Why Smart Investors Buy 10 Gram Gold

When you buy 10 gram gold, you're choosing one of the most flexible and affordable entry points into precious metals investing. Here's what you need to know right now:

Quick Decision Guide:

| Factor | What It Means for You |

|---|---|

| Weight | 10 grams = 0.322 troy ounces |

| Purity | Look for .9999 fine (24 karat) gold |

| Price Range | $1,071-$1,395 (varies by brand and market) |

| Best For | Entry-level investors, portfolio divisibility, monthly purchases |

| Top Brands | PAMP Suisse, Argor-Heraeus, Royal Canadian Mint, Valcambi |

| Key Feature | Lower premiums than coins, easier to sell in small increments |

Gold has historically served as a vital hedge against the volatility of paper assets. Unlike currencies that governments can print at will, physical gold is finite and holds intrinsic value.

The 10 gram size sits in a sweet spot. It's affordable enough for regular monthly purchases through programs like Autoinvest, yet substantial enough to represent meaningful wealth storage. When you buy 10 gram gold bars instead of larger bars, you gain divisibility—the power to sell portions of your holdings without liquidating your entire position.

I'm Eric Roach. After a decade advising Fortune 500 companies on hedging strategies, I now help everyday investors apply those same institutional tactics to build resilient portfolios with physical precious metals. My approach translates Wall Street risk management into clear, actionable steps for protecting your wealth.

Why a 10 Gram Gold Bar is the Smart Investor's Choice

When you buy 10 gram gold bars, you're choosing a balance of flexibility, affordability, and real value. It’s about owning gold in a way that works for your financial goals.

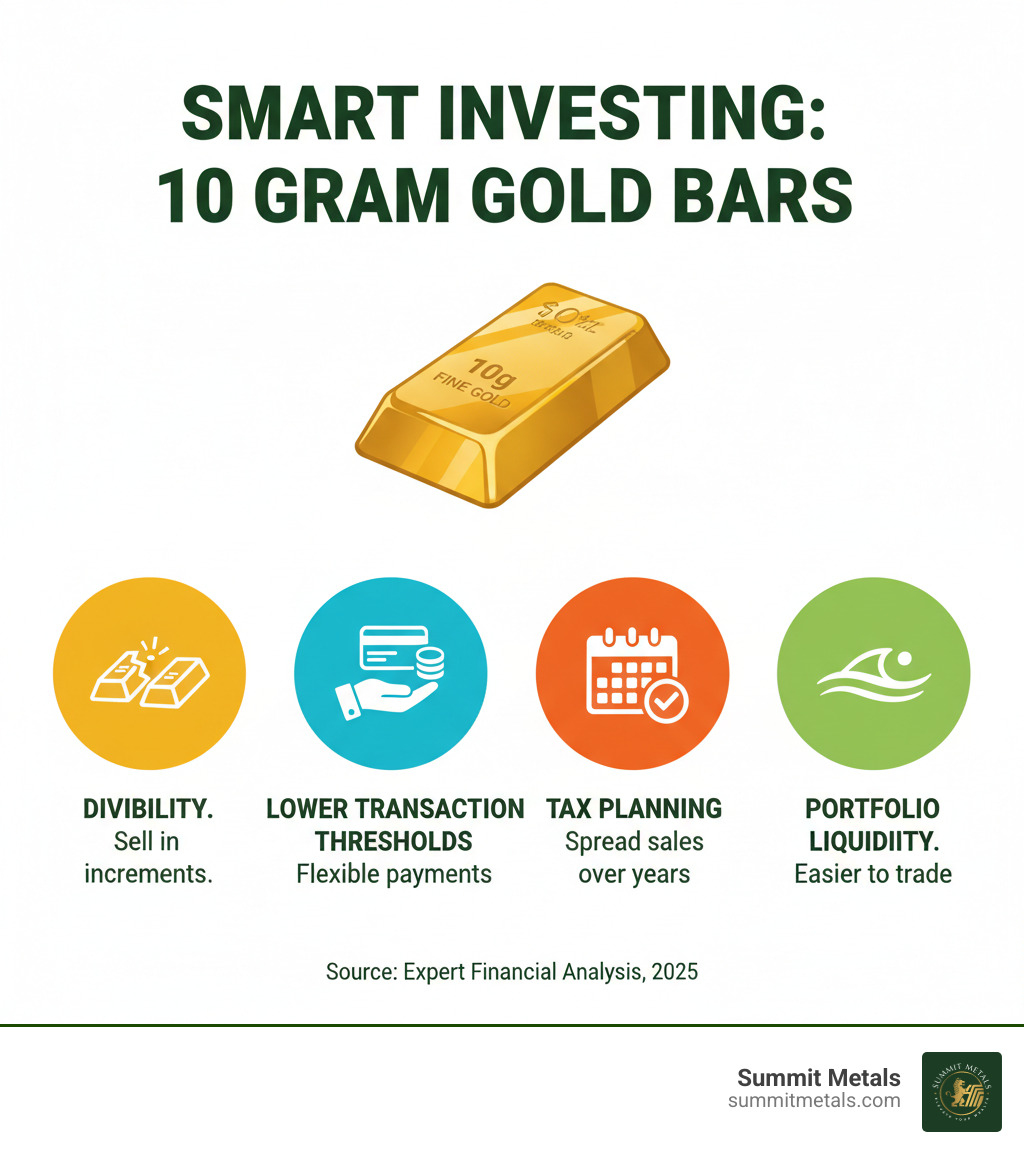

The Divisibility Advantage: Your Financial Flexibility

Imagine owning a 1-kilogram gold bar. When you need cash, you must sell the entire bar at once. The advantage of smaller bars is clear: with 10 gram bars, you gain strategic control. You can sell one or two bars to cover an expense or capitalize on a price spike, keeping the rest of your investment intact. This is like having ten $100 bills versus a single $1,000 bill—both have the same value, but only one offers true flexibility.

Liquidity: When You Need to Sell, Buyers Are Ready

A 10 gram gold bar is easier to sell than larger bars. Its lower price point creates a much broader market of interested buyers, whether you're selling to a dealer or a private individual. This high liquidity means you can convert your asset to cash quickly, allowing you to respond to opportunities without delay.

Affordability: Gold Ownership for Real People

With a price point that is accessible to most investors, 10 gram bars democratize gold ownership. They are an ideal way to start investing in physical gold without a massive upfront cost. This affordability makes them perfect for dollar-cost averaging through programs like Autoinvest. Instead of trying to time the market, you can buy a bar every month—just like contributing to a 401(k)—to smooth out price fluctuations and build your holdings consistently.

Lower Premiums: More Gold, Less Markup

Compared to gold coins of similar weight, gold bars have lower premiums. The premium is the cost above the raw gold value, covering manufacturing and distribution. Because bars have simpler designs, they are more efficient to produce, and those savings are passed on to you. This means more of your money goes directly into gold.

Your Hedge Against Inflation and Economic Chaos

Gold has protected wealth for millennia. When inflation erodes the purchasing power of your dollars or geopolitical tensions rattle markets, gold provides stability. It exists outside the traditional financial system—no government can print more of it. You hold it, you own it, and it's yours.

Portfolio Diversification: The Asset That Zigs When Others Zag

Stocks and bonds often fall together during a market crash. Gold frequently moves independently or even inversely to these assets, making it an essential tool for diversification. Adding 10 gram gold bars to your portfolio can stabilize your overall returns and protect you during downturns.

| Feature | 10g Gold Bar | 1kg Gold Bar | 1/4 oz Gold Coin |

|---|---|---|---|

| Divisibility | Excellent (sell in small increments) | Poor (must sell entire bar) | Good (sell individual coins) |

| Premium (over spot) | Low to Moderate | Lowest | Moderate to High |

| Liquidity | High (wide buyer market) | Moderate (fewer buyers) | High (popular size) |

| Counterfeit Protection | Assay card, serial number, advanced security | Assay card, serial number, testing | Government mint security, legal tender, face value |

| Entry Cost | Affordable | Very High | Moderate |

| Best Use Case | Regular purchases, flexible selling, wealth preservation | Large institutional investment, maximum gold exposure | Collectibility, gifting, small-scale investment |

The 10 gram size hits the sweet spot, offering serious advantages without the high entry barrier or inflexibility of larger bars.

Top 10 Gram Gold Bars to Buy in 2024

When you're ready to buy 10 gram gold, the refinery behind the bar matters. At Summit Metals, we only carry authenticated gold from mints with rock-solid reputations. Here are the standout options that combine security, value, and global recognition.

The Icon: PAMP Suisse Fortuna Veriscan Bar

The PAMP Suisse Fortuna is arguably the world's most recognized gold bar. Its front features the iconic Lady Fortuna design, a symbol of prosperity. Produced by the renowned Swiss refinery PAMP Suisse, these bars are made of .9999 fine gold (24 karat). Each bar includes Veriscan® technology, a unique surface fingerprint that you can scan with an app to verify authenticity. Sealed in a tamper-evident assay card with a unique serial number, it represents Swiss excellence and global trust.

The Innovator: Argor-Heraeus Kinebar & Goldseed

Argor-Heraeus is known for pushing boundaries in security. Their flagship Kinebar® features a holographic security element—a kinegram—on the reverse, which is virtually impossible to counterfeit and provides instant visual verification. For ultimate flexibility, their Goldseed divisible bars allow you to separate your gold into smaller 1-gram increments. With a commitment to Swiss manufacturing and .9999 purity, Argor-Heraeus also produces collectible Lunar Series bars.

The Sovereign Standard: Royal Canadian Mint (RCM) Bar

Gold backed by a national government carries a special guarantee. The Royal Canadian Mint (RCM) brings sovereign precision to its 10 gram bars, each guaranteed for weight and .9999 purity. The design features the iconic maple leaf along with advanced security features like radial lines and a micro-engraved privy mark. Delivered in tamper-proof packaging with an assay certificate, the global recognition of RCM ensures high liquidity worldwide.

Other Reputable Mints to Consider When You Buy 10 Gram Gold

Several other world-class refineries produce excellent 10 gram bars:

- Valcambi Suisse: Another Swiss powerhouse known for sleek, modern designs and distinctive orange assay cards. Their .9999 purity and individual serial numbers make them a trusted choice for serious investors.

- Perth Mint: Backed by the Western Australian government, this mint is famous for its high-quality craftsmanship and stunning collectible designs, often featuring native animals.

- Sunshine Mint: A leading U.S. manufacturer, Sunshine Mint supplies precious metals to sovereign mints worldwide. Their bars often feature MintMark SI™ technology, a micro-engraved security mark verifiable with a special decoder lens.

No matter which you choose, buying from a reputable mint ensures you're investing in authenticated, high-quality physical gold. At Summit Metals, we've vetted every bar we sell to meet the highest standards of purity, security, and recognition.

Your Ultimate Guide to How to Buy 10 Gram Gold Online

Buying gold online is a straightforward process that puts you in control. Let's walk through pricing, authenticity, and the logistics of getting your gold safely into your hands.

Understanding Price, Purity, and Authenticity

The price to buy 10 gram gold is composed of two main parts:

- Spot Price: The live market value of raw gold, which fluctuates based on global supply and demand.

- Premium: A smaller charge added to the spot price to cover refining, minting, security features, and distribution. Premiums on 10 gram bars are generally lower than on government-issued coins, giving you more gold for your dollar.

Investment-grade gold is .9999 fine (24 karat), meaning it is 99.99% pure. This standard ensures maximum value and liquidity. Verifying authenticity is crucial, and here’s what to look for:

- Assay Card: A tamper-evident package that certifies the bar's weight, purity, and unique serial number.

- Serial Number: A unique number stamped on the bar that must match the number on the assay card.

- Advanced Security: Leading mints include features like PAMP's Veriscan® app verification, Argor-Heraeus's Kinebar® holograms, or Sunshine Mint's MintMark SI™ technology.

The most important step is to buy from a reputable dealer. At Summit Metals, we sell only authenticated gold and silver, ensuring every product's provenance and quality.

Payment, Shipping, and Smart Investing Strategies

We've designed our process to be secure and transparent.

Payment methods include wire transfers (ideal for larger purchases with low fees), credit cards (convenient but with processing fees), and certified cheques or money orders (no fees but require a clearing period). For large transactions, ID verification may be required to comply with regulations.

Once your payment is confirmed, your order is sent via fully insured shipping. We use robust, discreet packaging with no external markings to protect your privacy and security.

One of the smartest strategies for building wealth is dollar-cost averaging—investing a fixed amount at regular intervals. This removes the stress of trying to time the market. When prices are high, you buy less; when prices are low, you buy more, averaging out your cost over time.

Our Autoinvest program makes this effortless. Think of it as a 401(k) for physical gold. You can set up recurring monthly purchases of 10 gram gold bars, and your investment grows systematically.

Set up your gold savings plan with Autopay and turn the goal to buy 10 gram gold into a disciplined wealth-building habit.

Frequently Asked Questions about 10 Gram Gold

Investing in physical gold can bring up questions. Here are answers to the most common ones we hear.

Are 10 gram gold bars a good investment?

Yes. Ten gram gold bars are one of the smartest ways to build a precious metals portfolio. They are an excellent choice for both new and seasoned investors because they offer:

- Affordability: A manageable entry point into gold ownership.

- High Liquidity: A wide market of buyers makes them easy to sell quickly.

- Divisibility: You can sell small portions of your holdings as needed, giving you financial flexibility.

- Security: Gold is a proven hedge against inflation and economic uncertainty.

For new investors, they are perfect for learning the market. For seasoned investors, they offer flexibility that larger bars can't. When you buy 10 gram gold, you're making a tangible investment in your financial security.

How can I verify the authenticity of my gold bar?

Verifying authenticity is critical. Follow these steps for peace of mind:

- Buy from a Reputable Dealer: This is your most important safeguard. Summit Metals sells only authenticated precious metals from trusted sources.

- Check the Assay Card and Serial Number: Ensure the tamper-evident packaging is intact. The serial number printed on the card must match the number stamped on the gold bar.

- Look for Advanced Security Features: Familiarize yourself with anti-counterfeiting technology like PAMP Suisse's Veriscan®, the holograms on Kinebar® bars, or Sunshine Mint's MintMark SI™.

- Consider Professional Testing: For ultimate assurance, a professional dealer can perform non-invasive tests like X-ray fluorescence (XRF) to confirm purity without damaging your bar.

What's better: a 10g gold bar or a 1/4 oz gold coin?

This depends on your primary goal. Both are excellent fractional gold options, but they serve different purposes.

10g Gold Bars are built for efficiency. They typically have lower premiums over the spot price, meaning you get the maximum amount of gold for your money. Their value is based purely on weight and purity.

1/4 oz Gold Coins offer unique protections. As legal tender, they are backed by a government, which provides an extra layer of anti-counterfeit security. Their official status and intricate designs can also give them collectible (numismatic) value beyond their gold content.

Many smart investors own both, using bars for cost-effective wealth accumulation and coins for their added security and collectible appeal. If your main goal is to buy 10 gram gold to build holdings efficiently, bars are the economically sound choice. Learn more about gold bars vs coins to explore this comparison in greater depth.

Conclusion: Secure Your Future with 10 Grams of Gold

If there's one takeaway, it's this: when you buy 10 gram gold bars, you are making a smart decision that balances affordability, flexibility, and real wealth protection. It's about building something tangible that maintains its value when paper assets feel uncertain.

The divisibility of 10 gram bars gives you control, their lower premiums maximize your investment, and their global recognition ensures liquidity. Most importantly, gold's proven ability to hedge against inflation protects your purchasing power.

At Summit Metals, we've built our reputation on trust. Based in Wyoming, with locations including Salt Lake City, Utah, we understand you need absolute confidence in your dealer. That's why we sell only authenticated gold and silver, provide transparent, real-time pricing, and use our bulk purchasing power to offer competitive rates.

Our process is straightforward and secure. With insured shipping, discreet packaging, and our Autoinvest program for easy dollar-cost averaging, building your holdings has never been simpler. Set up monthly purchases and watch your wealth grow systematically.

Your financial future can start today with a single 10 gram gold bar. We're here to make that journey smooth and secure.

Ready to start investing? Explore our gold collection today!