Opening Value: The 100 oz Silver Bar

A 100 oz silver bar packs a great deal of value into a small footprint. Here’s the quick snapshot:

- What it is: 100 troy ounces of .999 or .9999 fine silver, weighing under seven pounds.

- Why invest: Lower cost per ounce than smaller bars or coins, so more of your money goes into metal, not premiums.

- Benefits: Compact, easy to store or transport, and highly liquid in the bullion market.

I’m Eric Roach. After a decade advising Fortune 500 firms on Wall Street, I now help individual investors use tangible assets—like a 100 oz bar—to preserve and grow wealth.

Why Choose a 100 oz Silver Bar for Your Portfolio?

When you're building a precious metals portfolio, the 100 oz silver bar offers a sweet spot many investors find irresistible—large enough to matter, small enough to handle.

This specific weight isn't random; decades of market evolution have shown that 100 oz strikes the ideal balance between affordability, efficiency, and practicality. Let me walk you through why this size has become a cornerstone of smart silver investing.

Key Benefits of a 100 oz Silver Bar

The main draw is economics: lower premium per ounce compared with smaller products. With a 100 oz bar, more of your dollars buy metal rather than fabrication.

Beyond the savings, you're buying a proven hedge against inflation. Silver has protected purchasing power for millennia. It also adds diversification, often moving differently than stocks and bonds. Our guide on Is Silver a Good Investment? digs deeper.

Portability and Storage Efficiency

Despite holding 100 troy ounces of pure silver, a bar weighs less than 7 lbs—about the same as a newborn or a small laptop.

Storing one sleek bar is far easier than corralling 100 individual coins. And if you need to relocate your wealth, a single compact bar is simple to move.

Market Demand and Liquidity

The 100 oz format enjoys strong demand from investors and industry alike—think electronics, solar, and medical devices. Because the size is standardized and well-known, pricing is straightforward and selling is fast when the time comes. For a bigger-picture view, see our analysis of Silver Price: The Bullish Case for Silver.

Understanding the Value and Price of Your Bullion

When you're considering investing in a 100 oz silver bar, one of the first questions that comes to mind is probably, "What's this going to cost me?" It's a fair question, and the answer involves more than just a simple price tag. Learn the key components that determine the final price of a 100 oz silver bar, so you can invest with confidence.

Spot Price vs. Premium: What You Really Pay

Think of buying a 100 oz silver bar like buying a car. You've got the base price of the vehicle, and then you've got all the extras that get added on. In the silver world, the base price is called the spot price – this is what silver is trading for right now on the global market. It's constantly changing throughout the day as traders around the world buy and sell.

You can always track the value of silver per ounce on a reliable website to see where spot prices are sitting at any given moment.

But here's the thing – you can't actually buy silver at spot price. That's where the premium comes in. The premium is the extra cost that covers all the real-world expenses of getting that silver from a raw material into your hands as a beautiful, refined bar.

Manufacturing costs are a big part of this premium. Someone has to refine that silver to .999 or .9999 purity, pour it into bar form, and stamp it with all the proper markings. Then there's the dealer margin – yes, we need to keep the lights on and pay our team! The premium also covers logistics like shipping and insurance, because nobody wants a lost package when we're talking about thousands of dollars in silver.

So when you're calculating the price of a 100 oz silver bar, you take the current spot price, multiply it by 100, and then add the premium. If silver is trading at $30 per ounce, that's $3,000 in silver value, plus whatever the current premium is. Prices shown are at the time of this publication.

At Summit Metals, we work hard to keep our premiums competitive through bulk purchasing, and we believe in transparent, real-time pricing so you always know exactly what you're paying for. For a deeper dive into how all this works, check out our guide on Spot Price vs. Premium: How Precious Metals Pricing Works.

Factors That Influence Silver Prices

Silver prices can be a bit of a wild ride compared to other precious metals, and that's actually part of what makes it interesting as an investment. The value of your 100 oz silver bar gets influenced by a whole mix of factors happening around the world.

Supply and demand is the big one – it's basic economics in action. When there's lots of demand and not enough silver to go around, prices go up. When supply is plentiful and demand is soft, prices come down. It's that simple, but what drives that demand and supply is where things get interesting.

Industrial use plays a huge role because over half of all silver gets used in manufacturing. Your smartphone, your car's electronics, solar panels on rooftops – they all need silver to work. When these industries are booming, they're competing with investors like you for the same silver supply. If there's suddenly a surge in solar panel installations or electric vehicle production, that can push silver prices higher.

Investor sentiment is another big mover. When people get nervous about the economy, stock market crashes, or inflation eating away at their savings, they often turn to precious metals as a safe haven. This flight to safety can drive up demand for silver bars like yours pretty quickly.

Geopolitical events can shake things up too. Wars, trade disputes, or major political upheavals make investors seek out tangible assets they can hold in their hands. Silver has been a store of value for thousands of years, so it tends to benefit during uncertain times.

Currency fluctuations matter because silver is priced in U.S. dollars globally. When the dollar weakens, silver becomes cheaper for people using other currencies, which can boost international demand and push prices up. A stronger dollar can have the opposite effect.

Understanding these moving parts helps you make smarter decisions about when to buy and when to hold. We dive deeper into these market dynamics in our article about Why Gold and Silver Prices Fluctuate.

A Roundup of 100 oz Silver Bar Types and Styles

Not every bar looks or feels the same. Here are the main differences you’ll notice when shopping.

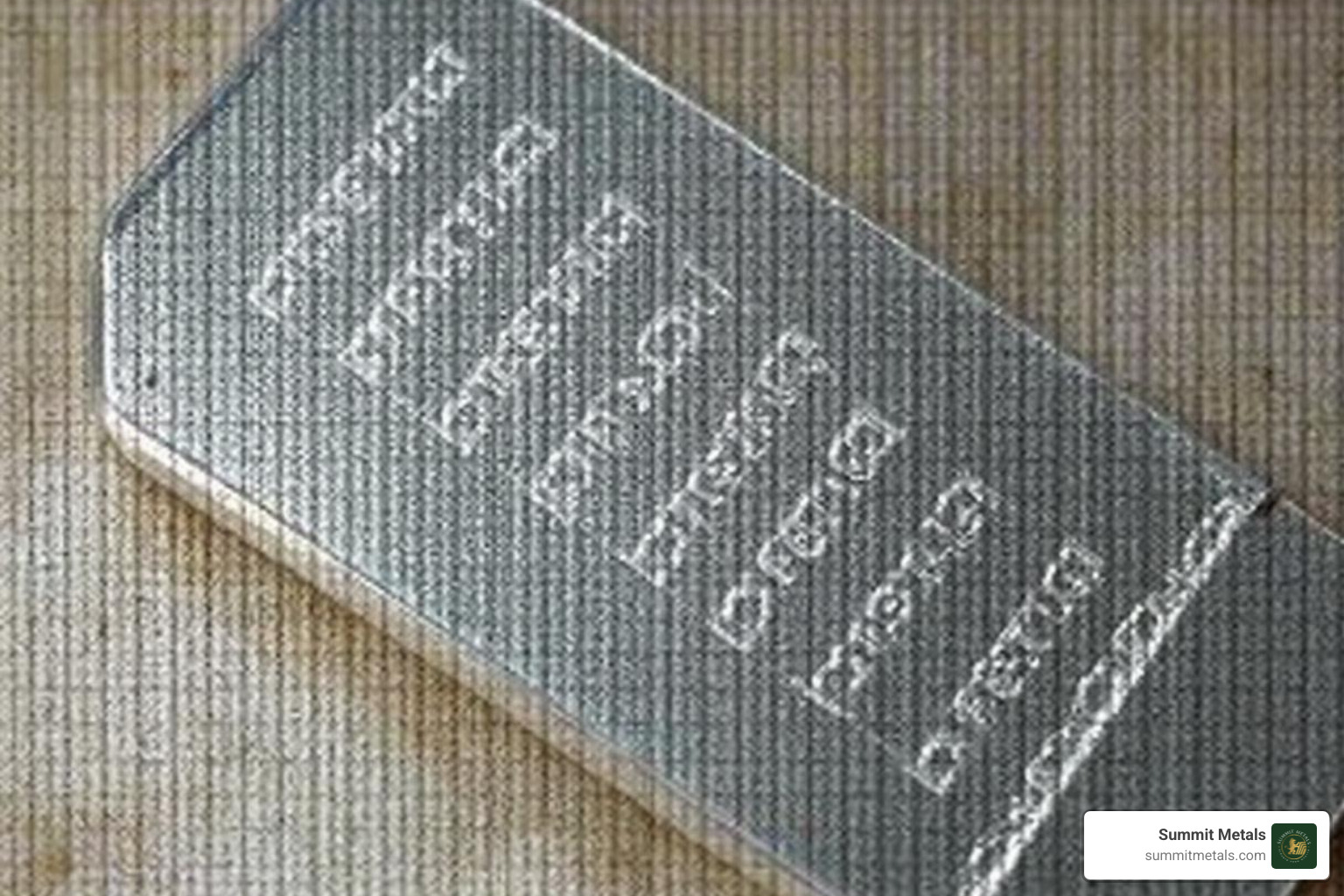

Cast vs. Minted (Struck) Bars

Cast bars are poured into molds; minted bars are precision-struck from blanks. Each has its own appeal:

| Feature | Cast Bars | Minted (Struck) Bars |

|---|---|---|

| Appearance | Rustic, each bar unique | Sleek, highly uniform |

| Typical Premium | Often a bit lower | Slightly higher |

| Collectibility | Vintage charm | Detailed designs |

Purity, Hallmarks, and Reputable Mints

Look for a .999 or .9999 purity stamp, a hallmark, and a serial number. Choosing producers on the London Bullion Market Association (LBMA) Good Delivery List makes resale easier. Popular names include Royal Canadian Mint, PAMP Suisse, Valcambi, Asahi, Perth Mint, and SilverTowne.

Secondary Market and Vintage Bars

Pre-owned bars can show toning or light scratches, but the silver content is unchanged. Because they’re already in circulation, premiums are often lower, and certain discontinued brands—like Engelhard or older Johnson Matthey pieces—have added collector value.

The Practical Guide: Buying, Storing, and Selling

Owning a 100 oz silver bar is straightforward when you focus on three areas.

How to Buy 100 oz Silver Bars Safely

Purchase only from dealers that provide test-verified metal and transparent, real-time pricing. At Summit Metals you see the live spot price plus our premium—no surprises. Bank wire keeps costs lowest, while credit cards or crypto add speed at a slightly higher fee. For more detail, read How to Buy Gold and Silver Online Safely and Identifying Reputable Bullion Dealers: Avoiding Counterfeits.

How to Safely Store Your 100 oz Silver Bar

A bolted, fire-rated home safe plus silica gel can work for smaller positions. For larger stacks—or if you prefer hands-off security—insured depository storage in Wyoming, Utah, or other vaults keeps your metal protected and fully allocated. Explore options in The Ultimate Guide to Precious Metals Storage and our tips on ways to store silver bars.

How and When to Sell Your Silver

100 oz bars are highly liquid. Summit Metals operates a competitive buy-back program, and you’re free to compare quotes with other dealers or vetted marketplaces. Many investors sell when they need to rebalance or when spot prices spike—timing discussed in When is the Best Time to Sell Your Silver & Gold?.

Frequently Asked Questions about 100 oz Silver Bars

Here are direct answers to some of the most common questions investors have about these substantial silver bars. These are the questions we hear most often from our customers, and we're happy to clear up any confusion.

Are 100 oz silver bars eligible for a Precious Metals IRA?

Yes, most 100 oz silver bars are absolutely eligible for inclusion in a Precious Metals Individual Retirement Account (IRA). This is great news for investors looking to diversify their retirement portfolios with physical silver.

The key requirement is that your silver bar must meet IRS requirements, specifically a .999 minimum purity standard. Most investment-grade silver bars exceed this requirement, with many offering .9999 fine silver purity. Bars from approved mints like the Royal Canadian Mint (RCM) or other reputable refiners typically qualify without any issues.

Here's what you need to know: you'll need a professional custodian to manage your Precious Metals IRA. This is an IRS requirement – you cannot physically hold the metals yourself within the IRA structure. The custodian will handle the storage and compliance aspects, ensuring your investment meets all federal regulations.

How much does a 100 oz silver bar actually weigh?

This question always surprises people! A 100 oz silver bar contains 100 troy ounces of silver, but when you pick it up, it weighs less than seven pounds in regular weight (about 6.85 pounds, to be exact). In metric terms, that's just over 3 kilograms – specifically 3.11 kg.

To get technical for a moment, a .999 fine bar contains 3,107.20 grams of pure silver, while a .9999 fine bar contains 3,110 grams. The difference comes from the tiny amount of other metals in the alloy.

What's remarkable is how manageable this weight is. You can easily lift and handle a 100 oz silver bar with one hand. It's dense, sure, but surprisingly compact for the amount of wealth it represents.

Are these bars a good investment for beginners?

This is a thoughtful question that deserves an honest answer. 100 oz silver bars offer excellent value and represent the most efficient way to buy silver in bulk, but they do come with a higher entry cost than smaller silver products.

For many beginners, smaller bars like 1 oz or 10 oz options, or silver coins, might be a better starting point. These allow you to get comfortable with the precious metals market without making a large initial investment. You can learn the ropes, understand how pricing works, and build confidence in physical silver ownership.

However, if you're ready to make a substantial investment and want to maximize your ounces per dollar, a 100 oz silver bar is an excellent choice. This represents a true long-term investment in your financial future and security. The lower premium per ounce means more of your money goes toward actual silver rather than manufacturing and handling costs.

For those just starting their precious metals journey, we recommend exploring The Basics of Gold and Silver Stacking to build a solid foundation of knowledge before making your first purchase.

Conclusion: Making a Substantial Investment in Your Future

A 100 oz silver bar is more than just a lump of metal; it's a significant, tangible step toward securing your financial future. Throughout this guide, we've explored how these substantial bars offer exceptional value through lower premiums per ounce, making them one of the most cost-effective ways to build serious wealth in physical silver.

When you hold a 100 oz silver bar, you're holding tangible security that has protected wealth for thousands of years. Unlike digital assets or paper investments that can vanish with a market crash or computer glitch, your silver bar remains real, valuable, and completely under your control. It's wealth you can literally touch and feel secure about.

These bars serve as a powerful instrument for portfolio diversification, helping balance your investments beyond traditional stocks and bonds. Silver's unique position as both an industrial metal and a monetary asset means it often moves independently of other markets, providing stability when you need it most. Whether economic uncertainty strikes or inflation threatens your purchasing power, your 100 oz silver bar stands as a reliable hedge against financial turbulence.

The long-term value proposition of silver remains compelling. With over 50% of annual silver production going to industrial uses – from electronics to solar panels to medical devices – demand continues to grow while supply remains limited. This fundamental dynamic supports silver's value over time, making your investment not just a defensive move, but potentially a profitable one.

At Summit Metals, we understand that choosing to invest in a 100 oz silver bar represents a serious commitment to your financial future. That's why we provide authenticated, competitively priced silver backed by transparent, real-time pricing and competitive rates due to our bulk purchasing power. We're here to guide you every step of the way, ensuring your investment journey is transparent and trustworthy.

This is a choice for those who understand the enduring appeal of physical assets in an uncertain world. Whether you're a seasoned investor looking to diversify or someone taking their first serious step into precious metals, a 100 oz silver bar offers the perfect combination of value, security, and growth potential.

We invite you to Explore our full range of silver investment options and find how we can help you build a more secure future with precious metals. Your financial independence starts with the decisions you make today.