Why Smart Investors Hunt for Silver Bargains

Discount silver bars offer an accessible entry point into precious metals investing. For those looking to get the most metal for their money, understanding where to find bargains is key. Here are the top ways to find genuine silver deals:

Best Sources for Discount Silver Bars:

- Generic/Secondary Market Bars: Same silver content, lower premiums.

- Bulk Purchases: 100 oz bars often have the lowest cost per ounce.

- Reputable Online Dealers & Local Shops: Trustworthy sources are crucial.

- "Design Our Choice" Options: Random mint selections save you money.

Key Factors That Create Discounts:

- Bar Size: Larger bars mean lower premiums per ounce.

- Condition: Toned or scratched bars are cheaper but have the same silver value.

- Brand: Generic bars are more affordable than premium mints like PAMP Suisse.

- Market Timing & Promotions: Dealer sales can offer significant savings.

Silver is a tangible store of wealth you can hold in your hands. Our research shows that generic and secondary market silver bars provide the most value, saving investors from the higher premiums of newly minted products. Condition is less important than authenticity and weight, as the market values the metal content equally.

Whether diversifying a portfolio or building an emergency fund, finding quality silver at competitive prices stretches your investment dollars. The key is knowing what creates a genuine discount.

Simple guide to discount silver bars:

- Investing in bullion

- Precious metals storage

- American silver eagle

Why Hunt for Bargains? The Advantages of Discount Silver

Picture this: you have $1,000 to invest. You could buy premium silver products, or you could seek out discount silver bars and acquire more ounces for the same price. Those extra ounces turn into real profit when silver prices rise.

Every dollar you save on premiums is another dollar that goes toward actual silver. Smart shoppers know that larger quantities mean better per-unit pricing, and the same principle applies to precious metals.

The Power of Lower Premiums

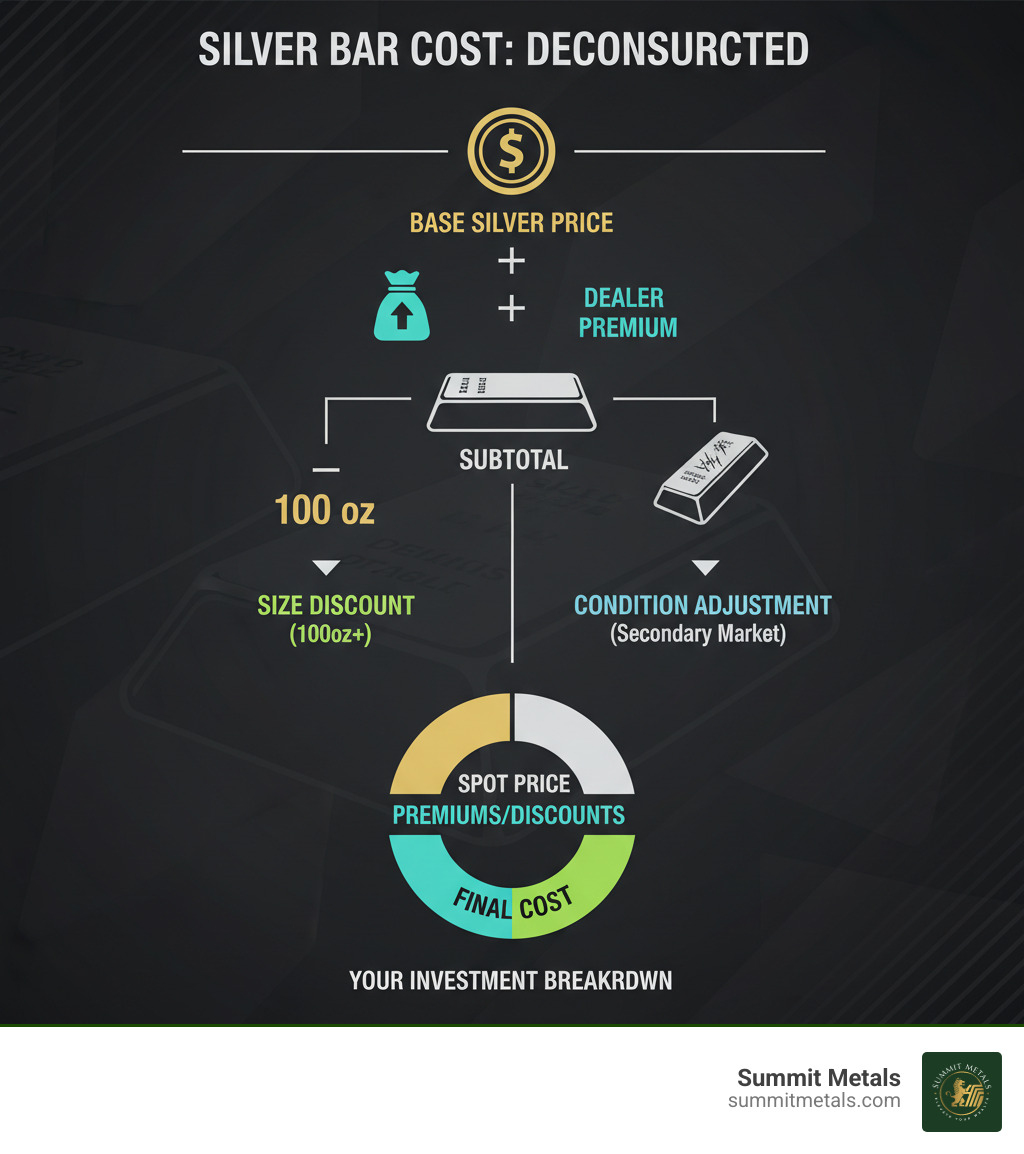

The price you pay for silver consists of two parts: the spot price (the raw market value) and the premium (additional cost covering minting, dealer costs, and profit). This premium is where your opportunity for savings lies.

Generic silver bars and larger-format bars consistently carry lower premiums. For example, a 1-ounce silver coin might have a $5 premium, while a 100-ounce bar might only have a $2 premium per ounce. On a 100-ounce purchase, that's a $300 savings for the exact same amount of silver. At Summit Metals, our bulk purchasing power allows us to pass these savings directly to you through transparent, real-time pricing.

Stretching Your Investment Further

When you consistently choose discount silver bars, your stack grows faster. Every dollar saved on premiums buys more silver, creating a compounding effect.

Generic silver bars are perfect for this strategy. They may not have intricate designs, but their intrinsic value is identical to their fancier cousins. When it's time to sell, buyers care about weight and purity, not aesthetics. For serious stackers, bulk purchasing is a game-changer. Those 100-ounce bars maximize your purchasing power.

To automate this strategy, consider setting up an Autoinvest program with us. Just like contributing to a 401(k), making regular monthly purchases helps you dollar-cost average, smoothing out price volatility while consistently building your stack at the lowest possible premiums.

If you're ready to think bigger, check out our guide on Stacking Silver: Here's Where to Buy 15 Kilos of Silver Bars.

Decoding the "Discount": What Makes a Silver Bar Cheaper?

Not all silver bars are priced equally, which is great news for savvy investors. When you see discount silver bars, it's rarely because something is wrong with the silver. Understanding the reasons for the lower price helps you spot genuine value.

Think of it like buying a car: a new luxury model and a reliable used sedan both provide transportation, but at very different prices. The main drivers of silver bar discounts are variations in the premium you pay over spot price.

Condition, Mint, and Design

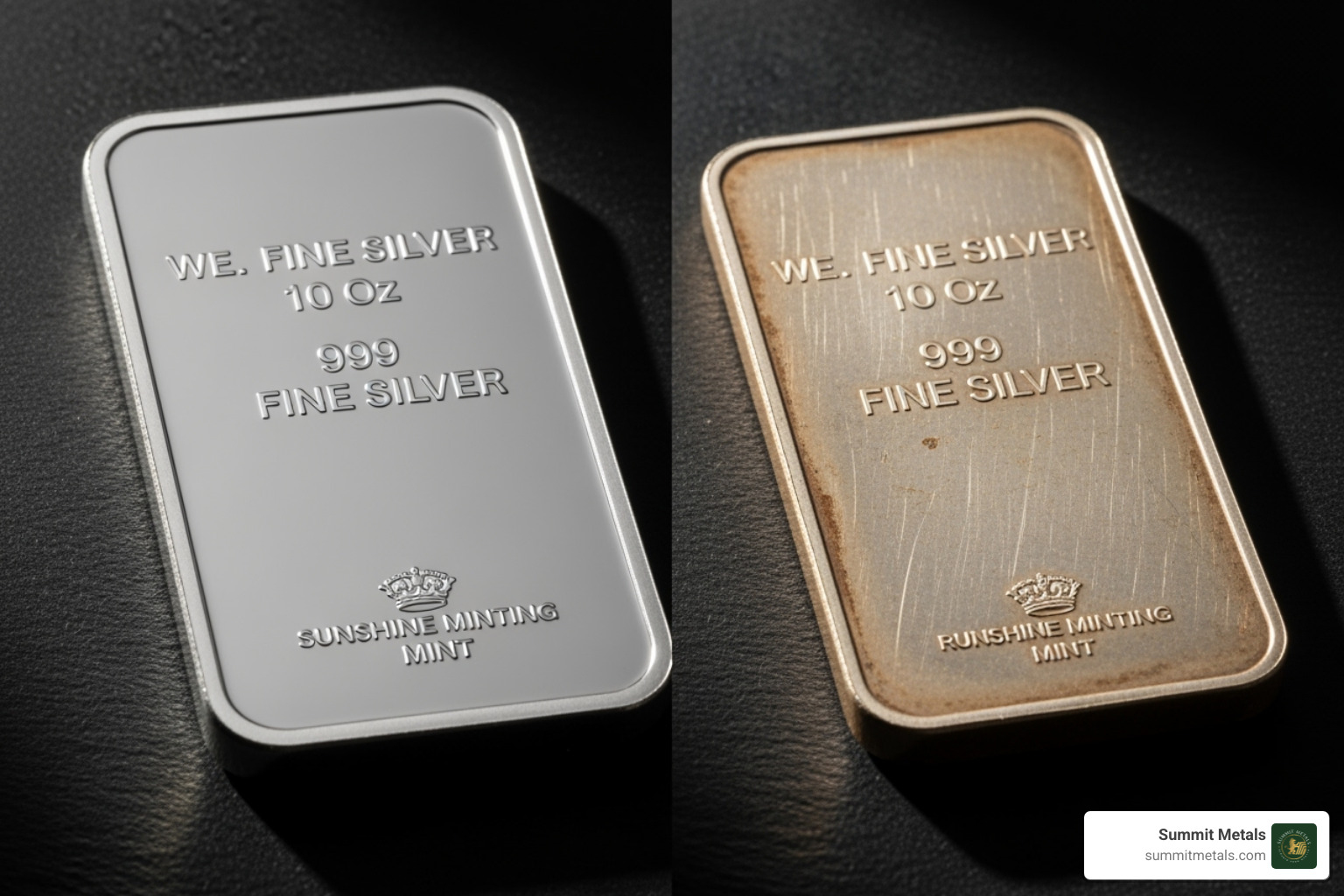

The biggest bargains often come from bars that aren't brand new. Secondary market bars may show minor scratches or natural toning (a harmless oxidation process). These cosmetic imperfections don't affect the silver's .999 purity or weight, allowing you to buy at a lower premium.

Similarly, generic bars contain the exact same silver as premium branded options (like PAMP Suisse) but without the added cost for brand recognition. This is why "design our choice" selections are so valuable. Dealers like Summit Metals offer authentic silver from our inventory at a lower premium because we choose the design. To see what premium brands offer, explore The Definitive Pamp 1kg Silver Bar Comparison.

Size and Type

Here's a reliable rule: larger bars have lower premiums per ounce. Manufacturing costs are spread over more silver, reducing your cost. A 100-ounce bar's per-ounce premium is significantly less than a 1-ounce bar's.

The manufacturing method also matters. Cast bars, made by pouring molten silver into molds, are the most economical. Minted ingots undergo extra processing for a refined finish, which adds to the cost. For pure accumulation, larger cast or generic bars offer the best value. For deeper insights, check out The Mmtc Pamp 1kg Silver Bar: Purity, Weight, and Worth.

Your Treasure Map to Finding and Buying Discount Silver Bars

Hunting for discount silver bars requires knowing where to look and how to verify you're getting authentic silver at a great value.

Where to Find Reliable Sources

Reputable online bullion dealers like Summit Metals are your best bet. We build our reputation on trust, offering competitive rates from bulk purchasing and transparent, real-time pricing. Local coin shops, such as those in Salt Lake City, allow for in-person inspection and potential price negotiation. When choosing a dealer, look for detailed product descriptions, clear policies, and positive reviews. For a detailed comparison, see The Best 7 Places to Buy Silver Bars Compared.

Tip: If you prefer set-it-and-forget-it simplicity, automate your stacking with Summit Metals' Autoinvest. Buy every month just like contributing to a 401(k) so you dollar-cost average through market moves.

Silver Bars vs. Silver Coins: Which is the Better Bargain?

This choice depends on your investment goals. Both are excellent, but they serve different purposes.

| Feature | Silver Bars | Silver Coins |

|---|---|---|

| Premium over Spot | Lower, especially on larger sizes | Higher due to minting costs & designs |

| Liquidity | Good, best with recognized brands | Excellent, universally recognized |

| Divisibility | Limited (must sell whole bar) | Highly divisible (1 oz units) |

| Government Guarantee | No government backing | Legal tender with fraud protection |

| Storage Efficiency | Excellent for bulk | Good, but less compact |

Silver bars win on cost efficiency. A 100-ounce bar almost always provides more silver for your dollar than 100 one-ounce coins.

Silver coins win on flexibility and security. As legal tender, coins like the American Silver Eagle are protected by anti-counterfeiting laws. This government backing provides a layer of security and recognition that bars lack, making them easier to trade. Learn more in our Ultimate Guide to Buying Silver Coins Online. To understand the concept of legal tender and why it adds fraud protection, see legal tender, and for a well-known example, read about the American Silver Eagle.

Bonus Comparison: Gold Bars vs. Gold Coins

If you're also evaluating gold, here’s a quick side-by-side to help you decide:

| Feature | Gold Bars | Gold Coins |

|---|---|---|

| Premium over Spot | Generally lower | Higher (minting/detail + legal tender status) |

| Liquidity/Recognition | Strong with recognized refiners | Excellent; globally recognized designs |

| Legal Tender/Face Value | None | Yes; face value and legal tender status support fraud protection |

| Divisibility Options | Wide range (1g to 1kg+) | Fractionals and 1 oz common |

| Storage Efficiency | Very compact for bulk | Less compact than bars per ounce |

Example: The American Gold Eagle is a legal-tender coin with a face value, adding recognition and protections under counterfeiting laws, while bars usually offer lower premiums for pure accumulation.

Pro tip: Whether you choose bars or coins, put your plan on autopilot with Summit Metals' Autoinvest. Schedule monthly purchases to dollar-cost average—just like a 401(k)—so you build your stack consistently without timing the market.

How to Ensure Authenticity

Protect yourself from fakes with these steps:

- Buy from Reputable Sources: This is your best defense. Established dealers like Summit Metals use professional verification tools like Sigma Metalytics verifiers.

- Verify Markings: Look for crisp, clear stamps for purity (.999 fine), weight, and the mint's mark.

- Check Weight and Dimensions: Silver has a specific density. A digital scale can spot fakes that are the wrong weight for their size.

- Avoid Risky Marketplaces: Be cautious on sites like eBay, which are common venues for counterfeits. Stick to highly-rated sellers with long track records.

For an extra layer of security, learn about certified bars in our guide, Bar None: The Best Understanding Certified Silver Bars.

Why Hunt for Bargains? The Advantages of Discount Silver

Picture this: you walk into a grocery store and see two identical bags of apples. One costs $10, the other costs $7. Which do you choose? The answer's obvious, right? The same logic applies to silver investing, but with one major difference - those savings can compound into thousands of extra dollars in your precious metals portfolio.

When you hunt for discount silver bars, you're not just pinching pennies. You're strategically lowering your cost-per-ounce, which means your investment capital goes further. Instead of buying 10 ounces of silver, maybe you can afford 12 or 13 ounces for the same money. That's 20-30% more silver working for you when prices rise.

The beauty of bulk purchasing really shines here. Larger bars come with significantly lower premiums, and we at Summit Metals leverage our bulk buying power to pass those savings directly to you. It's like getting a wholesale price because we're buying wholesale quantities.

The Power of Lower Premiums

Let's break down what you're actually paying when you buy silver. There's the spot price - that's the current market value of silver itself. Then there's the premium - the extra cost that covers manufacturing, shipping, dealer overhead, and profit.

Here's where it gets interesting: silver bars generally carry lower premiums than silver coins. Why? Because bars are simpler to make and they're bought purely for their silver content, not for fancy designs or collectible value.

But the real game-changer is size. Our data consistently shows that premiums decrease as bar size increases. A 1-ounce silver round might carry a $5 premium, while a 100-ounce bar might only have a $2 premium per ounce. Do the math - that's $300 saved on a 100-ounce purchase!

Let's say silver's spot price is $25 per ounce. A small coin with a $5 premium costs you $30 total. But a 100-ounce bar with just a $2 premium? That's only $27 per ounce, or $2,700 total instead of $3,000. You just saved $300 on the exact same amount of silver.

At Summit Metals, our transparent, real-time pricing means you always see exactly what you're paying. No hidden fees, no surprise markups - just honest pricing that reflects our bulk purchasing advantages.

Stretching Your Investment Further

Every dollar you save on premiums is a dollar that can buy more silver. It's like a snowball effect - the more you save, the more ounces you can afford, and the more your stack grows.

Generic silver bars are the ultimate example of this principle. They offer rock-bottom premiums over spot price, making them perfect for investors who care more about silver content than pretty designs. They might not win any beauty contests, but they contain the exact same .999 fine silver as their fancier cousins.

Think of it this way: would you rather own 100 ounces of generic silver or 85 ounces of premium-branded silver for the same investment? The generic bars give you 15 extra ounces of pure silver working in your favor.

For serious stackers, 100-ounce bars represent the sweet spot between affordability and low premiums. They're large enough to command wholesale-style pricing but not so big that they're impossible to store or sell later.

Consider setting up an Autoinvest program with us, where you dollar-cost average into silver just like you would with a 401(k). By automatically purchasing discount silver bars monthly, you smooth out price volatility while consistently building your stack at the lowest possible premiums.

If you're ready to think bigger, check out our guide on Stacking Silver: Here's Where to Buy 15 Kilos of Silver Bars. It's not for everyone, but for investors serious about accumulating substantial silver holdings, the premium savings become truly significant.

Decoding the "Discount": What Makes a Silver Bar Cheaper?

It's easy to think a discount just means "cheaper," but with silver, it's a bit more nuanced. Understanding why a silver bar might be sold at a discount helps you make informed decisions and truly unearth value. It's not always about a fire sale; sometimes, it's about the inherent characteristics of the bar itself.

The price of any silver bar starts with the fluctuating spot price of silver – that's the current market value of the metal itself. But the real opportunity for savings comes from the premium added on top. This premium covers manufacturing, shipping, dealer overhead, and profit margins. When you find discount silver bars, you're essentially finding bars with lower premiums, and that's where the magic happens for your investment dollars.

Think of it like buying a car. A brand-new luxury sedan and a reliable used sedan can both get you from point A to point B, but you'll pay vastly different amounts for essentially the same transportation value. Silver works similarly – the metal content might be identical, but various factors create pricing differences.

Condition, Mint, and Design

The biggest driver of discounts often comes down to three simple factors: how the bar looks, who made it, and how fancy it is.

Secondary market bars are the "pre-owned" vehicles of the silver world. These bars have been previously owned and might show some character – think minor scratches, contact marks, or what we call "toning." Now, toning sounds scary, but it's actually just a natural process where silver reacts with sulfur in the air, creating colorful patterns or a duller finish. It's like how copper turns green over time – completely natural and doesn't affect the silver's value one bit.

Here's the beautiful part: our research consistently shows that secondary market precious metals are valued the same as new ones in the market. So while a collector might turn their nose up at a slightly toned bar, a smart investor sees it as discount silver bars with identical intrinsic value.

The mint or brand makes a huge difference in pricing too. Bars from prestigious names like PAMP Suisse are like the luxury brands of the silver world – they're beautiful, well-recognized, and come with fancy security features. But here's the thing: a generic bar from a lesser-known refiner contains the exact same .999 fine silver. You're just not paying extra for the brand name and fancy packaging.

That's why we love offering "design our choice" options at Summit Metals. We pick a quality generic bar from our current inventory, and you get the same pure silver content at a lower premium. It's like buying the store-brand cereal that tastes just as good as the name brand but costs less. For those curious about premium options, you can explore The Definitive Pamp 1kg Silver Bar Comparison to see what you're paying extra for.

Design complexity also plays a role. A bar with intricate engravings or artistic elements costs more to produce than a simple stamped bar. If you're investing for the silver content rather than collecting for beauty, those plain bars offer the best bang for your buck.

Size and Type

Here's where the math really works in your favor: the bigger the bar, the smaller the premium per ounce. It's basic economics – it costs roughly the same amount of labor and energy to produce a 1-ounce bar as a 10-ounce bar, so spreading those costs over more ounces reduces your per-ounce premium.

This is why 100-ounce silver bars are the darlings of serious silver stackers. While a 1-ounce bar might carry a premium of $5 per ounce, that same 100-ounce bar might only have a $1 per ounce premium. Over a large purchase, we're talking about savings that can fund your next vacation.

The manufacturing method also affects pricing in interesting ways. Cast bars are made by pouring molten silver into molds – they're straightforward to produce and often have that appealing rustic look. Because they require minimal finishing work, they typically offer the lowest premiums.

Hand-poured bars are a charming subset of cast bars, often made by smaller artisan refiners. Each one is unique, with no two looking exactly alike. While some command premiums for their artisanal appeal, many generic hand-poured options still offer excellent value.

Minted ingots go through additional processing – they start as cast bars but then get pressed, shaped, and stamped to precise dimensions with detailed designs. All that extra work translates to higher premiums, making them the priciest option per ounce.

For investors serious about accumulating silver, understanding these differences is crucial. If you want to dive deep into specific bar types and their value propositions, check out The Mmtc Pamp 1kg Silver Bar: Purity, Weight, and Worth. But if your goal is simply to own as much silver as possible for your investment dollars, bigger, generic, secondary market bars in simpler forms will give you the most metal for your money.

Your Treasure Map to Finding and Buying Discount Silver Bars

The hunt for discount silver bars doesn't have to feel like searching for buried treasure without a map. With the right knowledge and trusted sources, you can steer this market confidently and find genuine value. At Summit Metals, we believe in making this journey straightforward - whether you're shopping online or visiting us in Wyoming.

The key to successful silver investing lies in knowing where to look, what to examine, and how to verify authenticity. Think of it like buying a used car - you want to check under the hood, but you also want to buy from someone you can trust.

Where to Find Reliable Sources for Discount Silver Bars

Your first step is finding reputable dealers who won't leave you holding a worthless piece of metal. The good news? There are several reliable paths to explore.

Established online bullion dealers often offer your best bet for competitive pricing and selection. Companies like APMEX and JM Bullion have built solid reputations over decades, with extensive inventories that include generic bars and "design our choice" options at lower premiums. Here at Summit Metals, we follow this same philosophy - offering transparent, real-time pricing and competitive rates thanks to our bulk purchasing power.

Local coin shops shouldn't be overlooked, especially if you prefer face-to-face transactions. While their inventory might be smaller than online giants, you can inspect silver in person and often negotiate prices for larger purchases or cash deals. Many local shops also carry unique secondary market pieces you won't find elsewhere.

Online marketplaces like eBay can occasionally offer deals, but they require extra caution. If you venture into these waters, stick to sellers with 99% or higher feedback scores, long histories of selling bullion, and clear product photos. Remember: if a deal seems too good to be true, it probably is.

When evaluating any dealer, always check reviews and ratings thoroughly. A reputable dealer will have clear shipping policies, return procedures, and detailed product descriptions including purity, weight, and specific markings. For a comprehensive breakdown of your options, explore The Best 7 Places to Buy Silver Bars Compared.

Silver Bars vs. Silver Coins: Which is the Better Bargain?

This age-old debate among precious metals investors comes down to understanding what each offers and matching that to your goals.

| Feature | Silver Bars | Silver Coins |

|---|---|---|

| Premium over Spot | Generally lower, especially larger bars | Higher due to minting costs and designs |

| Liquidity | Good, but may require more verification | Excellent, widely recognized |

| Divisibility | Limited - must sell entire bar | High - can sell individual coins |

| Government Guarantee | None (private mint products) | Legal tender status provides fraud protection |

| Storage Efficiency | Excellent - compact for large amounts | Good, but less efficient per ounce |

Silver bars typically win on cost efficiency. They're designed purely for investment, with simpler manufacturing processes that translate to lower premiums. A 100-ounce bar will almost always cost less per ounce than 100 individual coins.

Silver coins offer unique advantages through their legal tender status. This face value provides an extra layer of fraud protection that bars can't match. If someone tries to sell you a fake American Silver Eagle, you're protected by counterfeiting laws. Plus, coins are more divisible - you can sell one coin instead of an entire bar.

For investors focused purely on accumulating silver at the lowest cost, bars are usually the better bargain. But if you value liquidity and recognition, coins might be worth the extra premium. Many smart investors choose both - bars for bulk accumulation and coins for flexibility. To dive deeper into coin investing, check out Your Ultimate Guide to Buying Silver Coins Online.

How to Ensure the Authenticity of Discount Silver Bars

Finding a great price means nothing if you're buying fake silver. Fortunately, there are reliable ways to verify authenticity before and after purchase.

Start with reputable sources - this eliminates 90% of potential problems. Established dealers stake their reputation on selling authentic products and often use Sigma Metalytics verifiers or similar testing equipment.

Learn to read the markings on authentic bars. Look for clear stamps indicating purity (.999 fine silver), weight, and mint marks. These should be crisp and professionally applied, not rough or uneven. The bar in our image shows exactly what to look for - clear, precise markings that indicate professional manufacturing.

Weight and dimension checks are your next line of defense. Silver has a specific density, so a fake bar will either be too light or too heavy for its size. Many investors keep a digital scale handy for verification.

The sound test (or "ping test") can also help identify fakes. Genuine silver produces a distinct, clear ring when struck, while fakes often sound dull or flat. YouTube has excellent examples of authentic silver sounds.

Avoid marketplaces with poor security or dealers without clear policies. Always check a site's Privacy Policy and Terms of Service before purchasing. When shopping online, look for secure payment processing and clear return policies.

For bars that come with certificates or assay cards, learn about Bar None: The Best Understanding Certified Silver Bars to understand what those certifications mean.

Authentic discount silver bars are out there - you just need to know where to look and what to look for. With the right knowledge and trusted sources, you can build your silver stack confidently and cost-effectively.