Why the 1855 Gold Sovereign Value Spans from Hundreds to Hundreds of Thousands

An 1855 gold sovereign's value depends almost entirely on one detail: which mint struck your coin. This single factor determines whether you have a common gold piece or a six-figure rarity.

Quick Value Guide:

| Mint Location | Typical Value Range | Key Identifier |

|---|---|---|

| London Mint (Common) | $850 - $1,250+ | Shield reverse design with crown |

| Sydney Mint (Rare) | $3,150 - $144,000+ | "AUSTRALIA" inscription below crown |

| Melt Value (Minimum) | ~$740 - $960+ | Based on 0.2354 oz pure gold content |

Condition is critical—a circulated London sovereign might fetch $850, while a pristine, uncirculated Sydney sovereign can command over $100,000.

The year 1855 produced two dramatically different gold sovereigns. The London Mint struck millions of its traditional "shield back" coin during the Crimean War. Meanwhile, the new Sydney Mint issued Australia's very first gold sovereign—a coin so rare in top condition it is about four times scarcer than the famous 1852 Adelaide Pound.

This stark difference often leads to confusion. Many people find an 1855 sovereign and assume they have a fortune, only to learn it's the common London version. Conversely, some risk selling the rare Sydney issue for scrap, unaware of its true five- or six-figure potential.

As precious metals advisors at Summit Metals, we know that informed decisions separate wealth preservation from loss. This principle is crucial when evaluating the 1855 gold sovereign value. We apply the same rigorous analysis used in institutional investing to help our clients steer the gold market and protect their assets.

The Tale of Two Mints: London vs. Sydney 1855 Sovereigns

The 1855 Gold Sovereign tells two completely different stories depending on its origin. One was a workhorse coin, circulated by the millions in Victorian England during wartime. The other was Australia's first-ever sovereign, struck in limited numbers and now a celebrated rarity. Knowing which version you hold is the key to determining its 1855 gold sovereign value.

The London Mint "Shield Back" Sovereign

In 1855, the London Mint was in overdrive. To fund the Crimean War and maintain economic confidence, it struck millions of gold sovereigns.

The result was a beautiful coin featuring William Wyon's "Young Head" portrait of Queen Victoria and Jean Baptiste Merlen's distinctive crowned shield on the reverse. This "Shield Back" design unites the emblems of England (rose), Scotland (thistle), and Ireland (shamrock) under a single crown.

These sovereigns were produced in massive quantities—the "WW raised" variety alone had a mintage over 8.4 million. This high number means the coins are relatively common today, especially in circulated condition.

For collectors, a key detail is on the truncation of Victoria's neck. The engraver's initials, "WW," appear in two styles. The WW incuse (recessed) variety is more common. The WW raised (proud) variety is slightly scarcer and can command a modest premium.

Because millions were made, the value of a London sovereign typically stays close to its gold melt value unless it is in exceptional, uncirculated condition.

The Sydney Mint "Australia" Sovereign

On the other side of the world, something historic was unfolding.

The Australian Gold Rush created a currency shortage, leading to the establishment of the Sydney Mint. On June 23, 1855, it struck Australia's very first gold sovereign—a landmark event in the nation's history.

While keeping Queen Victoria's portrait, the Sydney version featured a completely different reverse. Instead of the British shield, it proudly displayed the word "AUSTRALIA" beneath a crown. This unique design makes identification simple and reflects Australia's emerging identity.

Only about 502,000 of these coins were minted. Many were lost, spent, or melted down. Today, high-grade examples are about four times scarcer than the famous 1852 Adelaide Pound, Australia's first gold coin.

This extreme rarity completely changes the 1855 gold sovereign value. While a London sovereign might sell for under $1,500, a high-grade Sydney Mint sovereign can command $65,000 to $144,000 or more. One "about Uncirculated" example was priced at $65,000, and top-grade specimens have achieved six figures at auction.

For serious investors, the 1855 Sydney Mint Sovereign is an investment-grade collectible with immense historical significance. You can track current market values at the NGC Coin Price Guide for Australia Sovereign KM 2.

COMPARISON TABLE: 1855 London Mint vs. Sydney Mint Sovereign

Here's how the two versions compare:

| Feature | 1855 London Mint Sovereign ("Shield Back") | 1855 Sydney Mint Sovereign ("Australia") |

|---|---|---|

| Mint Location | London, United Kingdom | Sydney, Australia |

| Reverse Design | Crowned shield with national emblems | Crown above "AUSTRALIA" inscription |

| Mintage | High (8,448,000+ for one variety) | Low (approximately 502,000) |

| Rarity | Common in circulated grades | Highly rare, especially in top condition |

| Typical Value | $850 - $1,250+ | $3,150 - $144,000+ |

| Significance | Standard wartime currency | Australia's first gold sovereign |

The difference is dramatic. One is a functional currency piece; the other is a foundational artifact of Australian history. Knowing which you hold is the first step to understanding its true worth.

Decoding the 1855 Gold Sovereign Value: From Melt to Mint State

The 1855 gold sovereign value isn't a single number but a range, starting with its raw gold content and climbing dramatically based on collector-driven factors. Think of it as a baseline price with significant upward potential.

Understanding the Baseline: Melt Value

Every gold sovereign has a safety net: its melt value. This is the intrinsic worth of the gold itself, and it represents the absolute minimum price for your coin.

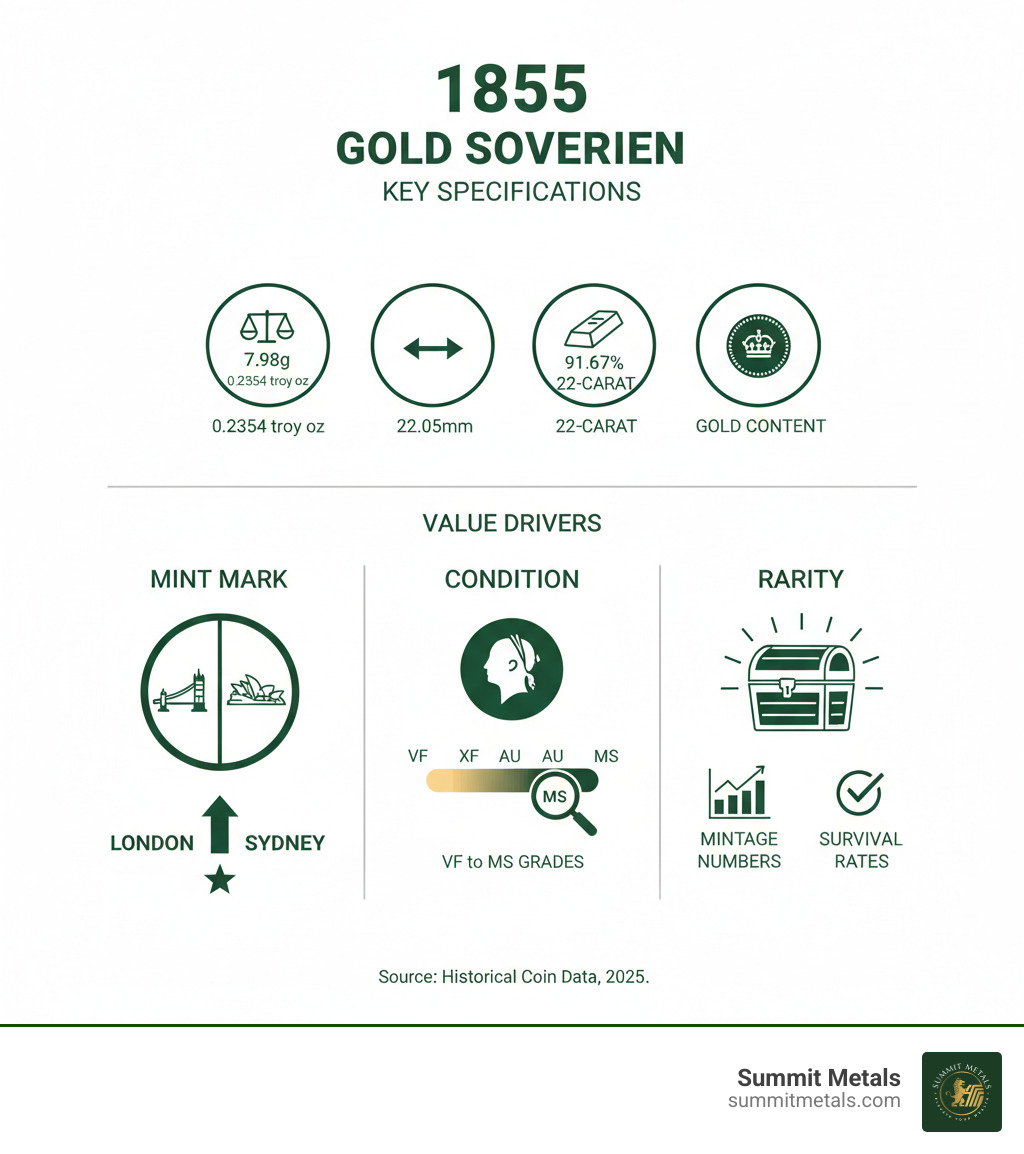

A Gold Sovereign contains 0.2354 troy ounces of pure gold. The coin itself is 22-carat gold, meaning it's 91.67% fine (0.9167 pure), with copper added for durability.

To calculate melt value, you multiply the gold content (0.2354 troy ounces) by the current spot price of gold. This price changes daily based on global markets.

For example, if the spot price of gold is $2,500 per ounce, the melt value is approximately $588 (0.2354 x 2500). If gold rises to $3,500 per ounce, that value jumps to over $820. This price floor fluctuates constantly, and at Summit Metals, we believe you should always have access to transparent, real-time data to know your assets' current base value.

Beyond Bullion: Numismatic Premiums

The melt value is just the beginning. The real excitement—and potential for high returns—comes from the numismatic premium. This is the amount collectors will pay above the melt value, and it's where an $800 coin can become an $80,000 treasure.

Several factors drive this premium:

Mint Mark (London vs. Sydney): This is the most important factor. A London Mint sovereign might trade for $850-$1,250, while a Sydney Mint example starts at several thousand and can reach six figures. Same year, same denomination, vastly different values.

Condition: A coin's state of preservation is critical. Professional grading services like NGC or PCGS assign grades from circulated (like VF-20, Very Fine) to uncirculated (AU-58, About Uncirculated) and Mint State (MS-60+). The price difference is staggering: an 1855 Sydney Sovereign graded VF might be worth $4,000, while the same coin in Mint State could be valued at $144,000.

Rarity and Mintage: The 1855 Sydney Mint struck only 502,000 sovereigns compared to millions from London. Rarity isn't just about mintage; it's about survival rate. Far fewer have survived in collectible condition after 170 years.

Varieties and Errors: Subtle details attract dedicated collectors. For the London sovereign, the "WW Raised" vs. "WW Incuse" initials of the engraver can add a small premium. Major errors, like a date punch mistake, are exceptionally rare and can make a coin uniquely valuable.

Getting your coin professionally graded by a service like NGC or PCGS authenticates it, assigns an objective grade, and protects it in a tamper-evident holder. This step is crucial for establishing trust and maximizing marketability, especially for high-value coins.

Current Market Prices and Where to Find Them

Once you've identified your 1855 Gold Sovereign, the next step is determining its current market value. While reliable pricing information is available, values swing dramatically based on the coin's origin and condition.

Here’s what you can realistically expect to pay or receive for each type.

London Mint Sovereign Price Range

The London Mint "Shield Back" sovereign is the more common and accessible of the two. Struck by the millions, these coins are relatively easy to find, though their historical charm and gold content remain appealing.

Circulated Examples: An average price is around $850 USD. These coins saw actual use and bear the marks of history. For instance, a circulated example in Very Fine condition sold at a London Coins auction in early 2024 for 629 USD (500 GBP), showing how condition directly impacts price.

Uncirculated Specimens: These pristine examples command significantly more. According to the Greysheet Catalog, both the "WW Raised MS" and "WW Incuse MS" varieties carry a CPG® value of $1,250.00. While the "WW Raised" variety is scarcer, both trade in a similar range in Mint State condition.

The typical range for London Mint 1855 sovereigns is $850 to $1,250+, with the premium depending on exceptional eye appeal and strike quality.

Sydney Mint Sovereign Price Range

Here we enter a different league. The 1855 Sydney Mint Sovereign is an investment-grade collectible due to its genuine scarcity.

As Australia's first gold sovereign, with only 502,000 minted, surviving examples command extraordinary prices.

- Circulated (VF-XF): Estimated values range from $4,000 to $5,000.

- Uncirculated (Mint State): The range explodes to $3,150 to $144,000, depending on the specific grade.

To put this in perspective, an "about Uncirculated" 1855 Sydney sovereign was priced at $65,000 in 2015, and top-grade examples have since pushed past the $100,000 mark. Its rarity—four times that of the 1852 Adelaide Pound in high grades—explains why serious investors treat it with such reverence.

If you own an 1855 Sydney Mint sovereign, you are holding a genuine treasure.

Reliable Pricing Resources

When researching 1855 gold sovereign value, always consult multiple sources, as the market is dynamic. Here’s where to find trustworthy data:

Online Price Guides: The NGC Coin Price Guide offers detailed valuations for Australian sovereigns, including the 1855 Sydney Mint issue. The Greysheet provides industry-standard CPG® values for both British and world coins.

Auction Houses: Sites like GreatCollections, Stacks & Bowers, and NumisBids publish realized prices from past auctions. These documented transactions show what real collectors are willing to pay.

Reputable Dealers: Specialists in rare coins and precious metals offer market knowledge that raw numbers can't capture.

At Summit Metals, we provide expert appraisals on the intrinsic gold value of your holdings and can guide you toward the right resources for rare coin valuations. Our expertise lies in helping investors build wealth through authenticated gold and silver, with transparent pricing you can trust.

Investing in and Collecting 1855 Gold Sovereigns

Whether you're a seasoned numismatist or new to precious metals, the 1855 Gold Sovereign is a compelling asset. It's a tangible link to the Victorian era, the Crimean War, and the Australian Gold Rush. At Summit Metals, we see how historic coins capture the interest of both practical investors and passionate collectors.

Gold Sovereigns: The Investment Edge Over Bars

When adding gold to your portfolio, you face a choice: bars, rounds, or coins? While all provide exposure to gold's intrinsic value, government-issued coins like Sovereigns offer distinct advantages.

Many of our clients at Summit Metals, serving areas like Salt Lake City and across Wyoming, initially consider bars but shift toward coins after understanding these benefits.

Gold Coin vs. Gold Bar

| Feature | Gold Coins (e.g., Sovereign) | Gold Bars |

|---|---|---|

| Divisibility | High. Easy to sell small portions of your holdings. | Low. A large bar must be sold all at once. |

| Numismatic Value | High potential. Rarity and history can add significant value above melt price. | None. Value is tied strictly to gold weight and purity. |

| Authenticity | High. Government-issued legal tender with complex designs. | Varies. Relies on refiner's reputation; easier to counterfeit. |

| Fraud Protection | Strong. Counterfeiting legal tender is a serious crime with federal penalties. | Weaker. Not backed by government anti-counterfeit laws. |

| Historical Appeal | Rich. Each coin tells a story, adding to its desirability. | None. A commodity with no inherent narrative. |

For investors building a diversified precious metals portfolio, gold coins offer a smart balance. You get the security of physical gold, the liquidity of a globally recognized asset, and the potential for your investment to outperform the spot price of gold itself.

Building Your Gold Position with Autoinvest from Summit Metals

Rare coins like the 1855 Sydney Sovereign are incredible finds, but for most people, building long-term wealth is about consistent, disciplined accumulation.

That's why we created Autoinvest at Summit Metals.

Autoinvest applies the powerful strategy of dollar-cost averaging, familiar from 401(k) plans, to physical precious metals. You set up a recurring monthly purchase of gold or silver, and the program automatically executes it for you. This disciplined approach builds your position steadily while you focus on your life.

By investing a fixed amount each month, you automatically buy more metal when prices are low and less when they are high. This smooths out market volatility and removes the impossible task of trying to time the market. It's a strategy that turns price fluctuations into an advantage.

The beauty of long-term wealth building with Autoinvest is its simplicity. No calls to make, no decisions to second-guess. The program runs automatically, growing your holdings through consistent contributions over time.

And because you're with Summit Metals, you get our signature transparent, real-time pricing on every purchase. Our bulk purchasing power ensures competitive rates, maximizing the metal you receive for every dollar invested.

Whether you dream of owning a piece of history or simply want to build a robust foundation of physical gold, Autoinvest provides a disciplined, effective path forward. It's how many of our most successful clients have built five- and six-figure positions—not through speculation, but through patient, consistent investment.

Ready to start building your gold position the smart way? Learn more about how Autoinvest can work for your financial goals.

Frequently Asked Questions about the 1855 Gold Sovereign

How can I tell if my 1855 Sovereign is from London or Sydney?

Check the reverse (tails) side of the coin. The identification is simple and definitive:

- A Sydney Mint sovereign is clearly marked with the word "AUSTRALIA" inscribed beneath the crown.

- A London Mint sovereign features the iconic crowned shield with the floral emblems of England, Scotland, and Ireland. It has no "AUSTRALIA" inscription.

This single detail is the key to knowing whether you have a common coin worth hundreds or a rarity worth thousands.

What is the minimum an 1855 Gold Sovereign is worth?

No matter its condition, an 1855 Gold Sovereign is always worth at least its melt value. This is the intrinsic value of its gold content and serves as the coin's price floor.

Every sovereign contains 0.2354 troy ounces of pure gold. To find its melt value, multiply that amount by the current spot price of gold. For example, with gold at $3,000 per ounce, the melt value is approximately $706. This figure fluctuates daily with the market.

Any price above this is the numismatic premium, which collectors pay for rarity, condition, and historical significance. At Summit Metals, we provide transparent, real-time pricing so you always know the current value of your precious metals.

Why is the 1855 Sydney Sovereign so much more expensive?

The huge price difference is driven by classic supply and demand:

Extreme Rarity: The Sydney Mint produced only about 502,000 coins, compared to millions from London. More importantly, very few have survived in high-grade condition, making them about four times scarcer than the famed 1852 Adelaide Pound.

Historical Significance: This was Australia's very first gold sovereign. It's a foundational artifact of the nation's economic history, born from the Australian Gold Rush. This story creates immense appeal.

Intense Collector Demand: A limited supply is being pursued by passionate collectors worldwide, especially those from Australia. This competition for a rare and historically important coin drives its value into the tens or even hundreds of thousands of dollars.

The high 1855 gold sovereign value for Sydney issues comes from owning a rare piece of history, not just a piece of gold.

Conclusion: A Golden Opportunity for Your Portfolio?

The 1855 gold sovereign value is a spectrum, stretching from the reliable worth of its 0.2354 troy ounces of gold to the six-figure sums paid for the rarest examples. The critical question is not just "what's it worth?" but "which one is it?"

A London Mint "Shield Back" sovereign is a solid gold investment and a tangible piece of Crimean War history. It offers a secure entry point into gold ownership, combining historical appeal with intrinsic value.

A Sydney Mint "Australia" sovereign is an extraordinary treasure. As Australia's first gold sovereign, its rarity and significance make it a premier investment-grade collectible that can transform a portfolio.

Understanding this distinction is the key to protecting your wealth and open uping opportunity. It's the difference between selling a coin for its melt value and recognizing you hold a five- or six-figure asset.

At Summit Metals, we believe informed decisions are the bedrock of successful investing. Whether you're evaluating a rare coin or building a long-term gold position through our Autoinvest program, we provide the transparent pricing and expert guidance you need. We help investors in Wyoming, Utah, and beyond steer the gold market with institutional-level rigor and integrity.

Your precious metals journey can be simple and rewarding. With the right information and a trusted partner, you can build a portfolio designed to last.

Ready to sell your precious metals or have your collection appraised? Our team is here to help you realize the true value of what you own.