Why a Precious Metals Investment Guide Matters Now More Than Ever

A precious metals investment guide helps you protect and grow wealth through assets that have preserved value for thousands of years. Here's what you need to know in a streamlined overview.

Quick Answer: Essential Steps to Invest in Precious Metals

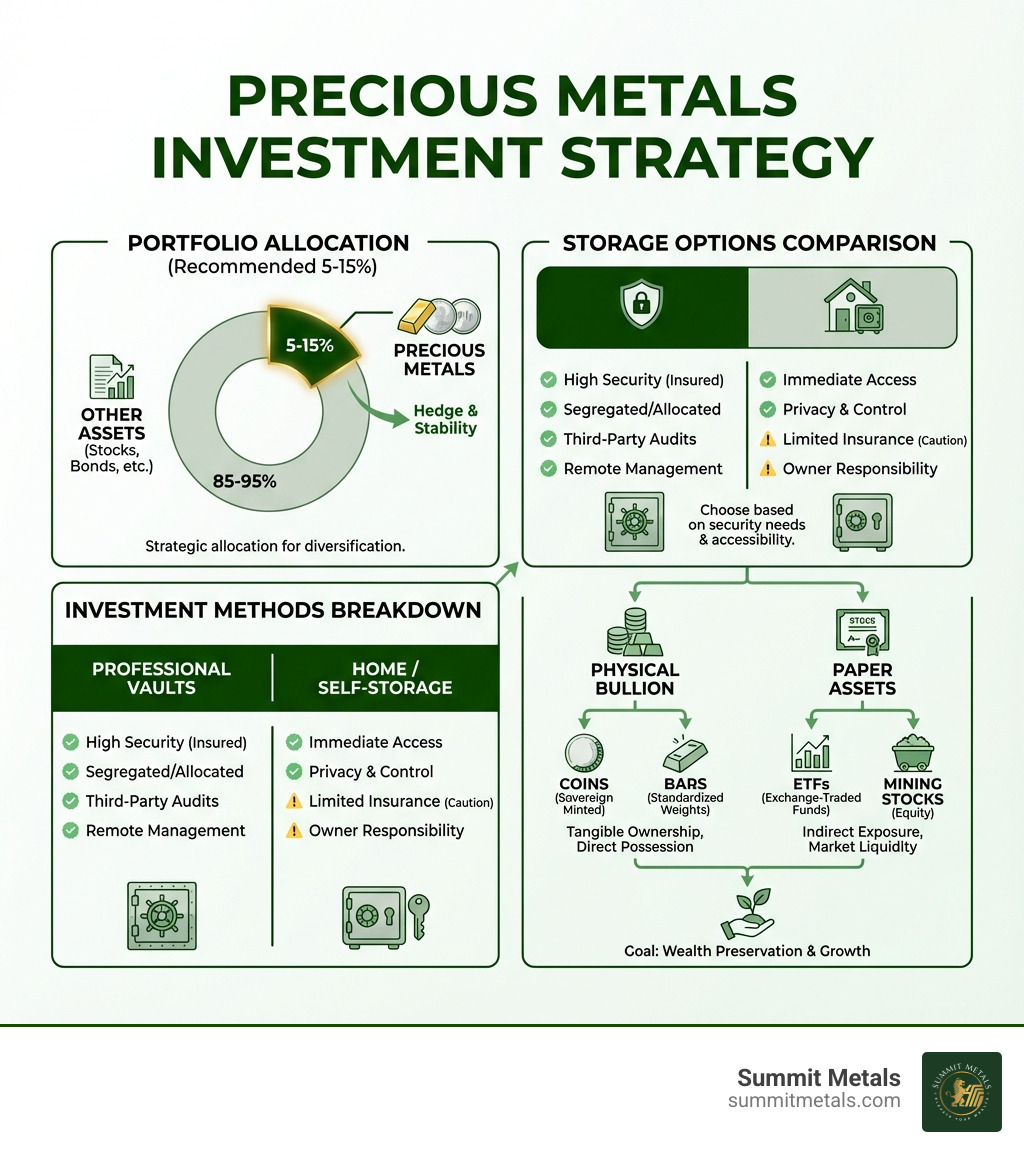

- Choose Your Metal – Gold for stability, silver for growth potential, platinum for industrial exposure.

- Select Your Method – Physical bullion (coins/bars) or paper assets (ETFs, mining stocks).

- Allocate Wisely – Most advisors recommend 5-15% of your portfolio.

- Store Securely – Use professional vaults or insured storage solutions.

- Buy Consistently – Dollar-cost average through programs like Summit Metals Autoinvest.

Gold has climbed 27% year-to-date versus 21% for the S&P 500. Since the United States abandoned the gold standard in 1971, gold prices have appreciated by almost 8% annually. When stocks and bonds recorded double-digit losses in 2022, gold rose 0.4%, silver jumped 6.3%, and platinum gained 12.2%.

Why precious metals matter for your portfolio:

- Hedge against inflation – Maintain purchasing power as currencies weaken.

- Low correlation – Move independently from stocks and bonds.

- Crisis protection – Historically outperform traditional assets by double digits during downturns.

- Tangible value – No credit risk or counterparty dependence.

- Global liquidity – About $130.9 billion in gold trades daily.

The challenge? Many investors struggle with opaque pricing, questionable authenticity, and complex storage logistics. They need clear guidance on which metals to buy, how much to allocate, and where to store physical assets safely.

I'm Eric Roach, and I've spent over a decade advising Fortune-500 clients on hedging strategies and market cycles in investment banking and M&A. Today, I help individual investors apply those same institutional tactics through a concise precious metals investment guide that turns Wall Street expertise into actionable steps for building wealth through gold, silver, and platinum.

Key precious metals investment guide vocabulary:

Gold vs. Silver vs. Platinum: Choosing Your Metal

When diving into precious metals, the first question often is: which one? While all three offer unique benefits, their roles in a portfolio differ based on rarity, primary uses, price drivers, volatility, and liquidity.

Here's a compact comparison to help you decide which metal best suits your investment goals:

| Attribute | Gold | Silver | Platinum |

|---|---|---|---|

| Rarity | Relatively fixed amount per human, but more above ground than platinum. Estimated all gold ever mined would fill about three Olympic pools. | More abundant than gold, but much is consumed industrially or discarded. | Rarer than gold; one of the rarest elements in Earth's crust. |

| Primary Use | Store of value, jewelry, investment (including central bank reserves). Over 90% for investment/jewelry. | Industrial (solar, electronics, EVs), jewelry, investment. Roughly half of demand is industrial. | Industrial (catalytic converters, medical), jewelry, investment. Over a third of demand is for catalytic converters. |

| Price Drivers | Economic uncertainty, inflation, interest rates, central bank buying, U.S. dollar strength. | Industrial demand, gold prices, economic growth, technological advancements. | Automotive industry health, geopolitical conditions in mining regions, green tech. |

| Volatility | Typically less volatile than silver. | More volatile than gold, known for bigger price swings. | Can be highly volatile due to small market size and concentrated supply. |

| Liquidity | Most liquid precious metal market (around $130.9B traded daily). | Highly traded but with larger price swings than gold. | Smallest and least liquid market of the three. |

Geopolitical factors, industrial demand, investment demand, central bank buying, and supply chain disruptions all shape the prices of these metals. For instance, platinum prices are heavily influenced by geopolitical conditions in major mining countries like South Africa.

Gold: The Timeless Safe Haven

Gold has been a monetary metal for thousands of years, revered for its enduring value. It is the classic "safe haven" asset investors turn to during economic uncertainty, inflation, or geopolitical instability.

Why gold?

- Hedge Against Inflation and Currency Devaluation: When the value of paper money erodes, gold tends to maintain its purchasing power. Since the U.S. abandoned the gold standard in 1971, gold prices have appreciated by almost 8% annually.

- Low Correlation to Stocks: Gold often moves independently of stocks and bonds. Adding gold to a portfolio can improve risk-adjusted returns because it tends to hold up when traditional assets struggle.

- Price Influenced by Real Interest Rates: Gold is inversely correlated with real (inflation-adjusted) interest rates. When real rates are low or negative, the opportunity cost of holding gold falls, supporting prices.

- Central Bank Reserves: Central banks worldwide hold significant gold reserves and have returned to buying roughly just under 1,200 tons per year on average in the last eight quarters, reinforcing gold’s role as a store of value.

For a deeper dive into gold's role, see A Beginner's Guide to Precious Metals.

Silver: The Dual-Role Dynamo

Silver is both a precious metal and a vital industrial commodity, giving it a unique price profile.

- Industrial Applications: Roughly half of silver's demand is industrial, including electronics, medical devices, and solar panels. Photovoltaic demand for silver has grown at roughly 16% annualized compound returns over the last nine years.

- Electric Vehicles (EVs): EVs use about three times as much silver as combustion-engine vehicles, creating a structural demand tailwind.

- Higher Volatility than Gold: Silver’s industrial exposure makes it more volatile than gold, which can mean larger upside in strong cycles and sharper drawdowns in weak ones.

- Store of Value: Silver also serves as a store of value and has maintained a very high correlation to gold since 2011, often moving in the same direction during periods of stress.

Platinum: The Industrial Powerhouse

Platinum is rarer than gold and heavily tied to specific industrial sectors.

- Rarer than Gold: Platinum is estimated to be 15-20 times rarer than gold in the Earth’s crust.

- Catalytic Converters: Over a third of platinum demand comes from catalytic converters in combustion vehicles, linking its price to auto sector health and emissions regulations.

- Green Hydrogen Technology: Platinum is ready to play a key role in the emerging green hydrogen economy, especially in fuel cells and electrolyzers.

- Supply Concentration: About 80% of global platinum supplies come from a handful of countries, primarily South Africa and Russia. This concentration makes prices sensitive to geopolitics, labor issues, and supply disruptions.

- Diversification from Gold: Because its drivers are more industrial, platinum does not always move in sync with gold, offering additional diversification within a precious metals allocation.

Quick comparison at a glance

| Goal / Concern | Gold Best For | Silver Best For | Platinum Best For |

|---|---|---|---|

| Long-term wealth preservation | Yes | Partly | Partly |

| Inflation hedge | Strong | Moderate to strong | Indirect (via industrial demand) |

| Growth potential | Moderate | Higher (with more volatility) | Potentially high but cyclical |

| Industrial & tech exposure | Limited | High (solar, EVs, electronics) | High (autos, green hydrogen, industry) |

| Portfolio stability | Highest of the three | Medium | Lowest (most cyclical and concentrated) |

| Best “first metal” to own | Typically | For smaller budgets or added growth | For more advanced, diversified metal investors |

The Ultimate Precious Metals Investment Guide: 2 Core Methods

Now that we've covered the characteristics of gold, silver, and platinum, the next step is how to invest. There are two core methods in this precious metals investment guide: direct ownership of physical bullion and indirect ownership through financial instruments. For Summit Metals, the focus is on helping you secure authenticated physical metals, which offers direct exposure and peace of mind.

Method 1: Physical Bullion (Coins & Bars)

Investing in physical bullion means owning the actual metal—gold, silver, or platinum coins and bars. This is the most traditional and for many the most reassuring way to invest.

- Tangible Ownership: You hold a physical asset that cannot be wiped out by a cyberattack or a bank collapse.

- Off-the-Grid Asset: In extreme scenarios, physical bullion can function as a store of value when financial systems are disrupted.

- Authenticated Metals: Summit Metals offers authenticated gold and silver products with transparent, real-time pricing and competitive rates achieved through bulk purchasing.

- Storage Costs & Insurance Needs: Physical metals require secure storage (home safes, bank boxes, or professional vaults). Homeowner's insurance typically covers precious metals for only $1,000 to $2,500 total, so separate coverage is often needed for meaningful holdings.

- Dealer Premiums: Physical bullion is sold at a premium above the spot price (the current market price of the raw metal) to cover refining, minting, and dealer costs.

Gold Coins vs. Gold Bars: Which Is Right for You?

When buying physical gold, most investors choose between coins and bars.

| Feature | Gold Coins | Gold Bars |

|---|---|---|

| Liquidity | Highly liquid, especially well-known government-minted coins (e.g., American Gold Eagles). Easy to sell in smaller increments. | Less divisible; larger bars may have a smaller pool of buyers. |

| Premiums | Usually higher premiums per ounce due to intricate design, smaller size, and collector appeal. | Typically lower premiums per ounce, cost-effective for larger investments. |

| Fraud Protection / Face Value | Government-issued coins have a legal tender face value, which helps protect against fraud and confirms authenticity. For example, a $50 American Gold Eagle has an official face value in addition to its metal content. | Bars do not have a face value. Their value is based solely on metal content and purity, without government backing. |

| Divisibility | Excellent—easy to sell one coin at a time to raise cash. | Less flexible; selling part of a large bar means selling the whole bar. |

| Storage | Convenient in small quantities and easy to handle discreetly. | More efficient for storing high dollar amounts in a compact form. |

Decision guide: Gold coin vs. gold bar

| If you prioritize… | Consider… |

|---|---|

| Maximum fraud protection and government backing | Gold coins |

| Ability to sell in small pieces | Gold coins |

| Lowest cost per ounce for larger purchases | Gold bars |

| Compact storage of high values | Gold bars |

For many individual investors, the added protection of a government-issued face value—plus better divisibility—makes gold coins the more flexible starting point, while bars can be added later for larger allocations.

You can explore authenticated physical gold, silver, and platinum bullion at Summit Metals.

Autoinvest: Build Wealth Consistently

One of the most effective long-term strategies in any precious metals investment guide is dollar-cost averaging (DCA). This means investing a fixed amount of money on a regular schedule, regardless of price.

At Summit Metals, the Autoinvest program lets you dollar-cost average by shopping with Summit Metals automatically—buying every month just like contributing to a 401k.

With Autoinvest, you can:

- Automate Your Purchases: Set recurring buys of your preferred gold or silver products.

- Smooth Out Volatility: Buy more ounces when prices are lower and fewer when they are higher, helping reduce your average cost over time.

- Stay Disciplined: Consistent monthly purchases remove guesswork and market timing from the equation.

Set up your automated investment plan today and let your position grow gradually, one scheduled purchase at a time.

Method 2: Secure Storage Solutions

Once you own physical precious metals, secure storage becomes critical. While some investors keep metals at home, professional, insured storage offers higher security and often greater peace of mind.

Summit Metals partners with trusted, insured storage facilities, giving clients in Wyoming, Utah, and beyond a straightforward way to safeguard their metals.

| Feature | Home Storage | Professional Secure Storage (Summit Metals' partners) |

|---|---|---|

| Security | Dependent on home safes and discretion; vulnerable to theft, fire, and natural disasters if not well protected. | High-security vaults with advanced surveillance, physical security, and environmental controls. |

| Insurance | Standard homeowner's policies usually cover only $1,000-$2,500 of metals. Extra riders can be costly. | Fully insured against covered risks by third-party insurers, with coverage sized to your holdings. |

| Accessibility | 24/7 access if you are at home and it is safe to retrieve. | Access typically during business hours and with advance notice, depending on facility. |

| Cost | Upfront safe cost ($500–$5,000+), plus any added insurance premiums. | Annual storage fee (often 0.5%–1.5% of value), generally including insurance and security. |

| Anonymity | High if you do not disclose holdings to insurers or others. | Holdings are known to the storage provider, which maintains client confidentiality. |

| Peace of Mind | Can require constant vigilance about security and who knows you have metals. | Professional oversight can significantly reduce day-to-day worry. |

To avoid the risks and hassles of home storage, you can learn more about secure vaulting options at Summit Metals Secure Storage.

Building Your Strategy: Portfolio Allocation & Timing

Investing in precious metals is not just about which metal you choose, but how you integrate it into your broader financial plan. A clear strategy covers allocation, timing, and discipline.

- Portfolio Diversification: Precious metals historically have low correlation with stocks and bonds. Adding them can help smooth overall returns.

- Hedging Against Market Volatility: During periods of stress, gold in particular often benefits from a "flight to safety." In crises, metals have repeatedly held up better than many traditional assets.

- Capital Appreciation vs. Income: Physical metals do not pay interest or dividends. Their role is long-term wealth preservation and potential price appreciation, not generating regular cash flow.

Recommended Allocation

Most financial advisors suggest allocating 5-15% of a portfolio to precious metals:

- Conservative (5-10%) – For investors focused on stability who want a hedge without significantly changing portfolio behavior.

- Balanced/Aggressive (10-15%) – For investors more concerned about inflation, currency risk, or systemic shocks. A permanent 10% allocation to physical gold is a common baseline.

Within your metals allocation, a simple starting mix is 70% gold / 30% silver, combining gold's stability with silver's higher growth potential.

Dollar-Cost Averaging (DCA) with Autoinvest

Trying to time the market is difficult even for professionals. Dollar-cost averaging is simpler and often more effective.

By committing a fixed amount every month, you automatically:

- Buy more ounces when prices dip.

- Buy fewer when prices spike.

- Reduce the emotional temptation to chase rallies or panic-sell dips.

Summit Metals' Autoinvest program is designed for this: you dollar cost average by shopping with Summit Metals automatically—buying every month just like investing in a 401k. It turns your precious metals plan into a regular habit.

You can learn more about this approach at More info about dollar-cost averaging.

Rebalancing Strategy

As prices move, your metals allocation will drift from target. Reviewing once or twice a year is usually enough:

- If your metals rise from 10% to 15% of your portfolio, you can sell a portion and reinvest in underweighted assets.

- If metals fall from 10% to 7%, you can buy to bring the allocation back up, effectively buying at lower prices.

This disciplined rebalancing helps lock in gains and maintain your intended risk profile without constant trading.

Advanced Concepts & Managing Risk

As you grow more comfortable with precious metals, you can incorporate a few advanced ideas from this precious metals investment guide to sharpen your strategy.

Understanding Price Volatility

All precious metals experience price swings. Key drivers differ by metal:

- Gold: Driven mainly by macro forces—real interest rates, U.S. dollar strength, inflation expectations, and geopolitical risk. Less tied to industrial use.

- Silver: Influenced by both investor sentiment and industrial demand, including electronics and solar. This dual role increases volatility.

- Platinum: Highly sensitive to automotive demand (catalytic converters) and supply disruptions in South Africa and Russia. Its smaller, less liquid market can amplify moves.

Lack of Yield and Counterparty Risk

Physical metals do not pay dividends or interest, which is a drawback for income-focused investors. However, they also have no counterparty risk: a gold coin in your possession cannot default or go bankrupt. This makes physical bullion a form of long-term financial insurance.

Transaction Costs: What to Watch

When buying or selling physical metals, you encounter:

- Spot Price: The market price per ounce of raw metal on global exchanges.

- Premium: The amount above spot to cover minting, distribution, and dealer margin. Coins usually carry higher premiums than bars.

- Spread: The difference between the dealer's buying price and selling price. Narrower spreads improve your effective return.

Summit Metals uses bulk purchasing and real-time transparent pricing to help keep these costs competitive.

Using the Gold-to-Silver Ratio

The gold-to-silver ratio shows how many ounces of silver equal one ounce of gold. Historically it has ranged roughly between 10:1 and 100:1.

- High ratio (e.g., 85:1): Silver is relatively cheap compared to gold. Some investors may tilt more toward silver.

- Low ratio (e.g., 50:1): Silver is relatively expensive. Tactical investors may rotate back into gold.

Example: If you swap 1 ounce of gold for 85 ounces of silver at an 85:1 ratio and later trade back when the ratio is 60:1, those 85 ounces could buy about 1.42 ounces of gold—an increase in gold holdings without adding new cash, purely by using relative value.

Gauging Market Sentiment

Because sentiment is a major driver—especially for gold—it can help to watch:

- ETF Flows: Large inflows to gold or silver ETFs suggest rising institutional interest; outflows indicate the opposite.

- Central Bank Activity: Reports of central banks adding to gold reserves are a strong signal of long-term confidence.

- News & Geopolitics: Headlines about inflation, recession risk, or geopolitical tension often coincide with increased demand for safe-haven assets like gold.

Combining these indicators with a steady, rules-based approach—such as monthly Autoinvest purchases and periodic rebalancing—can help you manage risk without overcomplicating your strategy.

Frequently Asked Questions about Precious Metals Investing

We often hear similar questions from new investors. Here are concise answers based on experience and industry data.

How do precious metals perform during inflation or economic uncertainty?

Precious metals, especially gold, have a history of holding or increasing value when inflation rises or the economy weakens. In 2022, when many stock and bond markets saw double-digit losses, gold climbed 0.4%, silver rose 6.3%, and platinum gained 12.2%. Gold has, on average, outperformed the S&P 500 by 24 percentage points and U.S. Treasuries by about 10 percentage points during recent major crisis periods.

What are the main risks of investing in precious metals?

Key risks include:

- Price Volatility: Metals can experience sharp short- and medium-term price swings.

- Lack of Income: They pay no dividends or interest, so all return is from price movement.

- Storage & Insurance Costs: Physical bullion must be stored and insured, which adds ongoing costs.

- Transaction Costs: Premiums and spreads when buying and selling can reduce net returns.

- Illiquidity for Large Physical Sales: While the gold market itself is liquid, quickly selling very large physical positions can be more complex than selling an ETF.

How much of my portfolio should I allocate to precious metals?

Many financial advisors suggest 5-15% of a total portfolio in precious metals:

- Lower end of the range for conservative investors.

- Higher end for those more concerned with inflation, currency risk, or systemic shocks.

Some investors maintain a permanent 10% position in physical gold as a core hedge. A practical way to reach your target is to start small and build gradually—using a consistent, automated purchasing plan such as Summit Metals Autoinvest, where you buy every month much like contributing to a 401k.

Conclusion: Start Your Investment Journey

This precious metals investment guide has outlined how gold, silver, and platinum can support long-term wealth preservation, diversification, and protection against uncertainty. Physical metals are tangible assets with no credit risk that can help anchor your overall portfolio.

Summit Metals, based in Wyoming with a presence in Salt Lake City, Utah, focuses on authenticated gold and silver, transparent real-time pricing, and competitive rates driven by bulk purchasing. That combination supports trust and value for investors building positions in physical bullion.

The simplest way to get started is with consistent, automated purchases. With Summit Metals Autoinvest, you dollar cost average by shopping with Summit Metals—buying every month just like investing in a 401k. Over time, those steady contributions can turn into a meaningful precious metals allocation.

Do not wait for the next market downturn to explore the benefits of metals. Set up your automated investment plan today and let Summit Metals help you build and protect your wealth, one ounce at a time.