Why the Smallest Maple Leaf Packs a Big Punch

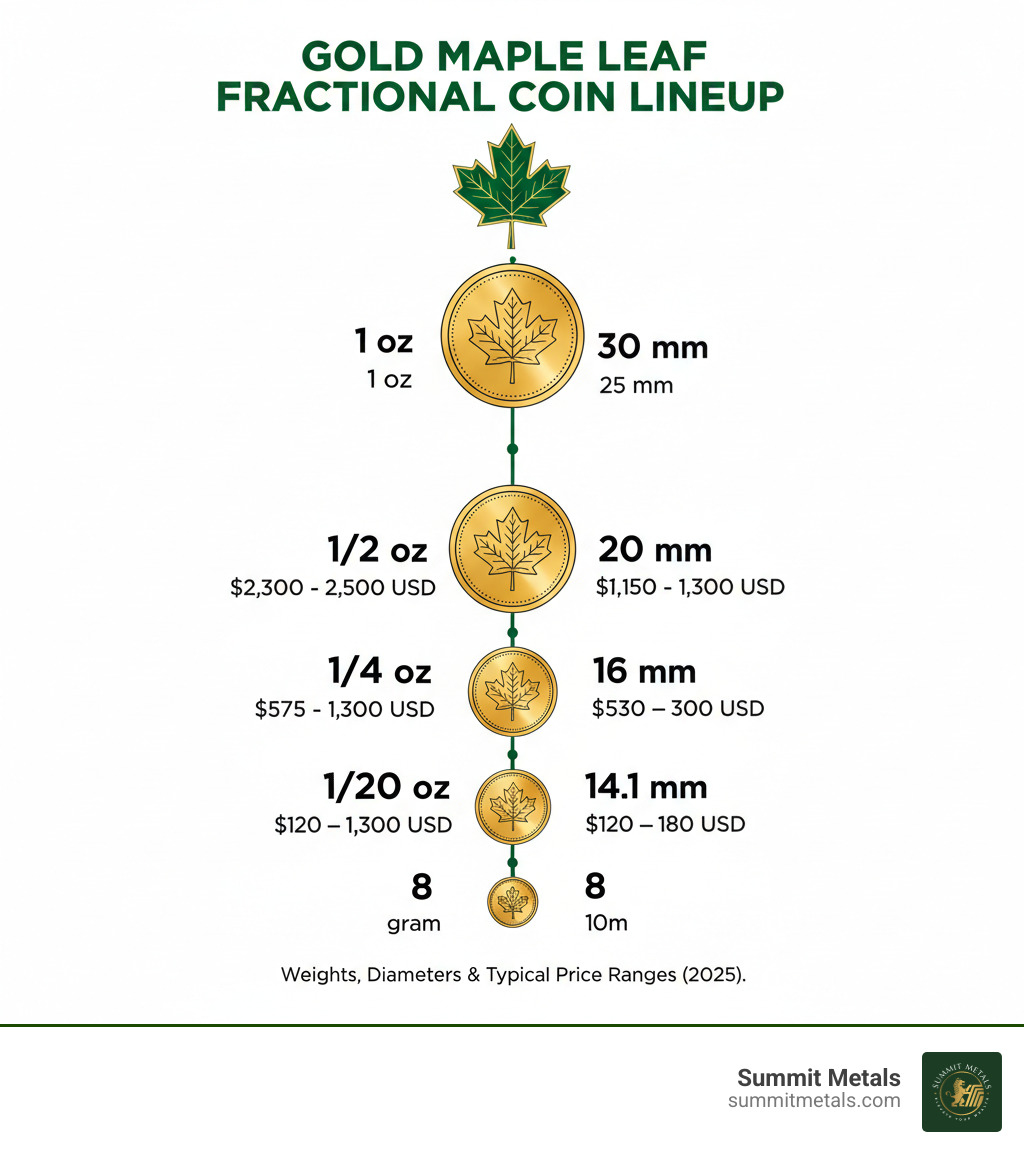

The 1 20 maple leaf gold coin represents one of the most accessible entry points into gold investing, combining the prestige of the Royal Canadian Mint with an affordable price that won't break your budget. Here's what makes this fractional gold coin special:

Key Features of the 1/20 oz Gold Maple Leaf:

- Weight: 1/20 troy ounce (1.555 grams)

- Purity: .9999 fine gold (99.99% pure)

- Face Value: $1 Canadian Dollar

- Diameter: 14.1 mm

- Security Features: Micro-engraved maple leaf, radial lines, Bullion DNA™

- Government Guarantee: Backed by the Royal Canadian Mint

- Global Recognition: Accepted worldwide by dealers and investors

This tiny powerhouse offers all the benefits of larger gold coins - fraud protection through government backing, instant global recognition, and premium security features - at a fraction of the cost. While gold bars might offer lower premiums per ounce, coins like the 1/20 oz Maple Leaf provide legal tender status and advanced anti-counterfeiting technology that bars simply can't match.

Since 1979, the Canadian Gold Maple Leaf series has sold over 25 million troy ounces worldwide, making it one of the most trusted names in precious metals. The 1/20 oz denomination allows investors to build their gold holdings gradually, similar to dollar-cost averaging with a 401k.

I'm Eric Roach, and during my decade as an investment banking advisor on Wall Street, I've guided clients through complex hedging strategies and helped everyday investors protect their wealth with precious metals including the 1 20 maple leaf gold coin. My experience has shown that fractional gold coins often serve as the perfect starting point for new precious metals investors seeking both affordability and authenticity.

The Anatomy of a Modern Classic: History and Design

When the Royal Canadian Mint introduced the Gold Maple Leaf in 1979, it revolutionized the precious metals industry. The original coin featured 99.9% gold purity, but in 1982, the mint raised the standard to an unprecedented .9999 fine gold, making the Gold Maple Leaf the world's first bullion coin to achieve 99.99% purity.

This "four nines fine" standard drove its incredible success, with over 25 million troy ounces sold worldwide. The series expanded to include multiple denominations, with the 1 20 maple leaf gold coin representing the most affordable way to own this legendary purity. Some special editions even reach an extraordinary .99999 purity, a level rarely seen outside a laboratory.

Key Design Features

The coin's design elements are symbols of Canadian heritage and royal tradition.

The obverse side features the reigning monarch, creating a historical timeline for collectors. For decades, this was Queen Elizabeth II, with artist Susanna Blunt's portrait used since 2003 being the most recognizable version.

The transition to King Charles III marks a significant numismatic moment. The 2023 coins honored Queen Elizabeth II with commemorative dates (1952-2022), while 2024 and 2025 1 20 maple leaf gold coins showcase the new portrait of King Charles III, adding collectible appeal to these transitional years.

The reverse side displays Canada's iconic maple leaf, designed by Walter Ott. He considered it his proudest achievement, and the design has become one of the most recognizable symbols in precious metals worldwide.

Specifications of the 1 20 Maple Leaf Gold Coin

The 1 20 maple leaf gold coin packs the same quality and prestige as its larger siblings into a compact package.

Weight and purity are defining features. At 1/20 troy ounce (1.555 grams), it contains precisely measured .9999 fine gold (24-karat), meeting the same exacting standards as every Gold Maple Leaf.

The diameter is just 14.1 millimeters, roughly the size of an M&M candy. Its compact size makes storage simple while still delivering the satisfying weight of real gold.

As legal tender, each 1 20 maple leaf gold coin has a $1 CAD face value. While its gold content is worth far more, this government backing provides important fraud protection that gold bars lack, guaranteeing you're buying authentic, government-verified gold.

For investors curious about the technical details, you can explore more about gold purity standards to understand how the .9999 specification compares to other products.

Why the 1 20 Maple Leaf Gold Coin is a Smart Investment

The 1 20 maple leaf gold coin is a small but powerful tool for protecting your wealth, acting as a portable financial insurance policy. Gold has protected wealth for millennia, and adding physical gold to your portfolio offers several key benefits.

- Portfolio Diversification: Gold often moves opposite to traditional investments like stocks and bonds, helping to balance your portfolio during market volatility.

- Hedge Against Inflation: As central banks print more money, the coin helps maintain your purchasing power. Unlike fiat currency, its intrinsic value endures.

- High Liquidity: Thanks to its global recognition, reputable dealers from New York to Tokyo will instantly recognize and value your Gold Maple Leaf, making it easy to sell.

At Summit Metals, we provide transparent, real-time pricing and competitive rates, helping you build wealth with confidence.

Comparing Your Options: Fractional Coins vs. Gold Bars

When choosing how to invest in gold, it's important to compare your options. The 1 20 maple leaf gold coin, as a sovereign coin, offers distinct advantages over a simple gold bar.

The government guarantee from the Royal Canadian Mint backs your investment, a feature that privately minted gold bars lack. Furthermore, the coin's legal tender status provides an extra layer of fraud protection. While you may pay a slightly higher premium for this security, many investors find the peace of mind well worth it.

| Feature | 1/20 oz Gold Maple Leaf Coin | 1/10 oz American Gold Eagle Coin | 1g Gold Bar (e.g., PAMP Suisse) |

|---|---|---|---|

| Purity | .9999 (24K) | .9167 (22K) | .9999 (24K) |

| Government Guarantee | Yes (Royal Canadian Mint) | Yes (U.S. Mint) | No (Private Mint) |

| Legal Tender Status | Yes ($1 CAD) | Yes ($5 USD) | No |

| Security Features | Advanced (Micro-engraving, Radial Lines, Bullion DNA™) | Basic (Reeded edge) | Often includes assay card, serial # |

| Liquidity | Excellent (Globally recognized) | Excellent (Globally recognized) | Good (Globally recognized) |

| Typical Premium | Higher per oz (Fractional) | Higher per oz (Fractional) | Lower per gram/oz |

| Fraud Protection | High (Govt. backing, security features) | High (Govt. backing) | Moderate (Assay card, dealer trust) |

Advanced Security for Your Peace of Mind

The Royal Canadian Mint has perfected anti-counterfeiting, and the 1 20 maple leaf gold coin includes its most advanced security features.

- Bullion DNA™ technology gives each coin a unique security mark within a micro-engraved maple leaf. The RCM can scan and verify these marks against its database, making counterfeiting virtually impossible.

- Radial lines are precisely machined on both sides, a feature that is difficult for counterfeiters to replicate.

- The micro-engraved maple leaf contains the coin's year of issue, creating another layer of authentication.

You can learn more about the RCM's security features directly from their website.

Investment Potential of the 1 20 Maple Leaf Gold Coin

The coin's low barrier to entry and serious investment potential make it highly attractive. This fractional coin makes gold ownership accessible without needing thousands of dollars to start. Global demand for Gold Maple Leafs ensures excellent liquidity, and gold's long track record as a store of value gives it strong appreciation potential, especially in uncertain economic times.

Consider using our Autoinvest program to build your gold holdings systematically. Like a 401k, you can make monthly purchases to take advantage of dollar-cost averaging, smoothing out price fluctuations and building wealth steadily.

Strategies for Acquiring Your Gold Maple Leafs

To make smart buying decisions for the 1 20 maple leaf gold coin, you must understand pricing. The foundation is the spot price: the live market price for one troy ounce of gold, which fluctuates throughout the trading day.

You will always pay a premium over the spot price. This covers dealer costs like minting, shipping, and insurance. For fractional coins like the 1 20 maple leaf gold coin, premiums are typically higher per ounce because fixed manufacturing and handling costs are spread across less gold.

For example, if gold is trading at $2,000 per ounce, the 1/20 oz coin's gold value is $100. However, with premiums, you might pay $120-$140. That extra cost is for the convenience and authentication of owning a physical, government-guaranteed coin.

At Summit Metals, we believe in transparent pricing without hidden fees. Our bulk purchasing allows us to offer competitive rates. When shopping, always look for reputable dealers and verify that coins are in "Brilliant Uncirculated" (BU) condition—mint-fresh and ideal for investment.

Building Your Stack with Dollar-Cost Averaging

Even professional traders struggle to time markets perfectly. That's why dollar-cost averaging is a powerful strategy for precious metals, and it's why we created our Autoinvest program at Summit Metals.

The principle is simple and works just like a 401k: you invest a fixed amount of money regularly. This means you automatically buy more gold when prices are low and less when they're high, which smooths out your average cost over time.

Our Autoinvest program lets you set up consistent monthly purchases of the 1 20 maple leaf gold coin. By investing a set amount, you systematically build your holdings without the stress of trying to time the market. This 401k-style investing approach makes gold ownership feel familiar and manageable, especially for beginners.

To learn more about these proven investment strategies, check out our detailed guide on Strategic Approaches to Investing in Gold.

Special Editions and Noteworthy Variations

Beyond the standard 1 20 maple leaf gold coin, the Royal Canadian Mint releases special editions that appeal to collectors. These often commemorate historical moments or feature unique designs.

- Queen Elizabeth II Memorial (2023): This issue features a special commemorative double date (1952-2022), marking the end of an era and adding historical value.

- Inaugural King Charles III (2024/2025): These transitional coins, including the 2025 1 20 maple leaf gold coin, often develop a strong collectibility factor among numismatists.

- Older vs. Newer Issues: Since mintage figures for individual denominations were not released after 2013, certain years may become more sought-after over time.

- Ultra-High Purity Variations: Occasionally, you might find special releases with .99999 fine gold, which typically command higher premiums.

While the primary value of any 1 20 maple leaf gold coin is its gold content, these special editions offer a blend of investment and potential numismatic appreciation.

Frequently Asked Questions about the 1/20 oz Gold Maple Leaf

Here are the answers to the questions we hear most often about this popular fractional gold coin.

How much is a 1/20 oz Gold Maple Leaf worth?

The value of a 1 20 maple leaf gold coin is determined by two main factors:

- Spot Gold Price: The coin's baseline value is its gold content—exactly 1/20th of the current spot price for one troy ounce of gold. If gold is $2,000/oz, the coin's gold content is worth $100.

- Dealer Premiums: You will pay a premium above the spot price to cover minting, handling, and insurance costs. Premiums are proportionally higher for fractional coins.

Coin condition is also a factor, but most of its value comes from the gold content. Certain years, like the 2023 memorial or first King Charles III issues, may also develop a small collector's premium.

Is the 1/20 oz Gold Maple Leaf a good investment for beginners?

Absolutely. The 1 20 maple leaf gold coin is an excellent choice for new investors for several reasons:

- Low Entry Cost: You can start investing in gold for a few hundred dollars instead of several thousand for a full ounce.

- World-Class Purity: It contains .9999 fine gold, the same high-quality standard as larger, more expensive coins.

- Global Recognition: The Gold Maple Leaf brand is known worldwide, ensuring you can easily sell it when needed.

- High Liquidity: Reputable dealers, including Summit Metals, readily buy back these coins at competitive rates.

- Tangible Asset: You own a real, physical asset that provides a peace of mind that digital investments can't match.

If you want to explore other affordable entry points, consider our guide on Silver Bullion Starter Packs.

How does the 1/20 oz Gold Maple compare to the Canadian Silver Maple Leaf Coin?

Choosing between the 1 20 maple leaf gold coin and the Canadian Silver Maple Leaf Coin depends on your investment goals.

- Gold (Wealth Preservation): Gold is a stable store of value that holds its purchasing power. The 1 20 maple leaf gold coin is a powerful tool for preserving wealth.

- Silver (Growth & Volatility): Silver is more volatile due to high industrial demand. This creates potential for higher returns but also carries greater risk.

- Price Point: A 1/20 oz gold coin costs significantly more than a 1 oz silver coin. Silver offers a much lower entry point for owning more physical metal by weight.

- Storage: Gold is much denser than silver. You need far less space to store the same dollar value in gold, which is a major advantage if storage is limited.

Both metals complement each other in a diversified portfolio. Gold provides stability, while silver offers growth potential. The right mix depends on your goals and risk tolerance.

Conclusion: Start Your Gold Journey with Confidence

Your journey into gold investing doesn't have to be intimidating or expensive. The 1 20 maple leaf gold coin proves that big things really do come in small packages. This tiny powerhouse combines everything you want in a precious metals investment: the affordability that makes gold ownership accessible to everyone, the security features that protect your investment from counterfeits, and the investment value that comes from owning one of the world's most trusted bullion coins.

Think about it - you're getting 99.99% pure gold backed by the Royal Canadian Mint's sterling reputation, complete with advanced anti-counterfeiting technology, all for a fraction of what you'd pay for a full-ounce coin. That's pretty remarkable when you consider you're holding the same quality gold that fills central bank vaults around the world.

At Summit Metals, we've built our reputation on making precious metals investing straightforward and trustworthy. Our transparent pricing means no hidden fees or surprises - just honest, competitive rates thanks to our bulk purchasing power. We believe everyone deserves access to authentic precious metals without the typical dealer markups that can eat into your investment returns.

Here's where it gets even better: you don't need to make one large purchase and hope you timed the market perfectly. Our Autoinvest program lets you build your gold holdings gradually, just like contributing to your 401k. Set up consistent monthly purchases of the 1 20 maple leaf gold coin, and you'll benefit from dollar-cost averaging - buying more when prices dip and less when they're high. It's a proven strategy that takes the guesswork out of investing and helps smooth out market volatility over time.

The beauty of starting with fractional gold coins is that you can begin building real wealth protection without breaking your budget. Every month, you're adding authentic, government-guaranteed gold to your portfolio. Before you know it, you'll have accumulated a meaningful stack of precious metals that can serve as your financial insurance policy.

Ready to take that first step? We've made it incredibly easy to get started. Begin building your gold portfolio with our Buying Gold guide - it's packed with everything you need to know about making your first purchase and beyond. Whether you're looking to start small with a single 1 20 maple leaf gold coin or set up an automatic investment plan, we're here to help you succeed.

Your future self will thank you for taking action today. Gold has preserved wealth for thousands of years, and with the Royal Canadian Mint's exceptional quality standards, you can invest with complete confidence. Start your precious metals journey with Summit Metals - where transparency meets value, and your financial security is our top priority.