Why Junk Silver Coins Value Matters for Today's Investor

Junk silver coins value is determined primarily by their precious metal content, not their face value or collectible rarity. If you're looking to calculate what your old silver dimes, quarters, or half dollars are worth right now, here's a quick reference:

Quick Reference: Junk Silver Coin Values

- 90% Silver Dime (1964 or earlier): ~$2.25 melt value at $31.11/oz silver

- 90% Silver Quarter (1964 or earlier): ~$5.63 melt value at $31.11/oz silver

- 90% Silver Half Dollar (1964 or earlier): ~$11.25 melt value at $31.11/oz silver

- 40% Silver Half Dollar (1965-1970): ~$4.60 melt value at $31.11/oz silver

- 90% Silver Dollar (Morgan/Peace): ~$24.06 melt value at $31.11/oz silver

Prices shown are at the time of this publication and fluctuate with the live silver market.

Despite the unflattering name, junk silver refers to authentic U.S. coins minted before 1965 that contain real silver. These circulated dimes, quarters, half dollars, and dollars aren't "junk" at all—they're widely recognized, government-minted silver that trades close to its melt value (the intrinsic worth of the silver content itself).

Unlike newly minted silver bars or modern bullion coins, junk silver typically carries lower premiums over spot price, making it one of the most accessible ways to own physical silver. The term simply distinguishes these common-date, circulated coins from rare numismatic pieces that command collector premiums.

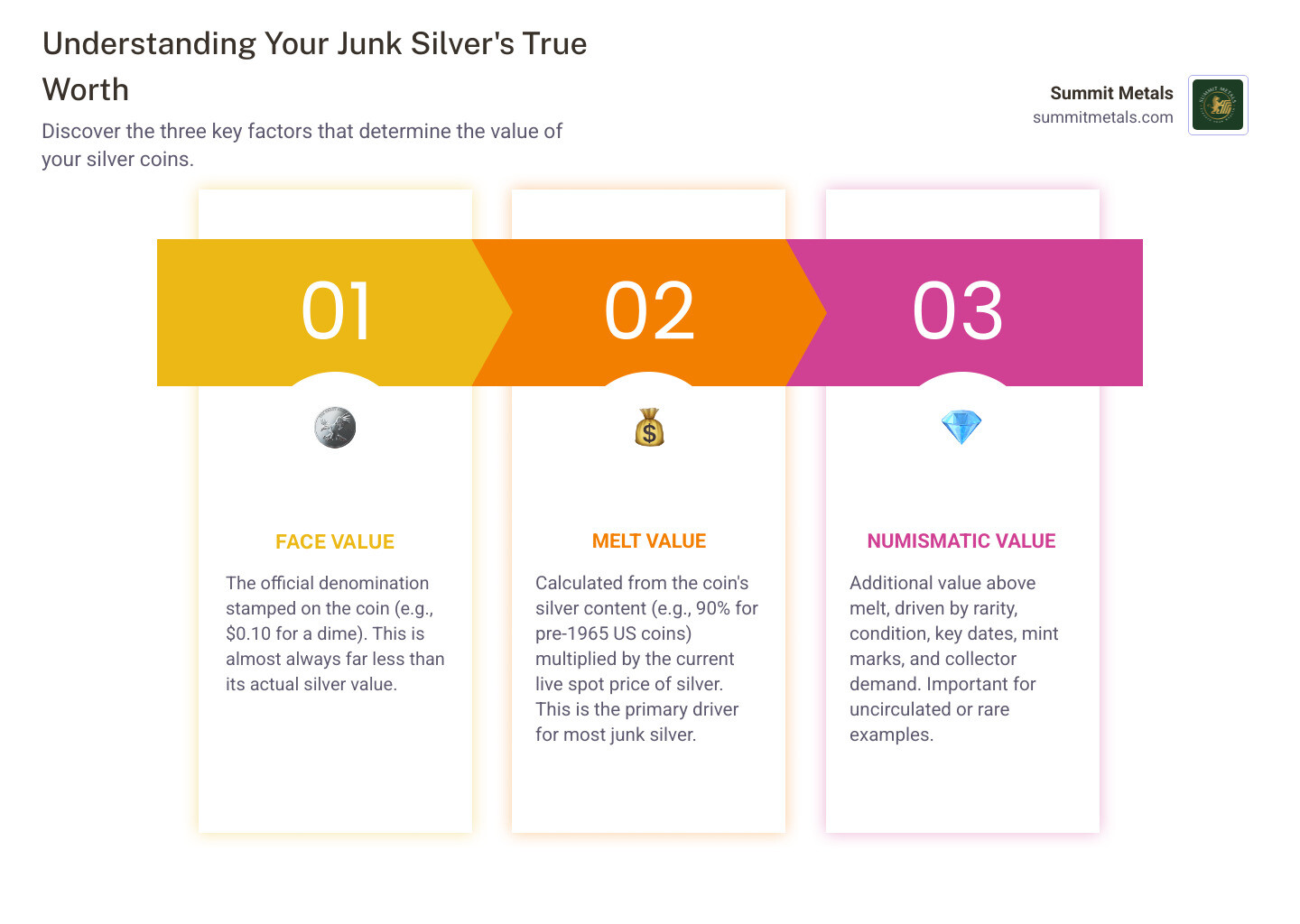

Understanding junk silver coins value requires looking at two factors: the melt value based on silver content and current spot prices, and the numismatic value driven by rarity and condition. For most circulated pre-1965 coins, melt value is the primary driver—but occasionally you'll find a key date or mint mark that's worth significantly more to collectors.

This guide will show you exactly how to calculate what your junk silver is worth, which coins to look for, and how junk silver compares to other precious metal investments. Whether you're liquidating old coins or building a diversified portfolio, you'll learn how to assess value with confidence.

Understanding Junk Silver: From Pocket Change to Precious Metal

Before 1965, U.S. dimes, quarters, and half dollars were made of real silver. This historical context is crucial to understanding junk silver coins value. The United States once minted its circulating coinage with precious metals, giving these coins an intrinsic value far beyond their stamped face value.

The Coinage Act of 1965 changed everything. As silver prices rose, the melt value of these coins exceeded their face value, leading people to hoard them. To keep coins in circulation, the U.S. government removed silver from dimes and quarters, switching to a copper-nickel clad composition. Half dollars had their silver content drastically reduced. This historical shift created the category we now call "junk silver."

Here's a quick breakdown of the silver content percentages you'll find in U.S. junk silver:

- 90% Silver: This is the most common category. It includes all dimes, quarters, and half dollars minted before 1965, as well as Morgan and Peace silver dollars. These coins are 90% silver and 10% copper.

- 40% Silver: Found only in Kennedy Half Dollars minted between 1965 and 1970. These coins contain 40% silver and 60% copper.

- 35% Silver: Known as "War Nickels," these are Jefferson Nickels minted between 1942 and 1945. Due to wartime demands for nickel, their composition was temporarily changed to 35% silver, 56% copper, and 9% manganese.

Common Types of U.S. Junk Silver

When we talk about junk silver coins value, we're usually referring to a specific set of U.S. coinage. Here's a list of the most common types:

-

90% Silver Dimes:

- Mercury Dimes (1916-1945)

- Roosevelt Dimes (1946-1964)

-

90% Silver Quarters:

- Barber Quarters (1892-1916)

- Standing Liberty Quarters (1916-1930)

- Washington Quarters (1932-1964)

-

90% Silver Half Dollars:

- Barber Half Dollars (1892-1915)

- Walking Liberty Half Dollars (1916-1947)

- Franklin Half Dollars (1948-1963)

- Kennedy Half Dollars (1964 only)

-

90% Silver Dollars:

- Morgan Dollars (1878-1904, 1921)

- Peace Dollars (1921-1935)

- 40% Silver Kennedy Half Dollars (1965-1970)

- 35% Silver "War Nickels" (1942-1945)

These coins, while common, represent a tangible piece of American history.

A Look at International Junk Silver

While our primary focus at Summit Metals is on U.S. junk silver for our investors in Wyoming and Salt Lake City, Utah, it's worth noting that other countries also issued silver coinage. For instance, Canadian coins minted before 1967 often contain 80% silver. You might also encounter Mexican silver pesos or other world coins with varying purities. The key to valuing any international junk silver is to determine its Actual Silver Weight (ASW) and apply the current spot price, just as you would with U.S. coins.

How to Determine the Junk Silver Coins Value

Determining the true junk silver coins value involves balancing two components: melt value and numismatic value. For most junk silver, the melt value is the primary factor. However, overlooking numismatic potential can mean leaving money on the table.

The spot price of silver is the foundation of melt value. This is the current market price for one troy ounce of pure silver, which fluctuates based on global supply and demand. A useful neutral reference is the Silver as an investment guide on Wikipedia, which explains how spot prices work and how they relate to physical bullion and coins.

Other factors include:

- Coin Condition: For melt value, wear slightly reduces a coin's weight and silver content. For numismatic value, condition is paramount. An "uncirculated" coin commands a much higher premium than a heavily worn one.

- Grading: Professional grading services (like PCGS or NGC) certify a coin's condition, which is critical for establishing high numismatic value.

- Rarity: Low mintage or "key date" coins are rarer and thus more valuable to collectors.

- Mint Marks: Small letters on the coin (e.g., "D" for Denver, "S" for San Francisco, "CC" for Carson City) indicate where it was struck. Some mint marks are more desirable.

- Collector Demand: A coin's numismatic value is ultimately driven by what collectors are willing to pay.

Factors Influencing Melt Value

Melt value is the intrinsic worth of the silver in your coins. It's the most direct way to calculate junk silver coins value. Here's what influences it:

- Live Silver Price: The price of silver per troy ounce fluctuates daily. We monitor these prices closely to ensure transparent, competitive rates for our customers.

- Silver Purity: U.S. junk silver comes in 90%, 40%, and 35% purities. This percentage is key to determining the amount of pure silver.

- Coin Weight: Each silver coin has a standard gross weight. This weight, combined with its purity, determines the Actual Silver Weight (ASW).

- Wear and Tear: Decades of circulation cause coins to lose a small amount of metal. This "wear" can slightly reduce the ASW, especially in heavily circulated pieces.

Opening Up Numismatic Value in Your Junk Silver Coins

While most junk silver is valued by its melt content, some pieces have a higher junk silver coins value due to numismatic appeal. "Cherry-picking" is the process of finding these hidden gems.

Look for these indicators of extra numismatic value:

- Key Dates: Certain years with low mintages are much rarer. For example, a 1916-D Mercury Dime or a 1932-D Washington Quarter is worth far more than its melt value.

- Rare Mint Marks: The "CC" mint mark for Carson City on Morgan Dollars, for instance, commands a premium.

- Uncirculated Condition: Coins that never circulated and retain their original mint luster are highly valuable to collectors, even if they aren't key dates.

- Error Coins: Minting mistakes, such as double dies or off-center strikes, can make a coin unique and highly sought after.

To confirm numismatic value, consult specialized coin price guides (like the Red Book), neutral educational resources such as the Coin collecting article on Wikipedia, or seek an appraisal from a reputable coin dealer.

Simple Comparison: Junk Silver vs. Modern Bullion for Numismatic Potential

| Feature | Circulated Junk Silver | Modern Bullion Coins (e.g., ASEs) |

|---|---|---|

| Primary Value Driver | Melt value | Melt value + small premium |

| Chance of Hidden Numismatic Gem | Moderate (key dates, errors) | Low (most are common dates) |

| Typical Premium Above Melt | Low | Moderate |

| Ideal For | Silver weight + occasional collecting upside | Consistent, uniform bullion holdings |

A Practical Guide to Calculating Melt Value

Calculating the melt value of your junk silver is a straightforward process that empowers you to understand the true junk silver coins value of your holdings. The basic principle is to multiply the current spot price of silver by the total Actual Silver Weight (ASW) of your coins.

The Formula:

Melt Value = Spot Price of Silver (per troy ounce) x Total Actual Silver Weight (ASW) of your coins

While this used to require manual calculation, many online tools can now do the heavy lifting. You can simply input the quantity of each coin type to get an instant melt value based on the current spot price.

Calculating the junk silver coins value: A Step-by-Step Example

Let's walk through some examples using a silver price of $31.11/oz (note: prices fluctuate):

-

Roosevelt Dime (90% Silver, 1946-1964):

- Contains approx. 0.0723 troy ounces of silver.

- Melt Value = $31.11/oz * 0.0723 oz = ~$2.25

-

Washington Quarter (90% Silver, 1932-1964):

- Contains approx. 0.1808 troy ounces of silver.

- Melt Value = $31.11/oz * 0.1808 oz = ~$5.63

-

Kennedy Half Dollar (40% Silver, 1965-1970):

- Contains approx. 0.1479 troy ounces of silver.

- Melt Value = $31.11/oz * 0.1479 oz = ~$4.60

-

Calculating Value for a $10 Face Value Bag of 90% Silver: Junk silver is often sold in "face value bags." A common rule of thumb is that $1.00 in face value of 90% U.S. silver coins contains approximately 0.715 troy ounces of pure silver.

- A $10 face value bag contains: 10 * 0.715 oz = 7.15 troy ounces of silver.

- Melt Value = $31.11/oz * 7.15 oz = ~$222.44

These examples show how easy it is to estimate the junk silver coins value based on market data.

To double-check your math or experiment with different spot prices, you can use various online calculators, then compare that to Summit Metals' real-time pricing before you buy or sell.

Common Misconceptions About Junk Silver

Let's debunk some common myths about junk silver coins value:

- It's worthless "junk": Not true. The term "junk" merely distinguishes these coins from rare numismatic pieces. They are a highly liquid and recognized form of physical silver.

- All old coins are 90% silver: This is incorrect. While dimes, quarters, half dollars, and dollars minted before 1965 are 90% silver, U.S. pennies and most nickels never contained silver (the exception being 1942-1945 "War Nickels").

- Melt value is the only value: For most circulated junk silver, melt value is the primary driver. However, some coins can carry a numismatic premium due to rarity or condition. It's always wise to be aware of the potential for collector value.

Quick Comparison: Manual Calculations vs. Online Calculators

| Method | Pros | Cons | Best Use Case |

|---|---|---|---|

| Manual Formula (ASW x Spot) | Full control; great for learning; works offline | Slower for large batches; easy to make arithmetic errors | Double-checking a few coins or small bags |

| Online Melt Calculator | Fast; handles large quantities; easy to change spot price | Requires internet; results only as accurate as inputs | Pricing larger holdings and comparing to Summit Metals' live quotes |

Investing in Junk Silver: Pros, Cons, and Comparisons

For investors in Wyoming and Salt Lake City, Utah, junk silver offers a unique blend of benefits compared to other forms of silver. Understanding these aspects can help you build a robust precious metals portfolio.

Advantages of Investing in Junk Silver:

- Lower Premiums: Junk silver often trades closer to the spot price than newly minted bullion, meaning you get more silver for your dollar.

- High Divisibility: Small denominations (dimes, quarters) are ideal for bartering or small transactions.

- Recognizability & Liquidity: As former U.S. legal tender, these coins are instantly recognizable and easily sold.

- Inherent Fraud Protection: The government-issued face value makes counterfeiting riskier for criminals compared to generic silver rounds, adding a layer of trust.

Disadvantages or Risks:

- Market Volatility: The junk silver coins value fluctuates with the silver market.

- Storage: Large quantities can be bulky and heavy, requiring secure storage.

- Numismatic Distraction: Searching for rare coins can distract from the primary goal of accumulating silver weight.

Junk Silver vs. Other Silver Investments

How does junk silver stack up against silver bars or modern bullion coins? This comparison highlights its unique advantages, particularly its divisibility and the fraud protection offered by its face value.

| Feature | Junk Silver Coins (e.g., pre-1965 U.S. 90%) | Silver Bars (e.g., 1 oz, 10 oz .999 fine) | Modern Bullion Coins (e.g., American Silver Eagle) |

|---|---|---|---|

| Purity | 35%, 40%, 90% | .999 or .9999 fine (very pure) | .999 fine (very pure) |

| Premium Over Spot | Generally Lower | Often the lowest | Generally Higher |

| Divisibility | Excellent (small denominations) | Poor (large units) | Good (1 oz units) |

| Numismatic Potential | Low to Moderate | None | Low to Moderate |

| Fraud Protection | Yes (Gov't-issued face value) | No (Relies on refiner's mark) | Yes (Gov't-issued face value) |

| Recognition | High (U.S. coinage) | Moderate (Trust in refiner) | High (Globally recognized) |

| Storage | Bulky for large amounts | Compact for high weight | Relatively compact |

| Liquidity | High | High | High |

Gold Coins vs. Gold Bars: A Quick Decision Chart

Many Summit Metals investors pair junk silver with gold. When deciding between gold coins and gold bars, similar trade-offs apply.

| Feature | Gold Coins (e.g., American Gold Eagle) | Gold Bars (e.g., 1 oz, 10 oz .9999 fine) |

|---|---|---|

| Face Value / Legal Tender | Yes – government-issued face value adds trust and fraud protection | No face value; relies on refiner hallmark |

| Recognizability | Very high; widely known designs | Varies by brand; well-known refiners are trusted |

| Premium Over Spot | Generally higher due to minting costs and demand | Often lower per ounce, especially in larger bars |

| Divisibility | Good (1/10 oz, 1/4 oz, 1/2 oz, 1 oz options) | Poor once you move above 1 oz; harder to sell partial value |

| Fraud Detection | Easier for most buyers to evaluate visually and by dimensions | May require more advanced testing for non-experts |

| Ideal For | Long-term savers who value liquidity, trust, and portability | Investors focused on lowest premium per ounce for large allocations |

If fraud protection and ease of resale are priorities, government-minted gold coins often win. If minimizing premiums on large purchases is most important, bars can make sense. Many investors choose a mix: junk silver for divisibility, gold coins for trusted wealth storage, and bars for bulk exposure.

Automate Your Silver Stacking with Autoinvest

Building a precious metals position requires discipline. That's why Summit Metals offers our Autoinvest program to customers in Wyoming and Salt Lake City, Utah. It makes regular silver and gold purchases simple and automatic.

Think of it as a 401k-style approach to physical metals:

- You choose a monthly dollar amount.

- Summit Metals allocates that amount into selected products (such as junk silver, bullion coins, or bars) at transparent, real-time prices.

- Over time, you dollar-cost average, buying more ounces when prices are low and fewer when they are high.

This "set it and forget it" Autoinvest strategy helps you steadily build a stack without trying to time the market, just like contributing to a 401k from every paycheck.

Ready to build your silver stack effortlessly? Set up your monthly silver investment with Summit Metals today.

Frequently Asked Questions about Junk Silver Coins Value

Here are answers to some common questions we receive about junk silver coins value.

Are all pre-1965 U.S. coins 90% silver?

No. While U.S. dimes, quarters, half dollars, and dollars minted in 1964 and earlier are 90% silver, other denominations are not. Pennies never contained silver, and only Jefferson Nickels from 1942-1945 ("War Nickels") contain silver (35%).

Is it better to invest in junk silver or .999 fine silver bars?

The "better" option depends on your goals.

- Junk silver offers excellent divisibility, lower premiums, and high recognizability. It's great for flexibility and those who appreciate its history.

- .999 fine silver bars offer the highest purity and are more compact for storing large amounts, often with the lowest premiums per ounce.

Many investors hold both to get the benefits of each.

How do I know if my junk silver has extra numismatic value?

Look for coins in excellent condition, key dates (rare years with low mintage), rare mint marks (like "CC" for Carson City), or minting errors. Heavy wear usually means a coin is only worth its melt value. To be sure, consult a reputable coin price guide (like the "Red Book") or seek an appraisal from a trusted dealer in Salt Lake City, Utah, or Wyoming.

Conclusion

Understanding junk silver coins value is about recognizing the worth of precious metals embedded in our history. Despite its name, junk silver is a tangible, accessible, and cost-effective way to invest in physical silver, offering lower premiums, high liquidity, and excellent divisibility.

We've covered how to identify junk silver, calculate its melt value, and spot potential numismatic treasures. Whether you're a seasoned investor or just starting, junk silver offers a solid foundation for a diversified portfolio.

At Summit Metals, we are committed to providing transparent pricing and authenticated precious metals to our customers in Wyoming and Salt Lake City, Utah. Understanding both melt and numismatic value is key to maximizing your investment.

Explore our collection of Constitutional Silver and own a piece of history while hedging for your future with Summit Metals.