types of coins available, you know what to look for in a dealer, and you have a clear picture of how to store your investment safely.

Ready to start your silver stacking journey? Explore our selection of authenticated silver coins and find how Summit Metals can help you build a precious metals portfolio that protects and preserves your wealth for whatever the future holds.