Why Buy Silver Bullets: The Unique Intersection of Investment and Collectibility

Buy silver bullets and you're entering a fascinating niche where precious metal investment meets novelty collecting. Here's what you need to know before you purchase:

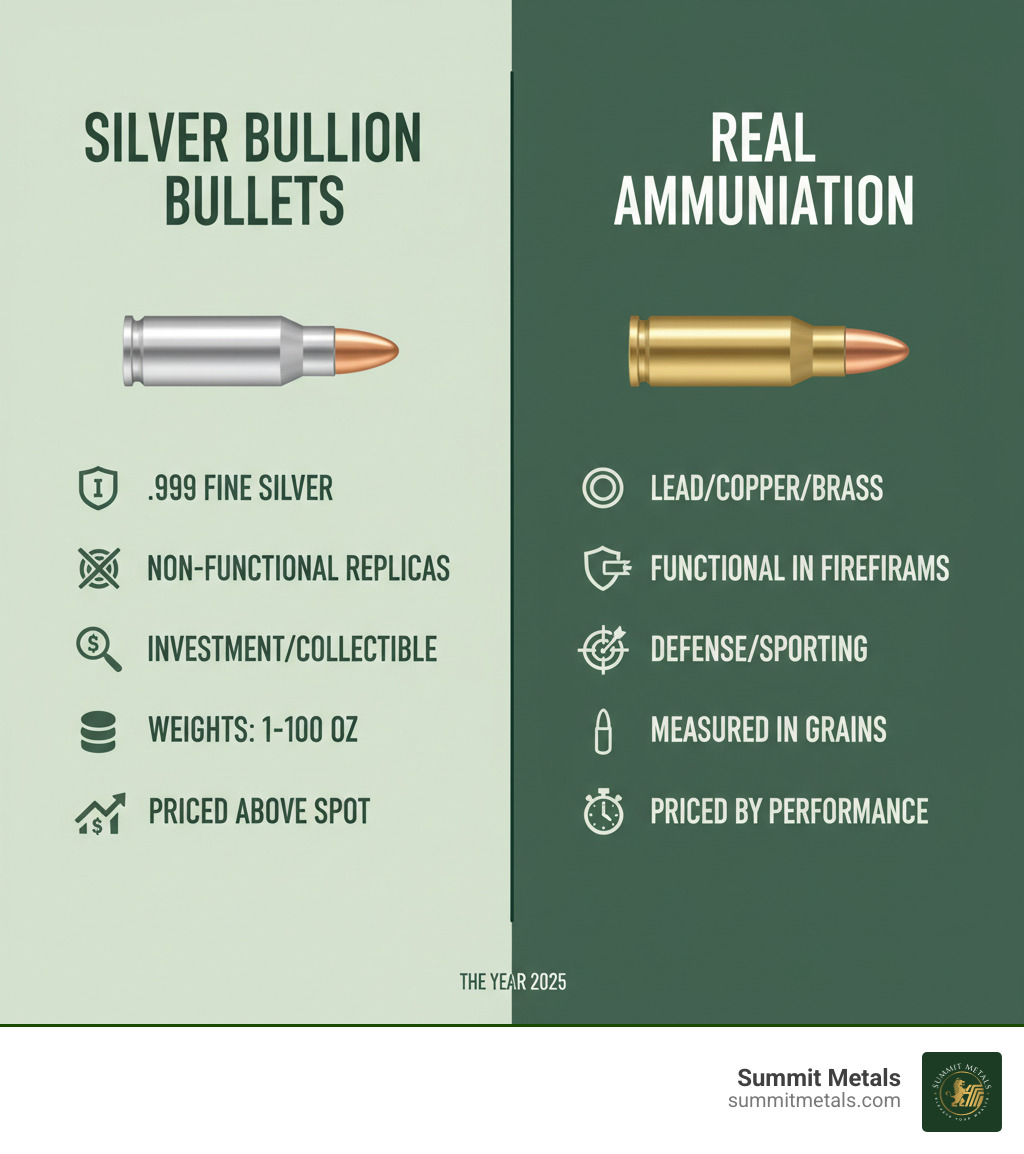

- What they are: .999 fine silver replicas of real ammunition calibers (.45 ACP, .308, 12 Gauge, .50 BMG)

- What they're not: Functional ammunition—they cannot be fired in firearms

- Who makes them: SilverTowne, Elemetal, and Texas Silver Ammo are primary manufacturers

- Common sizes: 1 oz (.45 Caliber), 2 oz (.308 Caliber), 5 oz (12 Gauge), 10 oz (.50 Caliber BMG)

- Where to buy: Reputable online precious metals dealers

Silver bullets have evolved from folklore—where silver was believed to defeat mythical creatures—into a modern investment vehicle that combines the intrinsic value of precious metal with collectible appeal. Unlike traditional silver bars or coins, these bullets offer a distinctive aesthetic that attracts gun enthusiasts, military collectors, and investors seeking unique ways to hold physical silver.

The market for silver bullets has grown significantly, with products ranging from single-ounce pieces to massive 100 oz replicas. They're priced at a premium over standard silver bullion—typically several dollars above spot price per ounce—reflecting their novelty and the detailed minting process.

I'm Eric Roach. With a decade of experience advising on portfolio diversification, I've seen how tangible assets provide stability. Silver bullets, in particular, offer a unique advantage. They are a defensive asset that's harder to liquidate impulsively than cash in a savings account, reinforcing disciplined wealth preservation. My background helps everyday investors understand how alternative silver products like these fit into a balanced portfolio.

What Are Silver Bullets? From Folklore to Fine Silver

The image of a silver bullet defeating a werewolf is classic folklore with roots stretching back centuries. Silver has long been credited with mystical protective powers against supernatural threats. The Brothers Grimm documented a tale where a witch was immune to lead bullets, and only silver buttons melted down and fired could defeat her. These stories reflected a deep cultural belief that silver possessed special properties—a theme explored in detail on Silver bullet and Brothers Grimm.

Today, we still use "silver bullet" as a metaphor for a perfect, simple solution. But when modern investors buy silver bullets, they're purchasing something quite different.

Modern silver bullets are investment-grade bullion pieces crafted to look like various ammunition rounds. Made from .999 fine silver—the same purity as quality silver bars and coins—these pieces replicate everything from .45 caliber pistol rounds to massive .50 caliber machine gun bullets. They're beautiful, weighty, and satisfying to hold.

Crucially, these aren't functional ammunition. You absolutely cannot load them into a firearm. Silver is too soft and would deform, potentially damaging the weapon. Instead, these are non-functional collectibles and investment pieces that combine the intrinsic value of precious metal with the visual appeal of detailed metalwork.

When you hold a silver bullet, you're holding a tangible asset that serves multiple purposes. It's a conversation starter, a collectible for military history buffs and firearm enthusiasts, and a legitimate way to hold physical silver that's more interesting than a standard bar in your safe.

The craftsmanship is impressive. Reputable mints stamp each bullet with purity marks (typically .999), weight specifications, and often their mint mark. These details authenticate your investment and confirm you're holding genuine fine silver, not a novelty item made from cheaper metals.

If you're exploring different ways to add silver to your portfolio beyond bullets, our guide on Your Guide to Silver Coin Investments: What You Need to Know offers valuable insights into traditional silver coins and how they compare to alternative bullion products.

A Roundup of Popular Silver Bullet Bullion

The market for silver bullets has blossomed, with manufacturers like SilverTowne, Elemetal, and Texas Silver Ammo leading the pack. These companies carefully replicate authentic ammunition calibers, stamping each piece with its purity mark (.999 fine silver) and weight on the base. This is your guarantee that you're holding investment-grade silver in a uniquely collectible form.

Whether you're drawn to military rounds or simply appreciate the novelty, there's a design for you. Let's explore the most popular options when you buy silver bullets.

The Classic: 1 oz Silver Bullet (.45 Caliber ACP)

Most collectors begin with the 1 oz .45 Caliber ACP. This design honors the iconic handgun round developed by John Browning in 1911, which served as the standard-issue sidearm for U.S. forces for decades. The 1 oz .45 Caliber is instantly recognizable, comfortably sized, and makes an excellent entry piece into novelty bullion. It also makes a perfect gift—compact yet substantial enough to feel like a real investment. Learn more about the cartridge this design is based on: .45 ACP.

The Marksman's Choice: 2 oz Silver Bullet (.308 Caliber)

The 2 oz .308 Caliber silver bullet replicates the beloved .308 Winchester rifle round, a favorite among hunters and sport shooters. The 2 oz format offers a satisfying heft and presence. For collectors expanding their purchase or investors wanting a middle-ground option, the 2 oz .308 Caliber hits the sweet spot. The rifle round design also appeals to those with hunting backgrounds or military service involving long-range weapons. Read more about the round here: .308 Winchester.

The Heavy Hitters: 5 oz & 10 oz Silver Bullets

The 5 oz and 10 oz silver bullets are statement pieces. The 5 oz version typically takes the form of a 12 Gauge shotgun shell, one of the most recognizable ammunition types worldwide. The 10 oz silver bullet goes bigger, replicating the fearsome .50 Caliber BMG (Browning Machine Gun) round, used in every major conflict since World War I. Holding one gives you a real appreciation for the power these weapons represented. Learn more about these formats: 12-gauge shotgun and .50 BMG.

These larger formats also offer a practical advantage: lower premiums per ounce. You get more silver for your dollar, making them attractive if you're focused on accumulating weight. For those building a portfolio through regular purchases, these larger pieces are excellent targets for a monthly Autoinvest strategy, allowing you to dollar-cost average into more substantial holdings—set it to buy every month just like contributing to a 401k.

Collector's Editions: Plated and Specialty Silver Bullets

For collectors seeking something special, manufacturers offer plated and specialty editions. Some feature rhodium plating for a brilliant, tarnish-resistant finish, while others showcase gold plating for a striking two-tone appearance. These finishes transform a unique piece of bullion into a luxury item. While they command a higher premium, they are perfect for gifts or as the crown jewel of a collection.

The innovation doesn't stop there. For serious collectors, there are massive formats like the 25 oz 20mm cannon round or even a 100 oz Howitzer artillery shell. These are sculptural representations of military history that contain significant amounts of investment-grade silver, offering a unique way to hold considerable weight.

Investing in Silver Bullets: Strategy and Value

When you buy silver bullets, you're choosing an asset that sits between pure investment and passionate collecting. Unlike a standard silver bar valued almost entirely by its weight, silver bullets carry a story and design that adds to their appeal. This means they typically have higher premiums over the spot price of silver compared to generic bars. The premium reflects the detailed minting process, craftsmanship, and novelty factor.

Like all physical silver, these bullets serve as a hedge against inflation and market volatility. They represent tangible value you can hold. The silver content has a "melt value" (the raw value of the metal), but the collectible appeal often pushes the total worth higher, especially for specialty designs.

So how do silver bullets stack up against other forms of silver?

| Feature | Silver Bullets | Silver Coins (e.g., American Silver Eagle) | Silver Bars (Generic) |

|---|---|---|---|

| Purity | .999 Fine Silver | .999 Fine Silver | .999 Fine Silver |

| Premium over Spot | Moderate to High (due to novelty/design) | Moderate (due to government backing/recognizability) | Low (closest to spot price) |

| Collectibility | High (unique shapes, designs, finishes) | High (mint marks, dates, limited editions) | Low (primarily for intrinsic metal value) |

| Liquidity | Moderate (niche market, but growing) | High (universally recognized, easy to sell) | High (standard investment vehicle) |

| Primary Appeal | Novelty, gifts, unique investment, firearms enthusiasts | Investment, collectibility, government assurance | Pure investment, maximizing silver weight |

| Potential Downsides | Higher initial premium, potentially slower resale than bars/coins | Higher premium than bars | Less aesthetic appeal, fewer unique designs |

Silver Coins vs. Silver Bars: Quick Comparison

| Feature | Silver Coins (Sovereign Mints) | Silver Bars (Private or Sovereign) |

|---|---|---|

| Legal status | Legal-tender face value, widely recognized | Not legal tender |

| Anti-counterfeiting | Advanced security features (micro-engraving, reeded edges, privy marks) help deter fraud and simplify authentication | Varies by mint; generally fewer features than coins |

| Premiums | Moderate (you pay for recognizability and security) | Low (best way to maximize ounces per dollar) |

| Recognition/liquidity | Very high; easy to sell worldwide | High; easiest in investment-focused channels |

| Best for | Gifting, recognizable savings, collections | Bulk stacking and lowest-cost accumulation |

Smart Strategies to buy silver bullets for your portfolio

Dollar-cost averaging is a powerful strategy. Instead of trying to time the market, you invest a fixed amount at regular intervals. This smooths out price fluctuations over time. At Summit Metals, our Autoinvest feature makes this simple. You can set up automatic monthly purchases—buy every month just like investing in a 401k—to consistently build your collection of tangible assets. It’s a disciplined, emotion-free way to grow your holdings. Our guide on The Power of Dollar Cost Averaging in Gold and Silver Investments walks through exactly how this strategy maximizes value.

Think bigger to get more bang for your buck. While 1 oz bullets are great starters, larger formats—5 oz, 10 oz, or even 25 oz and 100 oz pieces—typically offer lower premiums per ounce. You get the collectible appeal while paying less of a markup on the silver content. If your budget allows, a 5 oz or 10 oz piece might offer better long-term value.

Portfolio diversification takes on new meaning with silver bullets. They attract gun enthusiasts, military history buffs, and people who appreciate unique designs. That broader appeal could be an advantage if you ever decide to sell. Plus, they're a lot more interesting to show off than a stack of generic bars.

The key is viewing silver bullets as part of a balanced precious metals strategy. They occupy a sweet spot between pure investment and collectible passion, which can serve you well if you approach it with realistic expectations.

Where to Buy Silver Bullets and What to Look For

When you're ready to buy silver bullets, choosing a reputable dealer is the most important decision you'll make. The precious metals market has matured, and established online dealers have built solid reputations. Knowing what to look for separates the trustworthy from the questionable.

Transparent pricing is your first checkpoint. A reputable dealer displays the current spot price of silver and shows the premium you're paying. This transparency allows for informed decisions. At Summit Metals, we've built our business on this principle—real-time pricing with no hidden fees.

Every silver bullet should be clearly stamped with purity marks (".999 Fine Silver") and the exact weight. These marks are typically on the base of the bullet. Mint marks from manufacturers like SilverTowne or Elemetal add another layer of authenticity. These stamps are your guarantee of quality.

Secure shipping and insurance are essential. Your order should arrive in discreet packaging with full insurance coverage until it's in your hands. This protection is critical for peace of mind.

Perhaps the most reliable indicator of a dealer's quality is customer feedback. Independent review platforms provide unfiltered access to real experiences. Strong reviews from verified buyers tell you more than any marketing copy ever could.

Our guide on How to Buy Gold and Silver Online Safely walks through the entire process in detail, from spotting red flags to understanding payment options.

Tips for Your First Purchase when you buy silver bullets

Your first purchase should be simple and confidence-building. Start with a single 1 oz silver bullet—the classic .45 Caliber ACP is perfect. It's affordable, yet substantial enough to appreciate the craftsmanship.

Before buying, compare premiums across different dealers. Look at the premium over spot per ounce. Larger bullets often offer better per-ounce value.

Check dealer reviews for comments on shipping, packaging, and customer service. How a business resolves issues is what truly matters. Look for patterns in feedback.

Finally, understand all costs upfront. Some dealers offer free shipping above a certain order value. Insurance should be included automatically for valuable items.

Storing Your Silver Bullet Collection

Proper storage protects your investment's value and appearance. Many bullets come in protective capsules. If not, consider buying capsules or a display box to prevent physical damage.

For larger collections, a home safe is a wise investment. For extensive holdings, professional depository services offer climate-controlled environments and comprehensive insurance.

To prevent tarnish from air and humidity, use airtight containers or anti-tarnish strips. This is especially important for plated versions. When handling your collection, wear cotton gloves to avoid leaving fingerprints that can discolor the surface over time.

For comprehensive guidance, our article on Top Storage for Silver: Best Practices for Safekeeping Your Investment covers everything from home storage to professional vaulting.

Frequently Asked Questions about Silver Bullets

We often get questions from curious investors and collectors about these unique bullion items. Let's clear up some common queries so you can make informed decisions when you buy silver bullets.

Are silver bullets real ammunition?

No. Silver bullets are not real ammunition and absolutely cannot be used in a firearm. They are non-functional replicas crafted from .999 fine silver. Silver is too soft and dense to work as ammunition; firing one would deform the bullet and could seriously damage the firearm. These pieces are designed purely for collecting and investment.

Are silver bullets a good investment?

This depends on your goals. As a tangible silver asset, their value is tied to the spot price of silver. However, they command a higher premium over spot compared to generic bars because of their unique design, craftsmanship, and collectible appeal. You pay more per ounce initially, but you acquire a conversation piece with aesthetic value that appeals to specific markets like firearms enthusiasts and military historians. For many, this novelty and diversification potential justifies the premium.

For a broader perspective on silver's investment potential, our article Is Silver a Good Investment? provides comprehensive insights.

What purity are silver bullets?

When you buy silver bullets from reputable manufacturers, they are made from .999 fine silver. This means they are 99.9% pure silver, the standard for investment-grade bullion. Reputable makers always stamp this purity directly on the product, typically on the base, along with the weight. This marking is your assurance that you're getting genuine, investment-grade silver. The .999 purity ensures these bullets maintain their intrinsic melt value based on the silver spot price.

Conclusion: Hit Your Target with Silver Bullet Bullion

Silver bullets represent a special niche in the precious metals world. They are more than just silver; they are conversation pieces, a connection to folklore, and a satisfying investment. For the investor, they provide a hedge against inflation and economic uncertainty. For the collector, they offer intricate designs that generic bars cannot match. For the gift-giver, few presents make the impression of a polished silver bullet in a display case.

The available range is remarkable, from the classic 1 oz .45 caliber to a massive 100 oz Howitzer shell. Whether you prefer standard polished silver or the luxury of gold and rhodium plating, there's a silver bullet for your taste and budget.

At Summit Metals, we know trust is everything when investing in precious metals. Our reputation is built on transparent, real-time pricing and competitive rates. As a Wyoming-based dealer, we are committed to making your journey straightforward and rewarding.

Consider setting up regular purchases through our Autoinvest feature. It's like contributing to a 401k, but you're building a tangible collection of silver. This dollar-cost averaging approach takes the stress out of market timing and helps you steadily grow your holdings.

Ready to add something legendary to your portfolio? Explore our full range of unique silver products and find why silver bullets might be exactly what your investment strategy needs. It's a choice that combines smart investing with genuine enjoyment.