Why Understanding $50 Buffalo Gold Coin Value Matters

The

$50 buffalo gold coin value depends on several key factors that every investor should understand before making a purchase. These iconic American coins combine pure gold content with numismatic appeal, making their pricing more complex than simple bullion. While the coin's base value is tied to its one troy ounce of gold, its market price can vary significantly. For example:

- Bullion versions typically trade for a modest premium over the current gold spot price.

- Proof versions command higher premiums due to their limited mintage and superior finish.

- Professionally graded coins, especially those with high grades or from key dates, can be worth substantially more.

- The melt value is the intrinsic worth of the gold itself, which fluctuates with the daily market price of gold.

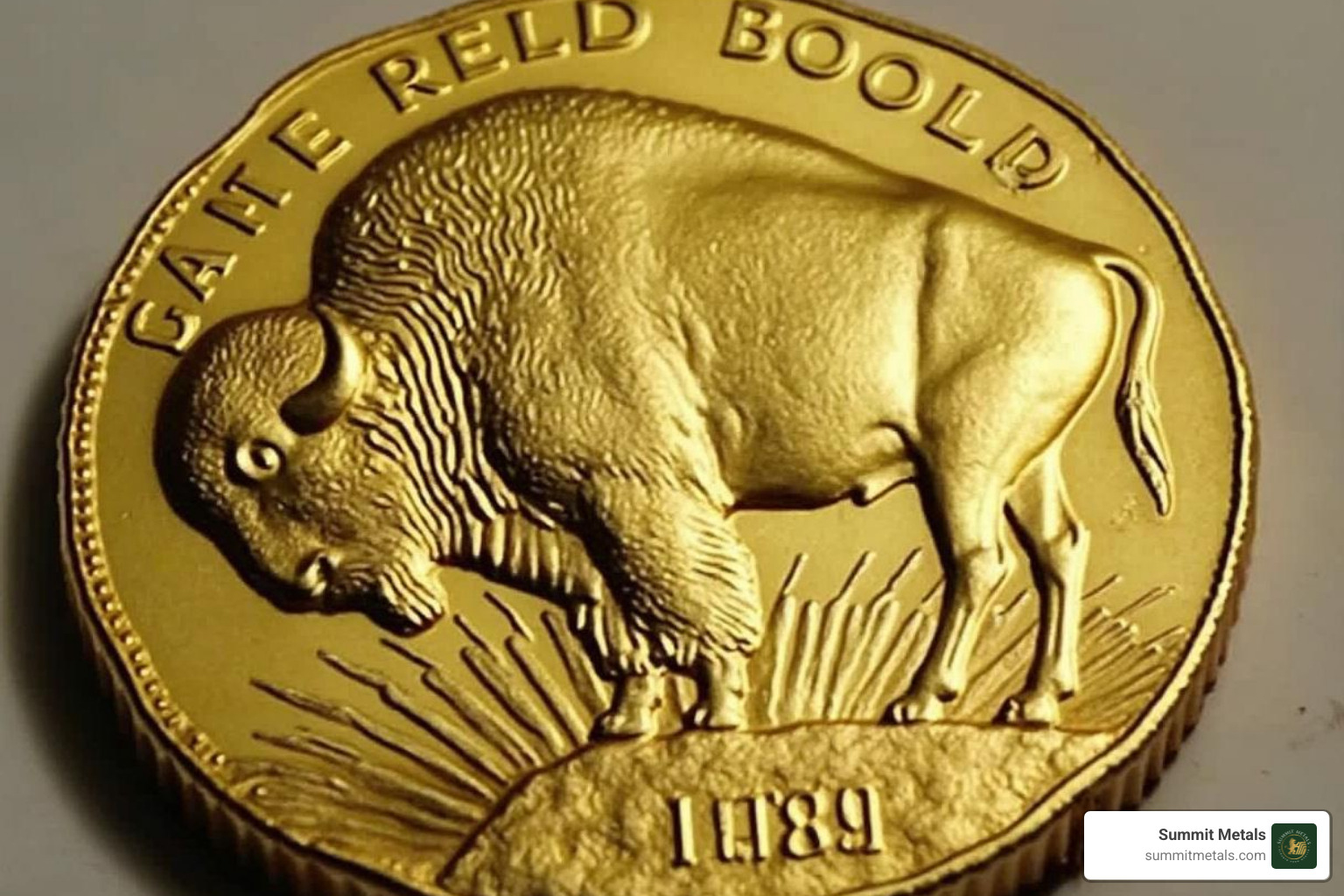

The American Buffalo Gold Coin stands as the first .9999 pure gold coin ever produced by the U.S. Mint. Launched in 2006, these 24-karat coins feature James Earle Fraser's iconic Buffalo Nickel design from 1913. Unlike other gold coins that mix alloys for durability, the Buffalo contains one full troy ounce of pure gold.

Coin Anatomy at a Glance

- Denomination: $50 (legal tender)

- Weight: 1.000 troy oz (31.1035 g)

- Diameter: 32.7 mm (1.287 in)

- Thickness: 2.87 mm (0.113 in)

- Purity: .9999 fine (24-karat) gold

- Edge: Reeded

- Designer: James Earle Fraser (original 1913 Buffalo Nickel)

Curious about how the design evolved? You can explore the full history on the American Gold Buffalo page over at Wikipedia.

What drives the value? The coin's worth stems from its gold content plus premiums for:

- Mint condition and professional grading

- Proof vs. bullion finish

- Year of mintage and rarity

- Market demand and collector interest

Whether you're looking at a standard bullion coin or a high-grade proof specimen, understanding these value drivers helps you make informed investment decisions.

I'm Eric Roach, and during my decade as an investment banking advisor on Wall Street, I've guided clients through complex hedging strategies that included precious metals like the $50 buffalo gold coin value analysis for portfolio diversification. Today, I help individual investors apply institutional-level risk management principles to build wealth through physical gold and silver investments.

Understanding the Core Value: Gold Content and Purity

When you look at the $50 buffalo gold coin value, the first thing that truly shines is its gold content. These coins are famous for being incredibly pure! We're talking about one full troy ounce of .9999 fine gold. That's 99.99% pure, making it a genuine 24-karat gold product.

Ever wondered how it stacks up against others? Well, unlike some other popular options, like the American Gold Eagle (which is 22-karat), the Gold Buffalo proudly boasts the highest level of gold purity you can find in a U.S. Mint coin.

One of the best things about the American Buffalo gold coin? The U.S. Mint stands behind it 100%! They guarantee both the weight and that incredible purity. This government backing gives you a fantastic level of trust and confidence as an investor.

Now, here's a fun fact that sometimes surprises people: while the coin does have a legal tender face value of $50 USD, its real value comes from its gold. We call this its "melt value." For example, if gold is trading at $2,000 an ounce, your $50 Buffalo Gold Coin is actually worth around $2,000! That's way more than the fifty bucks printed on it. So, that $50 denomination is really just a symbol; you're buying it for the gold, not to spend at the grocery store.

The story behind the Gold Buffalo is pretty interesting too! It came to life because of something called the Presidential $1 Coin Act of 2005. The big idea behind this law was to give U.S. investors their very own 24-karat gold option. Before this, many investors looked at pure foreign coins, like the Canadian Gold Maple Leaf.

So, the U.S. Mint made a smart move. By creating the Gold Buffalo, they really opened up the appeal of American gold coins to a wider, global audience. People around the world were starting to prefer that super high purity, and now the U.S. had a coin that fit the bill perfectly.

It's really important to grasp that difference between the coin's face value and its melt value when you're looking at the $50 buffalo gold coin value. While it's technically a $50 piece of legal tender, its actual worth in the real world is directly linked to how gold is trading right now on the international market.

Want to keep an eye on those gold prices? We've got you covered! You can check out our live chart anytime to see just how dynamic this precious metal truly is: Gold Prices Today: Live Gold Price Chart & Historical Data.

Key Factors That Determine the $50 Buffalo Gold Coin Value

Understanding what drives $50 buffalo gold coin value is like learning the rules of a game where gold content sets the baseline, but several other players can dramatically change the final score. Think of it as a recipe where pure gold is your main ingredient, but the finishing touches make all the difference in what someone's willing to pay.

Market demand acts as the primary seasoning in this recipe. When investors get nervous about the economy or inflation starts creeping up, suddenly everyone wants a piece of that shiny, tangible security. This increased demand naturally pushes prices higher, creating premiums above the basic gold content value.

Economic conditions and investor sentiment work hand-in-hand here. During uncertain times, people flock to gold like it's the last lifeboat on a sinking ship. This isn't just dramatic thinking – it's a pattern we've seen play out repeatedly throughout history.

Let's break down how different versions of these coins compare in the marketplace:

| Feature | Bullion Gold Buffalo (Uncirculated) | Proof Gold Buffalo |

|---|---|---|

| Primary Purpose | Investment in physical gold | Collector's item with numismatic value |

| Finish | Standard satin-like appearance | Mirror-like fields with multiple strikes |

| Mint Mark | No mintmark | 'W' mintmark from West Point |

| Mintage | Higher production volumes | Limited collector editions |

| Premium | Lower premium over spot price | Significantly higher premiums |

| Value Driver | Primarily gold content | Gold content plus rarity and aesthetics |

Reputable price guides from professional grading services can provide comprehensive pricing information across different grades and years for those looking to track market values.

The Role of Gold Spot Price

The $50 buffalo gold coin value starts with gold's spot price – that real-time number that makes precious metals dealers refresh their screens obsessively throughout the day. This is your coin's melt value foundation, the absolute minimum worth based purely on its one troy ounce of pure gold content.

When gold spot price moves, your Buffalo coin moves with it like a dance partner following every step. If gold jumps $50 per ounce overnight due to geopolitical tensions, your coin's base value jumps right along with it. This real-time fluctuation serves as the primary market driver for these coins.

What's fascinating is watching how global events ripple through the precious metals market. Central banks have been quietly accumulating gold reserves in recent years, sending a clear signal about gold's enduring value during uncertain times. This institutional behavior often influences individual investors to follow suit. You can dive deeper into this trend here: Why Central Banks Buy Gold (and Why You Should Too): A Look into the Power of Physical Gold.

Numismatic Premiums: How Rarity and Condition Affect the $50 Buffalo Gold Coin Value

Here's where things get really interesting. While gold content provides the foundation, numismatic premiums can launch $50 buffalo gold coin value into entirely different territory. It's the difference between buying a reliable sedan and driving off the lot with a vintage sports car.

Professional coin grading transforms a simple gold coin into a precisely evaluated collectible. When independent services like PCGS or NGC examine your coin under magnification, they're looking for perfection that would make a Swiss watchmaker proud. A coin earning the coveted MS-70 grade represents absolute flawlessness – no scratches, no spots, no imperfections visible even under 5x magnification.

The magic happens when you combine perfect grading with specific mintage figures and key dates. Take the 2006 bullion version with its 337,012 mintage compared to 2008's much lower 189,500 – that difference in rarity translates directly into collector premiums.

Some years stand out like celebrities at a small-town diner. The 2008 fractional coins represent a unique one-year experiment where the U.S. Mint produced 1/2 oz, 1/4 oz, and 1/10 oz Gold Buffalo coins. These smaller denominations never returned, making them highly sought after by collectors who appreciate their novelty.

The 2013 Reverse Proof takes uniqueness to another level entirely. With only 47,836 minted, these coins feature frosted fields and mirrored devices – essentially the opposite of a standard proof coin. It's like finding a left-handed guitar in a world of right-handed players.

Collector demand for these variations, especially in top grades, can push prices well beyond simple gold content calculations. Investors can consult established price guides for detailed pricing across different grades and years.

Proof vs. Uncirculated: How Finish Impacts the $50 Buffalo Gold Coin Value

The difference between a bullion version and a proof version is like comparing a beautiful photograph to a museum-quality oil painting – both capture the same subject, but one clearly required more artistry and time.

Bullion Gold Buffalo coins serve investors who want pure gold in coin form without paying extra for fancy finishing. These coins receive a single strike from the mint's presses, resulting in a clean, professional appearance with a subtle satin-like finish. They're the workhorses of the gold coin world – dependable, valuable, and priced primarily on their gold content.

Proof versions represent the U.S. Mint showing off its craftsmanship. Each coin gets struck multiple times with specially polished dies, creating those stunning mirror-like fields that seem to glow under light. The raised design elements receive a contrasting frosted finish that makes every detail pop like a 3D image.

Every proof coin bears the distinctive 'W' mintmark from the West Point Mint, essentially the coin equivalent of a designer signature. These limited collector's editions command higher premiums because they combine artistic beauty with lower mintage numbers. For example, while 2006 saw 246,267 proof coins minted, 2023's proof run dropped to just 14,007 – making recent proofs significantly more valuable.

Understanding these finish differences helps explain why identical-year coins can have vastly different price tags. The proof version isn't just prettier; it's genuinely rarer and more difficult to produce. For insights into how proper packaging protects these valuable finishes, read: Don't Get Flipped: The Truth About Gold Buffalo Coin Packaging.

The Iconic Design: A Legacy of American Coinage

Beyond its gold content, the $50 buffalo gold coin value is deeply intertwined with its stunning and historically significant design. The coin's imagery is a direct homage to James Earle Fraser's beloved 1913 Buffalo Nickel, a masterpiece of American coinage.

This remarkable design has quite the story behind it. It all started with President Theodore Roosevelt's initiative to beautify American coinage. Roosevelt wanted our coins to rival the artistic standards of ancient Greek and Roman coins - he believed American money should be as beautiful as it was valuable.

James Earle Fraser, a talented sculptor and student of the legendary Augustus Saint-Gaudens, was chosen for this important task. Fraser was asked to create something truly American, and boy, did he deliver.

The obverse design features a striking profile of a Native American man. This isn't just any generic portrait - Fraser created this composite image from three real Native American chiefs who actually posed for him. Iron Tail (an Oglala Lakota chief), Two Moons (a Cheyenne chief), and Big Tree (a Kiowa chief) all contributed to this dignified and powerful representation that captures the spirit of America's indigenous heritage.

Turn the coin over, and you'll see the reverse design - a majestic American bison. This magnificent creature was inspired by Black Diamond, a famous bison who lived at the New York City Central Park Zoo during Fraser's time. The bison perfectly symbolizes the American West with its wild, untamed spirit and represents the frontier that defined much of our nation's character.

The original Buffalo Nickel was minted from 1913 to 1938 and quickly became one of the most beloved coins in American history. People loved the design so much that it remained popular even after production ended. However, the nickel had some practical problems - the date and "FIVE CENTS" marking were placed in spots that wore down easily with handling.

When the U.S. Mint decided to create the Gold Buffalo in 2006, they carefully reproduced Fraser's original design with slight modifications. These changes accommodated the larger gold coin and ensured the historical significance would endure for generations. The result is more than just a piece of gold - it's a piece of American art and history that adds both aesthetic and cultural value to your investment portfolio.

Investing in the American Gold Buffalo

Investing in the American Gold Buffalo coin is much more than simply buying a piece of metal. It's about bringing a tangible asset into your life, one that carries a rich history and is strongly backed by the U.S. Mint. For many savvy investors, this coin is a cornerstone for portfolio diversification, offering a reliable hedge against inflation and economic ups and downs. Unlike paper assets, physical gold can't be created out of thin air or devalued by policy changes, giving you a sense of security and a time-tested store of value.

If you're just starting your journey into precious metals, our guide is here to help you take that first step: Gold Investment 101: Turning Your Savings into Solid Gold.

Gold Buffalo Purity: 24-Karat Advantage

One of the most compelling reasons to choose the Gold Buffalo is its incredible purity: it's 24-karat, meaning it's .9999 fine gold. This isn't just a fancy number; it means you're getting pure gold, with no other metals mixed in. While some folks might worry that pure gold is softer and more prone to scratches than, say, 22-karat gold (which has copper and silver added for durability), many investors actually prefer the absolute purity.

They value gold for its intrinsic worth, not necessarily for constant handling or circulation. The global market clearly agrees, with 24-karat gold making up about 60% of all gold transactions. The Gold Buffalo gives U.S. investors a direct ticket into this highly sought-after, pure gold market.

IRA Eligibility and Long-Term Strategy

Here's an exciting perk for long-term investors eyeing the $50 buffalo gold coin value: it's eligible for Precious Metals IRAs! This means you can hold these beautiful American Gold Buffalo coins right within your self-directed Individual Retirement Account. The best part? Your gold investments can potentially grow tax-deferred or even tax-free, depending on the type of IRA you choose.

The IRS has specific fineness requirements for gold coins held in IRAs, and guess what? The Gold Buffalo's .9999 purity perfectly meets these standards. Adding physical gold to your retirement plan brings a unique layer of security and diversification that traditional paper assets might not offer. It's a fantastic way to guard against inflation and market volatility, helping to preserve your purchasing power for decades to come. Ready to explore this golden opportunity? Dive deeper with our comprehensive guide: The Ultimate Beginner's Guide to Investing in Precious Metals.

Building Your Stack with Autoinvest

Want to build your gold wealth over time without the stress of timing the market? Smart investors know that consistent, disciplined investing is the secret. That's exactly why Summit Metals created our Autoinvest program – to help you effortlessly grow your gold stack.

Autoinvest harnesses the power of dollar-cost averaging. Just like you contribute to a 401k, you can invest a fixed amount in gold every month. This strategy removes emotion from buying decisions and can lower your average cost per ounce over time. Those small, regular investments add up, building substantial wealth for your future.

With Summit Metals' Autoinvest, you can set up automated monthly purchases of American Gold Buffalo coins. It’s a simple, effective way to steadily build your precious metals portfolio, one magnificent gold coin at a time. Start building your golden legacy today: Autoinvest with Summit Metals: Grow Your Gold Stack Every Month.

Frequently Asked Questions about the $50 Buffalo Gold Coin

When it comes to understanding $50 buffalo gold coin value, investors often have similar questions. Let me walk you through the most common ones I hear from people looking to add these beautiful coins to their portfolio.

How is the current market value of a Gold Buffalo determined?

The market value of your Gold Buffalo coin comes down to a simple formula: the live spot price of one troy ounce of gold plus a premium. Think of it like buying a car - you have the base price, then additional costs for features and dealer markup.

That premium isn't random though. It's influenced by several key factors that make each coin unique. The coin's condition plays a huge role - a pristine MS-70 graded coin will command much more than one with scratches or handling marks. Whether you're looking at a bullion or proof version makes a significant difference too, with proofs typically carrying higher premiums due to their superior finish and lower mintages.

The year your coin was minted matters as well. Some years had lower production numbers, making them more desirable to collectors. And like any market, overall collector demand can push prices up or down based on current interest levels.

Are American Buffalo Gold Coins a good investment?

Absolutely! These coins have earned their reputation as solid investments for several compelling reasons. First and foremost, they contain .9999 fine gold - that's as pure as it gets in the coin world. You're not paying for copper or silver alloys; you're getting straight gold.

The U.S. Mint backing provides an exceptional level of authenticity and trust. When you buy a Gold Buffalo, you know exactly what you're getting - no worries about counterfeits or purity questions that can plague other gold products.

These coins are also highly liquid, meaning you can sell them easily when needed. Gold dealers worldwide recognize and accept American Gold Buffalos, making them as good as cash in the precious metals market.

Their value moves with gold prices, making them an excellent hedge against inflation. When the dollar weakens or economic uncertainty rises, gold often strengthens, potentially protecting your purchasing power. Plus, rare or high-grade versions can appreciate beyond just the gold content, giving you numismatic upside potential.

For those looking to build their gold holdings steadily, consider our Autoinvest program. Just like contributing to your 401k every month, you can automatically purchase Gold Buffalos on a regular schedule, dollar-cost averaging your way to a substantial precious metals portfolio.

What is the difference between a bullion and a proof Gold Buffalo?

This is probably the most important distinction for new investors to understand, as it significantly affects both price and purpose.

A bullion Gold Buffalo is designed primarily for investors like you who want to own physical gold. These coins are struck once with standard production methods, resulting in a beautiful but not mirror-like finish. Their value stays closely tied to the gold spot price because investors buy them for their metal content, not their collectible appeal. Think of these as your "workhorse" gold coins.

A proof Gold Buffalo is an entirely different animal. These are special collector's editions that receive the royal treatment at the mint. They're struck multiple times with specially polished dies, creating that stunning mirror-like background with frosted design elements that collectors love. Each proof coin bears the distinctive 'W' mintmark from the West Point Mint, immediately identifying it as something special.

The proof versions typically carry higher numismatic premiums because of their superior aesthetics, lower mintages, and collector demand. While a bullion coin might trade for a modest premium over the gold spot price, a proof could command several hundred dollars more, depending on the year and condition.

Both contain the same amount of pure gold, but they serve different purposes in your portfolio - bullion for straightforward gold investment, proofs for those who appreciate the artistry and potential numismatic appreciation.

Securing Your Golden Investment

The American Buffalo Gold Coin represents a pinnacle of U.S. Mint craftsmanship and a solid investment in pure gold. Its value is a dynamic blend of its intrinsic gold content, historical significance, and numismatic appeal. For investors seeking authenticated, competitively priced precious metals, Summit Metals, based in Wyoming and with locations in Salt Lake City, Utah, provides a trusted platform to acquire these iconic coins. Our commitment to transparent, real-time pricing and competitive rates, thanks to our bulk purchasing, ensures you receive exceptional value and trust in every transaction. By understanding the factors that drive its price, you can make an informed decision to add this piece of American heritage to your portfolio.

Ready to start on your golden journey? Our comprehensive guide is here to assist you: Going for Gold: Your Ultimate Guide to the Precious Metal.