Why Understanding the Current Price of Gold and Silver Matters for Your Financial Future

Why does knowing what is the current price of gold and silver matter for your financial future? As of this publication, gold trades at approximately $4,038.97 USD per troy ounce, and silver at $47.83 USD per troy ounce. These prices, which fluctuate constantly, reflect the metals' growing role as a hedge against inflation, currency devaluation, and market volatility.

Here's a quick reference for current precious metals pricing:

| Metal | Price (USD/oz) | Price (CAD/oz) | Price (USD/gram) |

|---|---|---|---|

| Gold | $4,038.97 | $5,629.54 | $129.86 |

| Silver | $47.83 | $66.33 | $1.54 |

| Platinum | $1,589.50 | $2,226.07 | $51.11 |

| Palladium | $1,419.00 | $1,987.49 | $45.62 |

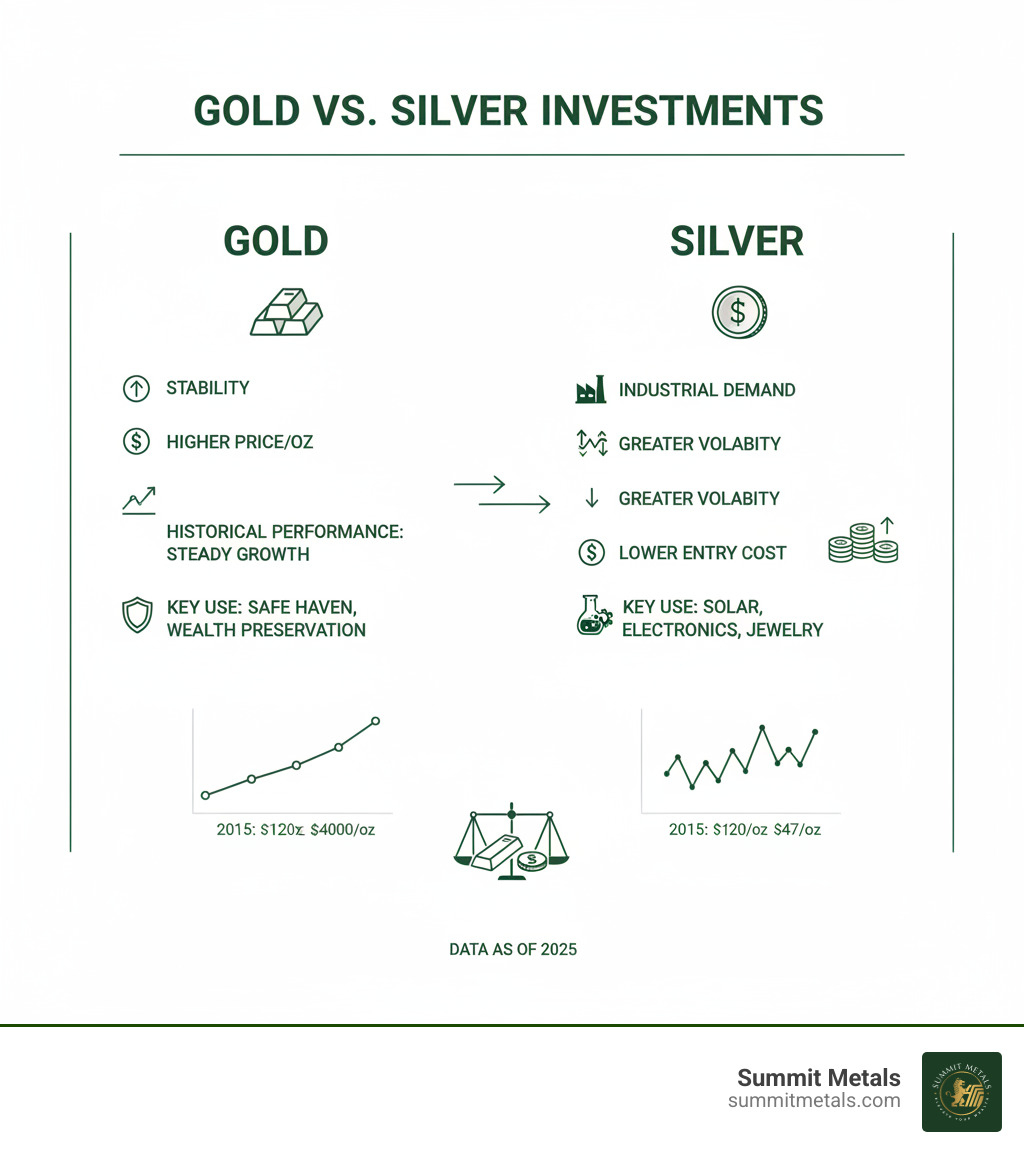

Gold has delivered extraordinary returns, climbing 46% over the past year and over 110% in five years. Silver shows similar strength, supported by industrial demand from sectors like solar energy. Unlike paper assets, physical gold and silver are tangible forms of wealth that have survived thousands of years of economic turmoil.

Understanding what drives these prices helps you decide when to buy and which products offer the best value. I'm Eric Roach, and after a decade advising on multi-billion-dollar transactions, I now help everyday investors use the same institutional strategies to safeguard their wealth with physical precious metals. This guide will show you how.

What is the Current Price of Gold and Silver and How is it Determined?

The "spot price" is the baseline for what is the current price of gold and silver. It's the real-time market price for one troy ounce (31.1 grams, about 10% heavier than a standard ounce) for immediate delivery. This price is set on global exchanges like COMEX in Chicago and benchmarked by the London Bullion Market Association (LBMA). When you buy a coin or bar, the dealer's price is the spot price plus a premium for fabrication and other costs.

Understanding Today's Gold Spot Price

The gold spot price currently sits at approximately $4,038.97 USD per troy ounce ($129.86/gram). While daily shifts may seem small, they tell a story of long-term value. Gold's performance over the last two decades—gaining over 750%—demonstrates its enduring power as a hedge against inflation and economic instability. This long-term reliability is why many investors use a dollar-cost averaging strategy with programs like Summit Metals' Autoinvest. By investing a set amount each month, you smooth out price swings and build wealth steadily, regardless of short-term market noise.

For deeper context on gold's price movements and what they mean for your portfolio, visit Gold Prices Today Live Gold Price Chart Historical Data.

Decoding the Current Silver Spot Price

Silver's spot price is currently around $47.83 USD per troy ounce ($1.54/gram). What makes silver unique is its dual role as both a precious metal and a critical industrial commodity. It has the highest electrical conductivity of any element, making it essential for electronics, solar panels, and medical devices. Roughly half of all silver demand comes from industry. This creates powerful price pressure; in 2023, demand outstripped supply by nearly 200 million ounces. This industrial need, combined with investment demand, gives silver a unique and compelling potential for growth, though it is typically more volatile than gold.

To understand silver's potential and why many analysts see significant upside ahead, check out Silver Price The Bullish Case for Silver with a Potential 20% Upside and What it Means for Precious Metals Investors.

Key Factors Driving the Precious Metals Market

The prices of gold and silver are constantly responding to a complex web of global forces. Understanding these drivers is key to interpreting what is the current price of gold and silver and why it moves.

- Inflation and Interest Rates: When inflation rises, the purchasing power of cash decreases, making gold and silver attractive as stores of value. Conversely, higher interest rates can make interest-bearing assets like bonds more appealing than non-yielding metals.

- U.S. Dollar Strength: Gold is priced in U.S. dollars, so a weaker dollar makes gold cheaper for foreign buyers, often increasing demand and pushing the price up. A strong dollar can have the opposite effect.

- Geopolitical and Economic Uncertainty: During times of crisis—market crashes, political instability, or war—investors flock to gold and silver as "safe-haven" assets. The rising U.S. national debt, for example, causes many to question the dollar's long-term stability and seek refuge in tangible assets.

- Central Bank Buying: When central banks, particularly in emerging markets, buy gold to diversify their reserves away from the U.S. dollar, their large-scale purchases can significantly impact prices.

- Supply and Demand: At a fundamental level, prices are moved by mining output (supply) and demand from both investors and industry. Silver, in particular, is heavily influenced by its industrial use in solar panels and electronics, where supply deficits can create upward price pressure.

For a deeper exploration of these price drivers, check out our detailed guide on Why Gold and Silver Prices Fluctuate.

The Gold-to-Silver Ratio: A Key Market Indicator

Beyond individual prices, savvy investors watch the gold-to-silver ratio. Calculated by dividing the gold price by the silver price, this ratio reveals their relative value. A high ratio (e.g., above 80:1) often suggests that silver is undervalued compared to gold, signaling a potential buying opportunity for silver. A low ratio may suggest the opposite. It's a powerful tool for making tactical allocation decisions between the two metals.

For a comprehensive breakdown of how to use this indicator, read our full article: Understanding the Gold-Silver Ratio: A Key Indicator for Precious Metals Investors.

A Strategic Guide to Investing in Gold and Silver

Knowing what is the current price of gold and silver is the first step. The next is building a strategy. At Summit Metals, we focus on making it easy to own physical precious metals through transparent pricing and time-tested strategies.

Physical Bullion: Choosing Between Coins and Bars

When buying physical metal, your main choice is between coins and bars. While both are excellent stores of value, they serve different strategic purposes.

Bars are produced for pure bullion value and generally have the lowest premiums over the spot price. This makes them the most cost-efficient way to acquire the maximum amount of metal for your money, especially for large-quantity investors. Reputable bars from refiners like PAMP Suisse include assay cards to certify their weight and purity.

Coins, such as the American Gold Eagle or Canadian Gold Maple Leaf, carry slightly higher premiums but offer a unique and powerful advantage: legal tender status. A 1 oz American Gold Eagle has a face value of $50, backed by the U.S. government. This makes the coin legally recognized currency, providing an important layer of fraud protection and ensuring global recognition and liquidity.

Here's how they compare:

| Feature | Gold & Silver Coins | Gold & Silver Bars |

|---|---|---|

| Premiums | Slightly higher due to minting costs and collector appeal | Lower premiums—more metal per dollar spent |

| Liquidity | Highly liquid globally; smaller denominations easy to sell | Excellent for wholesale; larger bars may have less retail liquidity |

| Verifiability | Government-backed, widely recognized, harder to counterfeit | Reputable bars come with assay cards for authentication |

| Fraud Protection | Face value provides legal tender status and fraud protection | Value based solely on metal content, no face value |

| Storage | Standardized sizes, robust construction, easy to store | Larger bars need more secure storage arrangements |

Many investors use a hybrid approach, holding coins for liquidity and legal protection while accumulating bars for cost efficiency.

Long-Term Strategy: The Power of Dollar-Cost Averaging with Autoinvest

Trying to time the market is a losing game. A more powerful strategy is dollar-cost averaging: investing a fixed amount of money at regular intervals. By doing this, you automatically buy more ounces when prices are low and fewer when they are high, lowering your average cost over time.

This is the same principle that makes a 401(k) so effective, and it's the foundation of our Summit Metals Autoinvest program. You can set up automatic monthly purchases of gold or silver, just like contributing to a retirement account. It removes emotion and guesswork, allowing you to build your holdings of tangible assets systematically. Autoinvest makes disciplined investing simple, letting you compound your wealth steadily over the long term.

Where to Find Data and What to Consider When Buying

Knowing where to find reliable data and what to look for in a dealer is crucial. At Summit Metals, we serve clients from our locations in Wyoming and Salt Lake City, Utah, with a commitment to transparency. We provide real-time pricing and competitive rates, ensuring you have the confidence to invest wisely.

Top Resources for Tracking the Current Price of Gold and Silver

To make informed decisions, use reliable, up-to-the-minute data sources.

- Official Benchmarks: The London Bullion Market Association (LBMA) sets the global benchmark prices that dealers and institutions reference. Their site, LBMA Precious Metal Prices, offers authoritative data.

- Charting Tools: Websites like TradingView provide interactive charts to visualize historical price movements over various timeframes, from minutes to decades. Their Gold Price chart by TradingView is a popular option.

- Financial News Sites: Major financial news outlets provide real-time quotes for gold, silver, and other commodities, offering broad market context.

- Mobile Apps: Many apps can send price alerts directly to your phone. Setting alerts for target price levels can help you act on market movements without constant monitoring.

Key Considerations Before You Buy or Sell Precious Metals

Before investing, consider these crucial factors:

- Reputable Dealer: Your top priority. Look for established dealers with transparent pricing and a history of excellent service. Summit Metals sells only authenticated precious metals sourced from trusted mints and refiners.

- Premiums and Spreads: Understand the "ask" price (what you pay) and the "bid" price (what you get when you sell). The difference is the spread. The premium is the amount over the spot price, covering costs like minting and insurance. These vary by product type and size.

- Purity and Authenticity: Bullion is marked with its fineness (e.g., .9999 pure). Buy from sources that guarantee authenticity. Reputable bars often come with an assay card certifying their weight and purity.

- Hidden Costs: Always account for transaction fees, shipping, and insurance. A trustworthy dealer will disclose all costs upfront.

- Secure Storage: You must have a plan for secure storage, whether it's a high-quality home safe, a bank deposit box, or a specialized third-party depository, which many dealers offer.

For a comprehensive guide to navigating these considerations, our article Price of Gold and Silver Bullion: Essential Investments for Wealth Protection Amid Economic Uncertainty in 2024 offers further insights.

Conclusion: Open uping Value with a Trusted Partner

Understanding what is the current price of gold and silver is about using knowledge to protect your financial future. We've covered the key price drivers like inflation and geopolitical risk, the difference between coins and bars, and the power of using the gold-to-silver ratio.

More importantly, we've outlined a clear strategy for success. By choosing physical assets and embracing disciplined, long-term approaches like dollar-cost averaging through our Summit Metals Autoinvest program, you can build tangible wealth systematically. This method removes the stress of trying to time the market and lets you benefit from the long-term stability of precious metals.

Gold and silver have been a reliable store of value for millennia. At Summit Metals, we make owning them simple and secure. With our commitment to transparent, real-time pricing and authenticated products, we provide a trustworthy partnership for your investment journey. Whether you're in Salt Lake City, Utah, or across the country, we're here to help you turn today's prices into lasting value.

For even more insights into making smart precious metals investments, explore our comprehensive guide: Investing in Gold and Silver: A Decision Guide for Savvy Investors.